As Vitalik Buterin famously wrote in the Ethereum (ETH) whitepaper, everything is a contract. Every contract is basically an if/else statement. The focal point of decentralized finance (DeFi) is to combine contract structure with blockchain technology. We can describe decentralized finance as an open finance movement. DeFi makes financial services available to any user with a smart device globally.

What is Decentralized Finance?

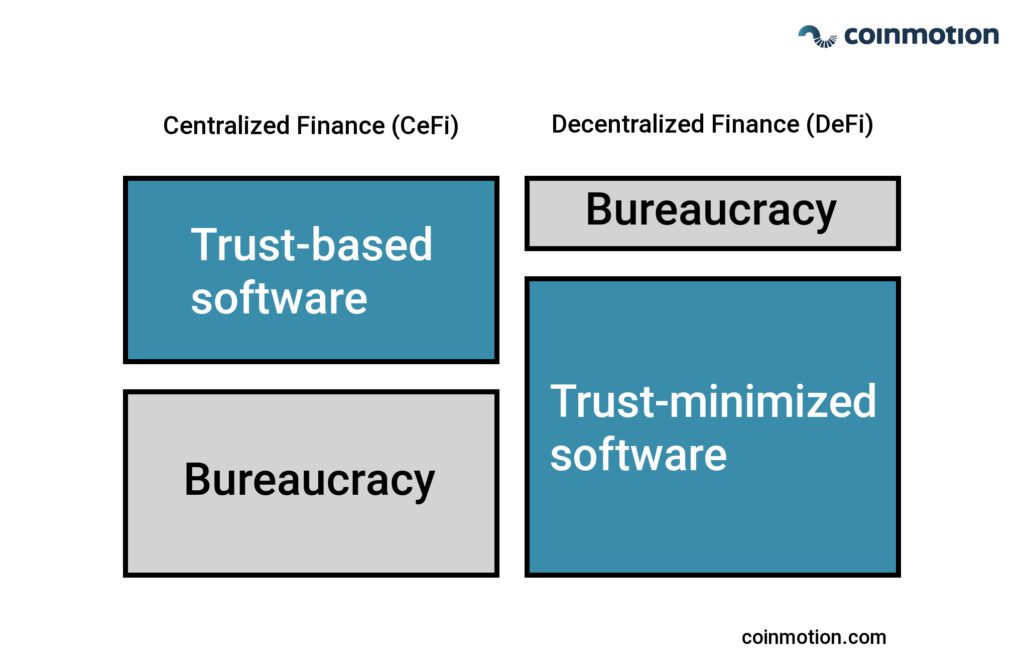

Decentralized finance’s value proposition is to solve the older financial industry’s inherent challenges. The idea is to contrast the traditional centralized financial service sector. The most notable drawbacks of traditional centralized finance, or CeFi, are single points of failure, monopolizing power, and bureaucracy. Centralized finance utilizes trust-based software and heavy bureaucracy, while decentralized finance tries to minimize bureaucracy with trust-minimized software.

The decentralization of financial services relies on smart contracts. In smart contracts, rules are embedded in a computer code that enforces them automatically. A distributed ledger stores all the transaction-related data. This process ensures that no party has complete control over transactions, thus preventing censorship or intervention.

