The technical analysis for week 34 interprets the decreasing exchange reserves and related investor activity.

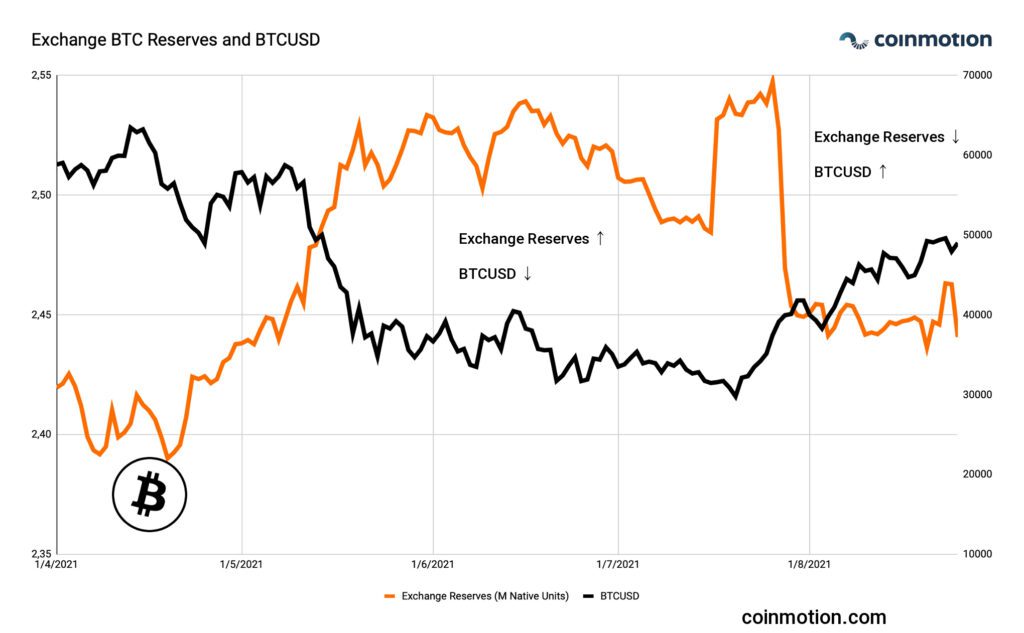

Exchange Bitcoin Reserves Decreasing Rapidly, Following The Market Uptrend

On-chain data, like exchange reserves, is an important instrument for interpreting market activity in greater detail. Exchange reserves mirror investor activity with the following logic: During a bull cycle assets are usually withdrawn from exchanges into private wallets and allocated to long-term cold storage. This is especially true in bitcoin’s case. Respectively, in a bear cycle investors move the funds back to exchanges, in order to convert them to fiat currencies, stablecoins, or other digital assets.

↑ Bullish sentiment: Native units flow back to private wallets for long-term storage.

↓ Bearish sentiment: Rising number of native units in exchanges. Units will likely be converted to national (fiat) currencies, stablecoins, or other digital assets.

When exploring the embedded chart, we see that exchange bitcoin reserves stayed low, close to 2,4 million unit level from April to May 2021. After May’s crash, the reserves quickly ascended to 2,5M units and above, marking a 100 000 BTC increase. The number of exchange reserves stayed high amid the bearish market environment, however, the setting shifted again in late July by rising bitcoin spot price.

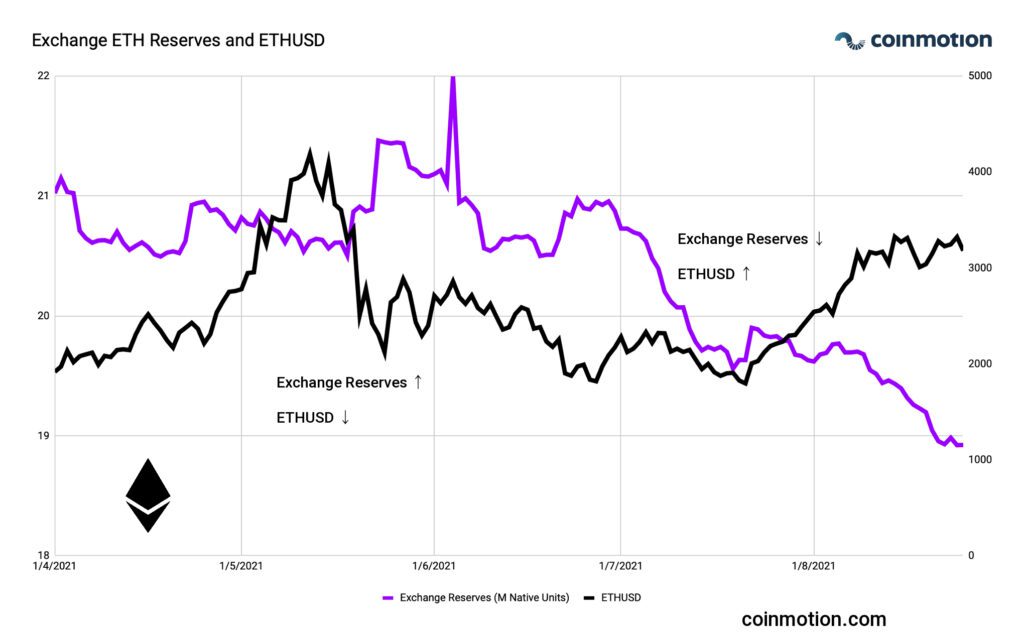

Exchange Ethereum Reserves in Secular Downtrend

Exchange Ethereum reserves follow a Bitcoin-like trajectory, however, ETH reserves are even in a deeper decline. The exchange Ethereum reserves stayed between 20 and 21 million native units before May’s crash, after which they momentarily increased to 22 million. Ethereum reserves already started to decline in early July and continued to descend with growing ETHUSD.

