Gold’s market cap of $8 trillion is roughly 10% of the world’s broad money

The amount of gold increases approximately 1,5% annually, so it is a very finite asset. The amount of gold in the world is not rising a lot from what it is now, while central banks are printing high amounts of fiat currencies every year. The amount of dollars, euros etc. are increasing a lot while the amount of gold is not.

Gold is an old investment asset in which people have been investing for a long time. The more money invested in there is, the more trustworthy and stable asset to keep your money in it will become. I like to call this as a ‘silent agreement’ among investors. Big group has agreed among themselves, without talking to each other, to put money in gold. They have noticed this works and that others have noticed this too, which builds trust.

Bitcoin in relation to gold

Technically bitcoin has all the same qualities as gold has and more. Bitcoin is finite as there will never be more than 21 million bitcoins in the world. Currently the amount of new bitcoins created annually is roughly 3,6% of the previously existing bitcoins. After next years halving event this will drop below 2% so the ratio will be very similar as in gold.

Bitcoin is a lot easier and cheaper to store securely, move around the world and transfer from person to person, which makes it technically superior to gold. This also makes bitcoin harder to control by governments than gold.

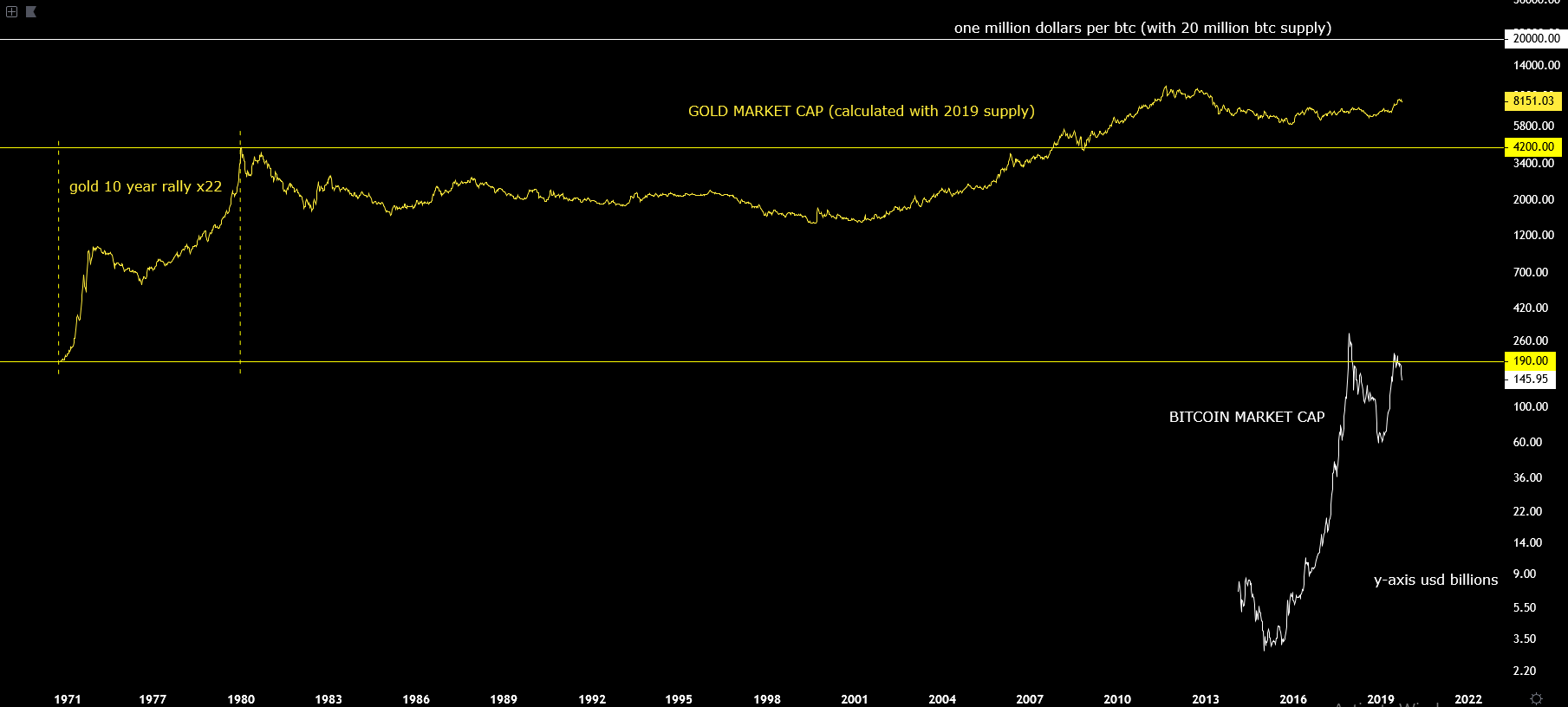

Bitcoin’s market cap is a lot smaller, $180 billion with $10k price per bitcoin. This makes bitcoin not as stable as gold, a lot more volatile, but also means that bitcoin can grow a lot bigger from what it is now. Central banks do not seem to be stopping printing money and also investments from gold to bitcoin will increase since bitcoin is better technically and growing faster.

Silent agreements on smaller scale are the reason why technical analysis can work

Moving average from 200 weeks (support/resistance) has stopped the bear markets in bitcoin’s history because big enough group of people and money have a silent agreement among themselves to buy this moving average. Just like big amount of money have an agreement to be invested in gold or in bitcoin.

Traders job is to find these supports/resistances that are under strong enough silent agreements and use them. These won’t always work, that’s why you need risk management, but the best ones work well enough to make trading very profitable for people who find these and use them.

These silent agreements can also be used to protect the bitcoin investment. This is the most important goal of trading in my opinion, since it allows one to invest more with less risk.

One more thing

Bitcoin will likely be bigger than gold in the future. One million dollars per bitcoin is perfectly possible. Bitcoin is finite, dollar is infinite. You can see historical charts of bitcoin and gold below. If you want to know more, read our complete guide to how to invest in bitcoin.

The author has written over hundred bitcoin analyses in the span of five years and is very experienced in trading bitcoin.