The technical analysis for week 37 focuses on large OTC deals and record low bitcoin exchange balances.

Massive OTC Deals in Q3

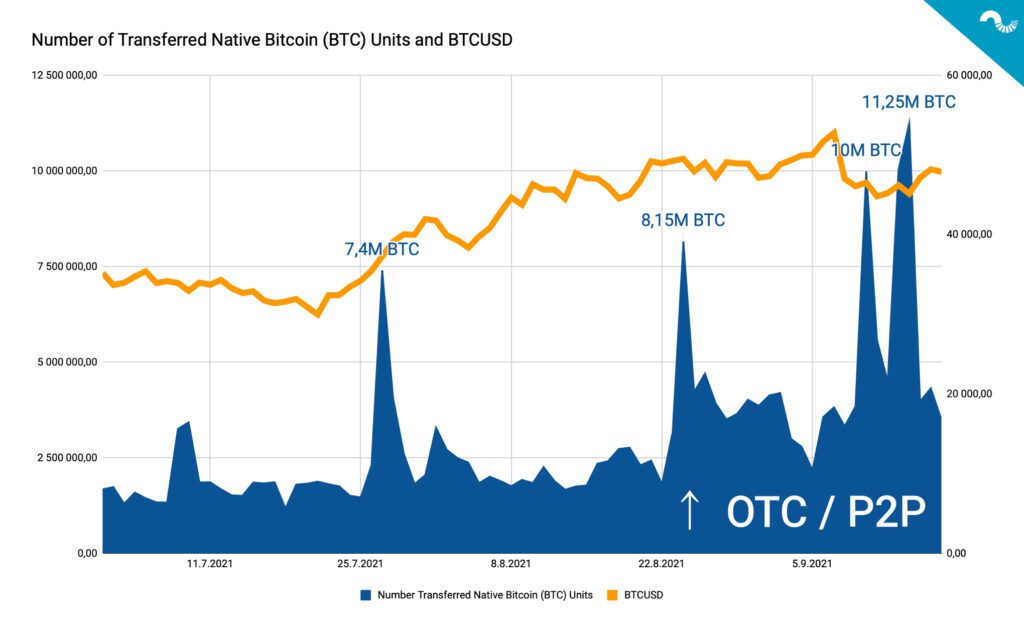

The number of transferred native bitcoin units (BTC) hit a 24 month high this month, propelled by increasing demand in over-the-counter (OTC) and P2P markets. Bitcoin’s spot price (BTCUSD, orange) has been growing steadily since May’s correction and consequent price descent. The number of transferred BTC units can be seen as a leading indicator, mirroring bitcoin accumulation in large buyer segments. Thus bitcoin’s spot price can be expected to positively correlate with growing amount OTC and P2P transactions.

The amount of transferred native bitcoin units has been growing in this quarter as occasional daily amounts have climbed from July’s 7,4 million to September’s 11,25 million. The average daily transferred bitcoin amount is 2,98 million for Q3.

OTC, or over-the-counter market, is an essential part of digital asset industry as it offers direct transactions between the buyer and seller. Exchange trading involves three parties by default: Buyer who sets the bids, seller who sets asks, and the exchange that acts as the market maker. The function of OTC market is to offer more liquidity to digital assets and established bitcoin OTC desks provide opportunities to buy or sell large amount of units quickly without slippage.

OTC desks also offer price protection at a set spot price and deals can be arranged without a limit. OTC market additionally deals rare tokens that can’t be bought elsewhere on a larger scale. Larger institutional OTC desks reguire KYC identification, however it’s even possible to OTC trade bitcoin without KYC.

Exchange Reserves at Record Low

Whereas the number of transferred bitcoin units hit a record high, the exchange reserves are dropping to increasingly low levels. Bitcoin reserves on all exchanges dropped to 2,38 million units this week, while reserves were >2,6 million in late 2020. The drop represents a -9 percent decrease year-over-year (YoY) and means 240 000 bitcoin units less for exchange reserves.

The decreasing amount of bitcoin units in exchange reserves might cause a “supply shock”, meaning there’s a notably smaller amount of sellers in exchanges. The Q1 2021 bull cycle is estimated to be caused by a supply shock, combining increasing demand from institutions and decreasing amount of retail sellers. The exchange reserves impact the bitcoin spot market with following logic:

↑ Bullish sentiment: Native units flow back to private wallets for long-term storage

↓ Bearish sentiment: Rising number of native units in exchanges. Units will likely be converted to national (fiat) currencies, stablecoins, or other digital assets

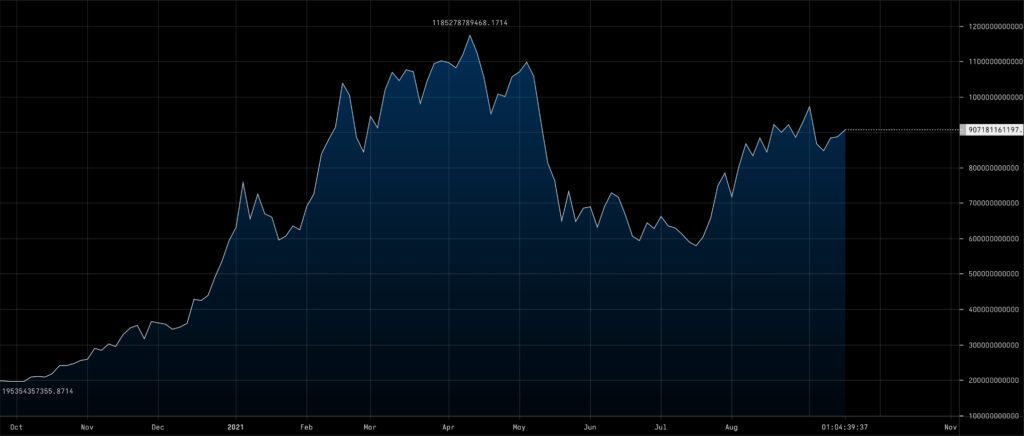

Bitcoin’s MCAP Rising, Dominance at 42%

Bitcoin’s market capitalization is rising again, crossing $900 billion this week. Bitcoin’s market capitalization quickly approached $970 in early September as it has been recovering from June-July lows. MCAP briefly dropped below 600 billion in mid-July, slightly before the spot price recovery.

Bitcoin’s dominance is currently at 42 percent, close to May’s lows. While bitcoin’s dominance was above 70% in January, it has been losing its relative market share to other cryptocurrencies and particularly to DeFi tokens. The dropping bitcoin dominance doesn’t render bitcoin a “less good” asset, it just mirrors the increasing competition and growth of the industry. Bitcoin still retains its position as the leading digital asset.