It seems the coronavirus may become one of the worst epidemics of our time. The illness has already infected thousands of people around the world and created economic uncertainty. China is a global leader, and whenever something notable happens there it inevitably also affects the whole world’s finances.

And Bitcoin is no exception. Bitcoin is indeed very resistant to political manipulation and attacks, but in the end it is only a tool. And tools are used by people who are not as immune as Bitcoin.

This week we will take a look at how the coronavirus has affected the cryptocurrency environment in China and Asia. Among other news we have a report about how marginal crypto crime is, as well as Bitcoin’s scalability success and lower transaction fees.

Last week’s news can be found here.

The coronavirus affects Bitcoin’s computing power

The coronavirus has caused storms in China and on the global markets. Now the epidemic has also started affecting Bitcoin. Chinese Bitcoin miners have been forced to halt or delay acquiring new mining equipment after quarantine measures limiting the country’s import.

This in turn has directly affected Bitcoin mining. The growth of the mining difficulty level has slowed down significantly as miners have been unable to upgrade their equipment.

Bitcoin’s difficulty level adjusts itself automatically according to the network’s computing power. The purpose is that it would take an average of 10 minutes to mine each new block regardless of the amount of computing power. When there is more computing power the mining difficulty level grows.

The difficulty level most recently changed on 11th February, when it only grew 0.52%. This marks a notable decrease from previous numbers. On 28th January the difficulty level grew 4.67%. Two weeks earlier on 14th January it was 7.08%.

However, the slowdown of computing power is unlikely to cause any problems for the Bitcoin network. In fact, it can even be useful for miners since it gives them at least a small break from the heated arms race of mining equipment.

Crypto events cancelled due to the coronavirus

The coronavirus threat has also caused harm outside the borders of China. Now a group of cryptocurrency-related events and conferences around Asia have been cancelled. Some crypto companies have even closed down their services due to the epidemic and political chaos.

Among the cancelled events are TOKEN2049, an annual crypto event in HONGKONG originally planned for March. Binance Blockchain Week Vietnam and Hong Kong Blockchain Week 2020 have also been frozen until further notice. Both events were set to take place in the spring, but are now postponed without exact dates.

At least one prominent blockchain company has also had to close its doors. The Hong Kong-based Bitspark announced halting its operations this week, citing the coronavirus and Hong Kong’s political situation as reasons.

Only a fraction of crypto transactions related to crime

Blockchain analysis company Chainalysis has published a report about cryptocurrency-related crime. According to the report the criminal use of cryptocurrencies doubled last year.

However, a more noteworthy statistic is that the criminal use of cryptocurrencies remains extremely marginal. In 2018 approximately 0.04% of all crypto transactions were related to crime. In 2019 the same number had increased to 0.08%.

While the media often connects crypto with crime, in reality most cryptocurrencies are extremely poorly suited for illegal use. The blockchain stores transaction data forever and unchanged, whereby cryptocurrency use can be electronically traced.

Fiat currencies such as the dollar and euro remain by far the most common choice among criminals. It also seems there will be no change to this in the near future.

Prasos Ltd listed on Privanet’s main list

Prasos Ltd, the company running Coinmotion and Denarium among others, has been moved to the main list of Privanet. Privanet is a Finnish investment platform brokering shares of unlisted companies.

”Prasos Ltd is one of the industry’s leading growth companies and our shares have interested many investors, whereby we now have over 1 500 owners. As an unlisted company low liquidity has been a challenge for both buyers and sellers. By moving to Privanet’s main list we aim to increase the company’s visibility, so share trading will have more volume and liquidity,” comments Henry Brade, chairman of the board of Prasos.

Shares of Prasos Ltd have earlier been listed on Privanet’s growth list, but now it has been elevated to the main list. In addition to greater visibility, companies on the main list update information and communicate with investors better than others.

Bitcoin can reach new records this year

Bitcoin’s enormous price rise has been discussed by cryptocurrency-focused media throughout the year. Now also traditional media have become interested. The Finnish financial publication Kauppalehti has written an article about bitcoin and possible reasons behind the rise.

The clearest reason seems to be bitcoin’s upcoming halving. Bitcoin’s block reward will drop to half next May, whereby the birth pace of new bitcoins decreases. The laws of supply and demand dictate that a sinking supply will lift the price if the demand grows or stays the same.

Earlier halving events have caused bitcoin’s price to rise significantly and it is possible this trend will repeat historical patterns. According to Fundstrat analytic Thomas Lee bitcoin’s price may even exceed $27 000 dollars.

”I expect Bitcoin to return to previous records and beyond this year,” Lee commented.

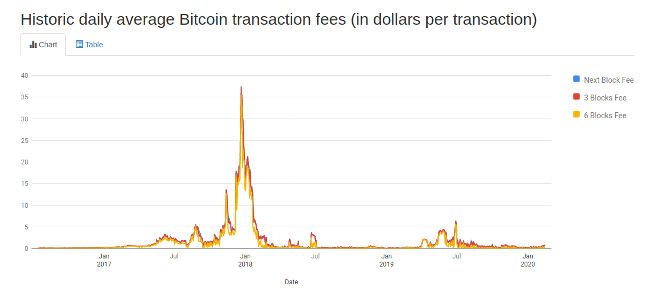

Bitcoin’s transaction fees have plummeted

Bitcoin’s average transaction fees are now considerably lower than a few years ago. In December 2017 the transaction fees reached a historical high, when a single transaction could cost up to $20 dollars.

Currently the average transaction fee is around $0.5 dollars. This is remarkable since the amount of transactions is now around the same as in December 2017, but the costs have fallen to a fraction of what they were.

The heavy drop of transaction fees indicates Bitcoin’s technology has succeeded in scaling itself much better than before. One reason behind this is the SegWit update, which has already been adopted into most Bitcoin user interfaces. SegWit allows storing information more effectively in blocks, whereby the Bitcoin network can handle an increasing amount of transactions.

Bitcoin’s transaction fees have plunged in the past years despite growing use.