What is Bitcoin CFD?

Contract for difference trading, or CFD trading, is a method that enables individuals to trade and invest in an asset by engaging in a contract between themselves and a broker instead of opening a position directly on a specific market. If you want to make a contract in digital currency, it is called cryptocurrency CFD.

The CFD broker and the trader agree to replicate the market conditions and settle the difference amongst themselves when the position closes.

I want to answer the question of “What is Bitcoin CFD?” with an example. Bitcoin CFD means that you are sure that the price of Bitcoin will rise substantially soon, and you want to profit from BTC price movements. However, buying Bitcoin seems complicated for some, and they wish to invest just for a couple of days.

If this fits your investment objectives, Bitcoin CFD could be a good option for you.

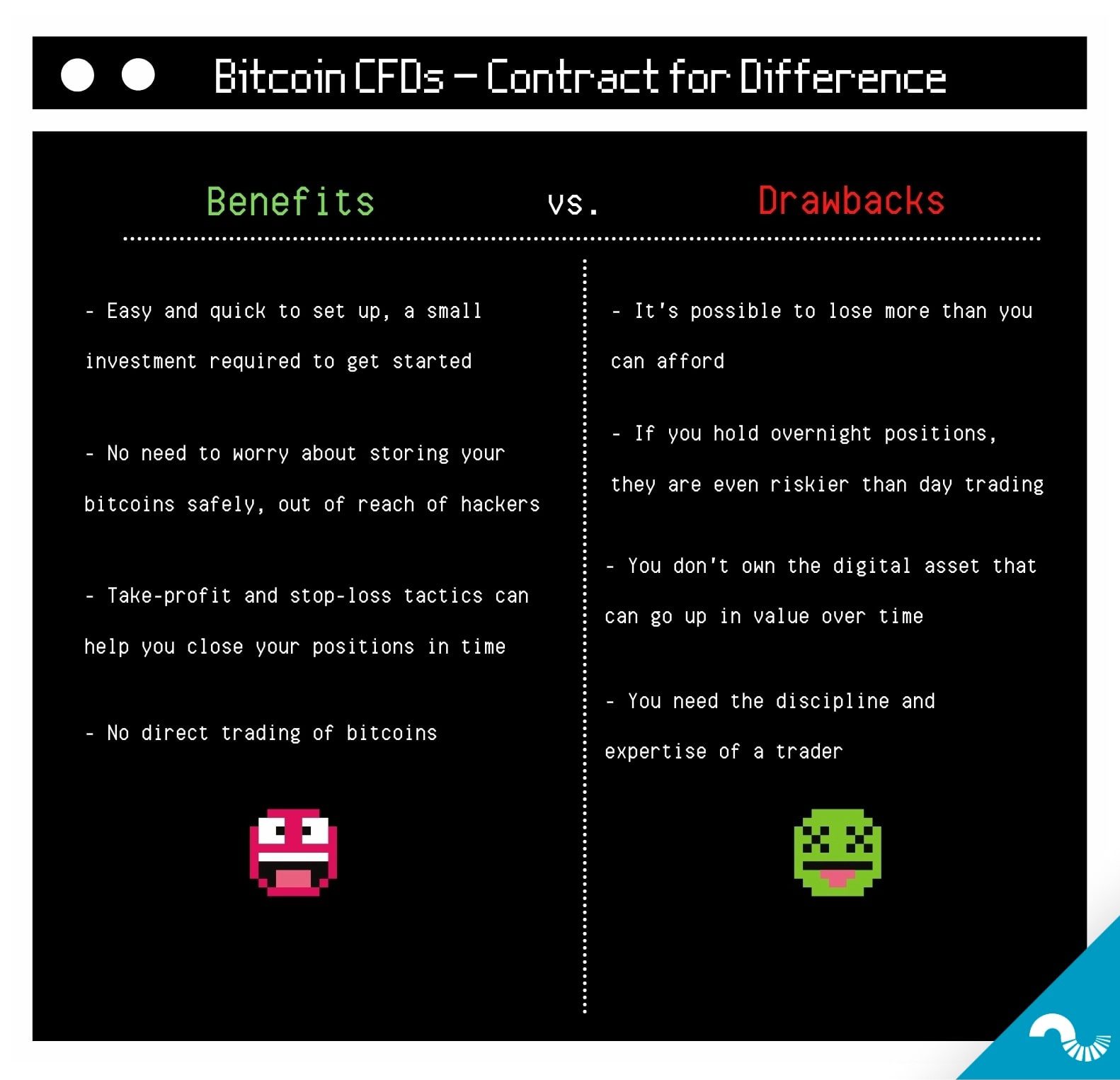

Advantages of Bitcoin CFDs

CFD trading has some advantages and disadvantages. If we look at the benefits, there is no direct trading at CDFs. For example, leveraged trading, short positions for assets, access to overseas markets traditionally do not offer that option.

Bitcoin vs Bitcoin CFD: Simpler trading & faster process

Another advantage is an easy setup. If you make CFD trading for other assets, you can easily add cryptocurrencies to your portfolio. Also, setting everything up and one-click trading with CFD is pretty straightforward.

Access to high leverage opportunities is another advantage of Bitcoin CFD. It means that if you have 1,000 euros, the leverage is 1:3, you can open a position for 3,000 euros. You can earn more money with a slight price increase.

Speed is another advantage of CFDs. Typically, buying Bitcoin takes up to 10 minutes. For other cryptocurrencies and networks, it sometimes takes more than an hour. However, buying or selling Bitcoin CFDs are executed in a second on the broker’s trading platforms.

