The TA of week 26 focuses on Deutsche Bank’s price target and possible technical patterns. Additionally, we explore the deleveraging market and why Bitcoin looks oversold.

Deutsche Targets $28K Bitcoin, Inverse Head and Shoulders Pattern Ahead?

The digital asset markets continued to slide down during the past seven days, leading to Bitcoin declining -5,7 percent. However, we’re seeing some emerging rays of hopium despite the challenging market environment. Deutsche Bank recently updated its spot price target for Bitcoin, citing a potential 30% increase and spot rising to $28K level. The strategists Marion Laboure and Galina Pozdnyakova noted that Bitcoin is exceptionally correlated with the stock market and S&P 500 Index. Bitcoin’s 90-day Pearson correlation with S&P momentarily dropped to 0,56 in early June but increased again to the current 0,61. In the bigger picture Bitcoin has fared well in the technology stock cohort during H1 of 2022.

2022 First Half (H1) Performance:

Apple: -23%

Microsoft: -24%

Alphabet: -25%

Amazon: -35%

Tesla: -35%

Zoom: -40%

Airbnb: -45%

Pinterest: -49%

Nvidia: -50%

Uber: -50%

Meta: -53%

Bitcoin: -59%

PayPal: -62%

Etsy: -64%

Netflix: -70%

Snap: -72%

Ether: -73%

Shopify: -74%

Coinbase: -80%

Investors have been categorizing Bitcoin as a high beta asset and thus Bitcoin has been following the trajectory of technology-related stocks. Deutsche’s Laboure and Pozdnyakova expect the S&P 500 Index to recover back to January levels later this year. Investors have been increasingly de-risking their positions amid the CeFi lending turmoil.

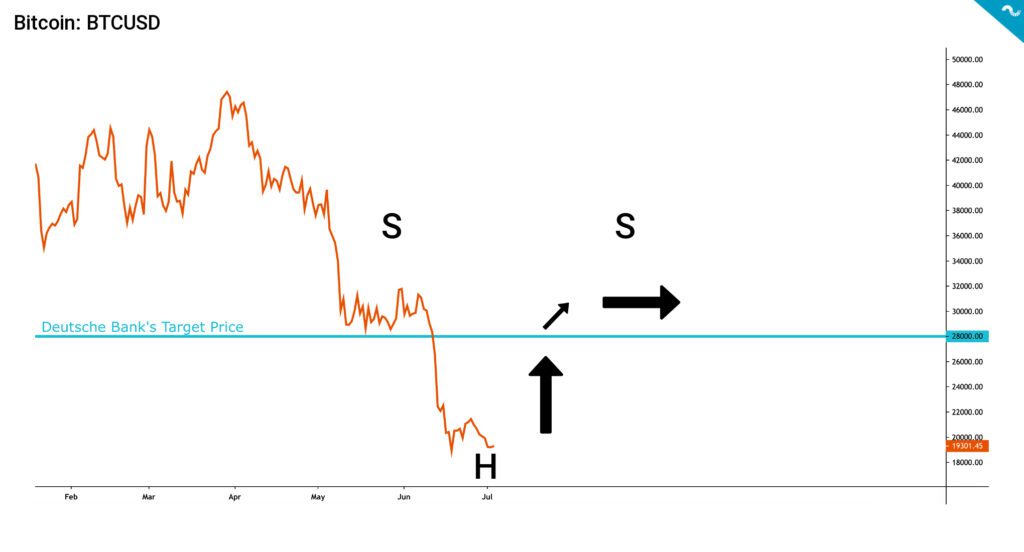

When looking at the embedded technical chart, Deutsche Bank’s $28K target seems reasonable as it would mean Bitcoin climbing back to its previous support level. If Deutsche Bank’s estimation is right, Bitcoin might form an Inverted Head and Shoulders Pattern. The first shoulder (S) was the previous $30K level, after which Bitcoin dropped to the head (H) of $19K. In the pattern, bitcoin would ascend back to shoulder (S) level of $28K-$30K.

Bitcoin’s spot price is yet again at crossroads and bulls might even have a chance here. The open interest just spiked hard and we’ll likely see an epoch of escalating volatility. The spot price fight point is at $19K and many traders are guessing it to go lower to $17K. However Bitcoin looks oversold and we might see a relief rally to $24K and even close to $30K, following Deutsche’s forecasts. As W.D. Gann famously said: “Time is more important than price. When time is up, price will reverse.”

Bitcoin Oversold as Market Cap Drops Below Delta Cap

The other cryptocurrencies continued to weaken in Bitcoin’s wake as many DeFi tokens like Uniswap (UNI) dropped almost 10 percent. While Bitcoin’s correlation with S&P 500 Index seemed to weaken last week, it has recently zoomed from 0,49 to 0,61. Bitcoin looks more oversold than seven days go, as RSI has decreased from 35 to 32.

