In 2021, the number of cryptocurrency users exceeded 100 million. So many small investors have been buying bitcoin that their investments are rivaling all institutional investors combined. Bitcoin keeps attracting new investors — but do they know how this new asset works? They do — because investing in bitcoin vs stocks is not that different.

Let’s get this out of the way. Bitcoin and stocks seem like apples and oranges. Bitcoin is just 12 years old, and stocks were created a few hundred years ago. So, to begin with, here are the main differences between investing in cryptocurrency and company shares.

Bitcoin vs stocks: nothing in common?

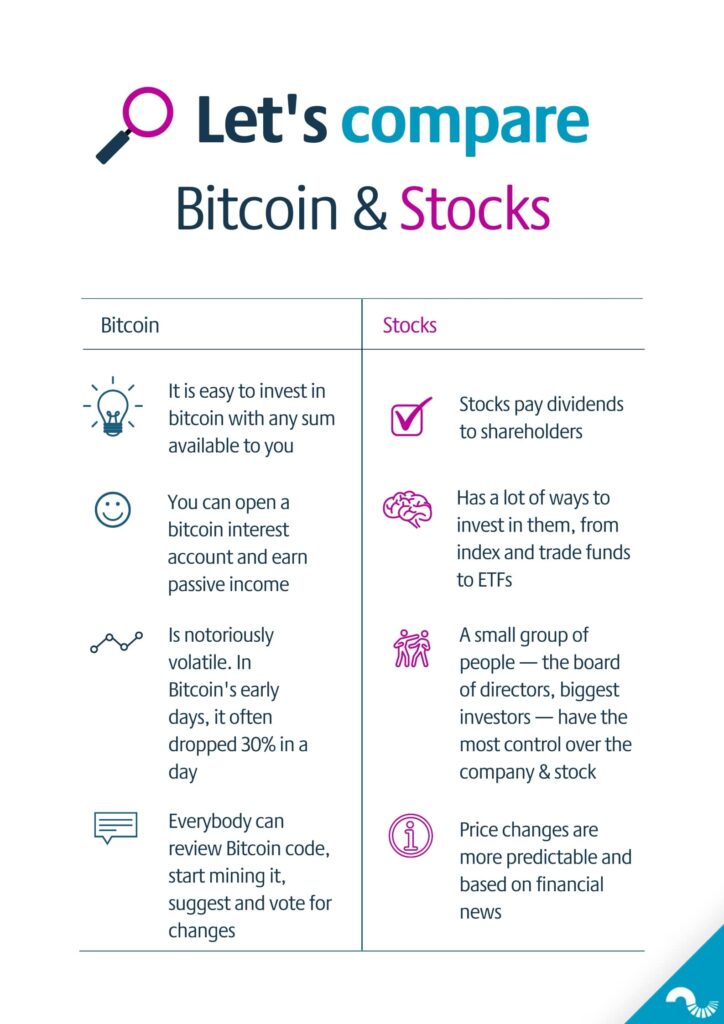

Obviously, both bitcoin and stocks can go up and down in value, so investing in either one involves risk. However, it’s bitcoin that has earned a reputation for daily volatility. Notably, the BTC volatility is decreasing in 2021, but it remains more volatile than your average stock.

On the other hand, stocks don’t tend to drop or rise in value dramatically and without warning. That is because stock value mainly changes depending on the news about the company behind it. If a stock sinks 10%, you’d call it a free fall. But for long-term bitcoin investors, a 10% drop is unpleasant but not a reason to worry.

Moreover, Satoshi Nakamoto, the anonymous creator of Bitcoin, had a vision of decentralized “digital cash” that would become a hedge against inflation — not a digital asset. You can pay with bitcoin in some stores in Finland and Europe — although it’s not its primary use case today.

And finally, bitcoin is not a business. No single entity — not even the creator of Bitcoin — controls it like a board of directors governs a public company. Bitcoin’s computer code is open-source, and anybody can review it.

A network of so-called miners, probably, hundreds of thousands of individuals, govern the network. They propose changes to the Bitcoin network, and the changes occur when miners reach a consensus. Arguably, the Bitcoin network is more transparent than public companies.

What is similar: bitcoin vs stocks

At the same time, a smart investor can find that there are also similarities between BTC and company shares. First of all, you can earn passive income with both bitcoin and stocks.

Instead of dividends, you can earn interest by lending your bitcoins. The cryptocurrency lending market is booming. Everybody can invest and open a bitcoin interest account, like in a regular bank.

Second, if you know how markets generally work, it’s not difficult to understand what influences the bitcoin price. I.e., just like company shares, bitcoin price soars when positive news comes out. Bad news, in turn, sinks the price. FUD (fear, uncertainty, doubt) and greed also have a psychological impact on investors and translate into price movements.

