The TA of week eight dives into current geopolitical situation and how bitcoin is playing a part of it. Additionally we explore bitcoin drawdowns, stablecoin reserves, and other metrics.

Geopolitics, Donations, and Sanctions

The markets have faced a tidal wave of macro and geopolitical risk recently by the escalating conflict in Ukraine. Thursday 24th of February represented a rude awakening for many as Ukraine was suddenly striked by a powerful invader. Now after three days of heavy fighting the attacker hasn’t reached many of its objectives and Ukraine seems to have a lot of mental power to resist. However the situation remains uncertain and could tip to any direction in future.

In the middle of the conflict Ukraine requested and received international help, despite some countries staying passive due to complex political backgrounds. Ukraine also built websites for IBAN donation, which allowed normal people and institutions to donate for associated causes. Then suddenly cryptocurrency donation addresses started to appear, one of the first initiatives belonging to George Kikvadze of Bitfury. George’s donation campaign has been hugely successful and has currently amassed 170,46 bitcoin units, equal to 6,57 million USD. His donation wallet has a total of 4017 transactions of various size.

Government Joins The Game

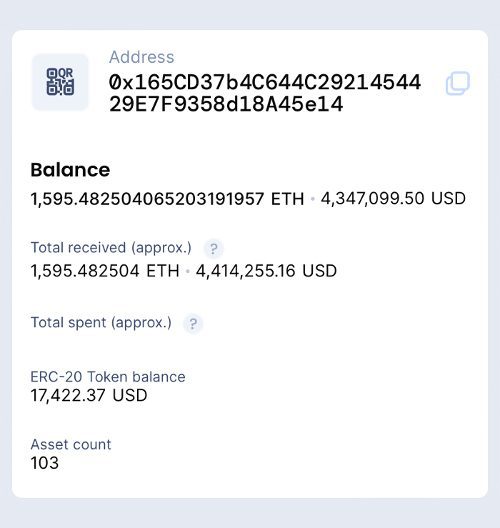

Possibly inspired by Kikvadze’s successful donation campaign the Ukrainian government itself joined the game, opening wallets for Bitcoin, Ethereum, and USDT transactions. The government’s wallet has currently received 31,74 bitcoins, which equals to 1,22 million USD. Apparently Patreon has blocked $250K worth of donations to Ukraine, however censorship-resistant Bitcoin transactions are going through and cannot be stopped.

The government’s Ethereum wallet received even bigger inflow of donations, rising to $4,32 million USD. This is an interesting addition to history books and likely the first time ever when a nation implements full-scale cryptocurrency donation system in a state of full-scale war. The use of Bitcoin, Ethereum, and USDT also signals government-level trust into the blockchain networks and this case is definitely good track record for these assets.

Incoming Sanctions

As a consequence to act of war by Russia the United States and EU are planning heavy sanctions for the country. The sanctions are implemented in two waves. First wave means removing a certain number of Russian banks from SWIFT, that essentially stops them from operating worldwide and effectively blocks Russian exports and imports. The second wave will paralyse the assets of Russia’s central bank by freezing its transactions. The freezing will make it impossible for the Central Bank to liquidate its assets.

US and EU are seemingly determined to cease all funding to Russia in order to defund the war. However these sanctions will also cause huge challenges to ordinary Russians as well as citizens and companies in other countries. Some analysts even expect a bank run to take place early next week as people try to cash-out their accounts in panic. Russia will likely place capital controls and restrict withdrawals in order to keep the system online. These challenges might further drive cryptocurrency adoption among all affected cohorts.

Despite the seemingly effective sanctions we should remember that Russia has exceptionally low debt to GDP ratio of approximately 18%, compared with 133% of US. In order to make the state independent of the west, Russia has only accumulated $3,9 billion of US treasuries. Additionally Russia owns 2298,53 tonnes of physical gold and an unknown amount of Bitcoin as a hedge to volatile times like these.

