The TA of week 11 focuses on recent spot price relief rally and correlating on-chain metrics. Additionally we explore how to hedge against emerging inflation and black swans.

A Relief Rally

The cryptoasset market entered a relief rally during past seven days, propelling bitcoin to a 7,8 percent climb. The second largest cryptocurrency and decentralized finance platform Ethereum gained 13,4% within the same timeframe. Many smaller DeFi-related tokens like Aave soared >30%, correlating with the volatile nature of small-cap tokens.

7-Day Price Performance

Bitcoin (BTC): 7,8%

Ethereum (ETH): 13,4%

Aave (AAVE): 30,9%

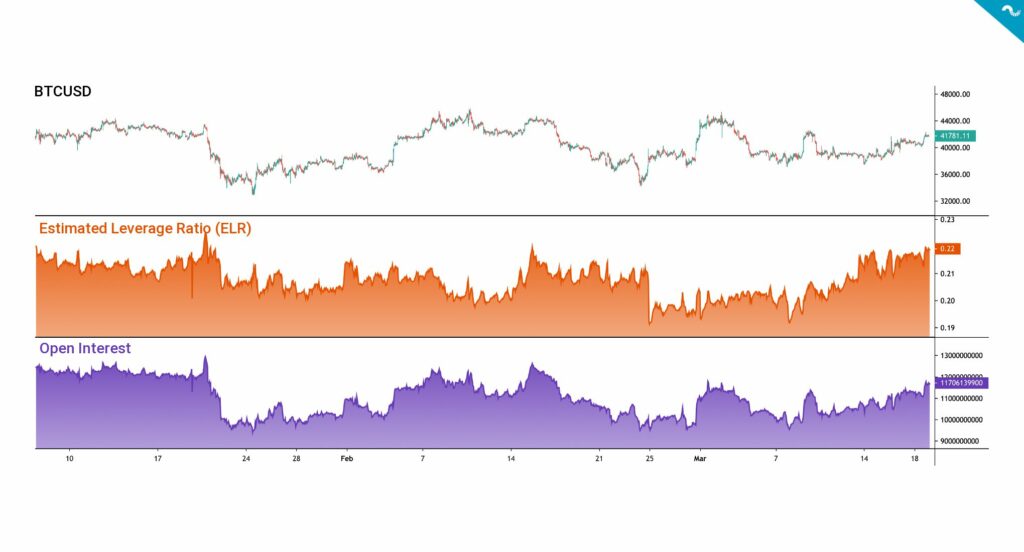

While bitcoin’s spot price has entered a healthy climb momentum, the Estimated Leverage Ratio (ELR) (orange) has reached its highest point since January, rising to 0,22. BTCUSD Open Interest (purple) is on the rise as well, marking a new high for March. Bitcoin’s Open Interest mirrors the amount of derivative contracts for BTCUSD trading pair, including longs and shorts.

The rising Open Interest can be seen as a bullish sign as it correlates with other on-chain indicators. Growing Open Interest indicates incoming volatility and liquidity to the market. In the current environment the upwards trajectory of Open Interest supports the spot price.

