How to avoid losses in a bear market? Now you get to choose between two options:

- Losing 30% in a week

- Losing 5% in a day and then being clear

The question may seem overly simplified, but most people usually choose the first option. This also applies to professional investors. Usually it’s about not believing a quick 30% drop would be possible, or expecting the price to turn back up soon. Since we’ve witnessed a growth period lasting over a decade many of us are used to eternal rise. Especially on the stock markets.

Everyone has probably noticed what has happened in the past month. Stock markets have plunged down and new bottoms are dug deeper every week now. At the time of writing the notable S&P 500 Index has lost up to 35% of its value since February. Meanwhile Finland’s index OMX 25 lost 38% in the same time. Bitcoin in turn temporarily lost as much as 60 percent of its exchange value.

Many investors lost a lot of money during this period, but could they have done something differently?

How do investors usually act when markets fall?

Market history is full of investors who fall in love with their investment. They refuse to give up their investment for any price and just wait as its value falls to new bottoms. When the market goes from upturn to downturn it means the trend has changed its direction. And it’s pointless to resist the trend on the markets, since “the trend is your friend” as the saying goes.

However, it’s completely different if you’re a long-term investor with plans exceeding 10 years. In that case the trends of a few years don’t affect in the same way, as the investment target’s fundaments mean more. Fundaments refer to factors which the investment target’s growth is based on. In this article we will not deal with long-term investments, but rather investments lasting less than 10 years. And in reality most investors are shorter-term investors.

History has repeatedly shown that there have been and still are traders with a 99% success rate, but one failed trade has collapsed their whole portfolio. During dramatic drops we are often just paralyzed and watch our investment fall and fall. Another option is to stop monitoring the investment target completely. This is because of the psychological effect that can leave our ego injured. So we deny reality, and refuse to confront the feeling of loss. And of course we won’t sell at a loss, since that would mean we have admitted our defeat.

So in reality many investors are not ready to suffer a 5% loss but prefer a 30% loss. Not to mention even greater losses.

How do professional investors or traders avoid losses in a bear market?

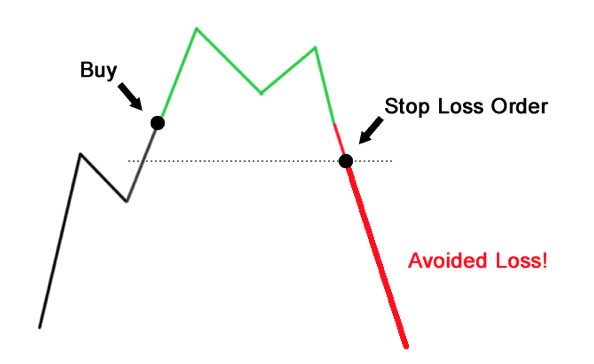

They minimize losses and maximize profits. This means they sell immediately after their investment falls below a certain limit level. Those who don’t actively follow markets in turn can use automated functions to stop losses. And since professionals use stop loss functions, why wouldn’t you?

This gets us to our actual topic – the Stop Loss function.

Avoid losses in a bear market: can you prepare for surprize dips?

Yes. The answer to this question is very simple: the Stop Loss function.

If you are a risk investor you don’t need stop losses for your investments. But if you want to secure the price rise of your investments, you should use stop losses. But how do stop losses really work?

The stop loss feature is easy to use. You simply set a stop loss order at the level you can tolerate loss. This means how much you are ready to lose in a certain time frame. If you don’t know, try and you’ll know. If you say you’re not ready to lose a single penny, it’s worth reading more investing literature. If you’re ready to lose 2%, then the daily fluctuation can eat your stop loss. Not to mention bitcoin’s generally heavier daily volatility, which can make narrow stop loss levels meaningless. It’s often advised to set stop losses close to weekly or monthly support levels.

Let’s take an example

The price of a stock has varied between €10 and €11 euros within a week. In this case a stop loss can be set around €9 – €9.5 euros.

If for instance bitcoin’s price has varied between $4000 and $6000 dollars within a month, you can set a stop loss around $3600.

This way you can shield your investment from larger losses.

According to my understanding all funds do not yet have stop loss functions, so I personally don’t see such funds as safe investment targets. But this is just my own view. Stocks, etf:s and cryptocurrencies usually always have this option available.

A short summary

“Learn to use stop losses, since they shield you from larger losses. If you don’t know the current market trend, use stop losses.”

If you don’t want to lose 30% in a week but rather minimize your loss to 5%, then stop losses are necessary for you. Stop losses are meant to protect your investments from value decline. Use them!

Hopefully these tips were helpful! Gaining profits on the markets often requires deep-rooted knowledge and several years of experience.

The writer is a board member of cryptocurrency organization Konsensus Ry and has years of experience in different investment fields, including cryptocurrencies.. The views presented are the writer’s own. The presented Stop Loss feature is also available on Coinmotion.