Technical analysis for week 38 interprets the recent market behaviour and escalating volatility.

Approaching Quarter Four

We’re quickly approaching the last quarter of the year as we shift to quarter four next Friday. This year has been incredibly fascinating for bitcoin investors, starting with bullish first quarter. Q1’s performance was largely derived from a bull cycle that stems back to Q3 and Q4 of last year, 2020. Bitcoin recently experienced a correction in Q2 2021, however the current Q3 has been cautiously bullish.

Bitcoin’s quarterly performance in 2021:

Q1: 102,9%

Q2: -40,4%

Q3 (so far): 24,99%

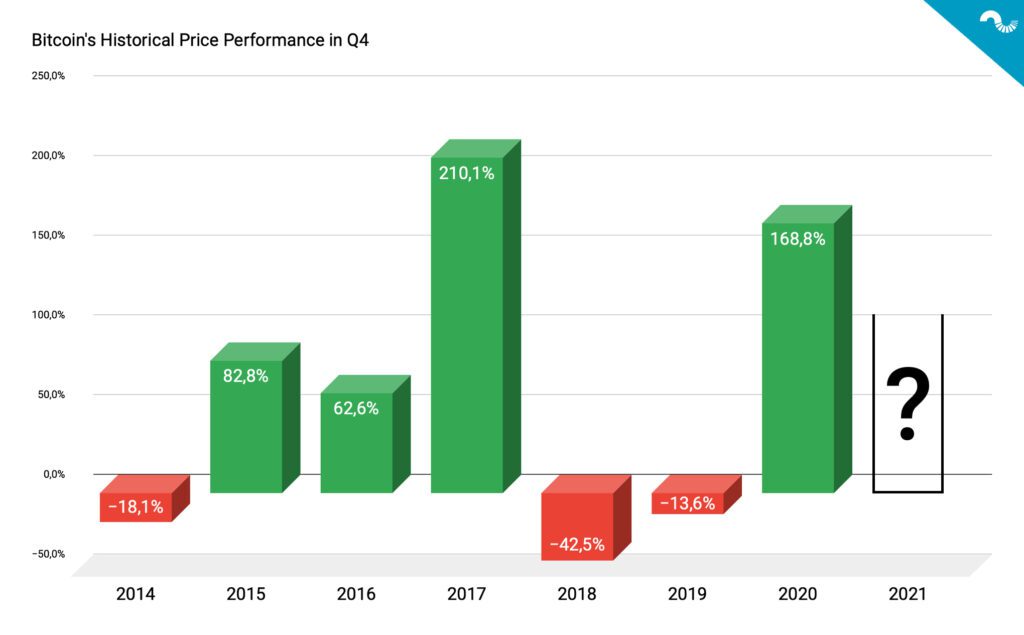

As the embedded chart shows, quarter fours have historically been bullish. Bitcoin has a tendency to perform well in Q4. The best Q4 so far (since 2014) has been in the 2017 bull market when BTCUSD ascended >210 percent, 2017’s huge bull market was mainly fueled by ICO funding rounds and retail demand. Since the previous Q4s have been bullish, it’s possible that investors see the upcoming quarter as self-fulfilling prophecy: When the critical mass thinks a quarter will be good, it becomes “true”.

The second best Q4 in terms of price increase was last year (2020) as BTCUSD grew 167%. The Q4 this year is still a question mark, however Bitcoin’s fundamentals are better than ever. By recent data, the amount of whales (addresses with 1000 or more bitcoin units) has been rising since May’s correction. In early May the said addresses contained 7,84 million native bitcoin units, while they currently hold 7,95M BTC. That’s a ~ 100 000 BTC increase from Q2 to Q4.

A look at Bitcoin UTXO data shows that 93% of native units haven’t moved in at least a month. As the demand for bitcoin increases in institutional and retail segments, the amount of liquid units might create a supply shock. Additionally Twitter rolled out platform support for Bitcoin Lightning payments this week, effectively making Bitcoin more mainstream. Twitter’s announcement was well received by the industry and Cathie Wood‘s investment firm ARK consequently bought $55 million worth of TWTR shares.

Volatility Spikes, Growing Sell Pressure from Asia

The volatility seems to be back as BitMEX‘s “.BVOL24H Index” surged from level 2 into close proximity to level 7 this week, following the Evergrande-induced panic. The Chinese Evergrande rise fear across markets this week as many expected it to default. The digital asset markets are also heavily leveraged and incoming bearish news may induce short-term panic selling.

