Ethereum price:

How does it work & what affects ETH value

Knowing how Ethereum’s price and value are determined can help investors make informed decisions when buying and selling ETH. After a significant price increase in 2021, Ethereum had consolidated its place among other cryptocurrencies, and for the first time, new investors began buying ETH instead of Bitcoin. By 2023, Ethereum had become the second-largest cryptocurrency worldwide, with a market cap of over $200 billion, making it one of the most sought-after and valuable cryptocurrencies

Table of Contents

To understand the changes in Ethereum’s value before investing, it’s vital to know the characteristics and history of Ethereum, just as you would familiarize yourself with any other asset before investing.

Ethereum: Quick Introduction

To help you understand the historical financial development of Ethereum, we have listed Ethereum’s lowest prices in the past years. What could be the lowest price for this year? Make your guess in the comment section below.

- 2015 1 ETH = 0,42 USD = 0,38 EUR

- 2016 1 ETH = 0,95 USD = 0,87 EUR

- 2017 1 ETH = 7,92 USD = 7,21 EUR

- 2018 1 ETH = 83,90 USD = 76,41 EUR

- 2019 1 ETH = 102,93 USD = 90,55 EUR

- 2020 1 ETH = 127,29 USD = 104,58 EUR

- 2021 1 ETH = 730,37 USD = 600,86 EUR

- 2022 1 ETH = 1377 USD = 1156 EUR

- Price of ether in May 2023 – 1 Ethereum (ETH) = 1820 USD = 1673 EUR

Read next: Where and how to buy Ethereum

What affects the Ethereum price

The price of cryptocurrencies depends fundamentally on the supply and demand of the markets. Overall, there are a few significant factors that affect the sentiment of the ether market.

Domination of Bitcoin

Bitcoin has the most influence over the value of other cryptocurrencies. If the bitcoin price increases, the value of other cryptos tends to increase proportionally. This happens in reverse if the price of bitcoin decreases.

Besides the bitcoin price changes, what also affects the Ethereum value is which coin dominates the market. In short, for years, Bitcoin has been the number one cryptocurrency in terms of market capitalization and number of active wallet addresses. But in July 2021, Ethereum, for the first time, flipped (dominated) Bitcoin by the number of daily active addresses on its network. Should the trend continue, the Ethereum price could spike.

Ethereum is seen as a legacy coin

The cryptocurrency market offers a selection of different assets for different investor segments. “Legacy” cryptocurrencies such as Bitcoin and Ethereum are a good fit for long-term holding. These coins carry less risk than newer, smaller tokens.

