Bitcoin Decouples from Stock Market Indices

Bitcoin’s quarter four (Q4) just launched with a bullish vibe, rising almost 15 percent during the first week of October. As argued before, quarter four has historically been a particularly good season for bitcoin, and investors’ expectations are high. Since bitcoin has evolved into a full-scale asset class, it’s relevant to regularly benchmark it against other asset classes. In the early 2021’s bull cycle, bitcoin outperformed stocks and gold by a huge margin, especially during Q1. However, May’s correction saw bitcoin momentarily dropping below tech stock performance. From Q3 to Q4 bitcoin has been excelling again, currently decoupling from the stock market indices.

Price Performance YTD

Bitcoin: +83,57%

OMX Helsinki 25: +13,44%

S&P 500: +18,89%

Gold: -8,92%

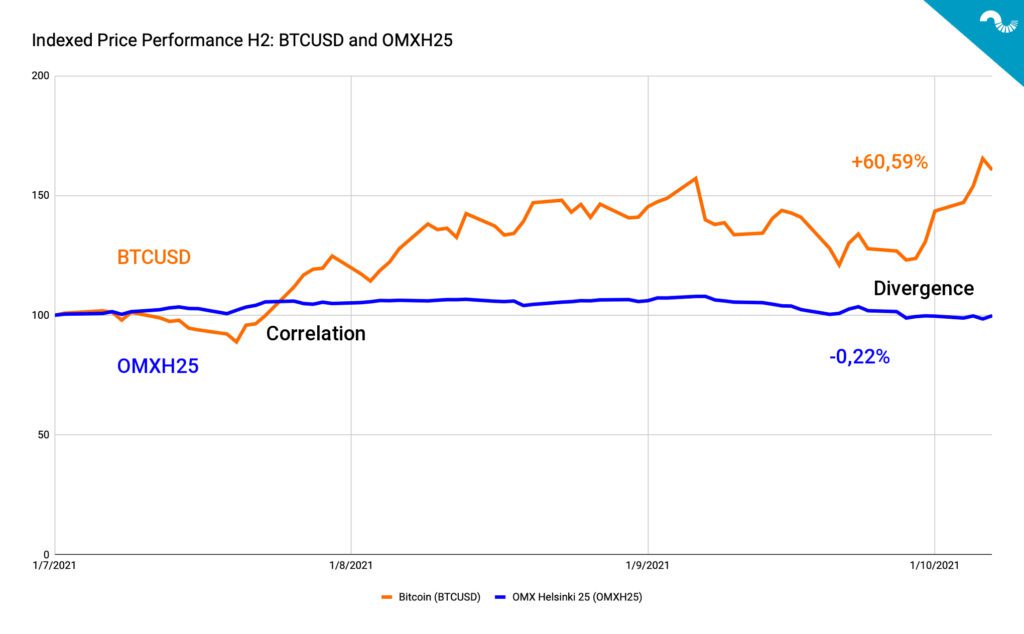

OMXH25

Bitcoin has outperformed OMX Helsinki Index 25 (OMXH25) since early Q3 by a wide margin. As BTCUSD has climbed 60,59 percent since early July, OMXH25 has dropped -0,22% in the same time frame. OMXH25 consists of 25 most traded Finnish companies, including technology, industrial products, and banking, among others. Compared with the American S&P 500 Index (SPX), the OMXH25 took a more severe hit in recent weeks, most likely due to OMXH25’s exposure to Asian markets. The stock markets dipped globally in late Q3, pulled down by China’s Evergrande crisis. Bitcoin’s excellent performance during the stock market drop again proves its value proposition as a hedge to traditional markets.

