Even though non-fungible tokens, or NFT, have been around for several years, NFTs were virtually unheard of outside of the cryptosphere — that is, until March of 2021.

After an explosive week of multi-million dollar NFT-based art sales by world-famous artists, including Banksy and Grimes, non-fungible tokens have officially arrived. And NFTs aren’t just popular in the art world: they have also been rising in popularity in the sports industry, the music industry, and, well — everywhere.

Indeed, the list of use cases for NFTs seems to be growing by the minute, and the potential for growth of the NFT economy is expanding right along with it. What is this new kind of crypto asset? How are NFTs used? And how can investors and creators make money in the world of these non-fungible digital assets?

What are NFTs and how do they work?

Similar to cryptocurrencies like Bitcoin (BTC), NFTs are tokens that are launched on a blockchain.

In fact, many NFTs have been created on the Ethereum blockchain. Some new blockchains that specifically support NFTs and their marketplaces have also been created. However, while NFTs have blockchain in common with Bitcoin, there is a key difference between them.

If you’ve traded baseball or Pokemon cards, you already know a bit about the core concept behind non-fungible tokens.

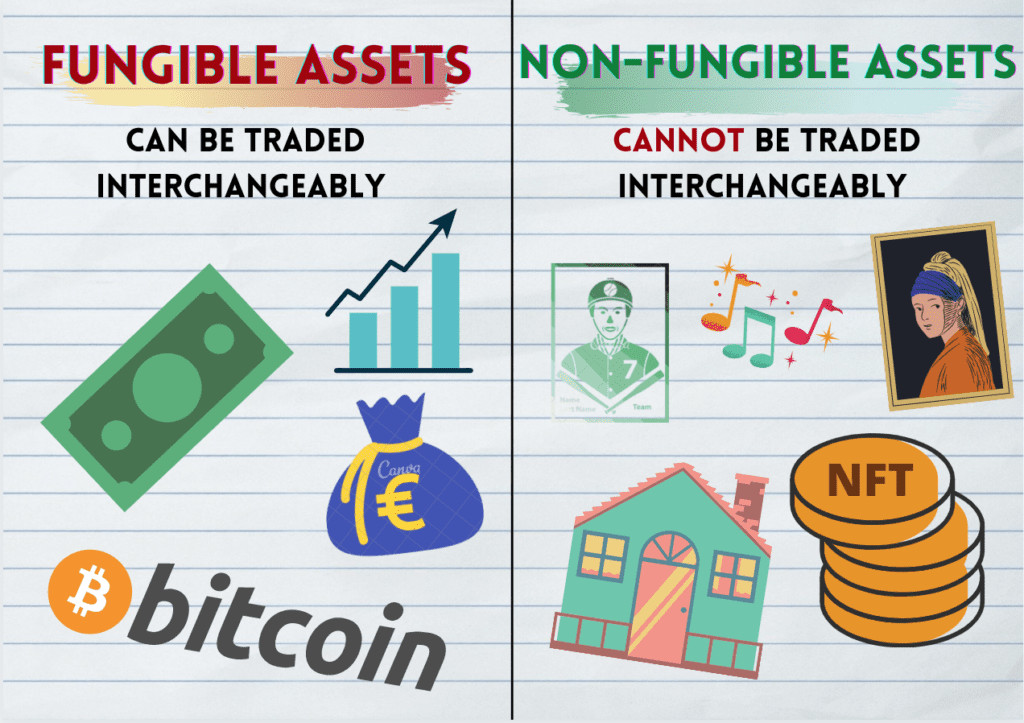

This is because trading cards, like NFTs, are not fungible: in other words, each card is unique. No two cards can necessarily be interchangeably exchanged for one another, even if they are technically the same kind of card. The fact that individual trading cards are unique and non-interchangeable is what makes them non-fungible.

By contrast, units of fungible assets, like Bitcoin (BTC) and USD, can be interchangeably exchanged for one another. For example, two separate $1 bills will always have the same value as one another, even if one is in perfect condition and the other has a mustache drawn on George Washington’s face.

NFTs, by contrast, cannot be interchangeably exchanged for one another. Like rare trading cards, each NFT is a digitally unique entity that has been created for a specific purpose.

NFT use cases: how can non-fungible tokens be practically used?

So far, the “specific purposes” that NFTs have been created for are wide-ranging:

