If you have ever read international Bitcoin forums, cryptocurrency news, or any crypto-related discussions on the Internet, you have probably come across the terms “HODL” or “HODLING”. Though the terms come from a misspelling of the word “hold”, it is not a typo.

In essence, hodling is a strategy of holding on to your Bitcoin and ignoring the day-to-day market movements and trading. Those who practice hodling believe that in the long-term Bitcoin’s price will go up regardless of the short-term price moves.

What does HODL mean?

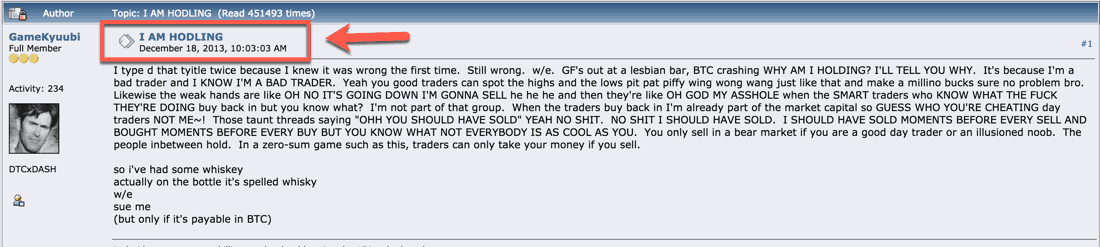

The word originates from the Bitcoin Talk forum rant posted on December 18 of 2013. A user going by the pseudonym GameKyuubi posted an obviously drunken, typo-ridden rant titled “I AM HODLING”. GameKyuubi had just drunk some whiskey and lost lots of money with poor trading choices.

“I type d that tyitle twice because I knew it was wrong the first time. Still wrong. w/e. GF’s out at a lesbian bar, BTC crashing WHY AM I HOLDING? I’LL TELL YOU WHY. It’s because I’m a bad trader and I KNOW I’M A BAD TRADER. Yeah you good traders can spot the highs and the lows pit pat piffy wing wong wang just like that and make a millino bucks sure no problem bro,” GameKyuubi wrote.

And instantly a new meme was born. People began to create pictures with Spartan warriors, Game of Thrones heroes, soldiers, and such with the word “HODL”. The word also found its way into the common lexicon of Bitcoiners, where it gained the meaning of describing an investment strategy of just holding onto your Bitcoin despite what happens in the markets.

What is HODL? Both a Strategy and a Philosophy

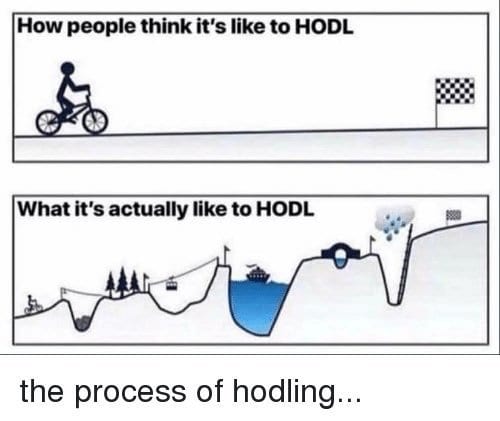

Even though the word itself has hilarious origins, hodling can be a very serious investment strategy, especially for those who don’t have enough time or understanding of the markets to play with day-to-day trading. A novice could easily lose lots of money by panic selling or buying high for the fear of missing out.

Hodlers just buy Bitcoins and then hold onto them for longer periods of time. This has the advantage of avoiding psychological foils such as fear, uncertainty, doubt, and so forth. Hodlers can just ignore what happens in the short-term markets and look upon the big picture. On a larger scale, hodling has been an extremely successful strategy. For about 99% of Bitcoin’s existence, hodling has been profitable.

For everyone who isn’t interested in daily trading, short selling, or other strategies that require a more active approach, hodling is one of the easiest, least risky, and most profitable strategies there is.

Hodling and Bitcoin Maximalism

Hodling is also connected to the philosophy of Bitcoin maximalists. Some people believe that Bitcoin or other cryptocurrencies could someday replace fiat currencies as the most common form of money. Others think that they could be used as global reserve currencies. Some think that Bitcoin could take the place of gold as the universally accepted way to store value. Or perhaps cryptocurrencies will become the most common method of transferring money on the Internet.

For people who believe that this kind of crypto future will someday take place, hodling Bitcoin is rational. If you see fiat currencies or the current monetary system inherently lesser than what Bitcoin and other cryptocurrencies have to offer, then it would be somewhat dumb to sell your Bitcoin for fiat. You just want to accumulate more and more of Bitcoin, for one day you don’t even have to sell them.

It’s Easy and Safe

All in all, hodling is a sound strategy, especially for those who want an easy and more or less safe strategy. Historically hodling has been extremely profitable and probably will be so also in the future. If you don’t know what you are doing, then HODL, HODL, and HODL some more.

Any information presented in this blog is not investment advice.