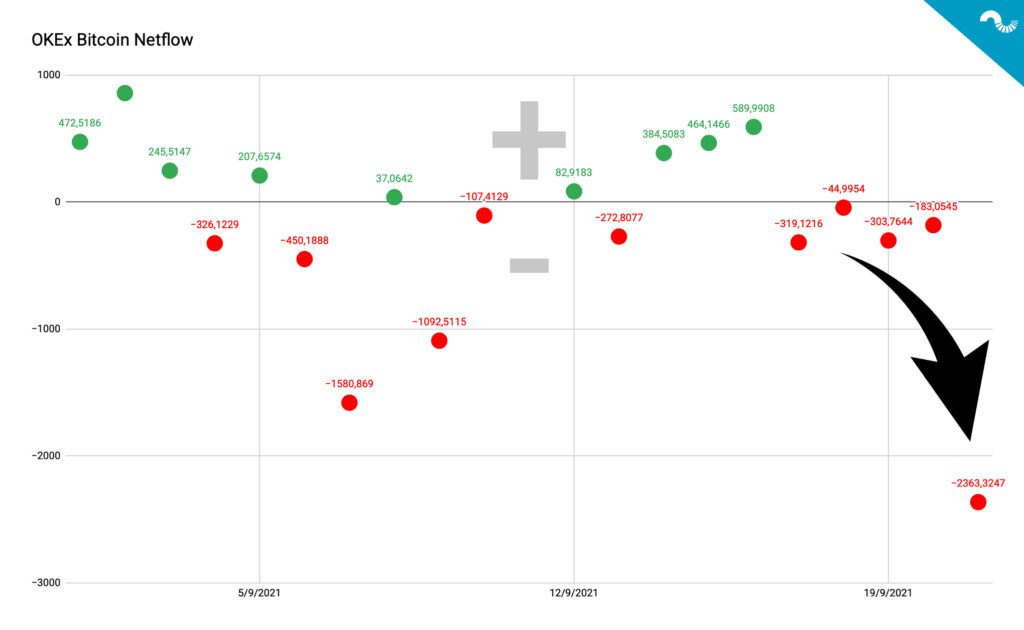

The Evergrande-related selling seems to be coming from Asia, indicated by daily OKEx netflow dropping to a lowest level since mid-June. Tuesday’s peak netflow of OKEx reached negative 2363,32 native bitcoin units. OKEx exchange is officially registered in Ceychelles for regulatory reasons, however it’s known to have a strong presence and offices in China and Hong Kong.

Market Seems to Recover Quickly

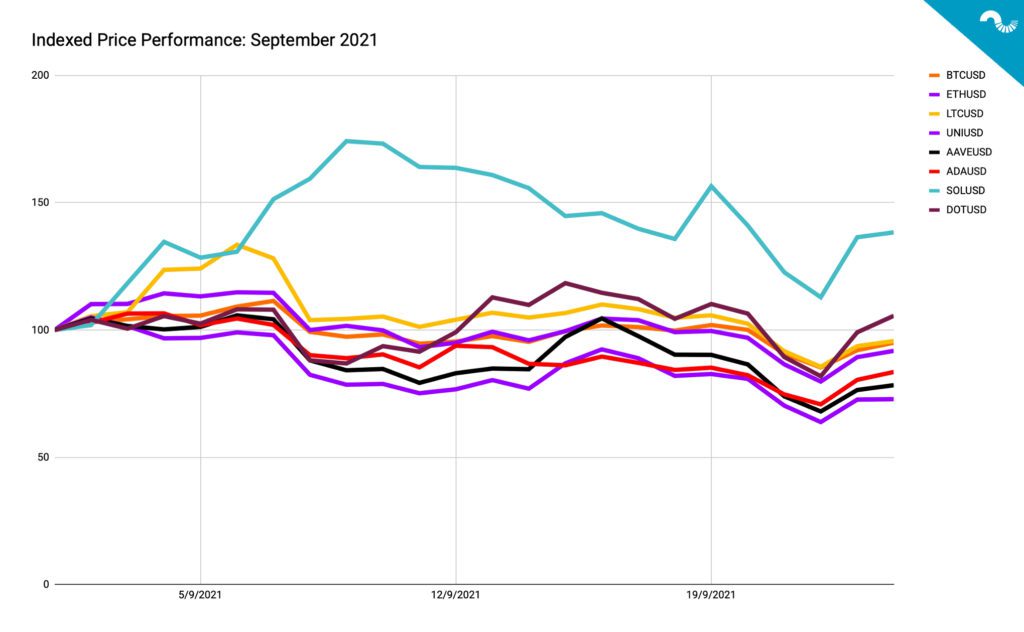

The market recovered relatively quickly from the Evergrande drop and many cryptoassets bounced back to pre-crash levels. Polkadot (DOT) for example is currently up 3,6 percent in 14 days, meaning Polkadot has not only fully recovered, but exceeded the pre-crash levels.

The current uncertainty is not linked to one subject, but a selection of factors. Investors were waiting for FED tapering decision, which turned to be a non-event for now. FED is expected to announce tapering updates in late Q4 this year. The markets were also slightly stirred by SEC’s policy towards digital assets and decentralized finance (DeFi). Additionally, the growth of NFT market seems to have unwinded for now, leading to some liquidity exiting the DeFi market. Nevertheless, Bitcoin’s value proposition is still intact: Bitcoin is the perfect for hedging inflationary monetary policies, combining huge upside with limited downside.