Uniswap is a decentralized exchange which is a newer concept created to contrast centralized exchanges. As the names suggest, a decentralized exchange removes the third party. Such an exchange allows users to send cryptocurrencies directly to other interested parties. The Uniswap platform functions as a public good, as their website describes it.

Decentralized Exchange

On October 3, 2016, the young founder of Ethereum (ETH) Vitalik Buterin announced a revolutionary decentralized exchange (DEX) concept. Vitalik criticized the high spreads of platforms like MKR and EtherDelta, proposing a more efficient alternative. The plan described an exchange structure that would incorporate low spreads and blockchain-only transactions.

Since Vitalik introduced the concept, multiple decentralized exchanges have emerged. After that, Uniswap has become one of the leading platforms in the scene. Uniswap is an open-source exchange that runs on the Ethereum blockchain.

The platform utilizes an automated market-making system instead of a traditional order book. In other words, Uniswap automatically matches individual buy and sell orders, allowing users to pool together two assets they trade against. The platform then determines the price based on the ratio between two traded assets.

How does a DEX work?

Uniswap has managed to mitigate some of the pitfalls traditionally associated with DEXs. The main problem they solved is low liquidity.

To address this issue, the platform developed its own liquidity protocol. The protocol collects pooled tokens on Uniswap together from liquidity providers (the users). The pools then make it possible to execute all the token swaps on the platform immediately. At the same time, Uniswap charges a flat 0.3% trading fee on each transaction. Next, liquidity providers receive rewards for joining the Uniswap pool and staking their funds depending on the amount of tokens they provided.

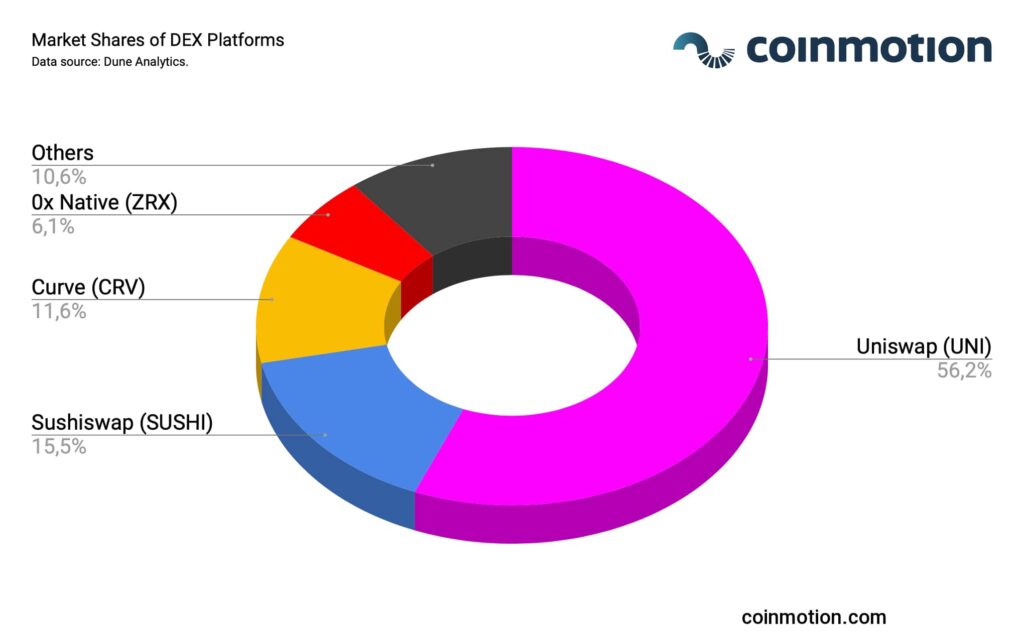

Uniswap has evolved into the de facto trade platform for decentralized finance. Namely, it has reached the third rank in terms of total value locked (TVL). Moreover, Uniswap is dominating the decentralized exchange (DEX) competition with a 56,2 percent market share.

What is Uniswap: The Brief History

October 2016: Vitalik Buterin unveils a decentralized exchange (DEX) concept.

November 2018: Uniswap launched.

