Bitcoin has recently seemed rather lifeless compared to the beginning of the year, when crypto coins generally increased their market share by billions. The price has mainly sawed sideways and short-term investors have already grown tired of waiting for much promoted roller coaster rides. It could have been better to visit an amusement park instead.

However, on a larger scale and behind the scenes things are unfolding constantly. In the past few weeks Bitcoin has gained hundreds of thousands of new users with no end for the growth in sight. Meanwhile large institutions – among them IMF, the World Bank and Bank of America – are seriously considering the revolutionary potential of crypto.

This week we will check out these phenomena. Additionally we will address the EU’s new proposal to impose stricter control over crypto companies and users in the name of – you guessed it – money laundering and terrorism. Among other news we will present the world’s first literal shitcoin.

Last week’s news can be read here.

EU plans stricter crypto control

News agency Reuters has accessed leaked documents revealing that the European Commission intends to found a new agency to oversee money laundering and illegal transfers. The authority would function as a center for national authorities and regulators in monitoring money laundering.

The EU has been put under pressure after it was revealed that Danske Bank, the biggest bank in Denmark, had conducted over $200 billion euros worth of suspicious money transfers between 2007 and 2015. The founding of the new authority seems to be a response to this case.

While money laundering and suspicious transfers happened with euros in the traditional financial world, the EU also intends to introduce stricter regulation concerning cryptocurrencies. The report asserts that cryptocurrencies are at the moment not overseen by the EU to a satisfactory extent.

“The lack of such rules leaves holders of crypto-assets exposed to money laundering and financing of terrorism risks, as flows of illicit money can be done through transfers of crypto-assets,” the leaked documents state.

According to the documents, lawmakers are already working on new legislation which would impose stricter requirements for crypto service providers to collect and share data with authorities.

Financial giants probe digital currency prospects

The World Bank, International Monetary Fund IMF and Bank for International Settlements BIS have published a new report detailing how central bank digital currencies (CBDCs) could benefit the world’s financial development and improve the economy.

According to the financial giants, CBDCs could bring relief to one of the biggest problems of the current financial system, meaning the slow and expensive nature of money transfers. Nowadays international money transfers are slow and cost a lot due to different verification systems.

“Faster, cheaper, more transparent and more inclusive cross-border payment services would deliver benefits for citizens, businesses, and economies worldwide,” commented Indermit Gill, vice president of the World Bank Group.

At the moment moving money from one country to another can take days and cost up to hundreds of even thousands of dollars depending on the sum. If central banks would start utilizing digital currencies like Bitcoin, the duration and cost could drop to a fraction of what it is now. With Bitcoin for instance billions can be moved anywhere across the world in less than an hour for the price of mere dollars.

Bitcoin.org suffers DDoS attack

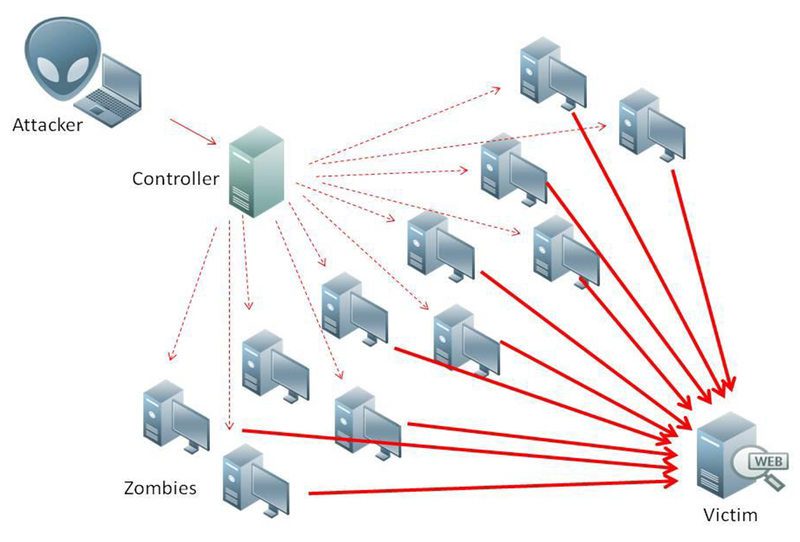

Bitcoin.org continues to face problems. Just a week after Satoshi claimant Craig Wright won a default decision by the UK high court, the site has suffered a massive distributed denial-of-service attack.

A DDoS attack refers to an attack in which a site or service is flooded with a massive amount of traffic that it fails to respond to them and is overwhelmed. The principle is the same as if a huge number of users would enter a site and download it over and over again.

The party attacking Bitcoin.org remains unknown at this point with no clue of their identity. However, the attacker demanded a ransom sum of 0.5 BTC to stop the attack.

Bitcoin.org is a non-profit organization intending to provide information and resources for Bitcoin users. Earlier it provided Satoshi Nakamoto’s original Bitcoin white paper as well as the Bitcoin Core reference program. Attacks against non-profit organizations in this scale are usually rather rare.

“I don’t think I’ve been this offended in a while. Ungrategul scum,” Cøbra responded to the attack.

New users flood into Bitcoin

While bitcoin’s price has recently been rather idle and moved sideways with analysts predicting bear markets, there seems to be light at the end of the tunnel. According to blockchain analyst William Clemente new users are constantly entering Bitcoin’s blockchain.

“The growth of new users is now reaching new all-time highs, over 50,000 new entities coming on-chain a day,” Clemente commented.

Also new whales, meaning users or institutions owning a large number of bitcoins, have increased recently. In the past week alone at least 17 new whales have entered the blockchain.

At the same time as new users have started using blockchain, the number of bitcoins owned by different crypto exchanges has decreased. Last week alone nearly 18 000 bitcoins have been transferred away from exchange wallets.

Bank of America interested in crypto

The second largest bank of the United States, Bank of America, is the latest large institute to show interest in cryptocurrencies. According to an internal memo, the bank has founded a research group specifically focused on cryptocurrencies.

Cryptocurrencies and digital assets constitute one of the fastest growing emerging technology ecosystems. We are uniquely positioned to provide thought leadership due to our strong industry research analysis, market-leading global payments platform and our blockchain expertise,” commented Candace Browning from Bank of America.

The bank’s memo estimates the cryptocurrency sector is currently worth around $1.5 trillion dollars and expected to grow. New utilities listed on exchanges are in turn estimated to be worth a total of $50 billion.

Bank of America has earlier been interested in blockchain and tried to patent related technologies. However, it has so far remained rather cautious about matters directly linked to cryptocurrencies.

Shitcoins became real

Crypto circles often use the word ”shitcoin” in a degrading fashing when speaking of different alternative cryptos or altcoins with no perceived real value or use. Now a Korean professor has decided to make the term a literal reality.

Professor Cho Jae-weon from the University of Ulsan in South Korea has developed an ecological toilet system which turns human excrements into fertilizers and pure energy. The system is already used to produce fuel and energy for instance for university stoves and heating devices.

“If we think outside of the box, feces has precious value to make energy and manure. I have put this value into ecological circulation,” professor Jae-weon commented.

The professor’s system also uses a native digital currency token called Ggool, with the intention of incentivizing the use of the ecological toilet system. Students can earn 10 Ggool per day if they use the toilet system. Ggools can in turn be used to buy coffee, bananas and books from the university.