Decentralized Finance: From State Trust to Zero Trust

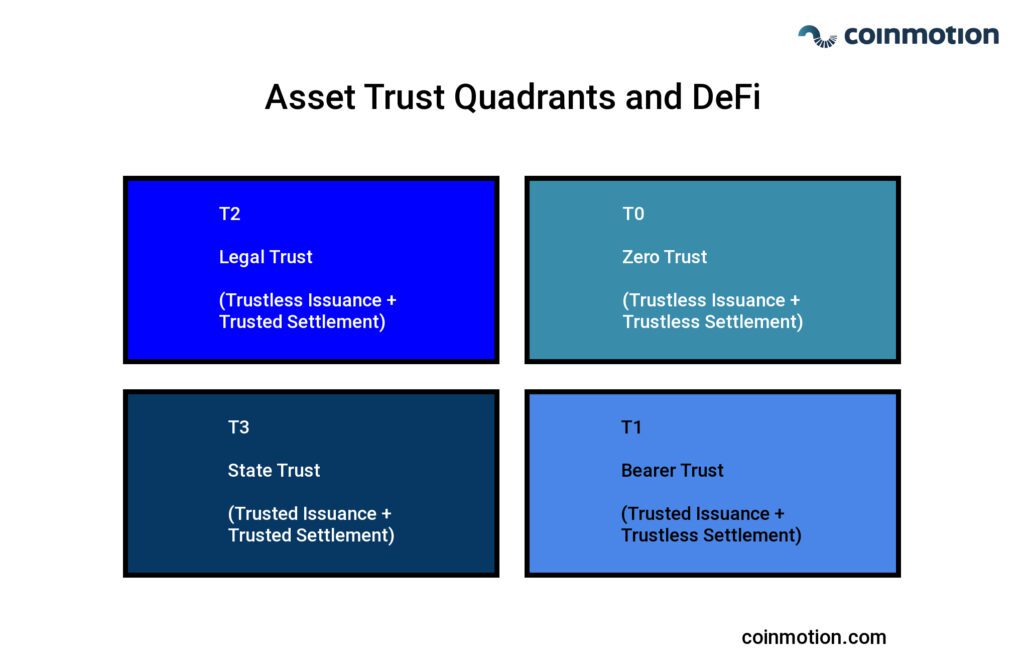

Decentralized finance aims to minimize trust; thus, we call it the zero trust layer. The Zero Trust Layer (T0) has built-in trustless issuance and trustless settlement. The layer consists of DeFi assets like Bitcoin (BTC), Ethereum (ETH), Maker (MKR), Aave (AAVE), and Uniswap (UNI). The zero trust layer is the most antifragile tranche in this category and holds vast potential.

The Bearer Trust Layer (T1) includes assets like bearer bonds, national currencies in cash form, and the BNB token. The bearer trust layer has trusted issuance but trustless settlement.

The Legal Trust Layer (T2) features trustless issuance and trusted settlement. The assets in the legal trust layer are tokenized products. Some of such products are gold ETFs, Paxos Gold (PAXG), Tether Gold (XAUT), and Wrapped Bitcoin (WBTC).

The State Trust Layer (T3) is the complete opposite of the zero-trust layer. The layer includes assets like stocks, real estate, and national currencies. The state trust layer features trusted issuance and settlement backed by a state-level actor.

Decentralized Finance & Total Value Locked (TVL)

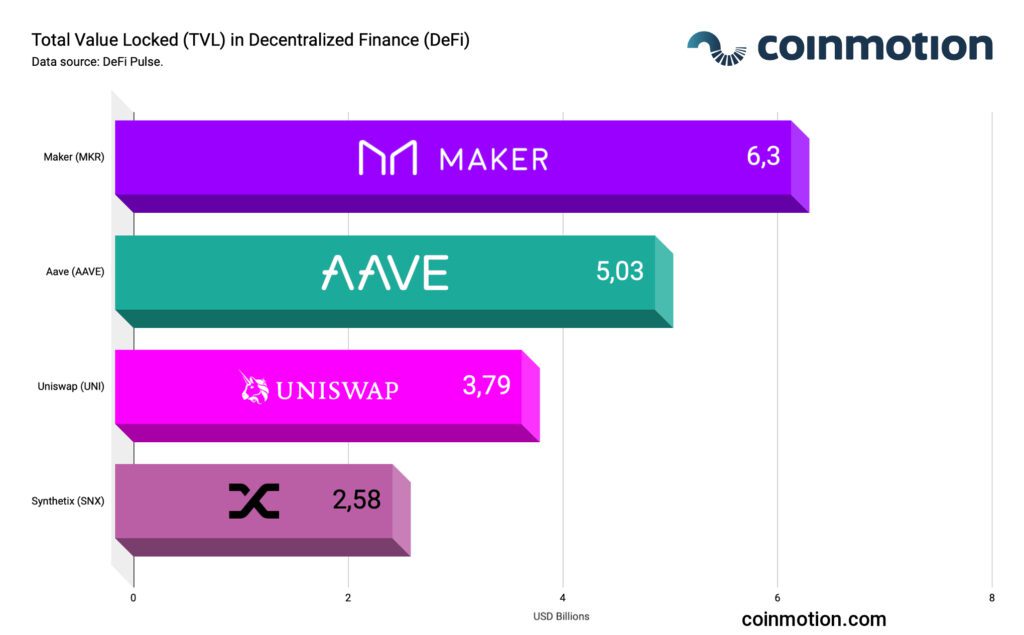

We can measure the adoption scale of DeFi projects by the total value locked (TVL) metric. Sites like DeFi Pulse track DeFi by pulling the entire balance of Ether (ETH) and ERC-20 tokens held by these smart contracts. We can calculate the total value locked by taking these balances and multiplying them by their price in U.S. dollars (USD). Maker (MKR) leads the DeFi scene with 6,3 billion dollars worth of TVL. Aave (AAVE) has above 5 billion USD TVL, and Uniswap (UNI) is 3,79 billion. We’ll explore these projects further in this blog.

