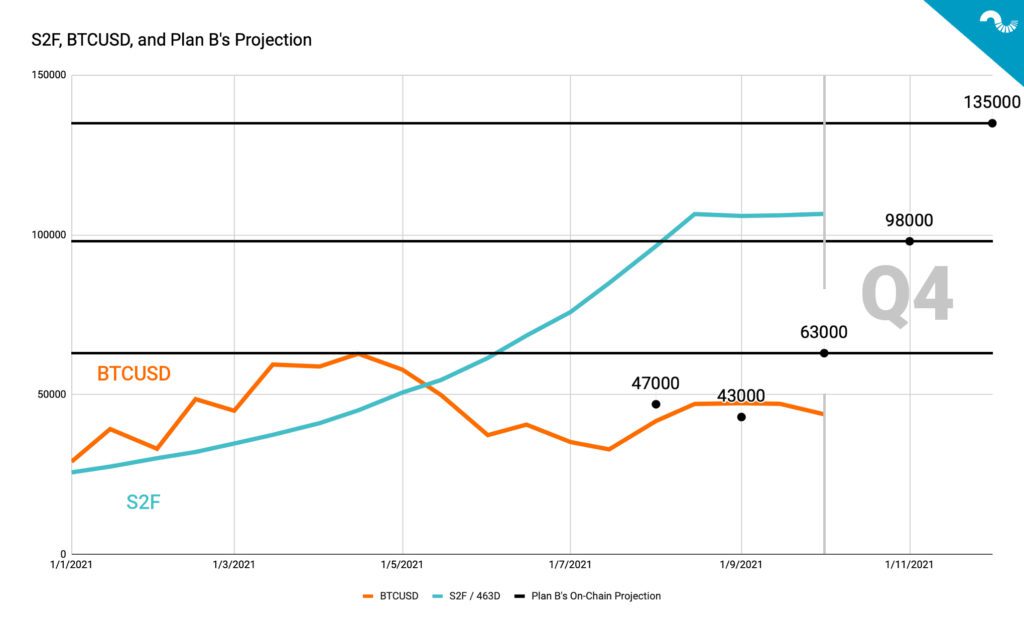

This week’s technical analysis interprets Plan B’s Stock to Flow projection for Q4 and beyond.

$135K Bitcoin?

As forecasted in last week’s technical analysis, bitcoin has a clear tendency to perform well during quarter fours (Q4). The volatility is certainly increasing as BTCUSD jumped >13 percent this week, accompanied by some altcoins ascending up to 30%. Particularly small-cap altcoins and DeFi tokens are gaining more traction.

Assuming the Q4 will continue to fulfill the bullish expectations, it needs to be backed by strong fundamentals. The creator of Bitcoin’s Stock to Flow (S2F) model, Plan B, has unveiled his on-chain projection that sees bitcoin climbing to $135K in December. Although Plan B stated his projection is not derived from S2F, it’s still numerically close and can be used as a sound benchmark.

Plan B’s price projection:

August: $47K (confirmed)

September: $43K (confirmed)