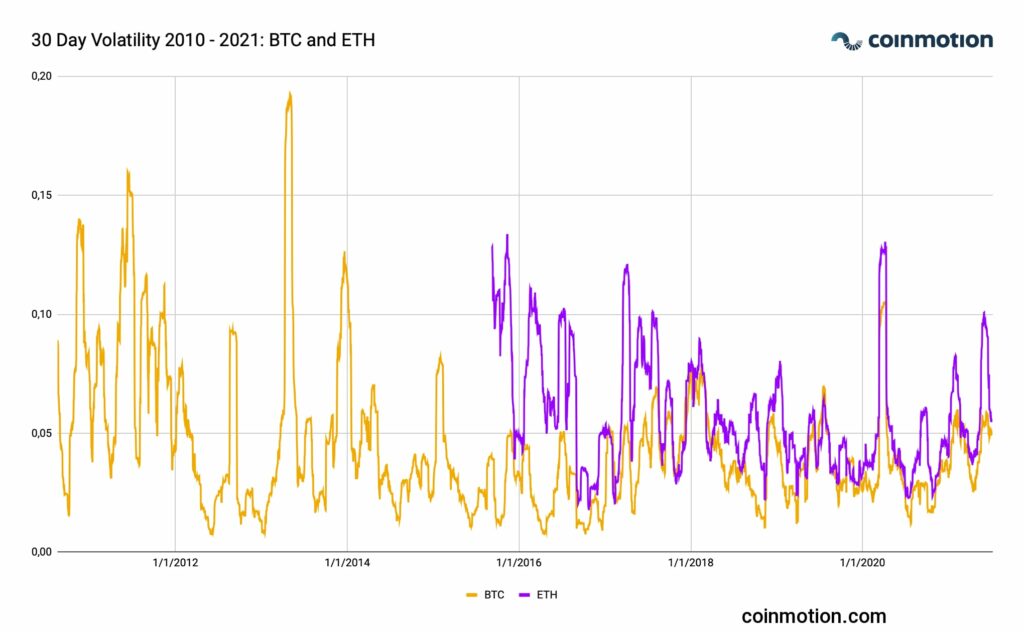

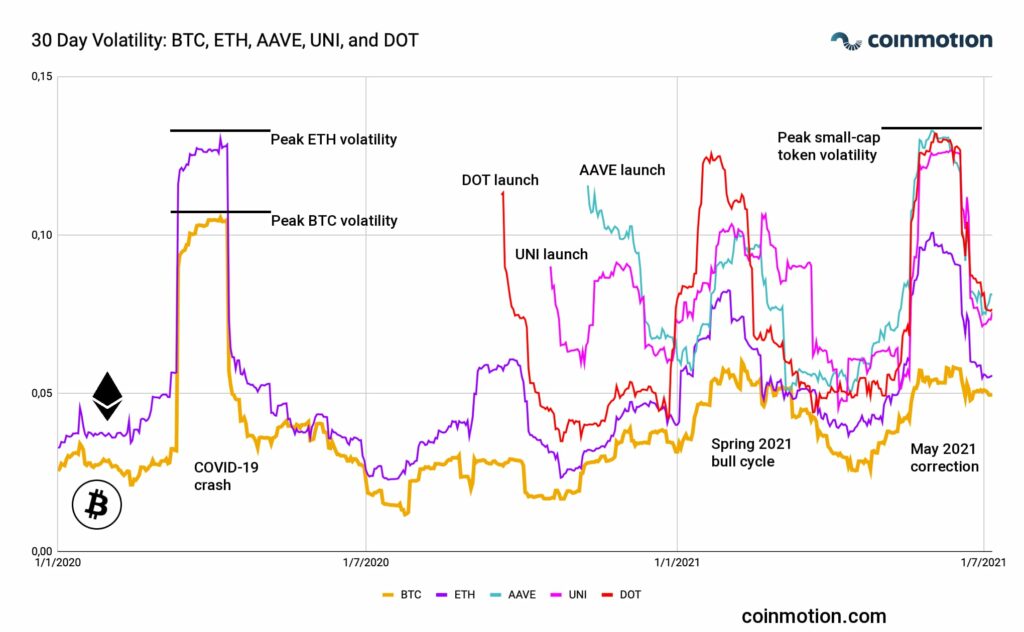

Since the COVID-19-induced market crash, the volatility of both bitcoin and Ethereum has been low if we compare it to newer cryptocurrencies. In the following chart, the volatilities of Bitcoin (BTC) and Ethereum (ETH) peak in the early 2020 COVID-induced crash. Then, the volatility of both assets stays relatively low after spring 2020.

In early-to-mid 2021, younger small-cap tokens showcased escalating volatility during the bull cycle and the May correction.

On January 2022 Ethereum price decreased to 2,411.91 USD (2,231.38 EUR). However, in the following months, the price of Ethereum remained at an average of 2600 USD. Of course, Russia’s invasion of Ukraine had brought even more volatility to the crypto market. However, by the end of 2022, Ethereum had seen a significant price increase, with one ETH being worth 1,377 USD and 1,156 EUR.

Platform upgrades

If the development of Ethereum’s platform includes improvements, the price will increase to reflect the added value. And in fact, the platform has been going through a series of extensive upgrades in its platform since its creation.

The upgrades were initially divided into four main stages: Frontier, Homestead, Metropolis, and Serenity. Serenity, the following stage will concentrate on improving the platform’s efficiency, speed, and scalability.

Ethereum 2.0 is a significant upgrade to the already existing Ethereum blockchain. Namely, this upgrade aims to enable the network to address the bottlenecks and increase the number of transactions. The alternative names for Ethereum 2.0 are Eth2 or Serenity. Thanks to this upgrade, more financial institutions could start using Ethereum.

During the shift to ETH2, the network undergoes a few hard forks. For example, the Ethereum London Hard Fork is launched in August 2021. This hard fork (or change in the blockchain) evens out the ETH network fees and limits the ETH supply.

Ethereum estimates that the 2.0 network could go live by 2022 if the development is successful and goes as planned. At the same time, cautious experts say the upgrade could take years.

Read next: The Future of Ethereum: The Beacon Chain, The Merge, and Shard Chains

Ethereum Supply & Demand

In the second half of 2021, the Ethereum network will undergo a major change. So far, the supply of Ethereum has been unlimited — but that is set to change. After the Ethereum London Hard Fork, the ETH blockchain will burn the fees it charges from crypto users.

This will create deflationary pressure on ETH. In other words, it will be more likely for ETH tokens to increase in value over time since their maximum supply became limited.

Investments & Institutional Usage

In April 2021, European Investment Bank (EIB) announced its plans to offer a two-year digital bond on the Ethereum blockchain. After this update, Ethereum set yet another price record.

But this piece of news was not the only reason behind the recently increasing investment into Ethereum. At the end of March 2021, payments giant Visa announced its first transactions settled with Visa in USD Coin (USDC) and transacted over the Ethereum blockchain.

In 2021, a lot of firms announced their investments in Ethereum. To summarize what happened, after every piece of news about that came out, the Ethereum price increased.

In 2022, the Ethereum Merge was finalized, marking a major milestone for the Ethereum blockchain. Ethereum was officially updated with its new Proof-of-Stake consensus mechanism, attracting many new ESG-minded investors.

