Bitcoin’s block reward halves approximately between four years. Thereby the amount of new bitcoins created decreases to half of what it currently is. The next halving will take place in May in a few months. What is bitcoin halving and how can it affect bitcoin investors?

What is bitcoin halving and mining?

First, it’s good to rehearse how new bitcoins are created through a process called mining. Mining as a term can be somewhat misleading, since it actually refers to maintaining the Bitcoin network. Mining is in essence a mathematical guessing game where computers around the world use their computing power to solve a problem as fast as possible. The winner gains the right to mine a block in Bitcoin’s blockchain as well as a block reward.

When Bitcoin was born, the block reward was 50 bitcoins, whereafter it has halved on two occasions during the years 2012 and 2016. Right now 12.5 bitcoins are born with intervals of roughly 10 minutes. After the 2020 halving, the pace droped to 6.25 bitcoins in the equivalent time. After that miners will only receive half of the current reward counted in bitcoins.

When is the next Bitcoin halving?

Th next time the halving of Bitcoin takes place is in 2024. In the 2024 halving, the reward will drop from 6.25 to 3.125 BTC per block.

What does Bitcoin halving mean for the network?

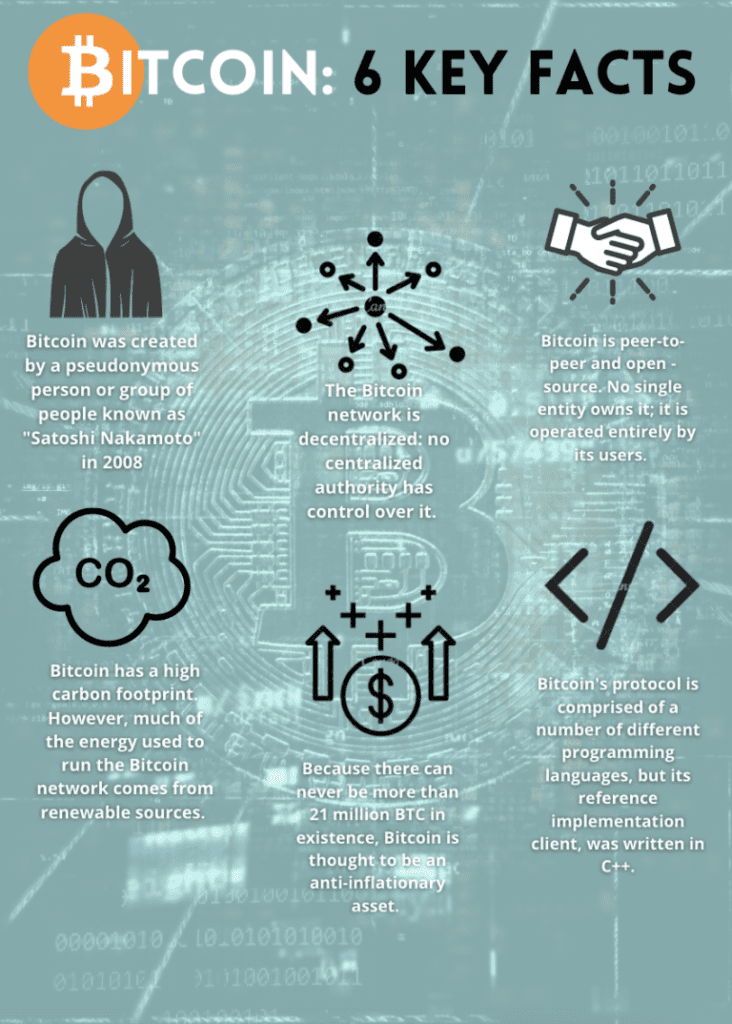

Miners also bind new Bitcoin transactions to the blockchain and receive a small portion of their income as transaction fees aside the block reward. At the same time miners use their computing power to ensure the blockchain remains safe from tampering. The more computing power the network has the more secure and effective it is. Bitcoin is currently the world’s overwhelmingly biggest project on decentralized computing, and therefore also the most secure and effective.

What is the purpose of Bitcoin halving?

The halving is a feature programmed into Bitcoin’s protocol with the intention of keeping the amount of bitcoins stabile and avoid inflation. Inflation is a kind of hidden tax where new created money decreases the value of existing money. Inflation arises since centralized parties such as central banks are responsible for currency reserves and can constantly print new money on questionable grounds. Central banks never run out of money since they can always create new money out of nothing. Money, however, is not the same thing as value.