1/🦄 Excited to announce the launch of @UniswapExchange ! It's a protocol for automated exchange of ERC20 tokens on Ethereum. https://t.co/czTqyRit7u

— hayden.eth 🦄 (@haydenzadams) November 2, 2018

The UNI Token

UNI token was introduced in September 2020. The primary purpose is to act as a governance token for community involvement and oversight.

The DeFi platform allows UNI holders to vote on project developments that align the course of Uniswap’s future evolution. UNI holders can also use the token for funding liquidity mining pools, grants, partnerships, and other platform-related initiatives.

Uniswap aims to grant even more power to UNI holders in the future, following the concept of decentralization. Uniswap has executed an airdrop of 400 UNI tokens to all platform users when the airdrop was sent to 250 000 Ethereum (ETH) addresses.

What is Uniswap in Numbers

Uniswap has clearly achieved a dominant position among decentralized exchanges (DEX) with a 56,2 percent market share. We can even describe this platform as one of the fundamental drivers behind the growth of the DeFi market.

In April 2021, Uniswap CEO Hayden Adams reported that the platform set a new weekly volume record. Its cumulative transactions went above $10 billion. Thus, if the exchange maintains this pace, it will result in $500 billion worth of transactions per year.

🔥 @Uniswap weekly trading volume just passed $10b for the first time!!!

— hayden.eth 🦄 (@haydenzadams) April 20, 2021

👀 $10b/week is over $0.5 trillion per year pic.twitter.com/ZibcDT9Zob

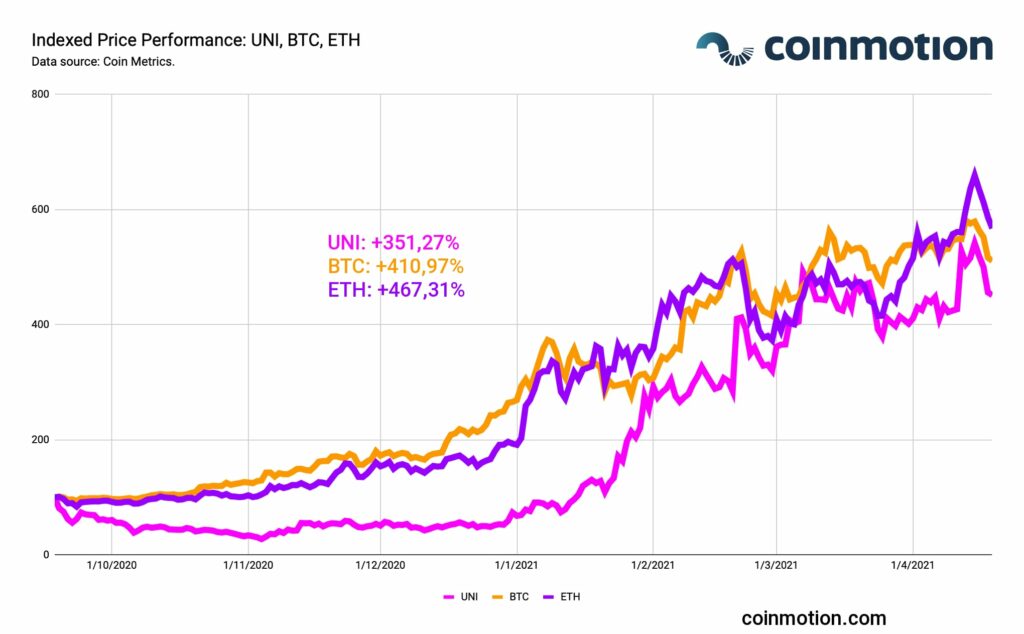

UNI has been relatively correlated with Bitcoin (BTC) and Ethereum (ETH). UNI showed a 0,30 correlation with the former and 0,45 with the latter. Furthermore, indexed price performance shows UNI rising 351,27% after launch. Meanwhile, Bitcoin has ascended 410,97% and Ethereum 467,31% within the same time horizon.

