The DeFi and NFT boom of 2021 has raised the demand for a scalable smart contract platform. So far, Ethereum has been the main platform that powers other tokens and projects — but will its main competitors, Cardano and Solana, kill ETH? This blog article benchmarks Cardano (ADA) and Solana (SOL) against the legacy DeFi platform Ethereum (ETH).

Market Composition: Solana vs Cardano

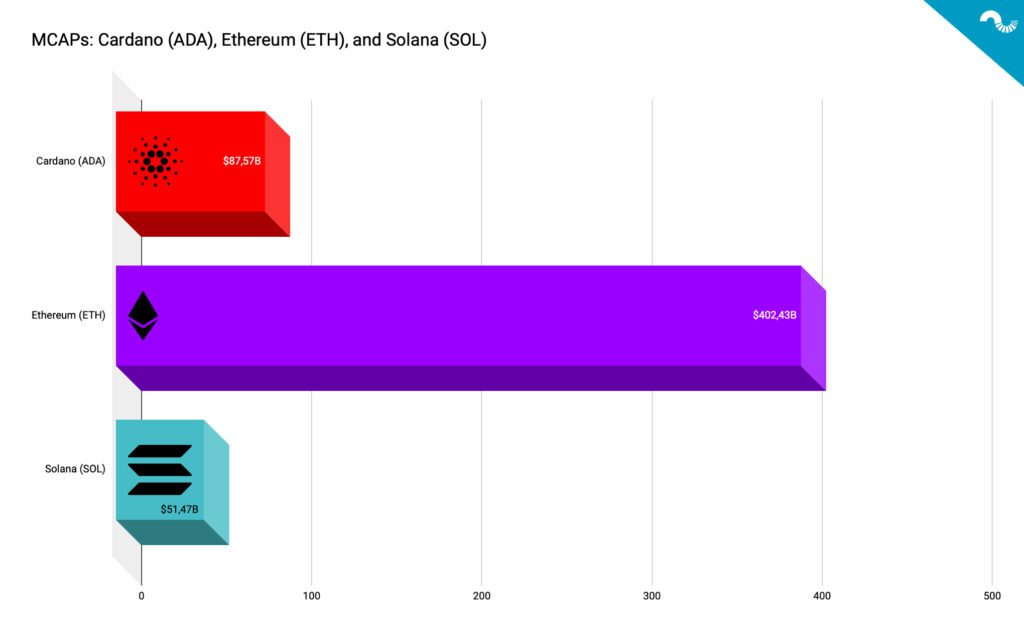

Ethereum (ETH) has been perceived as the de facto decentralized finance (DeFi) platform. Ethereum’s history dates back to the year 2015 when it was launched by Vitalik Buterin and Gavin Wood. The original value proposition of Ethereum was to be “one computer for the entire planet” and Ethereum has been evolving its narrative slightly since then. In the 2017 bull cycle, the Ethereum ecosystem was the main decentralized platform for a new kind of funding rounds, initial coin offerings (ICOs). Ethereum has been extensively utilized as a platform for decentralized applications (dapps) and more recently for non-fungible token art (NFTs). Ethereum is the leading DeFi ecosystem with >$402 billion market capitalization.

Are there really any potential Ethereum killers?

Vitalik and Gavin additionally developed Solidity, an object-oriented programming language that has become the default foundation of smart contracts. In addition to Ethereum, Solidity is also used on platforms like Tron (TRX) and Binance Smart Chain. Since Ethereum, Gavin Wood has founded projects like Polkadot (DOT) and Kusama (KSM). Polkadot is a multi-chain architecture that allows external networks and layer one (L1) parachains to communicate together. Gavin Wood also leads Parity Technologies.

The next Ethereum-like public blockchain platform Cardano (ADA) was launched in 2017 by Charles Hoskinson, whose background is also linked with Ethereum. Charles left Ethereum as he wanted to develop the platform using venture capital funding, while Vitalik wanted to keep ETH purely as a non-profit, decentralized organization. Cardano is the second largest of the three projects by market capitalization with $87 billion MCAP, around ¼ of Ethereum’s market cap.