Rise of NFT

Non-fungible tokens (NFTs) are yet another reason for the ETH price increase.

NFTs are a form of cryptocurrency. Their main feature is that instead of holding money, they contain assets like art. A non-fungible object, by contrast, has its distinct value, like a picture or a first edition book. And most of the NFTs are part of the Ethereum blockchain.

The NFT market value tripled in 2020, reaching more than $250 million. Therefore, an increasing amount of trades affected the ETH value.

DeFi explosion

The usage of the Ethereum network is becoming even more extensive in the wake of the decentralized finance (DeFi) explosion. Many DeFi tokens are based on the Ethereum blockchain, and their users, in turn, are paying the Ethereum gas fees. Gas fees are payments made by users to compensate for the computing energy required to process and validate transactions on the Ethereum blockchain.

DeFi, which aims to create an alternative financial system that is more accessible than the traditional one, is primarily built through decentralized applications (Dapps) on the Ethereum network.

Summary & video explanation

As with investing in any other asset, it’s essential to keep yourself updated on the subject. The more information you have, the better decisions you’ll make related to trading. Increased knowledge also helps you to anticipate possible risks related to the investment.

Cryptos are new phenomena that not everybody understands, and the conversation might get very technical due to their nature. That’s why it may be a good idea to watch an introductory video about Ethereum. The video also gives a recap of what Bitcoin and decentralized services are.

Ethereum price history: analysis & graph

Here’s a recap of the critical events in the history of Ethereum. These are mainly the important events from a financial point of view, as we have left out the technological milestones of the platform:

Mid 2014. The founder of Ethereum, Vitalik Buterin, gathers up crowdfunding (ICO, Initial Coin Offering) of 18 million dollars. Ethereum goes into the markets with a value of 31 cents per ether (USD).

May 2016. Ether places itself into the markets with a capitalization that exceeds 1.000 million US dollars.

17 June 2016. A hacker steals 3,6 million ethers, totaling around 70 million US dollars at that time. Ethereum divides into Ethereum and Ethereum Classic.

20 June 2017. Ethereum reaches a value of $376,36, which is more than 121.400% of its initial value.

13 January 2018. Ethereum reaches its historical high of 1.432,88 USD per ether.

2019. That was a pretty stable year, with a slight price rally in Q2. On June 26, Ethereum reached a price of 335 USD, which is the highest price for Ethereum since August 2018.

2020. Ethereum has started with a price of 127 USD in 2020. However, it has reached 741.12 USD at the end of 2020.

2021. From the first days of the year, Ethereum price has increased significantly. On the 10th of May 1, ETH was 4200,86 USD. It was an all-time high up to this date.

2022. Ethereum saw increased adoption by businesses, allowing for decentralized applications that could be used at scale. Many major cryptocurrency exchanges adopted Ethereum, allowing users to buy and sell the cryptocurrency easily. Meanwhile, Ethereum was officially updated with its new Proof-of-Stake consensus mechanism.

2023. Ethereum’s DeFi (Decentralized Finance) ecosystem continues to grow, allowing users to access various financial services through decentralized applications.

Ethereum price predictions

Everybody wants to hear price predictions for their favorite cryptocurrencies. Just like bitcoin, Ethereum has its maximalist fans who make optimistic price predictions. Like bitcoin, Ethereum also has its pessimistic critics.

By July 2021, Ethereum has outperformed all cryptocurrencies, including BTC, in the first six months of 2021, in terms of growth and trading volume. As a result, the Finder’s panel of crypto experts went as far as predicting that ETH price is likely to outperform BTC by the end of 2021 which didn’t happen.

According to Finder’s analysts in 2023, Ethereum’s price is expected to peak in at $2,474 per token and conclude the year at $2,184 per unit. Other expert predictions suggest that the price of Ethereum could be between $1,768.09 and $2,652.14 by the end of 2023. Meanwhile, some experts and industry analysts believe that Ethereum will come close to the $4,000 mark by the end of 2023. We’ll have to wait and see.

Ethereum is an asset of high risk and high reward

We can’t be 100% sure of the future of cryptocurrencies, as they’re still relatively new phenomena in the economy. The oldest one, Bitcoin, has existed for a bit over ten years. What we do know is that Ethereum and other digital currencies have evidently seen strong development and growth since they launched. Together they form a true challenge to the traditional ways of finance.

Ethereum’s price and potential are a hot topic for many investors and traders in the cryptocurrency market. Understanding the history, use cases, advantages, and drawbacks of Ethereum are essential for anyone looking to invest in or use the platform. At Coinmotion, we strive to provide our readers with the most accurate and informative content about Ethereum and other cryptocurrencies. With our comprehensive analysis and insights, you can make informed decisions about your investments in the crypto market.

Do you believe ETH will reach 10,000 USD before the end of 2023?

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

– Ali Abaday & the Coinmotion team