Over the last several years, stablecoins have grown to play an essential systemic role in the cryptocurrency ecosystem. What is the point of stablecoins and when would you need to use them? These are the questions that every crypto investor should know answers to.

Why do we need stable cryptocurrencies?

Stablecoins began as a novel tool for traders to easily maintain the value of their digital assets without having to offload into fiat currency. Converting cryptocurrency for fiat currency can take hours or even days. Therefore, a stable-value cryptocurrency was a quick and easy way for crypto traders to ensure price stability for their holdings.

However, the number of use-cases for stablecoins has grown significantly since then. People now create coins in association with several different reserve assets. In addition to fiat currencies, they can tie tokens to precious metals, real estate, and even other kinds of volatile digital currencies.

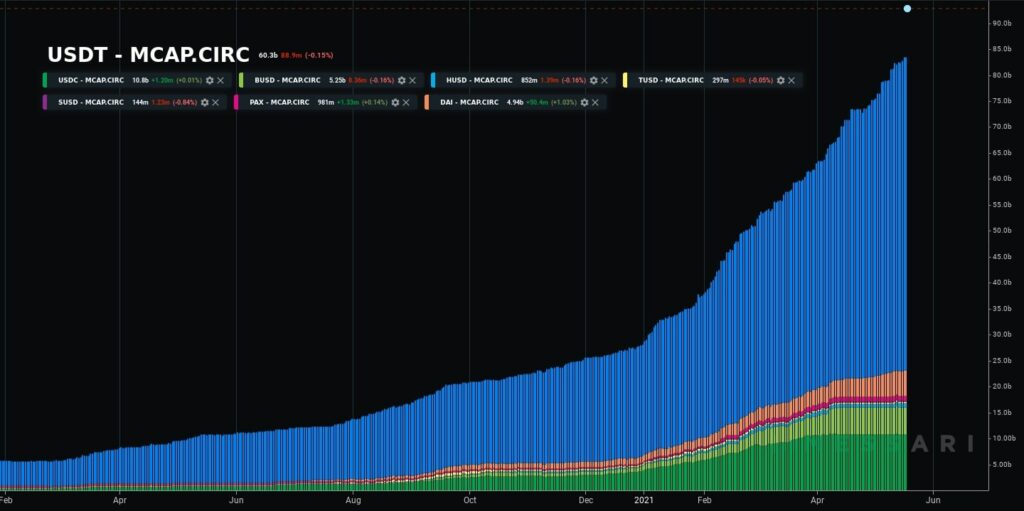

As the number of use cases has continued to grow, so too has the market capitalization of stablecoins. At the beginning of 2019, the total stablecoin market capitalization was roughly $2.6 billion. In May of 2021, stable asset markets had grown to $60.3 billion. In July of 2022, the stablecoin market capitalization reached $154 billion.

What are stablecoins, exactly?

The design of stablecoins is such that they are not subject to price volatility in the same way that traditional cryptocurrencies are. A stablecoin is a kind of blockchain-based token. It derives its value from various forms of collateral it’s tied to.

There are several different types of stablecoins. Each has its own set of use cases.

Fiat-collateralized stablecoins

Fiat-collateralized coins are tied to different kinds of fiat currencies such as the US dollar (USD), the pound sterling (GBP), or the euro (EUR). These kinds of popular stablecoins are back on a 1:1 basis. I.e., the issuers of these tokens must have fiat currency reserves equivalent to the number of coins issued and be regularly audited. Stablecoins pegged to fiat currencies are some of the most popular on the market.

There has been a growing number of initiatives to create government-issued fiat-backed stablecoins. For example, China’s central bank has been working on the development of a digital yuan stablecoin since 2014. Some analysts argue that government-issued cryptocurrencies could play a key role in mass cryptocurrency adoption.

Commodity-backed stablecoins

Commodity-backed coins can be tied to a unit of any commercial good that is interchangeable with other goods of the same type. This includes things like grains, beef, oil, and natural gas.

The most common type of commodity-backed coins are those that are tied to precious metals, such as gold. Tether Gold (XAUT), Paxos Gold (PAXG) are two of the most popular tokens the value of which depends on the price of gold. In July of 2022, the market capitalization of XAUT was roughly $445 million. PAXG’s market cap was more than $605 million.

Crypto-collateralized stablecoins

Stablecoins can also tie to crypto-assets like Bitcoin (BTC) and Ether (ETH). In order to maintain a truly “stable” value, crypto-backed tokens are typically “over-collateralized.”

In other words, the issuer maintains a larger number of cryptocurrency tokens in the reserve to create a relatively lower number of tokens. For example, one may keep $2,000 in BTC kept in reserve for the issuance of $1,000 worth of a BTC-backed stablecoin. This would accommodate for a price swing of up to 50%.

Algorithmic stablecoins

Non-collateralized, or algorithmic stablecoins, use smart contract-based mechanisms that alter their supply. This way, the coins maintain a stable value.

For example, Basecoin uses a consensus algorithm that automatically increases or decreases the supply of tokens on an as-needed basis.

Why do people use stablecoins?

For active cryptocurrency traders, the most practical use of stablecoins may be their initial purpose. After all, fiat-backed cryptocurrencies are a quick and easy way to protect the value of cash that investors and traders would otherwise store in volatile assets. Commodity-backed tokens can provide easy access to gold, oil, real estate, and other kinds of investments.

However, people increasingly use fiat-backed cryptocurrencies as a method of sending payments internationally. Even in 2022, sending a cross-border transaction through a bank can be a costly and time-consuming process.

On the other hand, one can make stablecoin payments almost instantly and with a far lower expense. However, it’s important to note that stablecoin transactions are not entirely free. Transaction fees can vary quite a bit depending on which blockchain the stablecoin works on. Additionally, stablecoin users are liable to pay fees associated with converting a stablecoin into fiat currency.

Stablecoins explained: here’s the TL;DR

You don’t need to be a stablecoin expert in order to use them successfully. Here’s what you need to know to make the most out of the stablecoins that are available to you.

- Investors can use fiat-backed stablecoins to protect the value of their money without offloading it into fiat currency completely. You can also use fiat-backed coins as an affordable method of sending international payments. Stablecoin interest accounts are another financial service that attracts crypto investors as the lending market grows in popularity.

- Commodity-backed stablecoins can be an easy way to access investments in commodity markets, including gold, oil, and real estate.

- Crypto-backed stablecoins are tied to volatile cryptocurrencies like Bitcoin and Ether. Algorithmic stablecoins, in turn, don’t depend on any assets. Instead, it’s an automatic mechanism that increases or reduces the supply and controls the value of algorithmic coins.

Coinmotion offers its users the ability to purchase and exchange USD Coin (USDC), one of the most trusted stablecoins on the market pegged to the U.S. dollar. To learn more, click here.

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.