Solana (SOL) is the other plausible “Ethereum killer” with a market cap of $51,47 billion, the smallest MCAP of the three. Solana was launched in 2019 by Anatoly Yakovenko. Solana is capable of 50 000 transactions per second, however, this speed is achieved by reducing decentralization. SOL has definitely been one of the most hyped tokens of 2021.

Price Performance of Solana, Cardano, and Ethereum

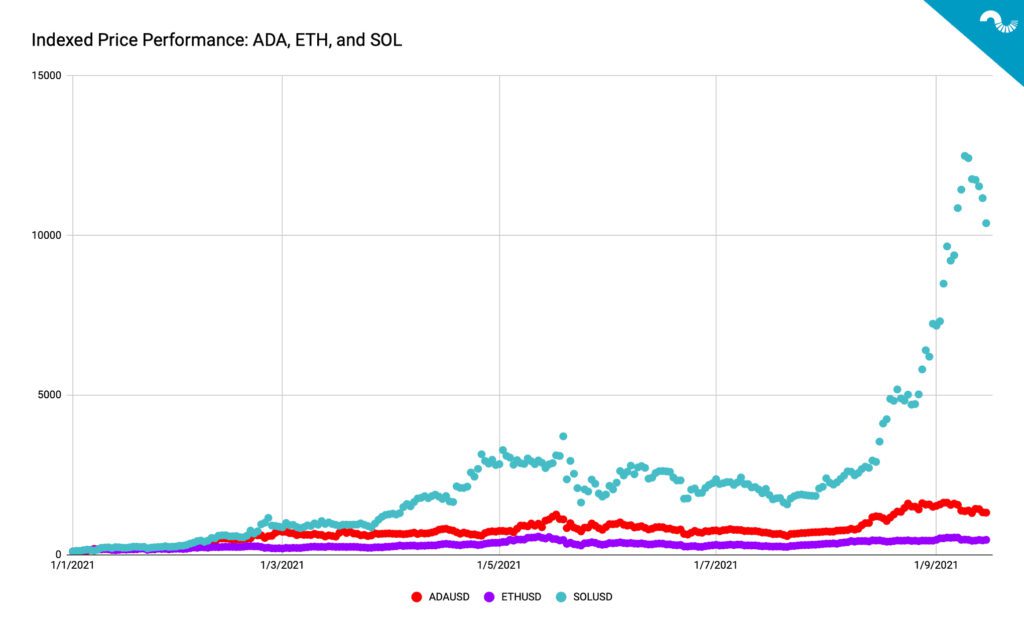

YTD Price Performance:

- ADA: 1255%

- ETH: 378%

- SOL: 10 687%

Let’s look at price performance from the beginning of 2021. Ethereum has climbed 378 percent, showing promising performance per se. As a benchmark, Bitcoin has “only” climbed 72% year-to-date (YTD). While Ethereum and Bitcoin have shown good performance this year, Cardano and particularly Solana have climbed four to five figures: ADA 1255% and SOL 10 687%. Solana has been hugely supported by venture capital injections and institutions like Alameda Research and FTX, propelling it to a high trajectory.

How does Ethereum (ETH) work

Protocol: Proof of Work (PoW) -> Proof of Stake (PoS)

Upsides: Tested and robust network, developer community

Downsides: Relatively expensive transactions, scaling

As mentioned before, Ethereum is the more traditional player in the scene, having operated since 2015. Ethereum can be described as the pioneering blockchain platform, evolving its way into future use cases. Compared with the newer challengers, Ethereum is relatively slow, processing only 15 transactions per second. However, speed usually comes with a cost of centralization and Ethereum allows users to operate their own full node. Ethereum currently has 2955 active nodes.

Ethereum has been criticized for exceedingly expensive transactions, ranging from a couple of dollars (USD) to 70$ this year. The high transaction costs have greatly limited Ethereum’s usability from time to time. Ethereum’s transaction fees are measured in “gas” called gwei.

