The world of decentralized finance, or DeFi, is constantly evolving. “Defi” describes financial applications in cryptocurrency or blockchain that recreate traditional financial services in autonomous, decentralized forms. For example, DeFi technology has been in use to recreate everything from lending platforms to insurance hubs. And new use cases are emerging all the time.

Indeed, it seems as though there are new DeFi platforms and projects almost every day. As one of the latest arms of the cryptocurrency space, Defi is primarily seen as the crypto sector’s most innovative hub.

However, as far as DeFi has come, some bitcoin “maximalists” still believe that it’s just another crypto fad, comparable to the ICO boom in 2017. They think that the Bitcoin network can and will provide everything that digital currency users require in the future. Similarly, there may be a school of thought among some DeFi users that bitcoin’s slow, energy-intensive protocol could eventually cause the asset to become obsolete.

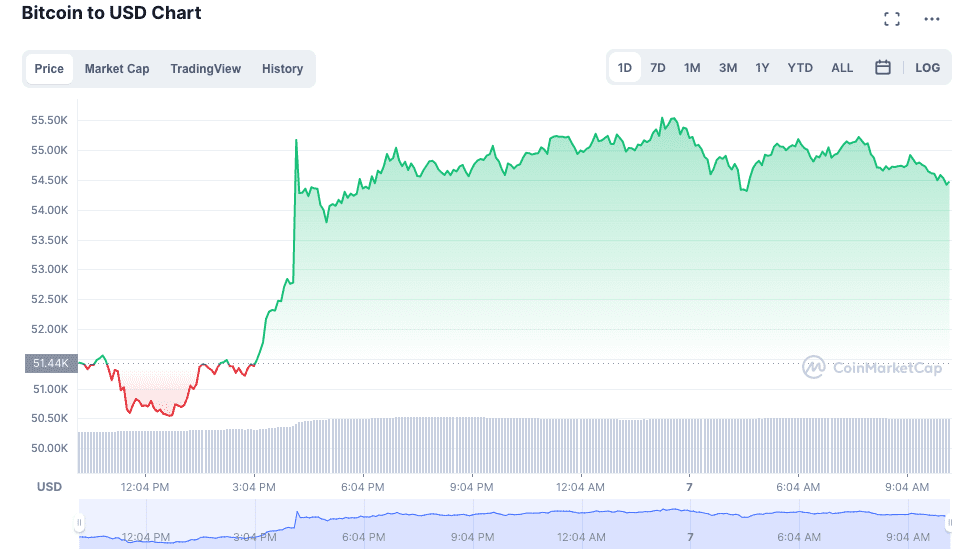

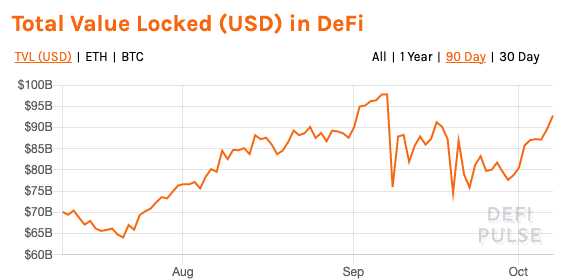

The reality, however, seems to be shaping up somewhere in the middle. Both Bitcoin DeFi has grown considerably over the past 12 months. In August 2020, the total value locked (TVL) in DeFi protocols was roughly $10 billion.

Today, it’s more than $76 billion. Similarly, a year ago BTC’s value was approximately $12,000 but is now worth $47,500. And these two aspects of the cryptosphere have not grown in isolation from each other–instead. Bitcoin has played an essential role in the growth of DeFi (and, arguably, vice versa).

What role does Bitcoin play in Defi?

For starters, some voices in the space have pointed out that Bitcoin was, in some respects, one of the earliest examples of DeFi on the market. For example, Ethereum.org points out that “Bitcoin in many ways was the first DeFi application…bitcoin is open to anyone, and no one has the authority to change its rules.

Bitcoin’s rules, like its scarcity and its openness, are written into the technology. It’s not like traditional finance where governments can print money which devalues your savings and companies can shut down markets.”