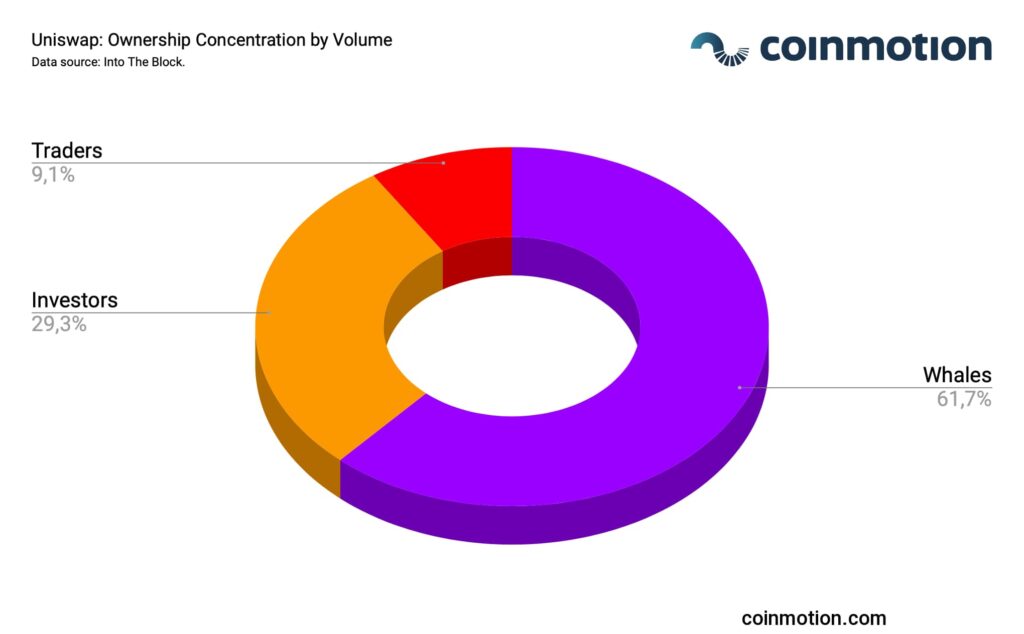

Uniswap’s owner concentration is typical for newer digital assets. Namely, it’s a large share of ownership in the hands of whales. Firstly, whales (large owners) own 61,7% of UNI tokens in circulation. Secondly, the investor tranche owns 29,3% of UNI tokens. Finally, the trader concentration currently remains relatively low at only 9,1%.

Uniswap Protocol and Potential

Uniswap’s most unique technology lies in an innovation called automated market maker (AMM). AMM is a smart contract managing pool within the platform. In brief, together they provide tokens used for effectuating a transaction. The AMM algorithm determines the effective price of the token calculated from supply and demand ratios between tokens in said liquidity pools.

Uniswap currently charges a 0,3 percent transaction fee. Users who contribute to the liquidity pools receive a fraction of transaction fees based on their staked pool share. Staking tokens is one of the ways to make passive income for crypto investors that is popular in the DeFi space.

Constant Product Formula

The AMM governs ERC-20 token market pairs with a process called “constant product formula,” x*y=k. In short, in the constant product formula, x and y are variables representing the total value of one token in said market pair. The core fundamental of the Uniswap platform is constant liquidity, regardless of the volatility in x and y values. The constant product formula maintains fair market value between each token pair on the platform.

DEX and crypto regulations

In theory, decentralized exchanges are not subject to local regulations, and anybody can use decentralized financial services freely. However, in July 2021, Uniswap Labs announced that due to an “evolving regulatory landscape” they restricted access to 129 tokens.

Allegedly, Uniswap selected tokens to remove if they could be considered unregistered securities by SEC. The removal took place days after the U.S. regulators announced they were going to increasingly scrutinize these types of services.

Uniswap’s decision faced a backlash from users, some of whom even called it “token censorship.”

Uniswap has introduced token censorship on the main UI

— banteg (@bantg) July 23, 2021

You can see a list of 129 hidden tokens herehttps://t.co/G9yjycH2F7

Why does Uniswap matter?

Uniswap has earned its place as one of the leading decentralized exchanges (DEX). To summarize, the platform utilizes technology like automated market makers (AMM) and liquidity pools to ensure 24/7 transaction capability. UNI token holders possess an increasing amount of decision power within the platform. These users get to decide the future path of the evolving decentralized exchange.

Decentralized finance (DeFi) has already established itself as a huge trend for investors by 2021 and keeps attracting more and more money. Many DeFi tokens have demonstrated an impressive price performance, and UNI is definitely part of this trend. Furthermore, Uniswap has become one of the well-known DeFi projects to invest in.

Uniswap tokens are now available for buying, selling, and storing on Coinmotion.com.