We have opened up the possibility to invest in another cryptocurrency besides Bitcoin. The first altcoin we chose to add to our service is Litecoin. Litecoin is one of the most established of the so-called altcoins: alternative cryptocurrencies based on Bitcoin code. It is among the most reckoned and noted of altcoins and one of the most promising candidates for Bitcoin alternatives.

Litecoin was developed by an ex-Google engineer Charlie Lee in year 2011. Lee set up to create a new, improved version of Bitcoin code which would be faster and smoother in financial transactions of lesser value. LTC was released with the first wave of alternative cryptocurrencies. Most of the first generation altcoins withered away and died out, but Litecoin is still going strong. LTC has build up a respectable community of users, coders and experts.

Litecoin is the sixth largest cryptocoin by market cap. It is behind of only Bitcoin, Bitcoin clones Bcash and Bgold and Ethereum and Ripple projects. Litecoin’s market cap is over 7 billion dollars and like bitcoin, litecoin’s price has seen significant gains during the passing year. In January 2017 litecoins were traded for a price of about 5 dollars each. In April of 2018 the price had risen to above 130 dollars.

Like with bitcoin, LTC too has seen great advancements during the last year.

Like with bitcoin, LTC too has seen great advancements during the last year.

Litecoin is Based on Bitcoin

Bitcoin is based on open source. This means that the entire code is open for everyone to read, copy and modify. This has made it easy to create new Bitcoin-based cryptocurrencies, which in turn has led to a huge amount of different cryptocurrencies and blockchain projects. Like many other altcoins and blockchain projects, LTC too is based on Bitcoin.

Litecoin transactions are handled and secured basically in the same way as Bitcoin transactions. New litecoins are created via proof-of-work mining, just like in Bitcoin. Users stay hidden behind their pseudonymous wallets at the same time as transactions are registered on a public blockchain. If you understand the basics of Bitcoin, you understand the basics of LTC as well.

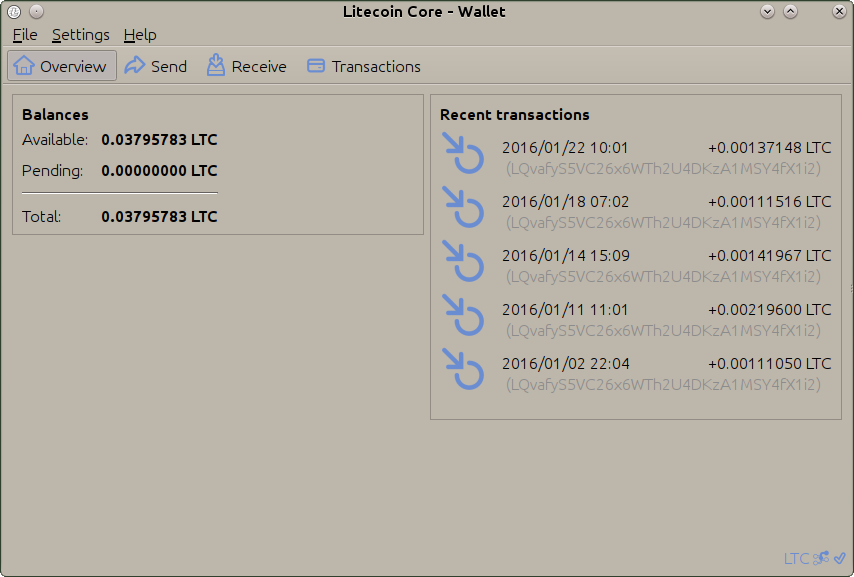

Because of the similarities between Litecoin and Bitcoin, using Litecoin is easy for anyone who has used Bitcoin. Litecoin wallets are near-identical to Bitcoin wallets in both how they work and how they look. Like with Bitcoin, there are several different kinds of Litecoin wallet solutions ranging from web-based wallets to hardware and paper wallets. Different LTC services are also very similar to Bitcoin services and thus familiar to Bitcoin users.

Litecoin-applications are usually much like Bitcoin-applications. For an example the Litecoin reference program Litecoin Core looks and works almost identical to Bitcoin Core.

Litecoin-applications are usually much like Bitcoin-applications. For an example the Litecoin reference program Litecoin Core looks and works almost identical to Bitcoin Core.

Litecoin is Leaner and Faster

It takes about 10 minutes to generate one Bitcoin block. With Litecoin these blocks are generated about four times faster with one block generated each 2.5 minutes. This means that Litecoin transactions are noticeably faster and cheaper than Bitcoin transactions. Litecoin can achieve speeds of even four times faster than Bitcoin.

With transactions of larger value it is usually recommended that users wait for at least two confirmations before they trust that the funds have arrived safely. Depending on transaction costs this could take about 20 minutes. With Litecoin the same recommendation applies, but because of the faster block generation times, it takes only about 5 minutes for two confirmations. This makes Litecoin more suited for faster transactions.

Of course faster transactions and faster block generation are not without their problems. Because Litecoin blockchain grows faster than Bitcoin, it has the potential to become heavier and larger than Bitcoin’s blockchain. At present this problem has not actualized, however, as the size of the entire Bitcoin blockchain is over 170 gigabytes, with blockchain of Litecoin standing in for only 36 gigabytes.

The maximum amount of bitcoins that will ever be in existence is pre-determined to be 21 million. This amount can never be surpassed. Because Litecoin has been engineered specifically for smaller, less valuable transactions, the maximum amount of litecoins is 84 million. The larger supply of litecoins means that the price of litecoin should stay lower than bitcoin. It might be impossible for most of the people to own a bitcoin, but it’s still possible for anyone to buy a litecoin.