Bitcoin’s pseudonymous creator Satoshi Nakamoto saw inflation as a harmful phenomenon. In order for a currency to remain immune to political abuse it is necessary that no one is able to create endless amounts of it. That is why only a limited amount of bitcoins are born and that pace will slow down until it reaches zero and new bitcoins are no longer born. This is estimated to happen around the year 2140, so it will still take a while.

The halving keeps the bitcoin supply limited

The halving happens roughly between four years. Technically it happens between 210 000 blocks, and since the birth pace of blocks varies it is impossible to know the exact time for the next halving beforehand. The first halving took place in November 2012, when the amount of new bitcoins dropped from 50 to 25 bitcoins. The second halving took place in 2016, when the amount decreased to 12.5 bitcoins. The upcoming halving is estimated to occur around the middle of May and will further lower the amount to 6.25 bitcoins.

This certainty and stability in bitcoin’s supply is one of the most significant reasons why bitcoin has become so popular among investors and economists. Bitcoin’s supply is even scarcer than that of gold, whereby it works as an excellent tool to store value. Bitcoin is very resistant to inflation, just like Satoshi Nakamoto thought.

Bitcoin’s stock to flow compared to gold

Bitcoin has since its dawn been called digital gold. Some even see this as an understatement, since bitcoin has superior qualities compared to gold. For instance, Bitcoin is notably easier to transfer and store safely than physical gold. The value of existing gold can also decrease if new extensive gold reserves are found under the ground or in space. The amount of bitcoins in turn is strictly limited to 21 million. So no underground stashes or asteroids from space can bring more bitcoins to the world.

Stock to flow in turn refers to the relation between existing funds and new funds flowing on the markets. Gold is mined annually very little compared to already existing gold, which helps gold maintain its value. Bitcoin’s stock to flow rate has constantly been declining due to the decreasing birth pace each four years. After the next halving bitcoin’s inflation will fall to 1.8 percent and its stock to flow is already very close to gold. According to estimates it will reach gold during the four year period beginning in May.

Bitcoin and blockchain pioneer Nick Szabo has presented a statistic according to which bitcoin’s risk adjusted returns after 2013 have constantly outperformed gold, stocks, real estate and other general investment instruments. If an increasing amount of investors start seeing more potential in bitcoin than gold, it can have far-reaching effects on the markets.

How can BTC halving affect markets?

There has been much speculation over how the halving can affect bitcoin markets. It would seem natural that a heavily rising demand and declining supply would lead to a strong rise in bitcoin’s price. This also happened on both earlier occasions when the block reward halved.

There are also risks related to the block reward halving. If the block reward halves and bitcoin’s price does not rise, mining can become unprofitable and lead to a lesser number of miners. On the other hand, the Bitcoin network nowadays has so much computing power that it would remain safe even in the case of a larger loss of miners. Miners have also continued their activity even in unprofitable situations with belief in upcoming price rises. And so far they have always been rewarded.

After the first halving bitcoin’s price shot up like a rocket. Around the halving in November 2012 bitcoin’s price was roughly $12.25 dollars. Toward the end of the year 2013 the price had already risen above $1000 dollars, marking a growth of over 9000 percent.

How has halving affected bitcoin price before?

A similar chain of events resulted after the halving in July 2016, when bitcoin also grew several thousand percent. Bitcoin’s price multiplied during the year 2017 and reached a peak of almost $20 000 dollars in December 2017 before a market correction.

For the past couple of years we have seen a bear market or recession period on the crypto markets reminding of the years 2014 and 2015. Therefore experts also believe the years 2020 and 2021 will remind of the years 2016 and 2017. The beginning has at least been promising, since bitcoin has risen over twenty percent within a single month.

It is still hard to compare earlier years with the current situation. Bitcoin’s use has grown radically and its price has gone through a wild roller coaster of rises and crashes. Bitcoin is on the lips of mainstream and institutional investors and its blockchain is eyed by the financial world. It is impossible to say what will happen, but there’s a lot of potential in the air. In case history repeats itself the coming years can bring enormous growth for bitcoin – both for its technology and price development.