7-Day Price Performance

Bitcoin (BTC): -5,7%

Ethereum (ETH): -6,3%

Litecoin (LTC): -9,7%

Aave (AAVE): -7,3%

Chainlink (LINK): -7,3%

Uniswap (UNI): -9,3%

Stellar (XLM): -8,8%

XRP: -9,9%

– – – – – – – – – –

S&P 500 Index: -2,2%

Gold: -0,8%

– – – – – – – – – –

Bitcoin’s 90-Day Pearson Correlation with S&P 500 Index: 0,61

Bitcoin RSI: 35

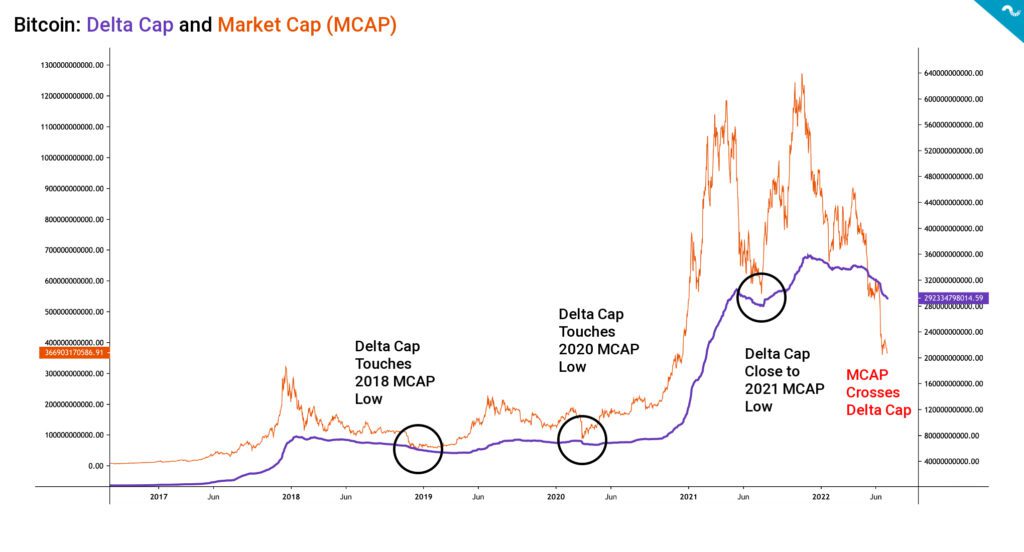

Another notable indicator mirroring oversold Bitcoin is the Delta Cap, which is calculated as the subtraction of Realized Cap by Average Cap. While Delta Cap has indicated market bottoms in 2018, 2020, and 2021, bitcoin’s market cap has recently crossed Delta Cap as a historical anomaly. The current Delta Cap tells about historically low valuation for bitcoin and marks a buying opportunity.

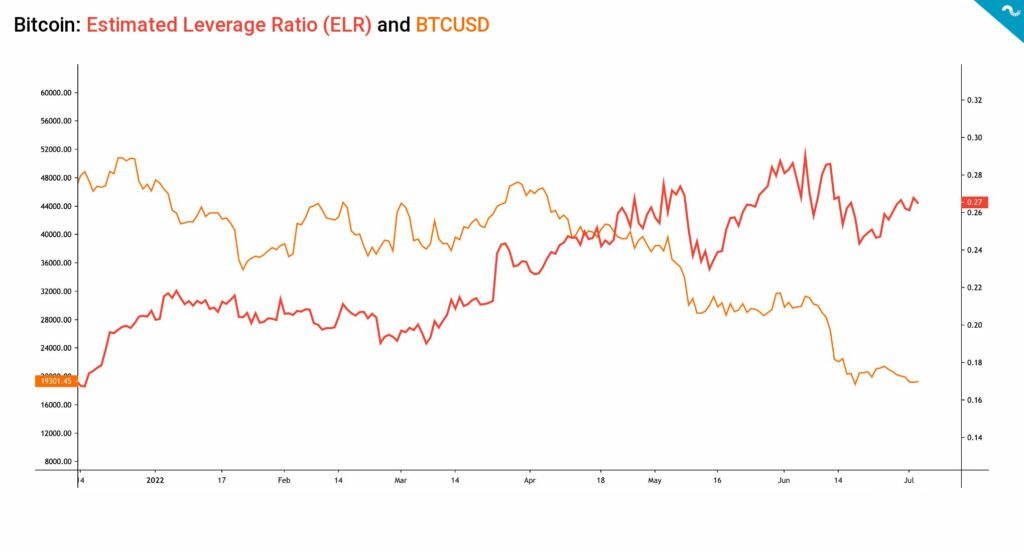

Estimated Leverage Ratio Peaked?