October: $63K

November: $98K

December: $135K

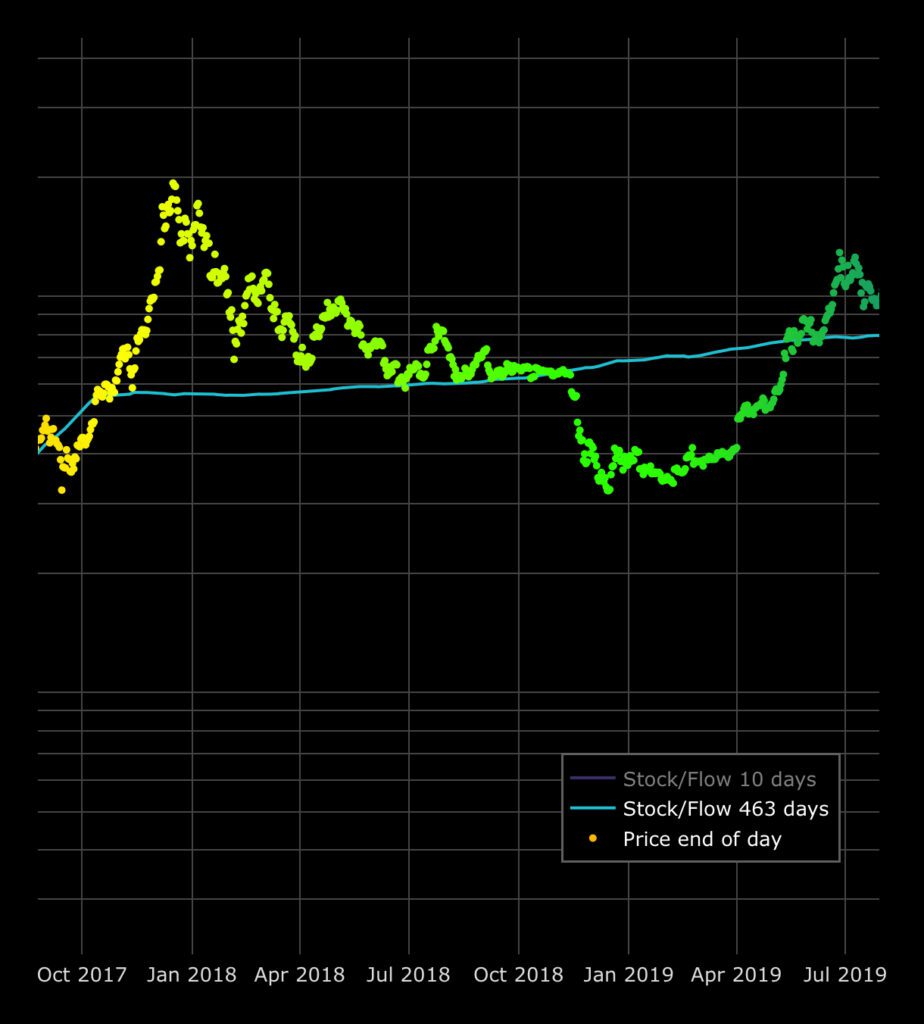

Stock to Flow model is a widely used instrument for assessing asset scarcity. It calculates the ratio of current stock of the asset and new production. In essence, stock to flow is a way to interpret the scarcity of a particular resource. Bitcoin is a scarce asset with a maximum supply set to 21 million native units. Bitcoin’s supply issuance is also defined on protocol level, making it highly predictable.