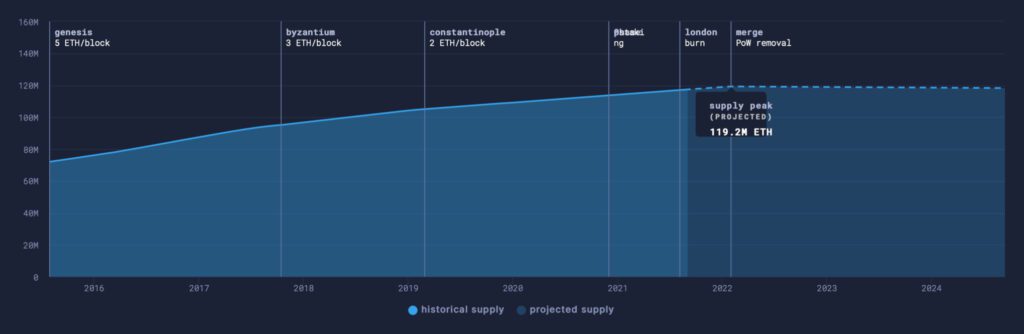

After years of cautious upgrade policies, Ethereum is currently going through a massive protocol-level shift from 2021 to 2022. The recent EIP-1559 hard fork focused on making the network more scarce and lowering transaction costs. The Ethereum network is being rendered more scarce by practically burning ETH units (Ether), significantly reducing the supply. The supply is expected to peak during early (Q1) 2022 at 119,2 million Ether units. This new hard fork has fuelled a meme called ultrasound money, correctly mirroring Ethereum’s deflationary path.

In addition to Ethereum’s radically increasing scarcity, the network is also making a great leap from the Proof of Work (PoW) protocol into the Proof of Stake (PoS). The shift is a huge paradigm shift as the power dynamics are no longer determined by computational power, but by the amount of staked Ether units. PoS allegedly consumes less energy than PoW, making it more alluring for ESG-minded investors.

How does Cardano (ADA) work

Protocol: Proof of Stake (PoS)

Upsides: More scalable than Ethereum, sidechains

Downsides: Slow(ish) development pace, complexity

Cardano is a decentralized blockchain and open-source ecosystem, aiming to develop a more advanced smart contract platform. Cardano allegedly evolves around scientific philosophy and a research-driven approach. Cardano has been one of the favorite projects of retail investors, rising 1255 percent this year. In 2020 ADA ascended 409 percent.

Although Cardano clearly contains a notable future potential, its expansion speed has been slow compared with Solana, and its developer base lags behind the two competing projects. Cardano’s transaction fees are low compared to Ethereum and it can handle almost 20 times more transactions per second than ETH. If Cardano can solve its slow(ish) progress pace and scale its developer community, it might evolve into a true ”Ethereum killer”.

Cardano (ADA) can be purchased by contacting Coinmotion’s Coinmotion Wealth team.

How does Solana (SOL) work

Protocol: Proof of Stake (PoS), Proof of History (PoH)

Upsides: Fast transactions, new technology (PoH)

Downsides: More centralized, single point(s) of failure

Solana (SOL) is arguably the most retail-hyped token of the year 2021, rising an incredible 10 687 percent year-to-date. Solana has been strongly supported by venture capital investors, in addition to popular exchanges like FTX. While Solana’s price increase has been a true lottery ticket for many, it also raises doubt on the possible upside potential. A token rising almost 11 000% can be considered as “peaked” for the year, although markets are not rational. As John Maynard Keynes famously said: “Markets can remain irrational longer than you can remain solvent”.

Solana network can handle 65 000 transactions per second, lifting it to another level compared with Ethereum’s 15. However, this transaction speed is achieved via centralization, compared against Ethereum’s more decentralized structure. The centralized nature of Solana was revealed again this week by an apparent DDoS attack that halted the network for 18 hours. Solana network was flooded by 400 000 transactions per second, practically crashing it. The network was later restarted successfully.

Solana (SOL) can be purchased by contacting Coinmotion’s Coinmotion Wealth team.