A mysterious Bitcoin transaction took place this week as 50 bitcoins, untouched since being mined back in 2009, were moved. The event naturally led to wild speculation over whether Bitcoin’s creator Satoshi Nakamoto himself has awoken from a prolonged slumber after disappearing a decade ago.

However, this seems highly unlikely and a more probable explanation is that some other early miner is behind the transaction. It is also more than likely that we will never know the truth with certainty.

This week we will take a closer look at this much discussed transaction. In other news we have the block reward halving’s effect on the markets, Iran’s crypto restrictions and how Harry Potter can be used to explain Bitcoin.

Last week’s news can be read here.

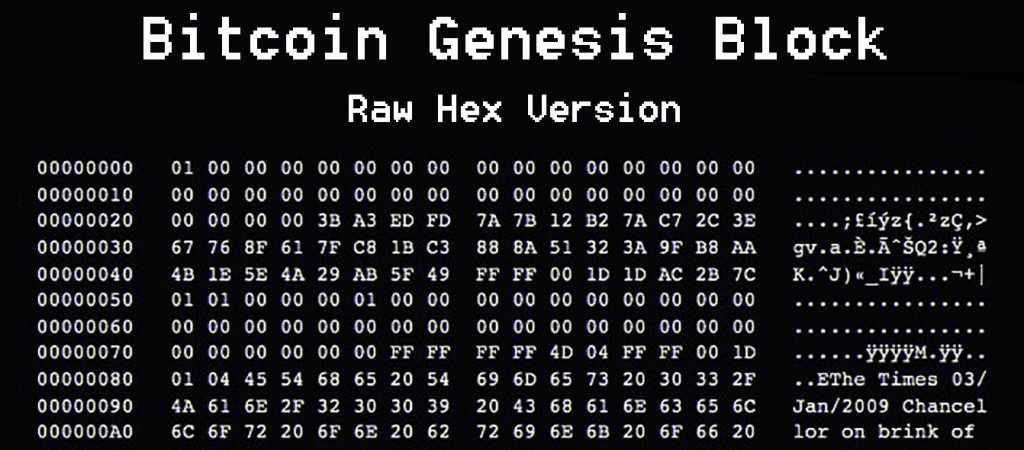

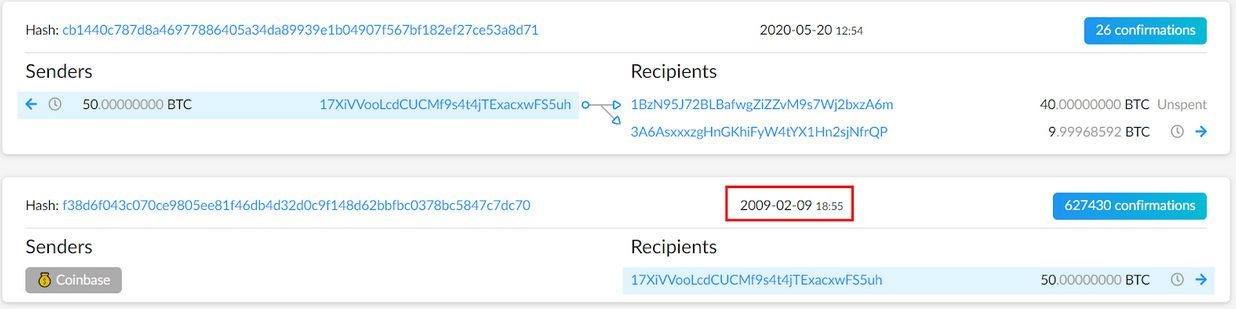

Satoshi-era bitcoins were moved

An unknown party has moved 50 bitcoins mined in February 2009 to two different wallets. This means the person was either Bitcoin’s anonymous creator Satoshi Nakamoto or one of the few other miners active over a decade ago.

It is, however, highly unlikely that the mover would be Satoshi himself. If Satoshi was to start selling his coins, he would probably choose more recent blocks to protect his privacy. Therefore it is more likely that another early miner moved the coins.

“Could be a million possible reasons. Maybe someone found a lost hard drive. Maybe someone needed to make a super-private transaction, so they used freshly mined coins. Maybe it’s just someone diversifying their assets,” commented Jameson Lopp, CEO of Casa.

”It’s basically impossible to prove that Satoshi didn’t mine these coins, but the best research we have suggests that Satoshi mined a specific set of blocks, of which this is not one,” Nic Carter from Coinmetrics added.

Bitcoin’s price quickly plummeted from $9 900 dollars to $9 300 dollars as the markets were startled by the event. While correcting upward after it became apparent that Satoshi was probably not behind he transaction, the price has since continued declining.

