Greetings, esteemed readers and crypto comrades. Hopefully you had a nice Midsummer full of feasts and festivities. At least here in the Northern Hemisphere we’ve enjoyed some sauna and sunlit nights with magical visions of Bitcoin surpassing a billion dollars sometime in the future.

Speaking of billions, did you know that the world probably has around 10 cryptocurrency billionaires? One could think the number is higher, but already a handful of people rising among the world’s richest is a big achievement. After all, they’ve done it with a technology whose main purpose is to change the whole financial system.

This week we will talk more about these crypto billionaires and how Bitcoin can move billions quickly, affordably and independently. We will also check out how a scandalous American book about the president relates to cryptocurrencies. In other news we have the world’s first chess game recorded on blockchain, UNICEF’s crypto fund and much else.

Last week’s news can be read here.

There are 5-10 crypto billionaires in the world

The world only has four known Bitcoin billionaires, estimate financial publication Forbes and crypto media Decrypt. All of the four known Bitcoin billionaires are leaders or founders of significant crypto companies.

According to Forbes the known crypto billionaires are Coinbase founder Brian Armstrong, Binance CEO Changpeng Zhao, Ripple developer Chris Larsen and leading Bitmain mining engineer Micree Zhan.

In addition to these four, there is at least one crypto billionaire who remains unknown – Satoshi Nakamoto. The crypto owned by Nakamoto is estimated to be worth over $10 billion dollars.

Aside public figures and Satoshi Nakamoto, the world might have at least a few other crypto billionaires. Three Bitcoin wallets with unknown owners contain over $800 million dollars worth of bitcoins. Since a single user can technically have an endless amount of wallets, it is hard to make an accurate estimate on the number of crypto billionaires.

Based on the available data, a likely conclusion is that there are more than 5 but less than 10 crypto billionaires in the world.

Bitcoin moved $2 billion in an hour

So called Bitcoin whales, meaning large owners, transferred 241 175 bitcoins in the span of a single hour last Friday. In fiat currency this would amount to over $2 billion dollars.

The transactions can be seen as historic events showcasing how effective Bitcoin is as a system. Over 2 billion dollars were moved in an hour without the need to involve a single bank or other financial institute in the process.

The bitcoins were sent in a total of seven transfers, of which each had an average of 30 000 bitcoins. The transaction fees were on average less than a dollar per transfer.

If the same money had been moved through banks, the processing costs alone could easily have risen to hundreds of thousands of dollars. No modern banking system could also have executed and verified the transfers as fast as Bitcoin.

Trump wanted the US Treasury to attack Bitcoin

A book by former US national security advisor John Bolton reportedly reveals that president Donald Trump had tried to use the Department of Treasury to attack Bitcoin. The alleged event dates back to May 2018.

According to the book Trump had told Secretary of the Treasury Steve Mnuchin to take measures against Bitcoin while also calling the cryptocurrency a fraud. The unexecuted order was reportedly related to trade negotiations with China.

President Trump has criticized Bolton’s book and asserted that it contains false accusations. However, he has earlier publicly opposed Bitcoin on his Twitter account, confirming at least that part of the revelations.

“I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air,” Trump wrote last year.

Federal Reserve claims Bitcoin is a fiat currency

According to economists at the Federal Reserve, the central banking system of the United States, Bitcoin is not a new form of money. The economists instead claim that Bitcoin is merely a new form of fiat currency, expressing their views on the Fed’s web page.

“Bitcoin, and more generally, cryptocurrencies, are often described as a new type of money. In this post, we argue that this is a misconception. Bitcoin may be money, but it is not a new type of money,” wrote Fed economists Michael Lee and Antoine Markin.

“Fiat money corresponds to intrinsically worthless objects that have value based on the belief that they will be accepted in exchange for valued goods and services,” they continued.

The economists seem to have taken an opposite stance to what is generally meant by fiat currencies. According to them money printed by national central banks have a judicial position, whereby they can not be directly called fiat currencies. Bitcoin in turn fits the definition perfectly.

While the economists are critical toward Bitcoin and seem to use a deviant definition of fiat, they still acknowledge the benefits of cryptocurrencies. According to them crypto can be used to maintain many different financial mechanism, such as gold-bound stablecoins, stock-like ICO tokens or traditional fiat currencies.

First blockchain-based chess game was played

The world’s first chess game recorded on blockchain has been played. The match between chess grandmaster Sergey Karjakin and Algorand founder Silvio Micali was broadcast live by the World Chess Federation and marked the first game for the new FIDE Online Arena.

While chess is considered a game for gentlemen, cheating is also a problem present in the sport. Games recorded on blockchain are meant to minimize this issue. The blockchain enables all moves to be recorded permanently, meaning they can be easily inspected and make cheating almost impossible.

Technologically speaking the game is regarded as one of the most historic chess matches since 1997, when chess master Garry Kasparov played against IBM’s Deep Blue supercomputer.

According to Karjakin, chess and blockchain fit together excellently and many chess masters are interested about the technology. Karjakin also told that he personally owns a small amount of cryptocurrencies.

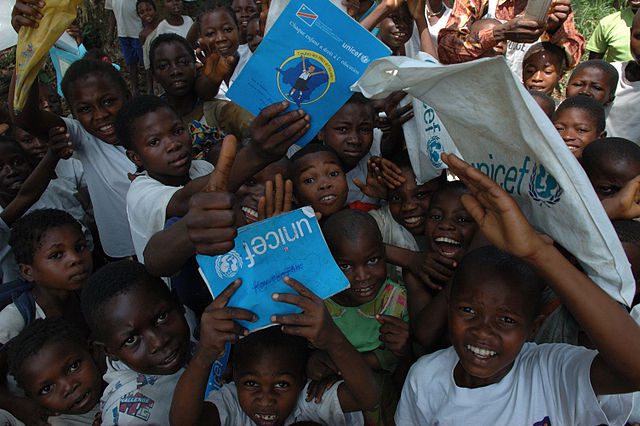

UNICEF’s crypto fund made historic investment

UNICEF’s cryptocurrency fund has made its largest investment ever. On the 20th of June UNICEF donated a total of 125 ether tokens worth approximately $30 000 dollars to eight different technology companies in seven developing countries.

The companies were supported by UNICEF with the intention to improve economic and social conditions in the countries. One of the supported companies, Afinidata, is offering different educational content and resources for parents of young children. Another company, Cireha, in turn is building communication systems for children with different speech defects or difficulties.

UNICEF has earlier supported the same companies with fiat currency donations amounting to $100 000 dollars. The cryptocurrency donations are meant to support scaling and improving the companies’ technology systems to a wider level.

“We are seeing the digital world come at us more quickly than we could have imagined – and UNICEF must be able to use all of the tools of this new world to help children today and tomorrow,” stated Chris Fabian from UNICEF.