The year 2019 wasn’t huge for bitcoin compared to many previous years, but it still managed to grow over 80%. This would be considered an extremely good result compared with any other asset class. Once again bitcoin was a very profitable asset choice as a part of an investment portfolio.

We have published a quarterly report about the development of cryptocurrency markets in co-operation with Timo Oinonen from DC Research. In this article we share some insights from the report, but we recommend you to download the full report from the following link: Download the full cryptocurrency market report.

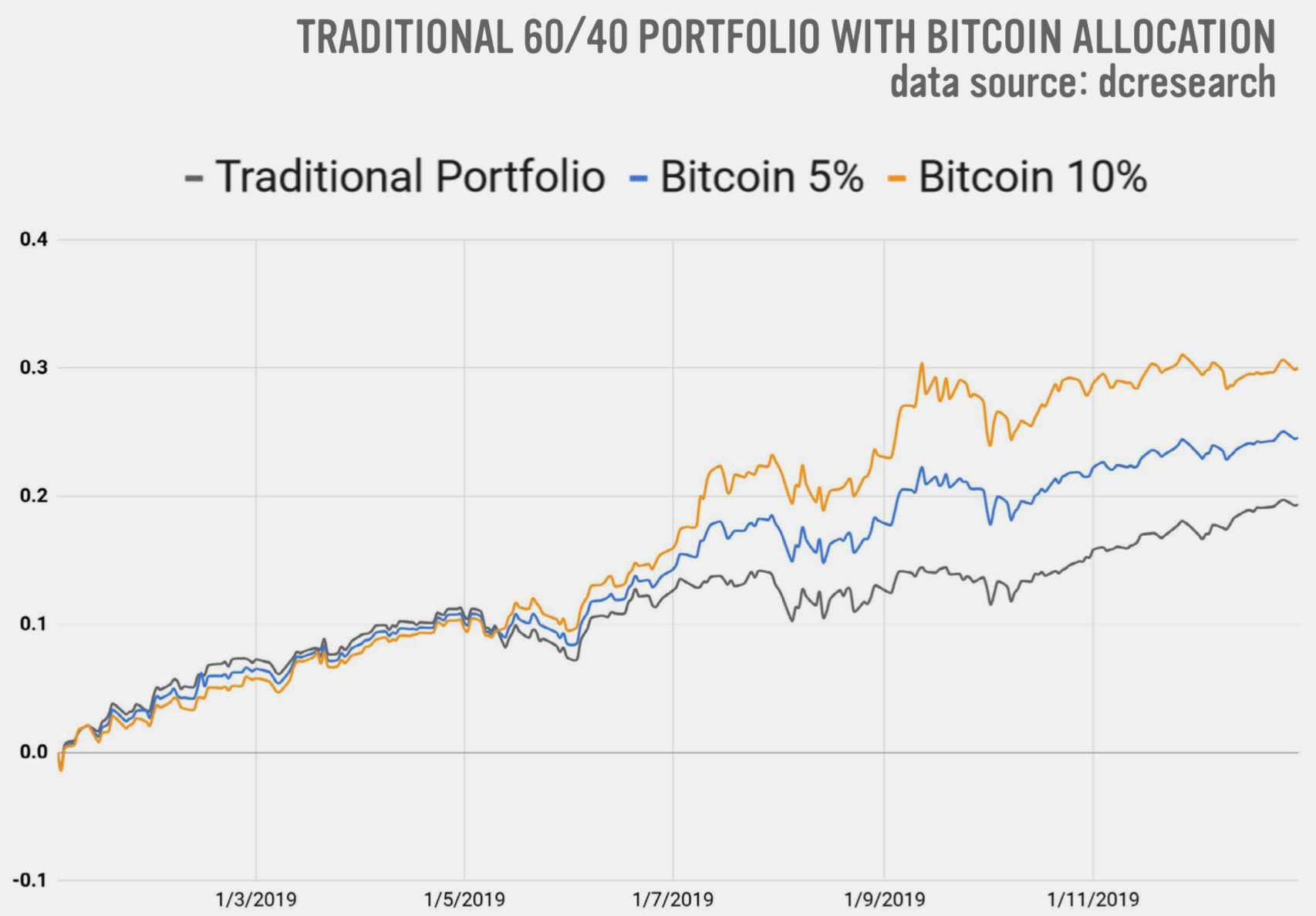

Diversifying traditional 60/40 portfolio with bitcoin brings results

Even a modest 5 percent allocation to bitcoin has historically enhanced the performance of a traditional 60/40 portfolio (60% stocks, 40% bonds). Total return percent for a traditional 60/40 portfolio for 2019 was 19,71%, uplifted by bullish S&P 500 index. The same portfolio with added 5% bitcoin recorded 24,61% total return.