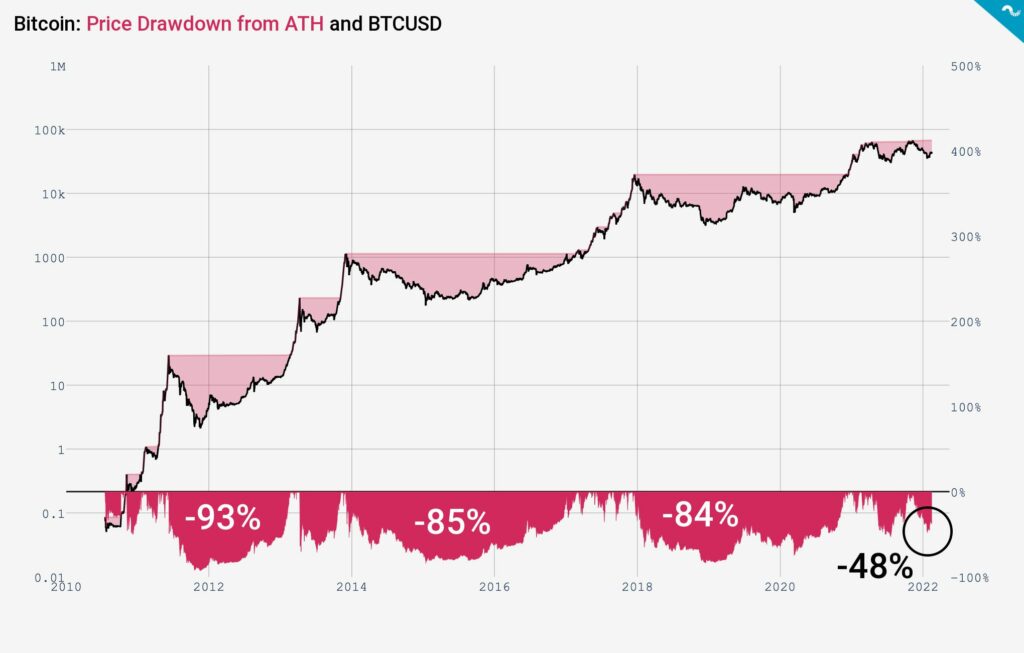

Has Bitcoin Reached Its Maximum Drawdown?

Bitcoin’s spot price broke its 90-day descending trendline in early February, which represented a turning momentum for the market. Since then bitcoin’s price performance has been bouncing sideways weighted down by macro environment. While the drop from $60K level to $30K level feels bad, it only represents a -48 percent drop.

The drawdowns of previous years have been in class of minus 80-90%, the worst so far occurred during 2012 as spot dropped -93%. As Bitcoin matures as an asset class the price cycles will likely become shorter. The contemporary stucture of cryptoasset market is completely different than it was during previous cycles. 2017-2018 cycle was pumped by speculative ICO with leverage and deleverage seasons. The pre-2017 cycles were characterized by relatively low volume.

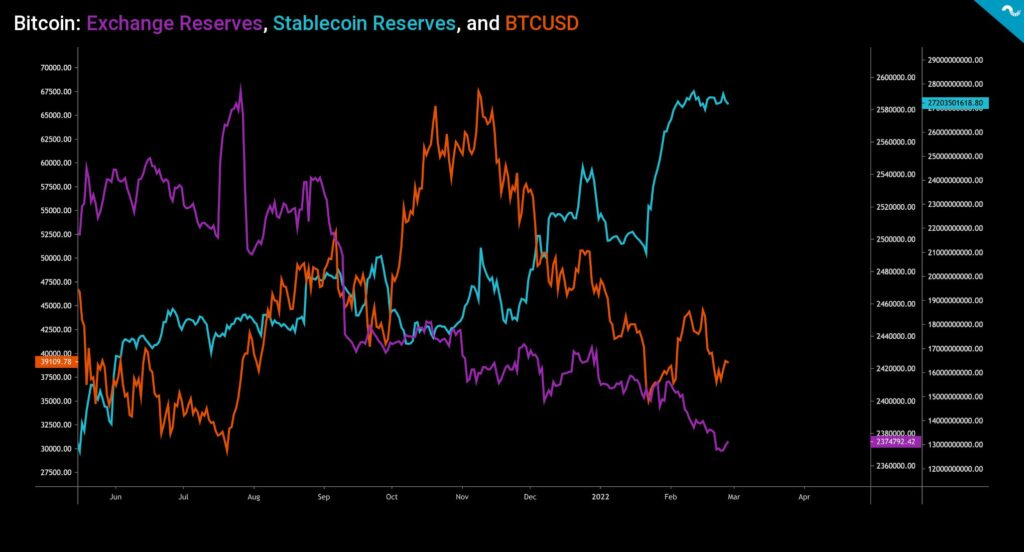

Exchange Stablecoin Reserves Rising to New Highs

The exchange stablecoin reserves have climbed to $27,2 billion despite the relative weakness of spot price. The stablecoin reserves represent a new all-time high and signal that there’s lot of money on the sidelines, waiting for an opportunity to buy bitcoin.

While the stablecoin reserves seem to be in inverse correlation with bitcoin, exchange bitcoin reserves are continuing their secular downtrend that originates from early 2020. When the increase of stablecoin reserves indicates latent buying pressure, the long downtrend of exchange bitcoin reserves mirrors the movement of units into long-term storage. Bitcoin is not the only cryptoasset with dropping exchange reserves though, Ethereum’s reserves have been in the same downtrend after EIP-1559 upgrade that shifts the focus towards digital scarcity.