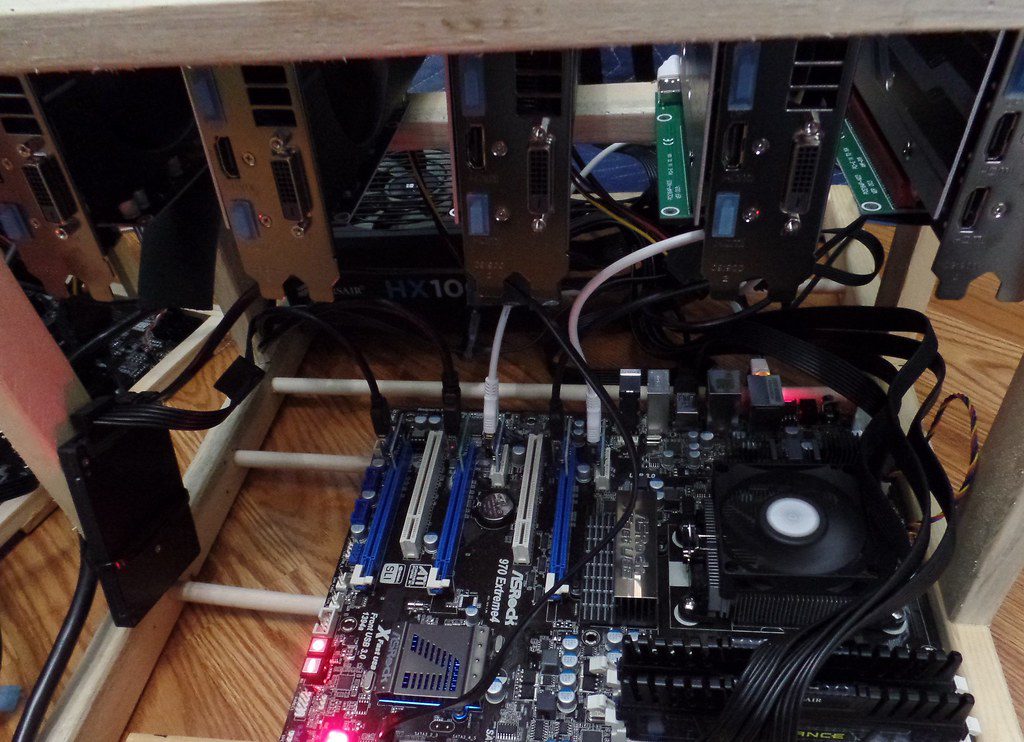

Bitcoin’s halving temporarily slowed down new blocks

Last Sunday only 95 blocks were mined in the Bitcoin network, marking an unusual deviation. This is thought to be related to Bitcoin’s block reward halving last week, which notably lowered the income of miners and forced many to decrease their hash rate.

In the past 10 years Bitcoin has seen only 8 days during which less than 100 blocks were mined. Most of these days coincided with the third quarter of 2017.

The mining speed of Bitcoin blocks is dependent on both the mining difficulty level and computing power allocated to the whole network. If the difficulty level is high while the computing power is low, blocks will as a result be created slower than normally.

The Bitcoin protocol automatically adjusts the difficulty level between every 2 016 blocks, meaning roughly two weeks. The point of the adjustment is that blocks would be born with an average interval of 10 minutes. However, before the adjustment kicks in the pace can vary radically if there are sudden changes in the network’s computing power.

Altcoins still interest investors

While Bitcoin has recently gained the most media coverage by far, investors continue to show interest for other cryptocurrencies. According to data from crypto exchange Coinbase, a vast majority of all crypto investors have interest in so called altcoins.

“Among customers with at least 5 purchases, 60% start with Bitcoin but just 24% stick exclusively to Bitcoin. In total, over 75% eventually buy other assets,” Coinbase reports.

Despite the high interest in altcoins, Bitcoin overwhelmingly maintains its first place globally. Bitcoin’s market dominance, meaning the total value of all bitcoins compared to other cryptocurrencies, is 66.8% at the time of writing. The number is nearly as high as the record for the whole year at 68%.

Iran wants to restrict cryptocurrencies

The Iranian regime is planning to restrict cryptocurrencies due to legislation related to money smuggling. According to Iranian news agency ArzDigital, the parliament has proposed putting digital currencies in the same legal category as foreign currencies.

In practice the proposal could cause serious problems for Iranian cryptocurrency operators and companies, who are at a risk of being restricted or even jailed by authorities. If the law passes, Iranian crypto exchanges must apply for a special license issued by the country’s central bank. However, the legislation is yet too unclear to stipulate any actual requirements.

The motive behind the proposal is widely believed to be the government’s desire to restrict capital flow out of the country. Due to economic sanctions set by the United States, Iranians have in increasing amounts turned to crypto to enable free global commerce. Many local crypto companies have even explicitly specialized in money traffic beyond borders.

If Iran succeeds in legislating its new cryptocurrency policy, it is likely to drastically limit the activity of local crypto companies.

ISIS made its first BTC transaction

According to a new report published by the Philippine Institute for Peace, Violence and Terrorism Research (PIPVTR), the Islamic extremist group ISIS has made its first crypto transactions. It is indicated the transactions were used to finance terrorist organizations, such as Mujahideen.

The report asserts that ISIS has used cryptocurrencies at least for money laundering executed in two phases. In the first phase cryptocurrencies with unclear origins were sent to unnamed exchanges, whereafter they were exchanged to fiat currencies.

However, cryptocurrency use for terroristic purposes seems to remain very minimal and is limited to a few single cases. Blockchain analysis firm Chainalysis also points out that many cases linking crypto to terrorism have been unfounded or based on false information.

Harry Potter author tried to understand Bitcoin

J.K. Rowling, creator of the Harry Potter fantasy book series, became the focus of Twitter’s Bitcoin scene earlier this week. Rowling originally tweeted that she doesn’t understand Bitcoin and wants more information on the subject. The author’s tweet inspired Twitter’s cryptosphere and quickly led to over a thousand replies.

“I don’t understand bitcoin. Please explain it to me,” Rowling tweeted.

Several tweets compared Bitcoin to Rowling’s own books and tried to use different Harry Potter analogies to clarify the cryptocurrency’s grounds.

“Remember when Dobby was freed by a sock? Bitcoin is that sock,” one tweet commented. Another in turn compared Bitcoin to Voldemort’s magical horcruxes, whereby even the Ministry of Magic could not imprison him.

Ultimately the Bitcoin community’s tweets did not make Rowling particularly convinced or educated about Bitcoin. Rowling later commented she regards bitcoins merely as collectible items similar to My Little Pony dolls.

“Pretty much, although massive currency issuance by government central banks is making Bitcoin Internet money look solid by comparison,” answered billionaire entrepreneur Elon Musk.