Bitcoin’s allocation effect on portfolio performance obviously grows with the percentage of bitcoin added. With 10% bitcoin allocation, the 60/40 portfolio would showcase 29,88% total return. And respectively with 30% bitcoin allocation the same portfolio would offer 48,57% total return.

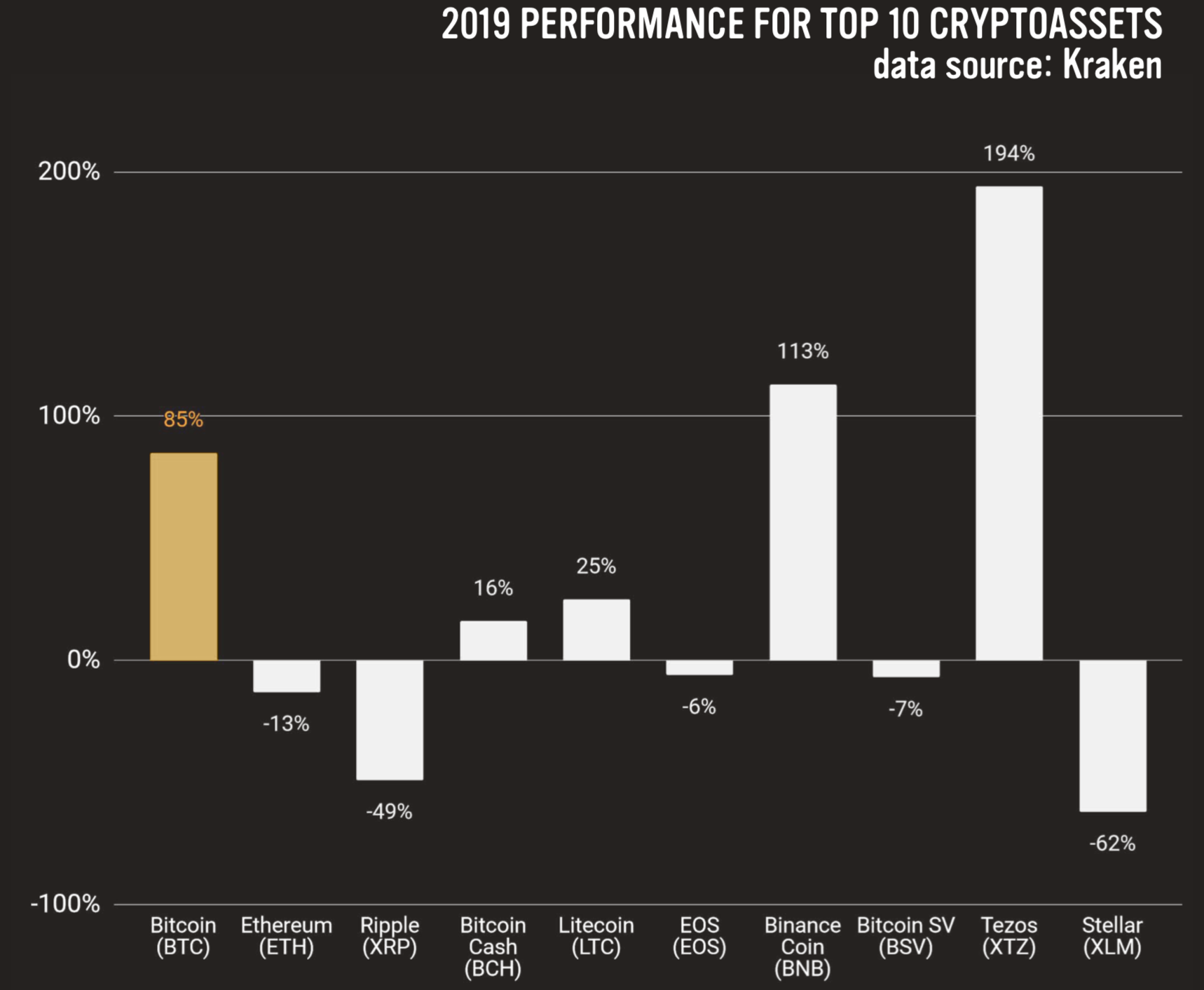

Bitcoin outperformed ethereum, litecoin and xrp in 2019

After the modest bearish sentiment of 2018, bitcoin pampered its investor segment in 2019 with 85% performance year-on-year (YOY). The year was much more successful for bitcoin than for the other top cryptocurrencies by market cap. Ethereum declined 13%, Ripple (XRP) lost nearly half (49%) of its price, but Litecoin managed to grow 13 percent during the year. Bitcoin’s dominance stayed in proximity to 70 percent through the fourth quarter.

