Bitcoin’s price has recently decreased and fallen below $30 000 dollars. Many reasons have been presented for this, such as the weakened investment interest of institutions. While institutions have normally been strong hands, they now appear to be rather weak. As prices swing, some tend to panic.

This is in itself not weird, since some institutions are rather new players in the crypto sphere and have not witnessed the same roller coasters as long-term investors, to whom swings of even double-digit swings are common events.

Meanwhile institutions still believe they may make an increasing amount of investments in the future. This is indicated by a new study, according to which most institutions believe they will continue to invest in cryptocurrencies and other digital assets in the upcoming years.

This week we will talk more about this study. In other news we have the collapsed position of China’s crypto mining and the ensuing drop in mining difficulty. Furthermore we will deal with crypto moving into whale pockets, blockchain adaptation and crypto maximalism.

Last week’s news can be read here.

Bitcoins moved from exchanges to other wallets

Bitcoin trading in crypto exchanges saw a significant drop in June. A report by CryptoCompare reveals that the largest exchanges saw a plunge of up to 42% compared to the previous month of May.

According to the report, the decreased trading volume resulted from bitcoin’s sinking price and low price volatility. If the price is stable or decreasing evenly, traders have more difficulties accumulating quick profits with bitcoins.

On the other low prices give whales and long-term investors a chance to acquire more cheap bitcoins. This appears to also be the case now.

According to blockchain analysis firm Glassnode, bitcoins are transferred outside exchanges in growing numbers. Glassnode asserts that the reason behind this is long-term investors moving their funds from exchanges to safer solutions, such as their own physical wallets. Glassnode reports that wallets holding bitcoins has grown by 50 000 units since May.

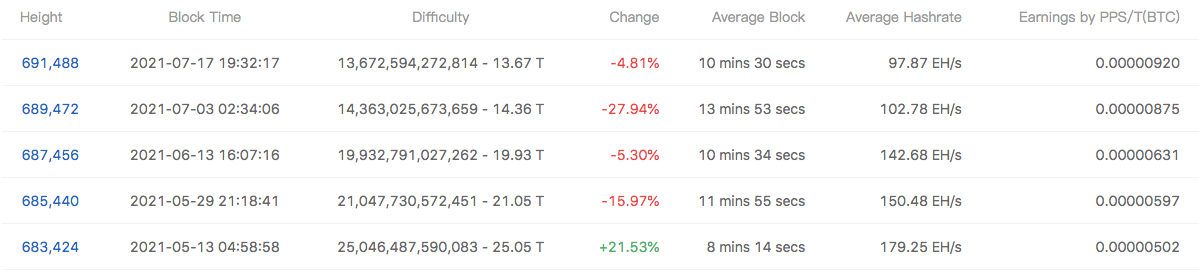

Bitcoin mining difficulty continues plunging

The difficulty level of bitcoin mining has once again plunged. Overall the difficulty level has halved since May. A major reason for this dramatic decline has been the shutdown of mining activity in China.

Bitcoin’s difficulty level changes between every 2016 blocks. The difficulty level varies according to how much mining power there is in the network. The higher the number, the higher the difficulty level also rises and vice versa. The reason behind this variation is to maintain an average interval of ten minutes between created blocks.

For others than Chinese miners their drop from the network has been good news, as it brings more income and less competition for other miners. Additionally the breakdown of Chinese superiority helps decentralize the Bitcoin network further.

Despite the drop in difficulty level and mining power, Bitcoin still remains the strongest process of ongoing decentralized computing in the world.

Institutions still interested in crypto and digital investments

Institutional interest for digital assets and cryptocurrencies appears to be growing, as revealed by a fresh study. The study was ordered by investment firm Fidelity Investments Inc, who interviewed 1 100 representants of institutional investors.

According to the study, seven out of ten institutional investors expect to invest in cryptocurrencies or other digital assets in the future despite remaining cautious at the moment. The greatest barrier appears to be the heavy price swings of these assets.

90% of interested institutions report that they believe customer portfolios will contain digital assets within the next five years. The remaining 10% did not report any estimated time span for upcoming investments.

While the activity of institutional investors has cooled down recently, the survey appears to indicate institutional investments have potential to increase in the future.

Port of Buenos Aires adopts blockchain

Argentina’s most significant cargo port, the port of Buenos Aires, is about to modernize maritime logistics and its freight systems using blockchain. The news was reported by a press release issued by an authority responsible for the port.

Blockchain will be utilized in the port’s e-PuertoBUE system, which is responsible for customs and freight traffic. The implementation is set to function as a form of digital notary to ensure the system’s data cannot be manipulated. Blockchain will for instance be used for freight traffic and the customs clearance of dangerous goods.

Blockchain has grown more common in freight traffic in recent years. It is used in many of the world’s most active ports, such as the port of Rotterdam. In Finland blockchain has also been used for rail freight in the city of Kouvola.

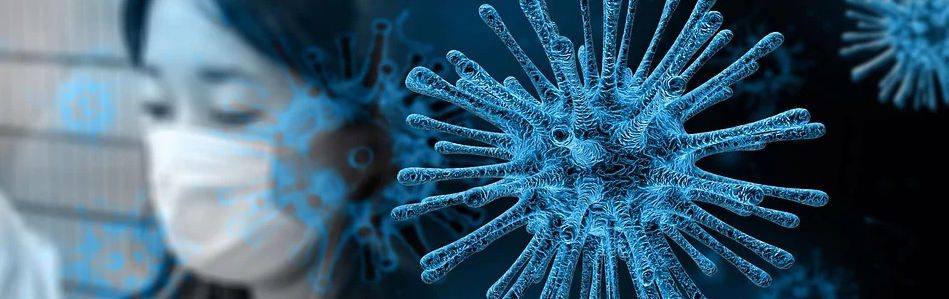

US corona checks used for BTC

Last year COVID stimulus checks issued by the United States appear to have uplifted bitcoin’s price, reports the Federal Reserve ‘s department of Cleveland. According to the Fed, the rise was relatively small but still notable.

In 2020 as the corona pandemic was at its worst, the US government paid $1 200 dollars to every American citizen to boost the economy. Bitcoin’s price rose in connection with these payments, leading to the conclusion that many of them were used for crypto investments. The central bank also confirms that this appears to have been the case.

According to the central banks researchers, an estimated 0.02% of all recent stimulus checks were used for bitcoin, with its trading rising by 3.8% and price by 0.7%. While these changes were relatively small, the researchers regard them as statistically significant.

Central bank researchers estimate that most purchases were made by young citizens with moderate income.

Missisippi mayor: Bitcoin can solve inflation

Scott Conger, mayor of the city of Jackson in the US state of Tennessee, believes Bitcoin may be an answer to problems caused by inflation. Conger expressed his opinions on Twitter.

”Why do we accept inflation? Why don’t we demand more from our federal government? 6.3% in 2 years. 172.8% in my lifetime. Every year our dollar is worth less,” Conger wrote.

Conger is a long-term spokesperson for Bitcoin and blockchain. He has also voiced intentions to create a workgroup for implementing blockchain for the city of Jackson. Conger has also exhibited so called laser eyes on social media pictures, a meme used by Bitcoin maximalists to express their opinions.

I would say institutions are in the FOMO mode. They are grabbing as many BTC and ETH possible before we go full adoption mode. This is possibly the last dip we would get. We would only be going up from here.