What is Maker (MKR) & MakerDAO (DAO)

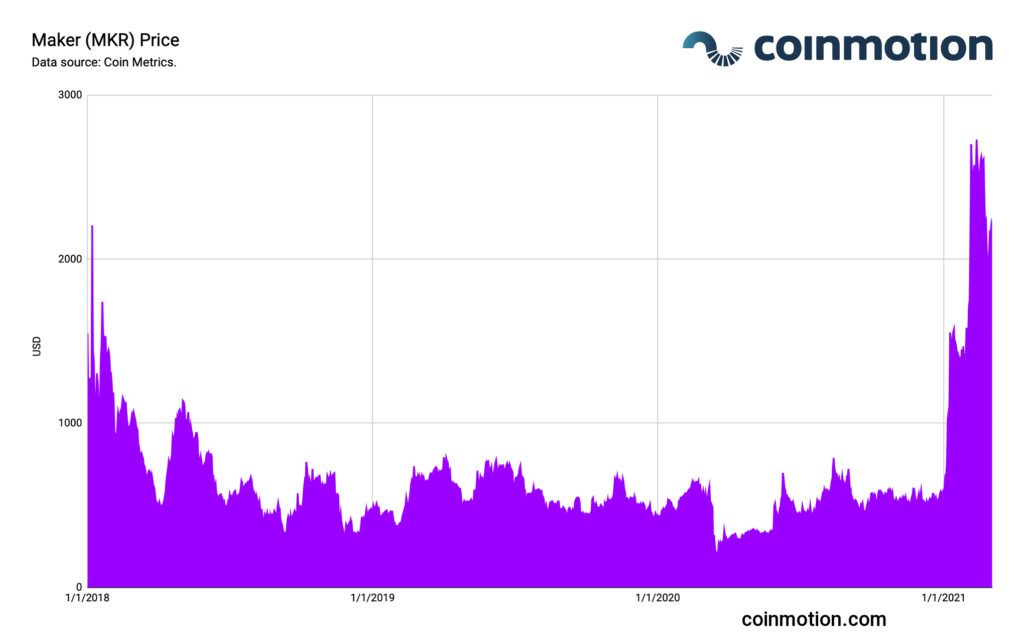

Maker is a stablecoin project and decentralized reserve bank where each stablecoin (called Dai) is pegged to the U.S. Dollar and backed by collateral in the form of crypto. In short, stablecoins offer crypto programmability. Moreover, stablecoins do that without the downside of volatility that you see with more traditional cryptocurrencies like bitcoin or Ethereum. For example, the price of Maker (MKR) has been performing well from 2020 to 2021 in both USD and BTC terms.

MakerDAO is the organization behind MKR and Dai tokens, developing technology for borrowing, savings, and stablecoins. In July 2021, Maker Foundation made good on its promise to decentralize the MakerDAO project. The Foundation would dissolve shortly, as the DAO (Decentralized autonomous organization) is now self-sufficient and continues to function as usual.

Above all, the purpose of the Maker (MKR) token is to support MakerDAO’s Dai token’s stability. Another purpose is to enable governance for the Dai Credit System. That is how the holders of MKR make critical decisions on the operation and future of the system.

MakerDAO is a project with a current estimation of 7.4 billion EUR total value locked into its platform as of May 25th, 2021. MakerDAO is a Decentralized Autonomous Organization that has gathered quite the buzz due to its native token DAI, one of the cryptocurrency industry’s most popular stablecoins.

DAI’s value is pegged to the US dollar and can be used by anyone for a variety of services, including the over 400 apps that have been integrated with the Maker ecosystem. These include wallets, projects, platforms, and games. Holders of DAI will gain a savings rate set by the Maker protocol, decided on by holders of Maker’s governance token MKR.

Why MKR matters

Maker is a futuristic decentralized autonomous organization built for ambitious governance and stable value functions. Maker is backed by leading venture capital firms, including a16z.