The Ethereum reserves have been in a secular decline since early June. This trend most likely stems from growing decentralized finance (DeFi) and NFT applications. The escalating number of users are interested in decentralized exchanges, wrapped products, and collectibles, consequently staking their ETH off-exchange. Ethereum investors are also preparing for upcoming ETH 2.0 update and the consequent PoW -> PoS transition. The recent London hard fork additionally made Ethereum more scarce, rising the incentives to save native units in cold storage.

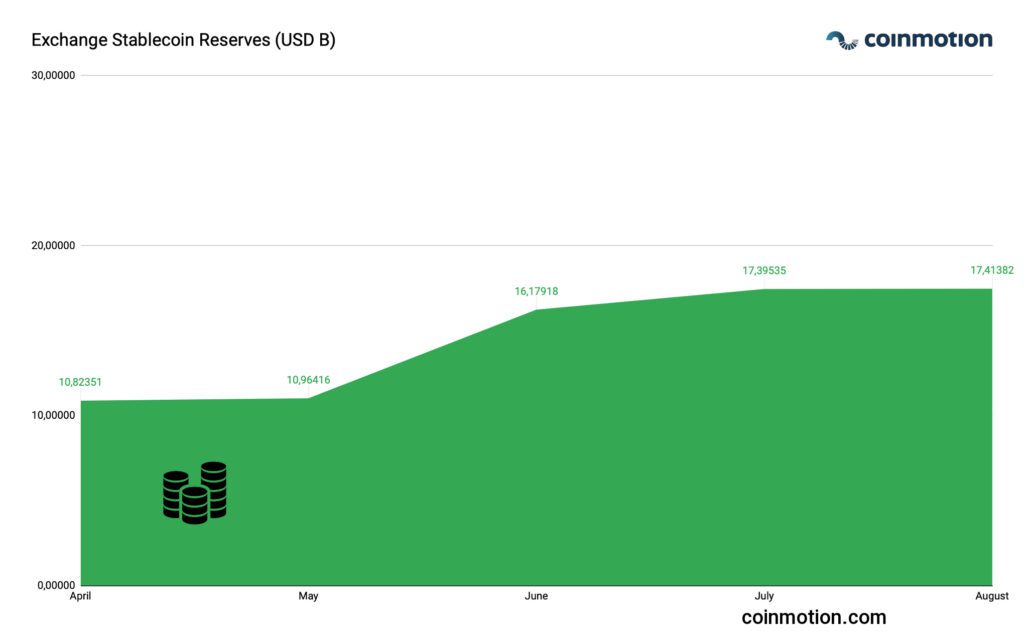

Exchange Stablecoin Reserves Reaching New ATH

Even though exchange Bitcoin and Ethereum native unit reserves are in decline, the stablecoin reserves have been growing since spring 2021. In April 2021 the exchange stable coin reserves crossed 10,82 billion USD, rising to 17,41 billion today. Huge stablecoin reserves are bullish for crypto markets as they practically indicate a lot of money waiting on the sidelines.

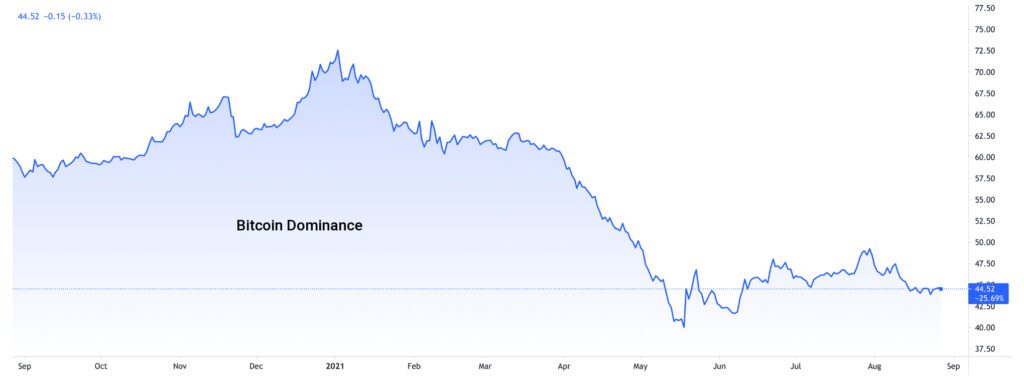

Bitcoin Dominance Still Low But Steady

As we know, the Bitcoin dominance index has hugely dropped through 2021, descending from early 2021 70 percent to the recent 44,52%. The decreasing Bitcoin dominance should not be a sign of trouble though, it just indicates that Bitcoin faces an increasing amount of competition. Especially Ethereum has been growing its relative market share this year. Ethereum might soon reach 50 percent of Bitcoin’s market capitalization, the former being at $379B and the latter at $908B.