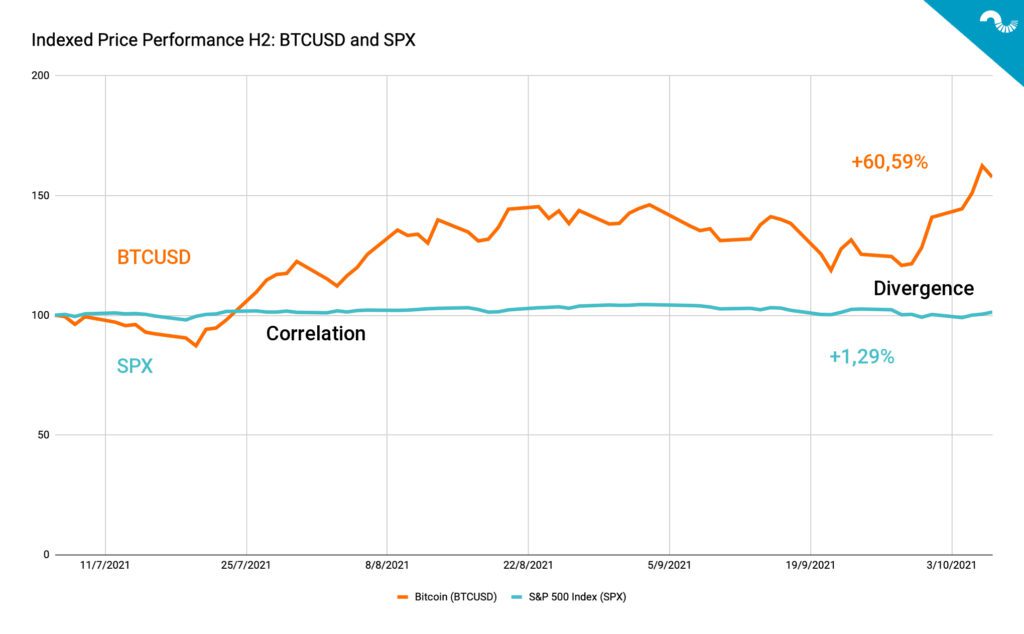

SPX

The S&P 500 Index fared better than its Helsinki-based benchmark during the Evergrande-induced market correction. U.S. stock market shows better resilience to Chinese housing market than OMXH25 likely due to its more diversified nature. While BTCUSD has climbed 60,59 percent from early July, SPX is only up 1,29% in the same time scale. Bitcoin’s price performance against S&P 500 again shows bitcoin’s hedge-attributes, that are superior to most assets.

Are Institutions Preferring Bitcoin over Gold?

JPMorgan released a note this week, forecasting a shifting institutional appetite in form of many companies preferring bitcoin over gold. As mentioned above, there’s a growing price divergence between bitcoin and gold, BTCUSD rising 83,57 percent YTD, and gold dropping -8,92% JPMorgan argued that the recent bitcoin’s price hike has been fueled by multiple drivers:

A. U.S. authorities recently assured that there’s no intention to follow China’s path towards banning digital assets.

B. The escalating rise of Lightning Network (LN) and other layer 2 solutions.

C. Increasing inflation concerns, combined with bitcoin’s resilience during Evergrande crisis.

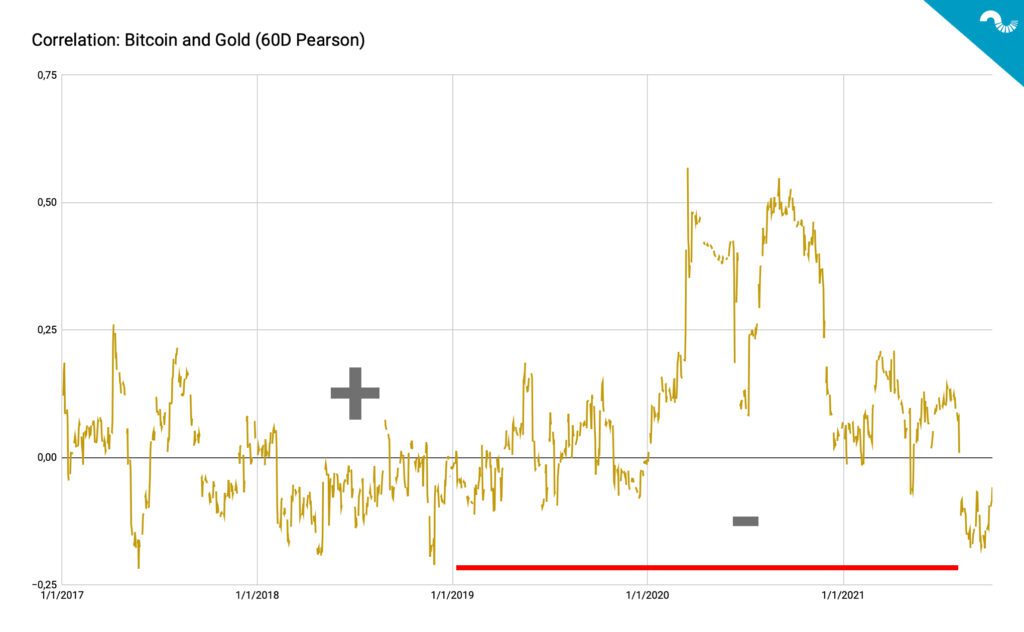

Lowest Bitcoin / Gold Correlation Since Late 2018

The correlation between bitcoin and gold (60d Pearson) has dropped to its lowest level since late 2018, inching towards -0,25 range. Bitcoin and gold are two asset classes with similar scarcity-derived features and the two have been often benchmarked against each other. In a growingly inflationary environment, bitcoin has been performing particularly well this year, rising over 80 percent year to date. As a stark contrast, gold’s year has been terrible, dropping close to -9% YTD. Gold needs to step up its performance as soon as possible, otherwise its investment narrative seems increasingly fragile.