But beyond the philosophical similarities between the Bitcoin network and DeFi platforms. BTC has a growing number of use cases that put it directly into decentralized finance. Most commonly, various platforms allow Bitcoin holders to put their coins into protocols that help them multiply their investments.

For example, yield farming platforms allow crypto holders to earn dividends on their coins in exchange for providing liquidity. DeFi lending platforms enable lenders to earn interest payments on coins they “lock” into decentralized protocols. Decentralized exchanges, or DEXs, give users the ability to exchange funds without paying fees to a centralized “middleman.”

These platforms only allow users to deposit tokens based on the same blockchain that they are. For example, a lending or yield farming service based on Ethereum will only accept assets issued on the Ethereum blockchain (i.e., ERC-20 tokens.)

So, how one can use bitcoin in DeFi protocols that are not based on its own blockchain? Enter “wrapped Bitcoin,” or wBTC.

What is wBTC, and what role does it play in DeFi?

Wrapped bitcoin first appeared on the scene in January of 2019 as a way to bring the liquidity and capital volume of bitcoin to the Ethereum network. It’s a tool that allows the use of bitcoin in DeFi protocols on the Ethereum blockchain. Users can lock wBTC into DeFi lending and yield farming protocols, exchange wBTC on decentralized exchanges, and more.

The wBTC protocol creates Ethereum-based tokens by freezing a bitcoin on its own network and minting a token representing the same bitcoin value on the Ethereum network (therefore, one wBTC = 1 BTC.) It’s a bit similar to dollar-pegged stablecoins’ relationship with USD: stablecoin protocols lock $1 for each stablecoin they mint on the blockchain (therefore, $1 = 1 stablecoin). wBTC users can port their BTC to and from the bitcoin blockchain through the wrapped bitcoin protocol.

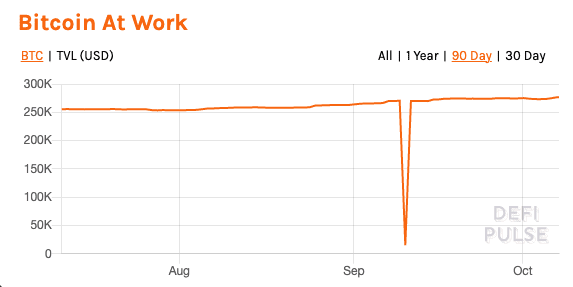

Eighteen months after its launch, more than $800 million worth of bitcoin was converted into wBTC. Today, that figure has risen to more than $9.3 billion. In August of 2021, DeFi Pulse data showed roughly $12.5 billion BTC “at work” in DeFi protocols, including wBTC and other bitcoin DeFi derivatives.

Beyond wBTC: How DeFi uses Bitcoin

Beyond wBTC, a number of projects have been developing the architecture necessary to expand the role of the bitcoin blockchain in DeFi.

For example, Rootstock (RSK) is a smart contract platform that uses sidechain technology to connect to the Bitcoin blockchain. Rootstock is designed to give the Bitcoin blockchain smart contract functionalities: it’s totally compatible with Ethereum’s applications but uses bitcoin (BTC) rather than Ether (ETH) as the underlying cryptocurrency. To use Rootstock, people have to “lock” BTC in the protocol. They receive an equivalent amount of RBTC that can be used to deploy or to interact with smart contracts and dApps on the Rootstock blockchain.

One popular Rootstock dApps is Sovryn, a decentralized, non-custodial, and permissionless protocol for BTC borrowing, lending, and trading. Sovryn is the DeFi application that allows you to yield farm bitcoin.

If you’re a bitcoin user who’s curious about DeFi protocols, wBTC may be an opportunity for you to start using decentralized finance tools to invest and earn passive income. As always, remember that investing in cryptocurrencies can be very risky. Never invest more than you can afford to lose.

his article does not present any investment recommendations, nor should it be interpreted as such. Gaining profits on the markets often requires deep-rooted knowledge and several years of experience.