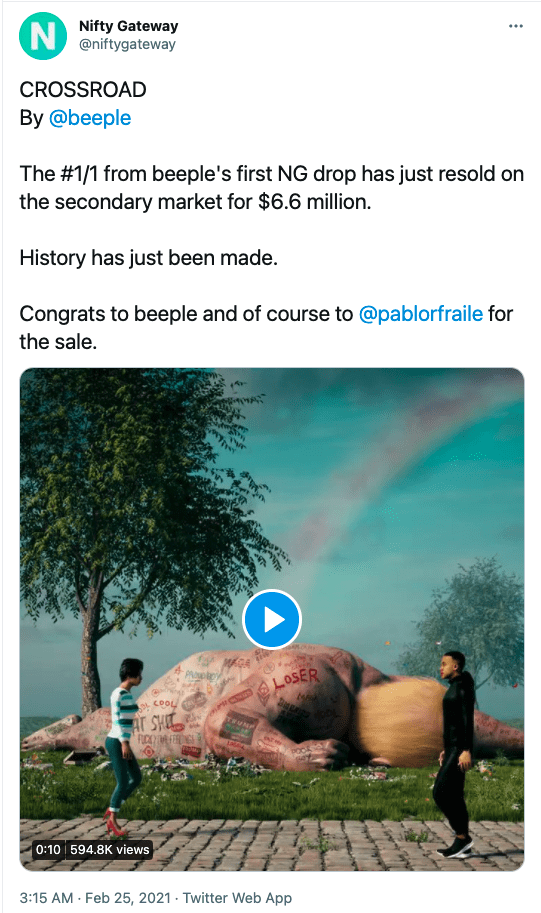

- In the art world, NFTs have been used to represent the ownership of physical and digital works of art. In early March of 2021, musical artist Grimes sold nearly $6 million worth of digital art pieces; an NFT representing a burnt painting by Banksy fetched almost $400,000 around the same time. An NFT representing a video clip created by digital artist “Beeple” sold for $6.6 million.

- The music industry is also getting in on the NFT scene. Last week, American DJ “3Lau”’ accumulated $11.3 million from an NFT auction. While some artists and musicians are concerned about their intellectual property rights, it’s important to note that most NFT sales do not involve intellectual property; instead, intellectual property remains with the artist. Therefore, many of these digital artworks can still be viewed or listened to online by anyone. However, some analysts have predicted that legal challenges surrounding NFTs and intellectual property rights could arise in the future.

- NFTs in the sports sphere have been used to create digital trading cards out of exciting moments in gaming history. The National Basketball Association’s (NBA) “Top Shot” NFT marketplace recently caught headlines after announcing that it had processed more than $230 million in sales in the 12 months before March of 2021. In secondary marketplaces, some of the NBA Top Shot collectable NFTs have sold for more than $200,000.

- Event tickets can also be sold as NFTs. Because each NFT is a digitally unique object, users can’t falsely recreate the tickets. If each ticket is sold as a digitally unique coin, it can be independently verified on the blockchain used to issue it. Additionally, blockchain-based identity verification could be employed to enforce selling limits. This could keep individuals from purchasing large quantities of tickets for reselling purposes.

- While there haven’t been many examples of this in practice as of yet, freelancing has also been identified as a use case for NFTs. Instead of trading contracts via email, freelancers could sell contracted services in the form of non-fungible tokens.

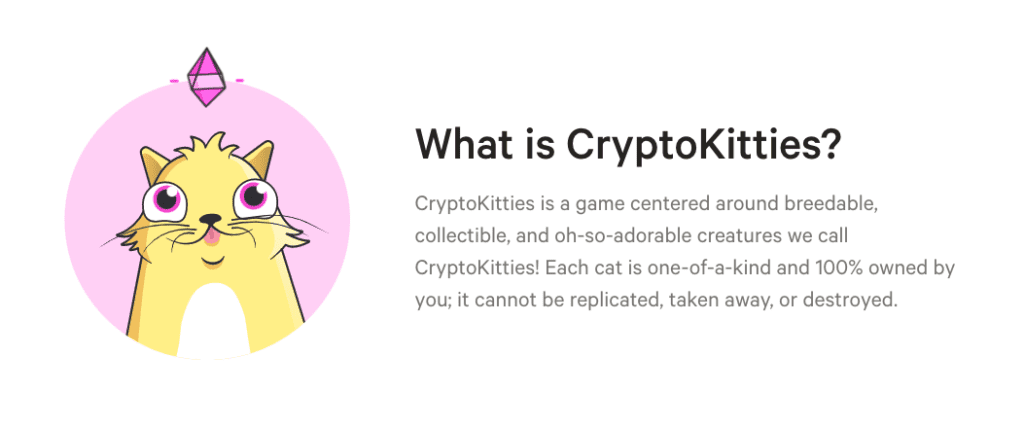

- CryptoKitties and similar digital collectable games are one of the oldest use cases associated with NFTs. These collectable, digitally-unique kitties became so popular in late 2017 that they seriously jammed up the Ethereum blockchain, causing transaction fees to skyrocket and transaction speeds to lag for hours.

Many analysts agree that eventually, NFTs could be used for almost anything you can think of. One of the more random examples that have come up so far was Twitter CEO Jack Dorsey’s decision to sell an NFT representing his first-ever Tweet. At press time, bids for the Tweet had reached past $2.5 million.

How can investors make money with NFTS?

While non-fungible tokens seem to have only just hit the mainstream, the huge dollar amounts that have been attached to some of these tokens have captured investors’ imagination.

Because the NFT space is still relatively new, different kinds of NFT-related income and investment possibilities will likely arise in the future.

For now, however, the best way to get in on the action may be to start buying tokens that are tied to the things you are interested in. Are you an art geek? Check out some NFT art. Into music? There are a growing number of musical artists that are selling NFT shares. Sports and comedy fans can also get in on the action.

Conversely, if you are a creator, there may never be a better time to start creating work tied to NFTs. A growing number of platforms will allow you to create NFTs based on your body of work.

What do you think the most interesting NFT use case is so far? Let us know in the comment section below.