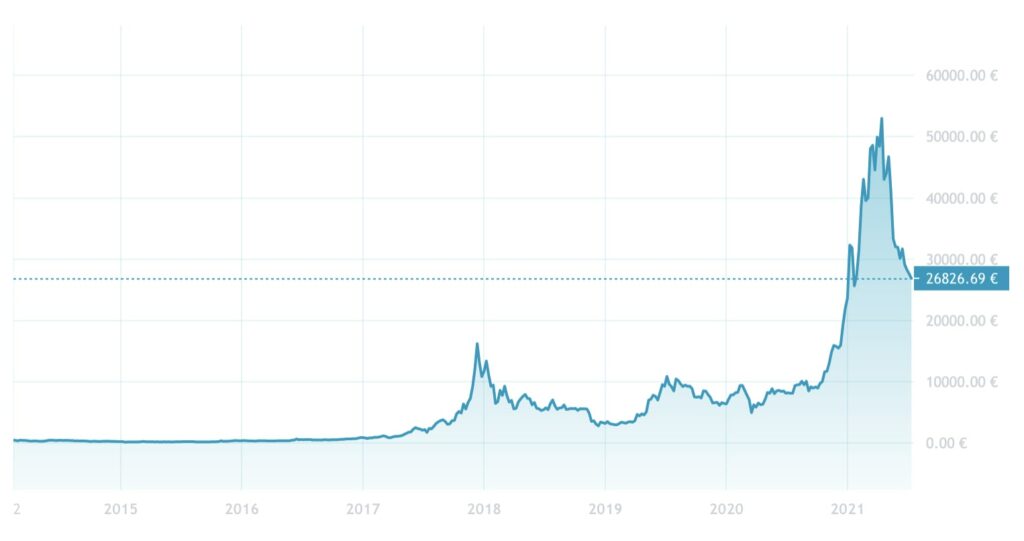

The law of supply and demand also determines bitcoin’s long-term price increase. Bitcoin grew from $0.08 in 2010 to an all-time high of $64,805 in April 2021. Like gold, there is a finite amount of BTC that will ever be mined. Meanwhile, investors, be that MicroStrategy, Grayscale, or a regular person, keep accumulating BTC. This means that the supply of bitcoin gradually decreases, and the demand will continue growing.

Buying or selling bitcoin or stocks is similar

Perhaps, in 2021 there are over 100 million cryptocurrency owners because it’s as easy to start investing in it as it is with company shares. The threshold for crypto investments is low, too.

For example, one Amazon (AMZN) share trades at $3,573 (at the time of writing) — but everybody can buy a fraction of the share instead of paying a large lump sum at once.

It’s the same with bitcoin. Everybody can deposit funds to a cryptocurrency exchange and buy a fraction of BTC (called satoshi) for as little as 10 euros. So if you want to, say, invest 1,000 dollars or euros, you can buy a share of a cryptocurrency for that exact sum.

When an investor decides to buy digital currency or stocks, they need to access the crypto exchange or stock exchanges where the assets are listed. To buy bitcoin, one needs to choose a reliable service.

Finland-based Coinmotion is licensed as a virtual currency service provider and payment institution by FIN-FSA across EEA. Coinmotion has been securely storing 100,000 European customers’ funds since 2012.

Not many traditional investment tools for bitcoin investors — at least, not yet

And lastly, since stocks are an older asset class and are regulated, there are also a lot of investment tools and services related to them. To make it easy to diversify one’s portfolio, we have contracts-for-difference (CFD), index funds, or exchange-traded funds (ETF). The funds track a certain index, for example, S&P500.

With bitcoin and other cryptocurrencies, index funds, trust funds, and ETFs are an emerging trend since the regulation of cryptocurrencies is in the developing phase as well. For cryptocurrency investors looking to capitalize on the growing popularity of exchange-traded funds, a fund that tracks bitcoin is a lucrative opportunity for this type of connection.

For now, companies are applying for registering Bitcoin ETFs. The Securities and Exchange Commission (SEC) hasn’t approved any digital currency ETFs in the US yet, as the interest in them keeps growing. For now, Bitcoin enthusiasts have to settle with fewer options than stock market investors.

“The central bank monetary system is at a risk of uncontrolled inflation. That is what people should be afraid of, not bitcoin. Bitcoin is the ultimate hedge to flawed central bank policy.”

Henry Brade, founder and chairman of the board at Coinmotion Ltd.

Five facts about Bitcoin

- Bitcoin was created in January 2009.

- Only 21 million bitcoins will ever be created.

- In April 2021, Bitcoin reached its latest record high of $64,895.

- Bitcoin is the asset class that has performed the best in the last decade – with an annual return of 230 percent.

Licensed Finnish brokerage helps invest in bitcoin

One should do their own research before making a financial decision. But if you already know how stock markets work, you are one step closer to becoming a cryptocurrency investor.