Despite its enormous popularity, some untruths, myths, and rumors about Bitcoin still prevail. Bitcoin experts have debunked five big bitcoin myths in the B-Word conference.

Bitcoin has been a dominant cryptocurrency for over ten years — but many Bitcoin myths are yet to unmask. Does Bitcoin waste energy? Is Bitcoin used by criminals? Is the BTC network scalable, decentralized, and irreplaceable? Read this to know how Bitcoin myths are debunked.

Bitcoin Myths Debunked

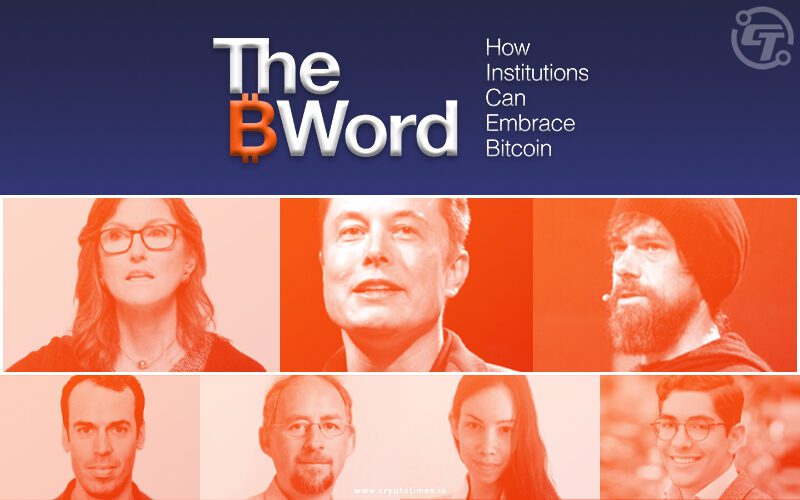

The Crypto Council Of Innovation’s B-Word conference was one of the most important cryptocurrency events in 2021. Lots of people became interested in this organization because of Elon Musk and James Dorsey.

Musk, Dorsey, and other participants debunked lots of Bitcoin myths. In one panel, five Bitcoin experts debunked five big Bitcoin untruths: Bitcoin wastes energy, Bitcoin facilitates criminal activity, Bitcoin is unscalable, the concentrated ownership of Bitcoin, and Bitcoin easy displacement.

Bitcoin energy consumption myths debunked

First speaker Nic Carter, General Partner of Castle Island Ventures and co-founder of Coin Matrics, debunked “Bitcoin Wastes Energy.” Carter said, Bitcoin is a neutral, global monetary network and provides settlement of a value and a political sense, without who is using the network. He continued, “it is not the case that adding more transactions will dramatically increase the energy consumption of the Bitcoin network, as many people mistakenly believe. Much of the energy consumption is really a function of the price of bitcoin (BTC) and, of course, the value of that new issue that the miners are collecting. “

He mentioned that, historically, the issuance of new BTCs motivates the vast majority of Bitcoin’s energy. This is because there are two ways to compensate miners: one is through the distribution of new units, and the second is through the fees users pay for cryptocurrency exchanges. It shows that the issuance of new units of bitcoin has dominated their income and, therefore, is the most incentive for their energy consumption.

Carter referred to energy consumption by Bitcoin miners. In this sense, according to the data he handles, he clarified that they use around 0.26% of the world’s electricity annually and 0.11 of world energy production. “Whether you consider that too high or too low depends on your perspective on the merits of Bitcoin,” he added.

However, it’s essential to understand that energy consumption doesn’t mean the same amount of carbon emission. This is because one unit of hydro energy will have a much less environmental impact than the same coal-powered energy unit.

Does bitcoin consume more energy than countries ?

Although there are no precise estimates about the usage of the energy mix in bitcoin mining, one report indicated that 73% of bitcoin’s energy consumption was carbon neutral. Moreover, Bitcoin has a carbon footprint comparable to that of New Zealand, producing 36.95 megatons of CO2 annually, according to Digiconomist’s Bitcoin Energy Consumption Index,

Carter sought to dismiss the comparisons that exist between the energy expenditure of Bitcoin and that of some countries:

“I think the comparisons at the industry level are much more illuminating than at the country level. Because Bitcoin is not a country but an industry that provides monetary, transaction, and savings guarantees (…), Bitcoin compares favorably with the energy used by copper mining, zinc mining, and gold mining. As far as we know, these have a higher energy impact. (…) Things like gold are a means of storing wealth outside the banking system and outside the state. So is Bitcoin, which has completely different qualities from these other monetary systems. So to the extent that Bitcoin is recognized as having utility, its power consumption becomes much more manageable, into something that we can feel more comfortable with.”

According to Carter, customers want to ensure that their bitcoin transactions are complete and final and that nothing else will change after that. This, according to him, justifies energy consumption.

Bitcoin uses 128 terawatt-hours annually, according to estimates from Cambridge University.

There is a promising development about Bitcoin energy use. A new Bitcoin Mining Council will “promote energy usage transparency” and encourage miners to use renewable sources.

Elson Musk tweeted that the group had committed to publishing renewable energy’s current and planned use details.