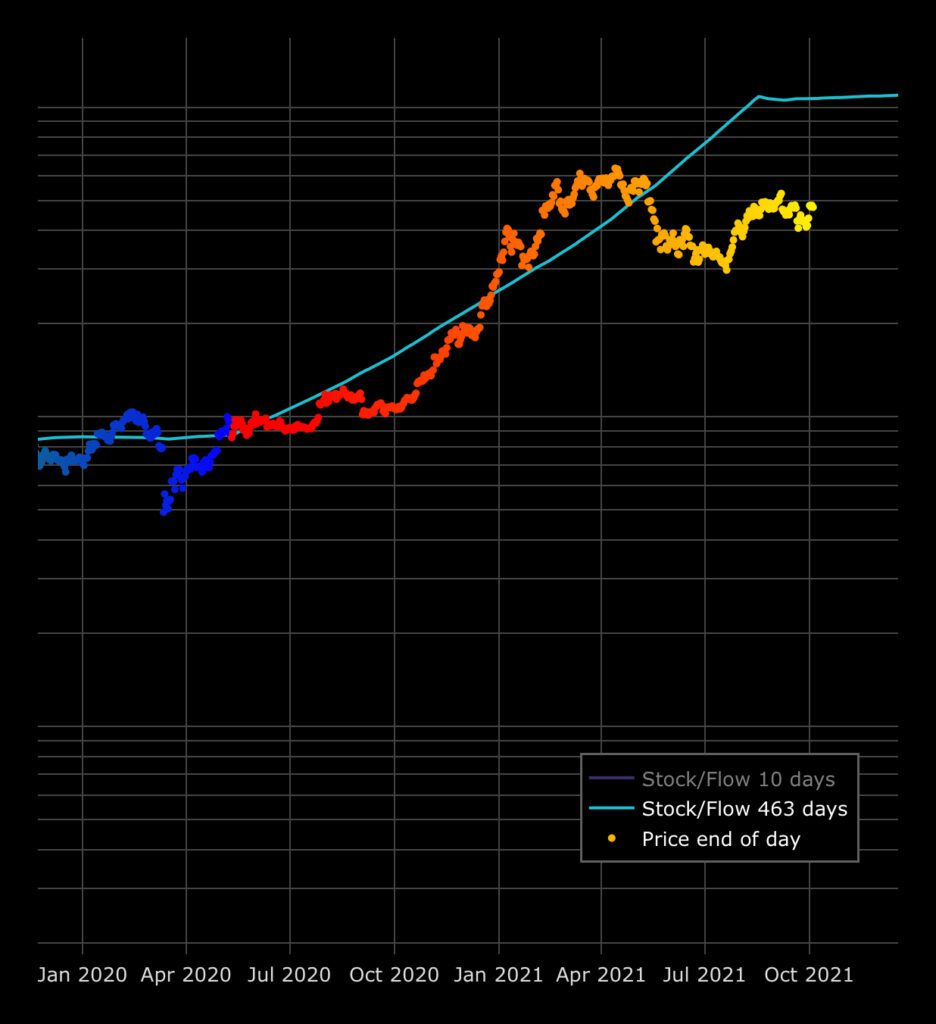

Albeit bitcoin’s price is currently well below the Stock to Flow trendline, this is not an unique occasion. BTCUSD has fluctuated above and below S2F across different cycles: In 2017 bull cycle BTCUSD climbed significantly higher than S2F. Respectively in early 2019 bear market BTCUSD dipped below S2F. Bitcoin’s price eventually seems to reach parity with Stock to flow, despite the seasonal divergence.

During early 2020 COVID-induced crash, BTCUSD dipped well below Stock to Flow, however bitcoin recovered quickly and remained in close correlation with S2F until summer 2021. If bitcoin is able to continue its upward trajectory, $100K price level in Q4 2021 – Q1 2022 is possible. One possible catalyst to support bitcoin’s price hike into 6 figures would be SEC’s green light for the first U.S. ETF. SEC is rumored to consider approving the first futures-based ETF. Even if the ETF decision would be postponed till 2022, investors are still trying price it in, leading to increasing buying pressure.

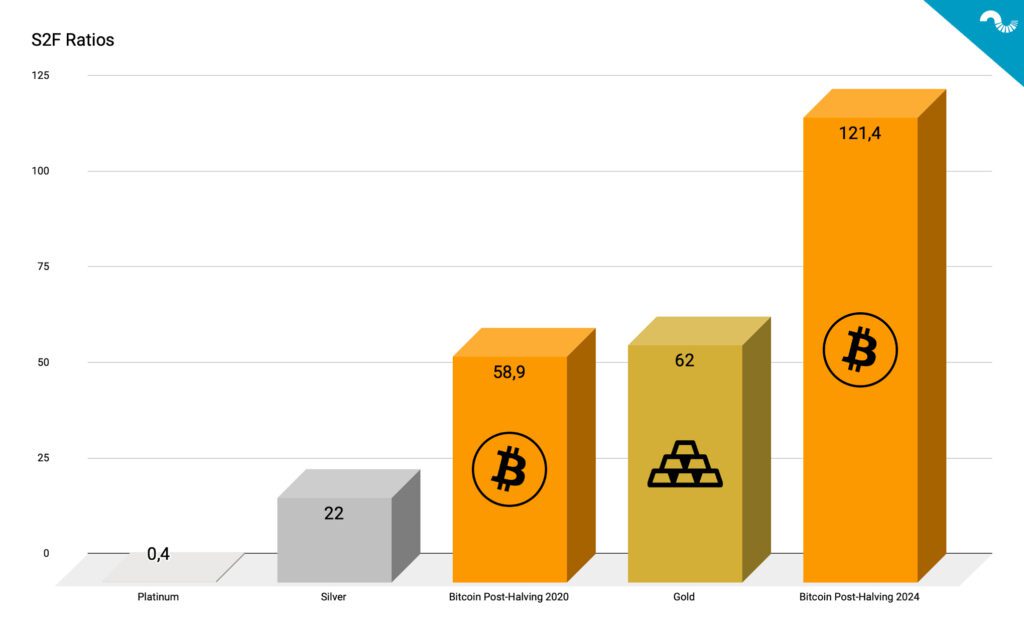

S2F and Precious Metals

Benchmarked against bitcoin, gold has had a terrible year with -10,35 percent decrease year-to-date. Bitcoin has ascended 49,01% in the same timeframe. Despite of the weak track record this year, gold is still a remarkably scarce asset. It’s scarcity is in close proximity with bitcoin, reaching to 62 Stock to Flow. Bitcoin’s built-in scarcity will climb even further, reaching 121,4 after the 2024 halving.

30 Day Volatility Approaching Spring Levels

As mentioned in last week’s technical analysis, BitMEX’s .BVOL24H Index climbed rapidly on August 20th. Now we’re seeing the increasing volatility in longer time horizons as well, 30 day volatility is ascending towards spring numbers. The last quarter is by default considered to be a decisive quarter, combined with higher volatility.