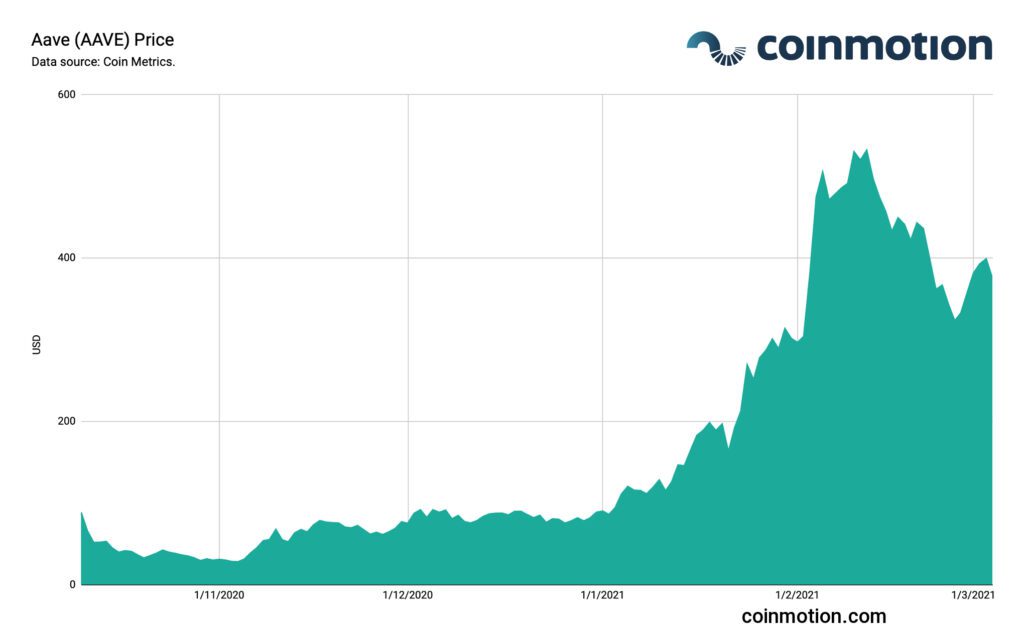

What is Aave (AAVE)

A DeFi project with Finnish roots, Aave (AAVE), crossed $5,03 billion in total value locked (TVL) during spring 2021. Aave continued to grow since.

Aave is an Ethereum-based DeFi platform that started its journey as ETHLend. The platform focuses on lending and recently launched undercollateralized lending based solely on social reputation. CEO Stani Kulechov, currently residing in London, manages Aave. Stani has a Finnish background. That’s how the project got its name: “aave” means ghost in Finnish, which reflects Stani’s relationship with Finland.

Aave issues two types of tokens for ecosystem operations. One type is aTokens, issued to lenders so they can collect interest on deposits. Another type is AAVE tokens, which are the native token of Aave.

The AAVE cryptocurrency offers holders several advantages. For instance, AAVE borrowers don’t pay a fee if they take out token-denominated loans. Additionally, borrowers who use AAVE as collateral get a discount on fees. AAVE owners, if they pay a fee in AAVE, can examine loans before the general public gets access to them. Borrowers who post AAVE as collateral can also borrow slightly more. The Aave ecosystem uses sophisticated game theory-inspired structures to incentivize different parties.

Why it matters

In short, Aave is one of the leading Ethereum-based ecosystems for future money markets. As a result, Aave has raised funding from Blockchain Capital, Blockchain.com Ventures, Framework Ventures, and Three Arrows Capital.

What is Uniswap (UNI)

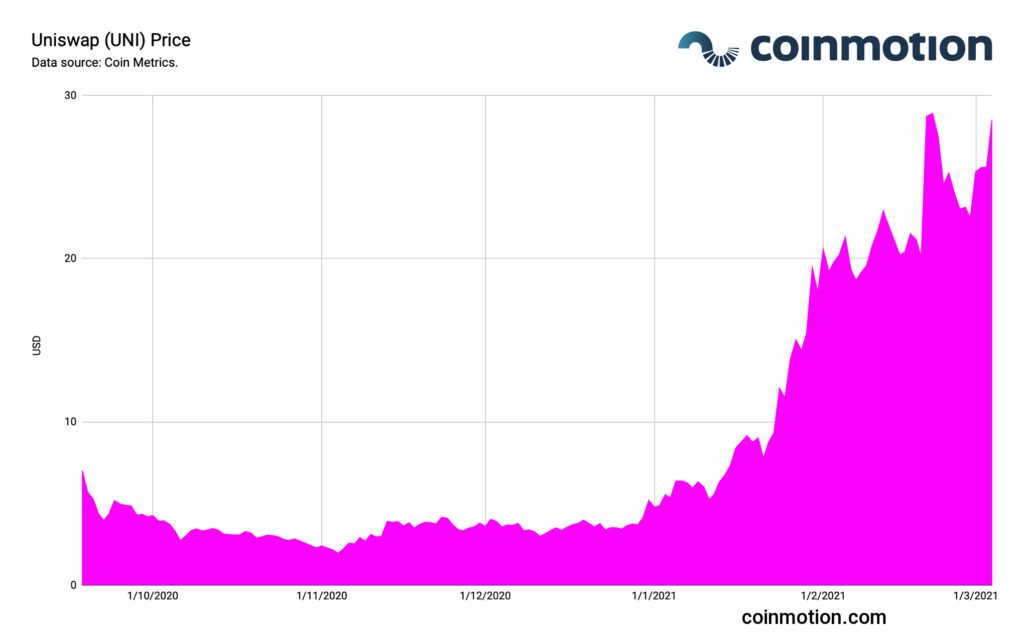

Uniswap (UNI) is a relatively new platform. As the price data shows, its governance token UNI has only been available since September 2020. The UNI governance token gives its holders the right to vote on developments and changes to the Uniswap platform.