The bitcoin dominance index has been a bit controversial, as it’s not addressing volume correctly. A new approach, by Arcane Research, weighs real volume and excludes stablecoins (which are often pegged to USD). It offers a more clarified view on bitcoin’s dominance. By the said model, bitcoin’s authentic dominance is estimated to be over 90 percent.

Upcoming halving lifts expectations

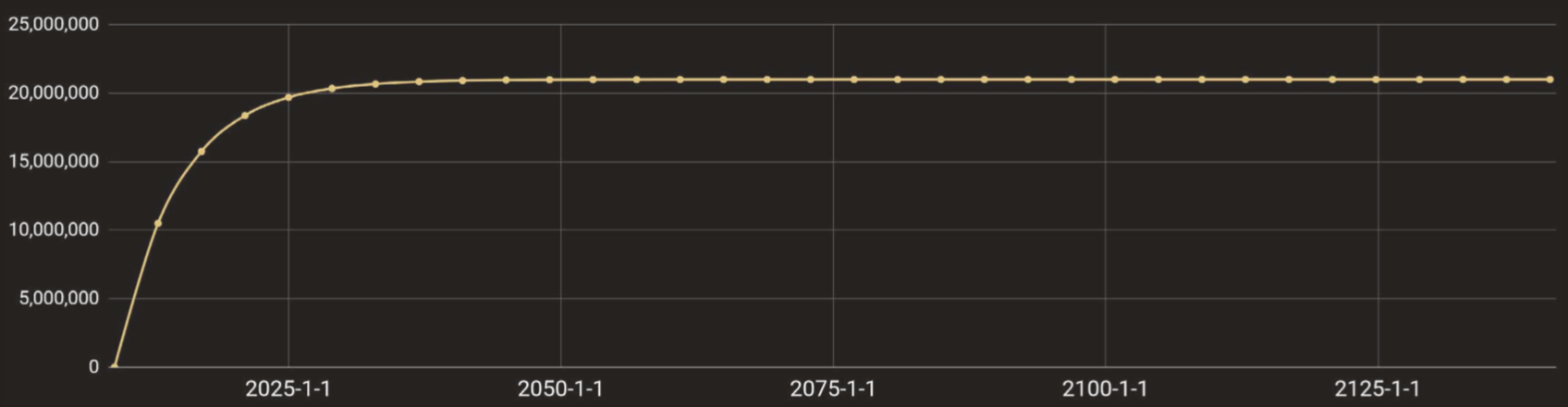

Bitcoin is closing in on its 21 million coin supply and its third halving event. Bitcoin’s price has historically been following an upward pattern after halving events. After previous halving events bitcoin price has rocketed during the following year.

After 2012 halving bitcoin surged +9180% by the peak of 2013. After 2016 halving the growth by 2017 peak was +2875%. The bitcoin supply is no longer growing much annually, even though the end of bitcoin creation is still far in the future (approximately 2140).

You can read more about the latest trends in cryptocurrency market and indicators for the future from the full report. You can download it from the link below.