Ethereum’s Spot Price Breaks Through Long Resistance

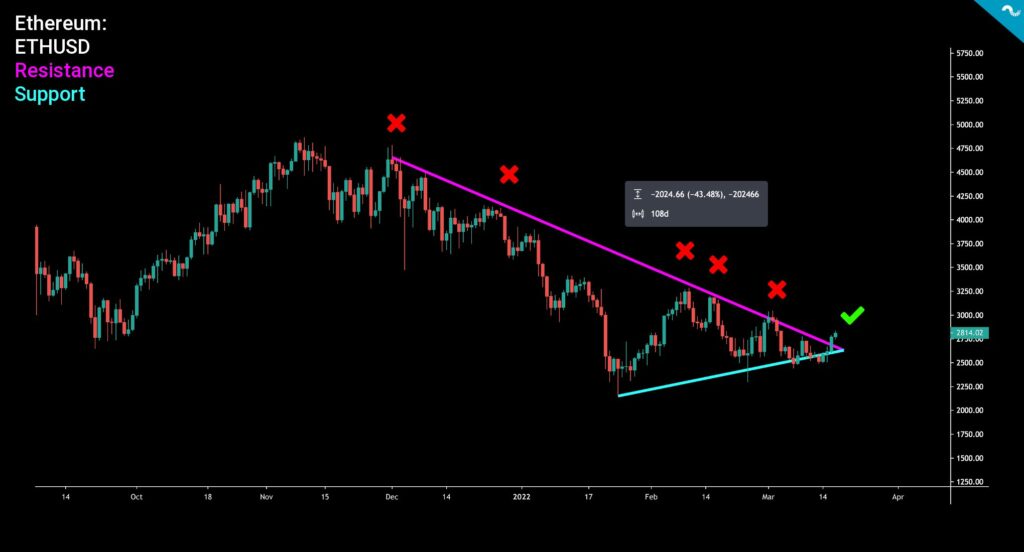

Ethereum’s spot price has increased more than 13 percent within the last seven days. While the percentual growth is impressive per se, Etherum’s upward trend also unwraps a technical breakthrough. As cryptocurrencies started their 100+ day downtrend in November 2021, they formed a technical resistance that wasn’t breached for 100 days.

Ethereum’s spot price (ETHUSD) tried to break through the resistance line (pink) multiple times in late 2021 and early 2022, as indicated by the red marks. However these breakout attempts were strictly cancelled each time, leading to a further spot price decrease. The resistance line was breached during week 11 as indicated by the green check mark and this setting opens a new frontier for price discovery.

Ethereum is currently loaded with expectations as the platform moves closer to protocol-level paradigm shift. The network is about to shift from Proof of Work (PoW) to Proof of Stake (PoS) protocol during the summer of 2022, however the time window has been moved multiple times. Ethereum’s supply is expected to peak at 118,5 million Ether units at the turn of June and July, and the recent EIP-1559 upgrade is burning an escalating amount of network fees. This burning essentially renders Ethereum more scarce and some analysts say it tries to imitate Bitcoin’s digital scarcity attributes.

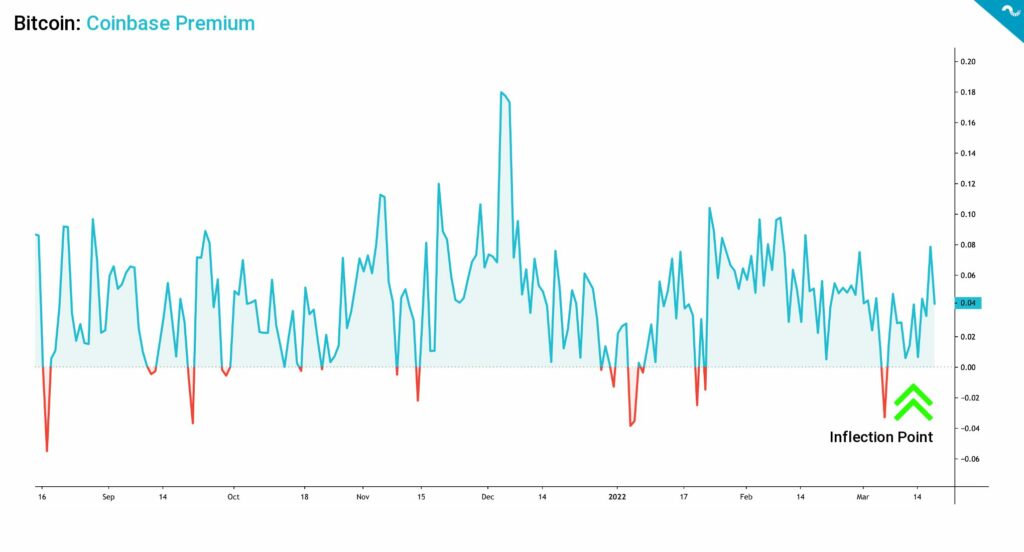

Coinbase Premium Faces an Inflection Point

The premium of the leading US exchange Coinbase has been closely aligned with the growing spot price of bitcoin. Coinbase Premium dipped to -0,03 in early March before gaining new momentum towards level 0,08. This inflection point likely indicates a local spot price bottom.