Uniswap is a fully decentralized exchange (DEX), and no single entity owns it. Uniswap is also completely open-source, which means anyone can copy the code to create their own decentralized exchanges. It even allows users to list tokens on exchange for free.

Uniswap runs on two smart contracts — an “exchange” contract and a “factory” contract. The factory smart contract adds new tokens to the platform. Meanwhile, the exchange contract facilitates all token swaps or so-called “trades.” Then, users can swap any ERC-20-based token with another on the platform. Uniswap has solved its liquidity challenges with an automated liquidity protocol that incentivizes users to become liquidity providers (LPs).

Why it matters

Uniswap is the market-leading decentralized exchange (DEX). It has massive potential. Moreover, the UNI governance token offers exciting opportunities for investors.

What is Synthetix (SNX)

As one of the DeFi projects with the most value locked in its smart contracts, Synthetix continues to be one of the fastest-growing projects out there.

Synthetix allows users to mint new crypto assets that synthetically mimic other real-world assets, such as the Euro and crypto-assets like Ethereum.

Users can collateralize an asset by purchasing native synth tokens and locking them away into a designated smart contract for the asset of their choice. Through oracles, these smart contracts gather data on the asset allowing users to follow fluctuations in the market. The platform maintains liquidity through the open market of synths across DEXs in the DeFi space.

The Future of Decentralized Finance & Investing in it

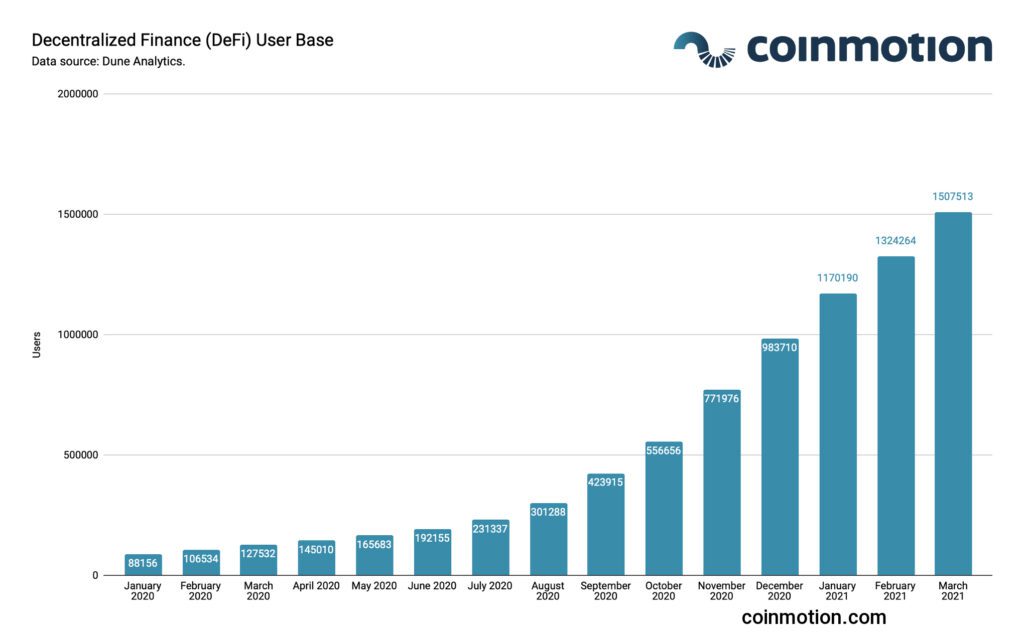

The user base of decentralized finance is growing, and the industry is scaling up rapidly. Consequently, an escalating number of investors are looking to allocate in the developing industry. Before investing in DeFi, as with any other industry, it is important to know what you should pay attention to and what projects you should know.

ETH, AAVE, LINK, and UNI tokens are available for buying, selling, and storing on Coinmotion — as well as the USDC stablecoin and ETH that powers them all.

If you want to invest in more DeFi tokens, contact our Coinmotion Wealth team.

Boom! Impressingly compact and on point! I tip my hat to you sir!