What kind of investor are you? What relationship do you have with the markets? Are you a

- gullible fool

- coward

- passionate player

- or, perhaps, a cynical realist?

Whatever you chose, this also defines your relationship with other market actors.

First of all, there is no wrong alternative on the list. You can choose one, several or none at all. This time you won’t lose anything.

In other words, you can relax. This article will not judge you since every one of us has at times been a gullible fool, coward, passionate player, and cynical realist.

… but if you had to choose, which one might you be?

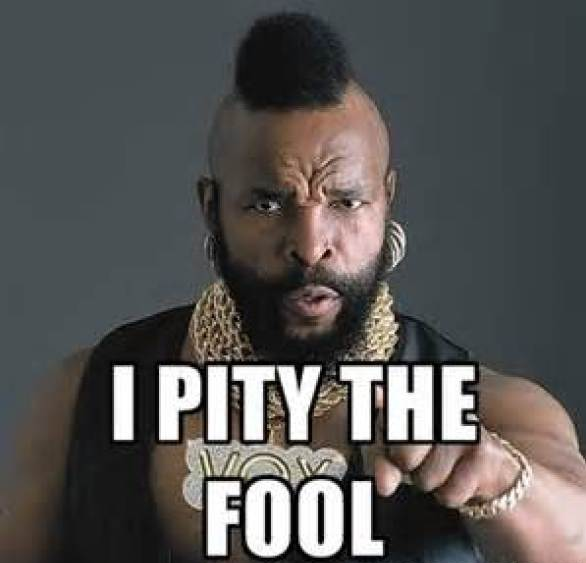

Are you, perhaps, a gullible fool? What kind of investor are you

Gullible fools are everyone’s favorite on the market place since gullible fools don’t really know the markets. They may do a lot of honest work and believe they will make profits on the markets just because their neighbor did. Gullible fools also don’t have time to follow the markets – there’s always something better to do. But getting profits like your neighbor would sure be nice.

Gullible fools also tend to believe all kinds of groundless promises. This unfortunately happened in 2017, when powerpoints and clumsy webpages could make millions. And who paid the price? Gullible fools, of course.

Why so?

Because gullible fools psychologically inflate their investment target and pay a steep price for it. In other words, they are willing to sacrifice wild amounts of money since they expect to get acceptance from their investment target in return for monetary sacrifices. Sometimes gullible fools seem to expect the markets to lift them above normal life like a messiah. And they want to believe in eternal profits and anyone who promises them.

In conclusion, it can get messy unless gullible fools start improving their ways on the markets… and fast. On the crypto markets, a gullible fool probably invested in November 2017 and sold in December 2018.

What to do then?

Gullible investors may, at times, even make good profits but forget to sell when the time comes. A realistic understanding of the markets and investment targets can remedy this. Realism does not mean cynicism, but real contemplation to support decisions. A concrete plan is a good start.

For instance, a cryptocurrency investor can check a few key figures, such as the crypto project’s current user base, level of funding, know-how, and so on. This reveals if the project can actually be realized with current resources and the prospect of yielding returns. This simple step can save a lot of trouble.

So, if you think you are a gullible fool, make investing more realistic with something concrete to guide your way. That way, you won’t end up paying for unrealistic Lamborghini projects every time.

What kind of investor are you? Perhaps, a coward?

Are you a coward who doesn’t dare to do anything in the marketplace? Mostly you blame market forces, the government, authorities, and market scammers. You fear losing everything in an instant, so you are shocked by the smallest shifts and news. You no longer sleep well at night, so you sell everything you bought the past evening by morning. Cryptocurrencies are scary since there are scams and crimes around them. And no one should make profits with them, since there’s always something illegal in big profits.

Why so?

Cowards rarely have the courage to invest – and when they do, they profit nothing. This is because cowards sell after the smallest rise. And if there’s a small drop, the coward will also sell. Cowards don’t believe in big profits, so they don’t make them. They lack belief in themselves and the market. This way can definitely shield from big losses, but it also yields no profits. And cowards would never touch crypto. Not with a long stick.

What to do?

Cowards don’t usually lose much on the markets, so they avoid big losses. This is indeed the only good trait of cowards. The problem is not understanding the larger market mechanisms and potential therein. While gullible fools believe too much in the markets, cowards have difficulty believing at all.