No need to worry about storing BTC

Last but not least, one of cryptocurrency CFD’s advantages is that you eliminate the need to store your digital assets. Storing bitcoin safely and protecting it from being stolen by hackers is an essential part of investing in cryptocurrencies. Not everybody wants to spend time on that — which is why CFDs might be more suitable for some.

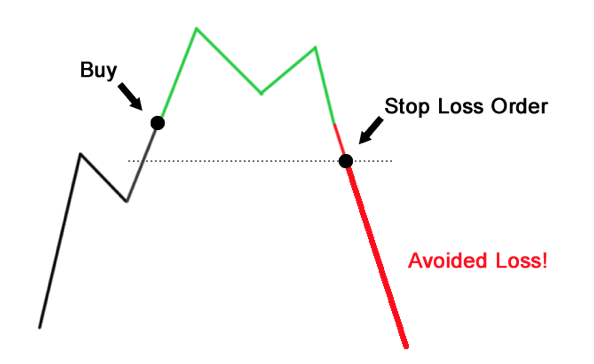

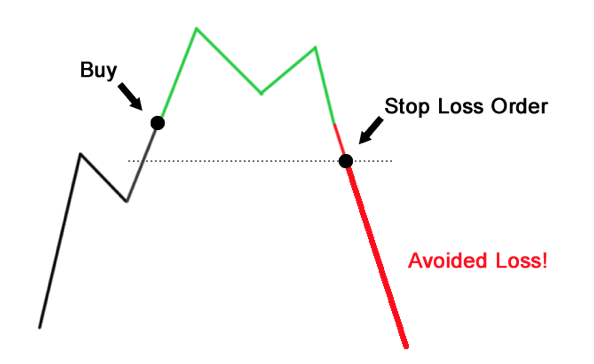

Bitcoin vs Bitcoin CFD: Helpful tactics

Those who decide to trade CFDs and understand the risks can attempt to make price fluctuations work for them — with stop-loss orders. Say, you opened a position when BTC is at 30,000 euros. You can use stop-loss to automatically close the trade when the BTC price drops, say, 10%. This way, you avoid potentially more extensive losses.

Luckily, trading bitcoin and other virtual currencies also allow you to employ stop-loss and take-profit tactics.

Disadvantages of Bitcoin CFDs

There are also disadvantages to crypto CFDs. Before starting trading, it’s vital to get to know those as well.

The most crucial disadvantage of crypto CFDs is that you might lose more than what you could afford. It is tough to predict Bitcoin or other cryptocurrencies’ price movement. Prices can rise and fall up to 10% on any given day on the backs of rumors, tweets, and unsubstantiated news. Their value can always increase or fall because cryptocurrencies could be subject to market manipulation or investors panicking.

Sometimes they lose half of their value in a week. In this situation, you lose more than the money that you initially deposit.

Bitcoin vs Bitcoin CFD: Trade all day, all night

Regular exchange markets close around 17:00. The price of the bonds does not change during the night. But cryptocurrency markets are open 7/24. You can buy and sell anytime — and watch how your portfolio develops around the clock.

However, at Bitcoin CFD, holding a position overnight increases your risk. Those are trading positions that are not closed by the end of the trading day. These trades are held overnight for trading the following day. After regular trading closes, the prices might fluctuate more than during the day. Moreover, you pay the overnight fee. For this extra fee, you need to talk to your broker before you take a position.

Not owning a tangible asset bitcoin

If you trade Ethereum CFD, Bitcoin CFD, or Dogecoin CFD, it means you won’t end up owning any cryptocurrency. If you aim to hold some cryptocurrencies and invest long-term, you must buy them through other means. Additionally, if you want to exchange crypto and profit off a price change, you should still buy a cryptocurrency and not CDFs.

The psychology of trading & risks

Some traders say that it’s hard to get used to the idea that all trades don’t have to be successful. For some, it’s challenging to close long positions just in time to make a reasonably good profit. It’s essential to have the discipline that allows you to stop when the market movements breach your exit level.

Once again, investing in CFDs and other leveraged products requires a certain level of experience. There are high-level risks involved, and CFDs may not be suitable for everybody.

Bitcoin vs Bitcoin CFD: TL;DR

First, you should understand the nature of the market. It’d be a wise move to choose a niche, say, Bitcoin CDFs, and study how bitcoin’s price works. You would then learn that bitcoin has its world and rules — but in some cases, the BTC price behaves similarly to other assets.

Any bad piece of news hurts the Bitcoin market price — and, on the other hand, good news increases the Bitcoin value. Another thing to remember is that the Bitcoin supply is limited. Suppose demand rises, the price increases, too. In fact, this is true for many other cryptocurrencies.

When you start Bitcoin CFD, you must watch every piece of news about Bitcoin very carefully and take a position. In the cryptocurrency market, everything is speculative.

Bitcoin vs Bitcoin CFD: Trade crypto or invest long-term?

If you want to hold a cryptocurrency like Bitcoin long-term, you need to access an exchange market. Coinmotion is a FIN-FSA licensed service provider that helps over 100,000 users invest in bitcoin safely and securely. However, if you have a hunch that Bitcoin price will go up or down and want to speculate, you need a broker that offers CFDs. Remember that CFDs are not suitable for all investors, and you must DYOR (do your own research).

Written by Ali Abaday and Valeriya Kushchuk

Read next: Invest in Bitcoin vs Stocks — What’s the Difference?