As Coinbase is a known on-ramp and gateway for US-based institutions, the Coinbase Premium can be seen to mirror wider institutional appetite. Back in bitcoin’s parabolic liftoff of 2020, the main source of buying pressure came from institutions like MicroStrategy. Coinbase is also a preferred platform for US-based whales, i.e. accounts with at least 1000 bitcoin units.

Inflation as a Black Swan and How to Hedge It

The emerging COVID crisis of 2020 was considered to be a global black swan event, however the consequences to economy turned out to be less pronounced than expected. As a contrast the current crisis in Ukraine might have potential to disrupt global supply chains and significantly escalate inflation.

By definition the black swan is an unpredictable event that is beyond what’s normally expected, and it generates severe consequences. The events are characterized by rarity, impact, and they are by default considered to be obvious in hindsight. The black swan concept was popularized by Nassim Nicholas Taleb in his famous book “The Black Swan”.

The conflict in Ukraine has been exceptionally savage in terms of civil casualties and infrastructure destruction, however it might also act as an catalyst to even wider macro-level consequences. David Beasley of UN World Food Programme recently estimated that the escalating war in Ukraine might take global hunger to catastrophic levels. Ukraine and Southwestern Russia account for 15 percent of global wheat production and 30% of all wheat exports.

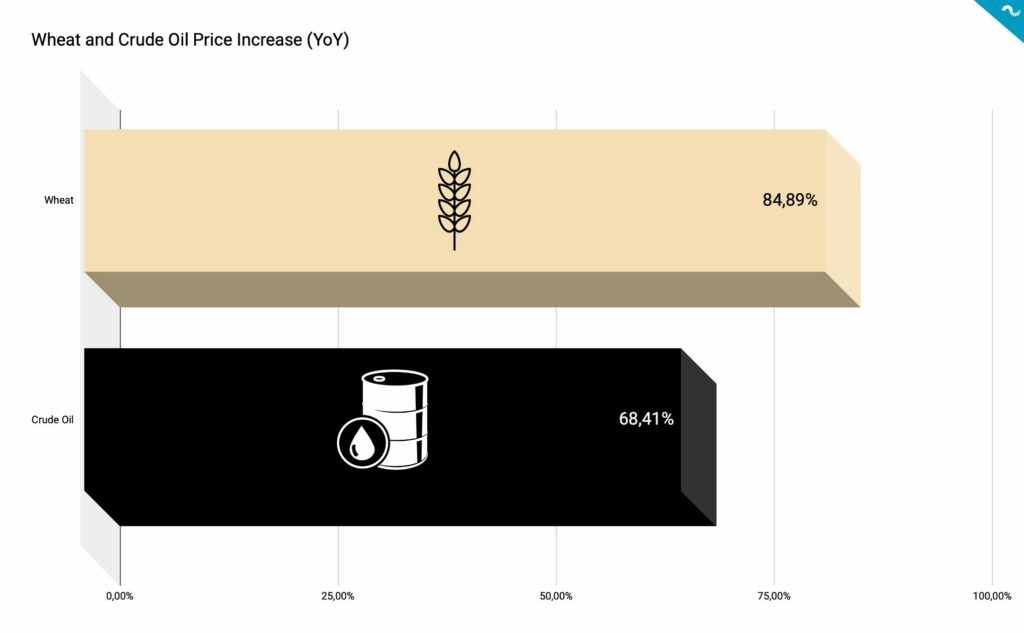

The rising raw material prices can already be seen and felt in real life. Price of wheat has risen 84,89% in a year, while price of crude oil has jumped 68,41%. In a scenario of a prolonged conflict these prices might still go up significantly. In an difficult macro and geopolitical environment it’s essential to hedge your position. Cryptoassets like bitcoin have been sound inflation hedges and bitcoin additionally offers censorship-resistant transactions to all individuals, regardless of the background.