Spoke with North American Bitcoin miners. They committed to publish current & planned renewable usage & to ask miners WW to do so. Potentially promising.

— Elon Musk (@elonmusk) May 24, 2021

Bitcoin and illegal activities myth debunked

The second speaker Philip Gradwell, the Chief Economist at Chainalysis, debunked, “Bitcoin facilitates criminal activity.”

According to Gradwell, Bitcoin has a mysterious aura. It created an anonymous person and triggered big changes in the understanding of money. Then Gradwell gave Silk Road examples, where both legal and highly illegal activity took place through 2013.

“The part of the mystery also comes from how many people first hand, were heard of Bitcoin. Generally, people heard about bitcoin first in Silk Road, which operated from 2011 to 2013. Silk Road was the first darknet place where people actually used Bitcoin. The website was used for buying and selling drugs. When the bitcoin entered into consciousness for the first time, it was related to criminal activity.”

Gradwell said that Bitcoin’s public blockchain brings unprecedented transparency to economic activity.

“Transparency means a criminal activity on Bitcoin can be measured. Data shows that illicit entities accounted for 2% of all economic activity on Bitcoin in 2020. That means 98 % of activities are legal”. Also, Transparency means that law enforcement and Anti-Money Laundering (AMT) checks by cryptocurrency businesses can trace and stop criminal activity.

“Not only law enforcement but also cryptocurrency businesses around the world perform AMT checks using Bitcoin blockchain data to meet regularity obligations to disrupt criminal activity,” Gradwell continued.

He said in 2020, criminal activity used an equal to 10 billion USD Bitcoin, But this number is minimal in comparison to criminal activities in the global economy.

Debunking “Is bitcoin scalable?”

Third speaker Arjun Balaji, Investment Partner Paradigm, debunked “Bitcoin is Unscalable.”

Balaji rejected the concept that Bitcoin should improve its block size to assist bigger transaction volume. It will sacrifice Bitcoin’s decentralization by making it troublesome for a median particular person to run a full node.

Instead, he proposes that Bitcoin can scale by layers. Technologies like the Lightning Network scale settlement assurance by deferred settlement, which can finally secure bitcoin by the bottom layer.

Alongside different applied sciences equivalent to sidechains and Bitcoin banks, customers have versatility when it comes to the strategies. Customers use to settle transactions, which all differing function tradeoffs of decentralization, scalability, and safety.

Debunking “Is bitcoin centralized or decentralized?”

Nate Maddrey, an analyst at Coin Metrics, debunked “Bitcoin Ownership is Concentrated.”

Maddrey said the myth that Bitcoin is overly concentrated within the fingers of whales (big companies). However, deceptive headlines usually put forth understanding based mostly on publicly accessible blockchain knowledge showing comparatively few addresses with large quantities of Bitcoin inside.

However, a Bitcoin deal doesn’t essentially symbolize a person. It might represent an alternate, establishment, or multiset pockets utilizing one deal with which to symbolize a whole lot and even hundreds of people. Also, most of the aforementioned “whale” addresses are useless wallets, probably held by individuals who amassed a lot of bitcoin way back; however, they have lost their keys since.

Furthermore, when put next in opposition to different cryptocurrencies equivalent to Ethereum and Dogecoin. Bitcoin has the evenest distribution of all throughout numerous percentiles. This is basically a result of Bitcoin’s proof of labor consensus mechanism. Bitcoin’s proof of labor forces the preliminary recipients of Bitcoin- miners- to rapidly promote a lot of their Bitcoin with a view to cover the prices of working their operations, which helps unfold Bitcoin on the open market.

Debunking “What will replace Bitcoin?”

The last speaker of the panel, Lyn Alden, founder of Lyn Alden Investment Strategy, debunked “the easy displacement of bitcoin.”

Lyn Alden debunked the idea that “Bitcoin Can Be Displaced Easily” FUD. Bitcoin has three “irreplaceable attributes,” says Alden – security, scale, and decentralization. She takes note of the oft-used comparison of Bitcoin to MySpace. Bitcoin, she reminds, hit a $1T market cap 13 years after coming into existence. It’s a level of scale and market dominance that MySpace never even sniffed at.

She also highlighted that while you can fork the code, you cannot fork the community. She gave an example on Wikipedia. So just like someone could copy Wikipedia without the network effects and all the links, just copying it is insufficient to make it a true Wikipedia competitor. However, people are still looking at the actual Wikipedia. It is impossible the copying Wikipedia’s traffic.

As Ethereum is clearly the second most scaled layer one blockchain in terms of network development and market capitalization, Alden pointed out how Bitcoin is clearly ahead in terms of decentralization.

She hinted how Ethereum uses difficulty bombs on the blockchain to force a quicker update path. That gives developers more influence over the network. Ethereum’s issuance rate has been more variable, as its monetary policy has been prone to changes. Alden says, while some view the greater ability of Ethereum to change as a positive feature, it comes at the price of lessening decentralization, as it alters which players have the primary control.

If you want to listen to this panel, you can reach the video here.

What do you think about Bitcoin? Do you have some negative thoughts about it? Tell us your thoughts and ideas.