Where as Bitcoin is “Internet gold”, Litecoin is “Internet cash”. (PHOTO: BTCKeychain)

Where as Bitcoin is “Internet gold”, Litecoin is “Internet cash”. (PHOTO: BTCKeychain)

Scrypt Keeps Mining in Check

One of the main problems Litecoin was created to answer to was the problem of concentrating mining. Bitcoin mining has become exceedingly difficult and its nearly impossible for a commoner to begin any reasonable bitcoin mining venture. The mining is concentrated on enormous halls full of specialized mining gear working day and night to crack the encrypted mysteries of Bitcoin. Even though Bitcoin is a distributed system, mining bitcoin is not.

This monopolization of mining can cause several different kinds of problems. Miners might be tempted to use their power to their own advantage even if it wouldn’t be the best solution for the network as whole. The recent ASICBoost case is a good example of this: a mining pool used a technology to attain unfair advantage in mining even though it clogged the blockchain down with empty blocks.

Litecoin tries to solve this problem by changing the algorithm used for mining. Bitcoin uses an algorithm called SHA-256 while Litecoin uses an algorithm called Scrypt. The main difference between SHA-256 and Scrypt is how the mathematical problems are solved. Scrypt is a so-called “memory intensive problem”, which means that to solve Scrypt-based problems requires a large amount of RAM instead of pure calculating capacity.

In practice this means that it is generally harder and more expensive to create specialized ASIC-mining gear for Litecoin. ASIC-miners also give less of an advantage over miners using non-ASIC-gear. This means that investing in Litecoin ASIC-miners is less profitable than investing in Bitcoin ASIC-miners. This has lessened the impact of mining “arms-race” significantly. Even though we have seen several new Litecoin ASIC-miners in the past years, litecoin mining is still closer to the end-user than bitcoin mining.

Bitcoin mining has been compared to the arms race of Cold War. Scrypt algorithm tries to curb this evolution. (PHOTO: Bernie Boston)

Bitcoin mining has been compared to the arms race of Cold War. Scrypt algorithm tries to curb this evolution. (PHOTO: Bernie Boston)

Litecoin Community is Less Conservative

There are huge amounts of resources behind Bitcoin. Investors have put billions into the queen of cryptocurrencies and different companies, banks, states and other institutions are using millions on research-and-development of Bitcoin technologies. Bitcoin is thought to be even capable of revolutionizing the entire monetary system.

This enormous reponsibility and power has made the Bitcoin community a tad conservative. The default attitude towards different improvement proposals is critical and judging. For an improvement to become part of Bitcoin, it has to go thru an intensive period of testing, research and debating. This process can take years even if the proposal is good. Of course this conservatism is not a bad in itself, for it has meant that Bitcoin has been able to grow steadily and securely as both an economic infrastructure and a technology.

Because there is far less political and economic weight behind Litecoin, its developing team has been able to maneuver more freely and with less risks involved. Of course LTC community reviews every improvement proposal tightly and critically, this community also tends to be less conservative and more open to new ideas. For an example the SegWit scaling update was implemented on Litecoin before it was implemented on Bitcoin. In fact the successful implementation of Litecoin’s SegWit was one of the key factors which secured the path to Bitcoin’s SegWit update.

If the omens are correct, it’s very likely that Litecoin will continue being this kind of “testing laboratory” for Bitcoin. For an example it seems possible that the future lightning network technologies will be tested first on LTC before they see a mainstream adaptation on Bitcoin. The development of Litecoin advances the development of Bitcoin also.

Bitcoin community has gained some reputation as being “techno-conservative”, but LTC community is more eager to try new options. (PHOTO: Kobel Feature Photos)

The Future of Bitcoin and Litecoin

Even though LTC is superior in many ways to Bitcoin, it is unlikely that it will entirely replace Bitcoin, neither it is Litecoin’s purpose. One of the many advantages of cryptocurrencies over traditional currency is that cryptocurrencies can be programmed to have different attributes and properties. One cryptocurrency might be better suited to handle some task, while another would be better for another task. Several different cryptocurrencies also mean that even though some individual cryptocurrencies would fail, it won’t mean the end of the phenomena.

Bitcoin and Litecoin serve different purposes. People invest in bitcoin, because it is a powerful way to protect oneself against market fluctuations and economic turmoil. For many bitcoin is akin to gold. The power of Bitcoin ecosystem and its independence of political and economic institutions make it an useful safe haven instrument. On the other hand bitcoin isn’t used that much in everyday transactions.

After dipping near to 100,000 in early October, the number of Litecoin (LTC) transactions has since returned to above 140,000, also in the same month the Litecoin Foundation announced the debut of its LTC Visa e-wallet, which is powered by fintech startup Unbanked.

LTC was created for the very purpose of small and fast transactions and thus to be used in more mundane purchases. Faster transactions and lower costs make Litecoin better suited for micropayments, donations and small purchases.

Because its possible to make technical advancements to Litecoin which would be very hard to implement on Bitcoin, Litecoin has the potential to develope faster than Bitcoin. Because Bitcoin and Litecoin work fundamentally in the same way, these technological advantages can easily be copied on Bitcoin as well. Litecoin can work as a testing ground for new technologies beneficial for both cryptocurrencies.

The usage of cryptocurrencies is on rapid rise. This can be seen in growing investements, increasing adaption and prices that reach new all-time highs from week after week. It seems likely that Bitcoin will be on the center of this progress, but it also seems likely that there will not be just one cryptocurrency, but several. Litecoin is one of the cryptocurrencies which have something real to offer in this new cryptocurrency world we are emerging to.