Therefore cowards need to become more familiar with the whole markets. This can be aided by studying the economy, including inflation, interest, and economic cycles, to better understand the markets. Slowly the day of investing the first euro approaches… but not in crypto, not yet.

So, if you are a coward, learn to trust the marketplace by studying the general economy. This way, you will, in time, learn to trust the market forces, avoid catastrophes, and soon notice you can make more daring investment decisions.

What kind of investor you are: a passionate player?

A passionate player makes profits on the markets since he has learned to understand the markets over the years and dares to take big risks. A passionate player knows that without passionate research, there can be no significant profits. The player’s expertise is based on experience from thousands and thousands of hours: wins, losses, and many wild tales to be told. He really understands and knows the market game.

A passionate player even loves taking risks so that players may fall in love with the game itself. In this case, profits lose their meaning. Investing can at best be art but at worst complete chaos. The markets are made for passionate players.

Why so?

Passionate players genuinely love the markets, so he quickly learns to understand their mechanisms. He has daringly tried different strategies to know what works and how to really make good profits. However, when a player trusts his own skills too much, his ego may grow bigger than the whole marketplace.

A player believes he controls the market, and his lust for power may cause such hubris that all other market actors become pawns. He thinks fellow investors are stupid, banks should obey the player, and the marketplace should give him special rights like some crystal swan.

This kind of game will eventually lead to mistakes in the marketplace, such as the failure of a once-flawless investment strategy or humane errors. Passionate players are often prisoners of their own ego and expect others to regard them divine. This may happen, but when the truth unfolds, the fall can be steep and harsh.

What to do?

A passionate player has many good traits since he is like a fish in water on the marketplace. Players should nonetheless remember also to consider others. Nothing is more annoying than an inflated ego belittling others. That’s why players should consider donating a part of their profits to charity since true greatness is the ability to share from one’s own abundance. This may even make others forgive the player’s egoism. A little bit of cynical realism and even a drop of cowardice can be good for a player.

If you are a passionate player, remember to share your knowledge and luck with others. And don’t be too optimistic without leaving room for realism and even cowardice. You don’t always have to win. This way, the markets won’t turn against you, and you’ll stay alive longer.

Or are you a cynical realist? What kind of investor you are

A cynical realist is like a computer. They can mathematically analyze all events beforehand. They also know market theories and history. A realist has done a lot of work and been patient to achieve his place. His portfolio and its risks are always counted on an optimal level. Cynical realists can be great speakers when sharing their knowledge. They are geniuses but more approachable to listeners than arrogant players. A player may beat realists with market profits, but that does not mean they are better.

A cynical realist knows how to build a long-lasting investment strategy without egoistic traps like carelessness. Crypto markets are well-suited for realists since realists know how to benefit from them in the long run.

Why so?

A cynical realist believes in cause and effect, so nothing in his world happens by chance. That’s why a realist can always motivate his strategy to listeners. However, realists have their own problems and may miss big profits since they don’t believe in them. In a way, realists are victims of their own earthly realism. They may never have rapid success, but long-term profits are on a good basis. At least theoretically.

What to do?

A cynical realist has a good trait of not believing in luck. He knows that luck must be earned on the markets over the years. A realist should still relax without overthinking and accept he may not know or account for everything. It’s good to know that most people in the markets spend much less time thinking about causal effects than realists. And that’s some food for thought since most market players make investment decisions in a couple of minutes or even seconds. For realists, this seems insane.

So, if you are a realist, take a look at the real market where simple powerpoints and webpages can earn millions in a few months. Realists could also consider holding onto their investments a little longer since the markets can exceed their expectations.

Be honest and recognize your own investor type

Ultimately it doesn’t matter what kind of investor you are, since you can achieve profits with all the aforementioned styles. The important thing is to be honest with yourself, recognize yourself, and act accordingly. This will hopefully make you a better investor. The final tip is not to overthink investing.

Hopefully, these tips helped pursue better profits!

This article does not present any investment recommendations, nor should it be interpreted as such. Gaining profits on the markets often requires deep-rooted knowledge and several years of experience.

The writer is a board member of cryptocurrency organization Konsensus Ry and has years of experience in different investment fields, including cryptocurrencies.

2 Responses

I am

I’m a passionate player