The past week has once again been quite a roller coaster for Bitcoin and its entourage of altcoins. Just a few days back many cryptocurrencies reached all-time record prices, only to correct and fall up to tens of percent over the weekend.

Such corrective movements and fluctuating prices are nothing new in the world of crypto. On the contrary, they seem to be a rule as bitcoin has grown in waves with huge rises followed by lesser plunges. At least so far bitcoin’s price has stabilized far higher than it was in previous cycles every time. Should history repeat itself, this can also be expected to happen in the future.

This week we have expanded the cryptocurrency selection of Coinmotion with four new tokens. Aside from addressing this expansion, we will check out Coinbase’s listing on Nasdaq, stolen crypto funds moving and blockchain charity by legendary rockers.

The previous news archive can be found here.

Coinmotion expanded its crypto selection

Coinmotion has added new cryptocurrencies to its selection. The new available coins include Link, Uniswap, USD Coin and Aave.

Three of these – Link, Uniswap and Aave – represent the explosively growing DeFi sector. USD Coin in turn is a so called stablecoin pegged to the US dollar.

To honor the new currencies, Coinmotion’s Pessi Peura made a video interview with Aave’s CEO Stani Kulechov and Coinmotion’s CEO Heidi Hurskainen. The video interview is available in Finnish on Coinmotion’s Facebook page.

Coinmotion will also continue expanding its selection in the future. Customer feedback is welcome to influence what cryptocurrencies should be added to the service in future batches.

Coinbase listed on Nasdaq

Cryptocurrency exchange giant Coinbase has successfully listed on the Nasdaq stock exchange. The listing was a triumph for the company, which quickly grew to become one of the biggest on the exchange soon after its debut.

Coinbase did not issue any shares prior to the listing, but instead allowed their shares to be valued according to supply and demand. The given reference price was $250 dollars, but the share soared to $328 dollars already the first day.

The whole company’s market value also rose above $85 billion dollars during the first day of trading. At best it even surpassed $100 billion as the markets wavered between different prices in search of stability.

Crypto thieves transferred half a billion euros worth in BTC

Bitcoin funds stolen from the Bitfinex exchange have moved for the first time in years. A total of 10 057 BTC amounting to over half a million euros was transferred by the thieves. The funds were relocated to several wallets, with the largest single transfer worth around $65 million euros.

The Bitfinex exchange was hacked in 2016, when nearly 120 000 BTC went missing from the exchange. At that point the irvalue was approximately 60 million euros, but since then bitcoin’s price has risen quite a bit. Currently the stolen bitcoins are worth close to 6 billion euros. In other words, the transferred sum was only a small portion of all the stolen coins.

Bitfinex and authorities have tried to track the perpetrators already for five years, but the case has not proceeded much. It remains to be seen if authorities and blockchain analysts manage to unearth something new through this latest twist.

Turkey bans cryptocurrency use

Bitcoin and cryptocurrenies have become a political dispute in Turkey. Last Friday the country’s central bank announced all domestic cryptocurrency use will be made illegal by April 30th.

Soon after the central bank’s announcement, opposition leader Kemal Kılıçdaroğlu critized the decision on Twitter and questioned its grounds.

“To whom did you consult the crypto decision, O ruler?” Kılıçdaroğlu asked in reference to the authoritarian president Recep Tayyip Erdoğan.

According to Kılıçdaroğlu, the crypto sector would be the most likely industry in Turkey to create new companies worth more than a billion dollars. Kılıçdaroğlu also pointed out the president does not seem to tolerate technologies used by young people.

Much like in other authoritarian countries, the popularity of Bitcoin and crypto has risen in Turkey particularly among the younger population. Meanwhile the country’s own official currency has depreciated significantly.

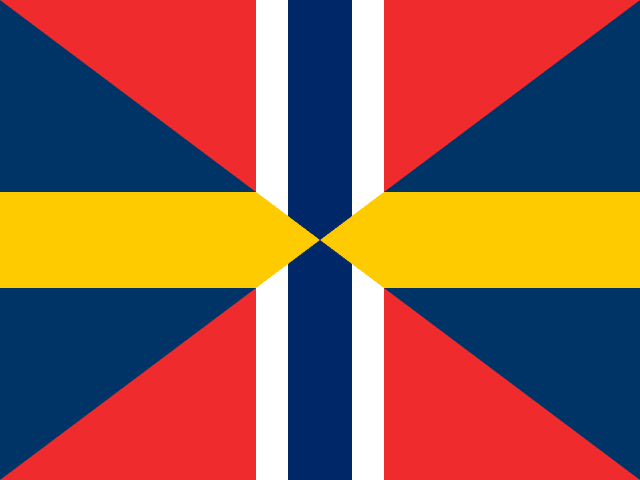

Nordic retirement funds own BTC

Nearly five million Swedish citizens indirectly own bitcoin through Sweden’s retirement fund AP7 Såfa. At least two companies owned by the retirement fund have BTC investments.

AP7 Såfa owns 0.09% of all Tesla shares. Tesla in turn bought 48 000 BTC earlier this year. Aside from Tesla, AP7 Såfa also own 0.1% of payment service Square, which has also invested in bitcoins.

However, the retirement fund’s crypto holdings are not particularly large when calculated per citizen. Swedish savers own roughly $0.59 dollars worth of BTC through Tesla and only $0.12 dollars through Square.

Also Norwegians have indirectly accessed crypto saving through the state. Norway’s retirement fund own almost 600 BTC, meaning nearly 28 million euros worth of cryptocurrency.

Music legends raise money with NFTs

Rolling Stones legend Mick Jagger has started using NFTs to fund the music industry plagued by the covid pandemic. Jagger together with Nirvana drummer Dave Grohl created a digital work of art which is now auctioned online.

The artwork itself is a clip of a man running through human heads. A song called “Easy Sleazy” composed by Jagger and Grohl is played in the background.

The profits from the auction will be donated to small independent venues in the US and UK. Many venues have been forced to close their doors even permanently due to different covid restrictions.

NFT, or non-fungible token, refers to a method in which a blockchain token is linked with certain rights to some other digital utility. Such rights can, for instance, include copyrights to a picture or song. These rights can then be transferred, sold or bought much like cryptocurrencies.