Investment bank JPMorgan’s analyst Nikolaos Panigirtzoglou recently commented on the digital asset market and according to him, the “crypto winter” is about to end. At the same time, one of the multiplicative effects of weakening spot price has been the decreasing Estimated Leverage Ratio (ELR), which is a healthy trend. A decrease in ELR means a decrease in the relative number of speculative investors.

According to Panigirtzoglou, the decline of the speculative retail segment is inversely correlated with the appetite of smart money. The interest of institutional money is indicated by the growth of venture capital investments, which rose to $8 billion from May to June. Despite the crisis in CeFi loan services, the market is clearly maturing and players like FTX are taking a bigger role in rebalancing the market. Remarkably, the crypto sector seems to be surviving the winter completely without public support, unlike the traditional finance in the aftermath of the 2008 subprime crisis, which resulted in publicly funded bank bail-outs.

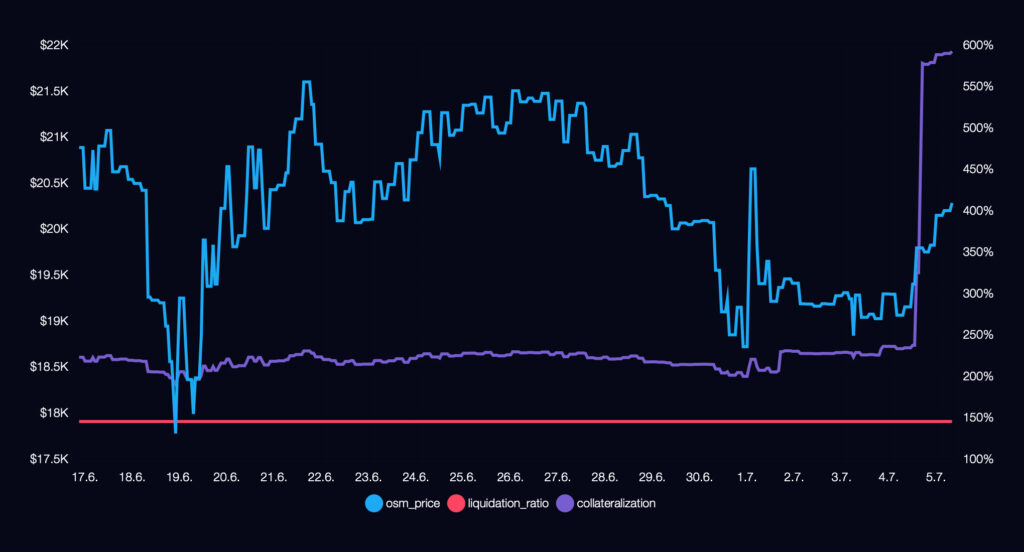

Celsius’ Liquidation Price Has Dropped to $4967

The meltdown of Terra and its multiplicative effects on CeFi lending operators have truly stress-tested the market this year. However, now we’re seeing some light at the end of the tunnel as Celsius is seemingly able to balance its financials. The recent data shows how Celsius has spent $140 million in order to lower its liquidation price from $13K to around 5000 USD. This move makes Celsius a lot more resilient to potential further spot price decreases.

The Celsius community has been surprisingly active in defending their positions and it successfully organized a short squeeze some weeks ago. In the short squeeze, the CEL token was suddenly pumped up over 300 percent in a week, effectively destroying CEL shorters. Celsius has reportedly hired an army of external attorneys and consultants, who are working hard to bring the platform back to solvency.

What Are We Following Right Now?

Peter McCormack and Lyn Alden discuss the rise and role of central banks: Their intermittent role in the US’s history, the piecemeal erosion of a gold standard, the new era of easy money, and whether Bitcoin could replace central banking.

There are only 2 million Bitcoin left to be mined as mining difficulty increases. Bitcoin is about to become an even more scarce asset class.

⚠️ Only 2 million #Bitcoin left to be mined ⚠️ pic.twitter.com/h1Vcv7Uibz

— Bitcoin Magazine (@BitcoinMagazine) July 3, 2022

Where does the DeFi yield come from? An insightful wrap-up by Token Terminal.

Where does the YIELD come from in DeFi?💰

— Token Terminal (@tokenterminal) July 2, 2022

• DEXs: trading fees

• Lending: interest

• Options: premiums

• Staking derivatives: block rewards (& tx fees)

• All protocols: governance token incentives

• Yield aggregators: all of the above

June 2022 was an exceptional month for the blockchain industry. Travis Kling of Ikigai Asset Management opened his thoughts about the state of the market.

I've been doing these for 46 straight months and I've never seen one like this before. pic.twitter.com/aGGpKYIoti

— Travis Kling (@Travis_Kling) June 30, 2022

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.