Information and first details about China’s cryptocurrency wallet have leaked on the Internet. Many had certainly anticipated this, even though China has earlier had an inconsistent relation to blockchain money. Meanwhile Bitcoin-related searches and discussions have grown enormously in China.

This week we will take a closer look at China’s national crypto, which is being adopted by at least McDonald’s, Subway and Starbucks. Among other news we examine the charity of the crypto community and how Bitcoin works as a shield against inflation. After the upcoming block reward halving Bitcoin will become an ever rarer asset than gold.

Last week’s news can be read here.

Information about China’s cryptocurrency leaked

Rumors about China developing some kind of cryptocurrency have been circulating for years, but so far the central bank and authorities have denied the project exists.

However, now these rumors have been confirmed through a leak on the Internet. Among other things the leak revealed details about how the digital currency’s application and wallet works, as well as how the currency itself would work in use of the wider public.

According to the leak China’s cryptocurrency seems to work similarly to for example Alibaba’s popular payment app Alipay. The app includes a “touch and touch” function, whereby two users can execute a transaction just by simultaneously touching their smartphones.

According to sources behind the leak China’s banks are already doing tests regarding the cryptocurrency. The first private companies expected to take it into use include McDonald’s, Starbucks and Subway.

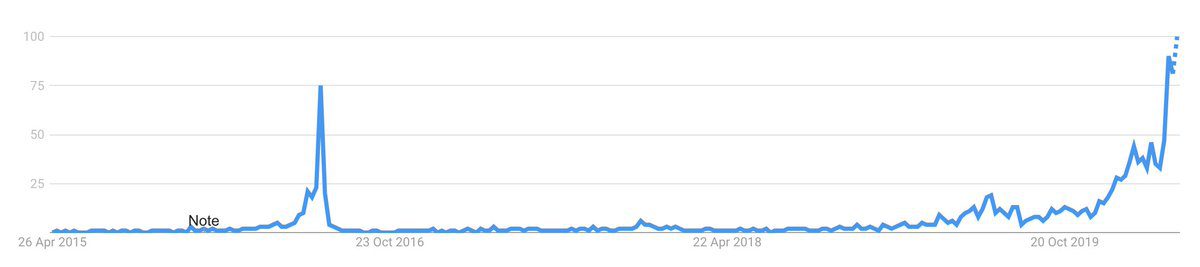

Bitcoin halving searches continue to rise

Google searches about the halving of Bitcoin’s block reward have grown already several weeks in a row. Now as the halving is only weeks away related searches have even grown exponentionally.

In the past weeks halving searches have roughly doubled compared to the average. In comparison to last year’s November searches have as much as quadrupled.

The interest for the halving is only visible elsewhere on the Internet. Weibo, China’s equivalent to Twitter, has seen the block reward halving rising among the six most searched terms. Weibo alone has hundreds of millions of users.

Google searches and general Internet interest have earlier been good indicators on what course cryptocurrency prices will take. If the interest is also realized as acquiring bitcoin, we can expect to see notable price rise after the upcoming block reward halving.

Bitcoin’s inflation drops to half of world average

Bitcoin’s yearly inflation is going to sink below the global average, estimates crypto analyst Mati Greenspan. According to Greenspan’s calculations Bitcoin’s current annual inflation rate is 3.65%, but after the halving it will drop to 1.8 percent.

In 2019 the average annual inflation was approximately 3.41%. This year the inflation has been roughly 3.65%. After the block reward halving Bitcoin’s inflation is set to become almost half lower than the global average. For comparison the inflation of gold is roughly 2.5%. After the halving bitcoin will become an even scarcer commodity than gold.

Low inflation and the limited maximum supply of bitcoins is seen as one of the system’s benefits. No state or other party can print new bitcoins, as the maximum supply will always be limited to 21 million units.

Crypto donations combat the corona crisis

The corona pandemic has heavily highlighted the solidarity and goodwill of the crypto community. Aside individual donations by bitcoin users, several big companies in the sector have made significant donations to combat the epidemic.

For example Binance, one of the world’s biggest crypto exchanges, has pledged to donate $1.5 million dollars to China. The money is intended for buying medical equipment, which there is a lack of in the corona-ridden country. Binance has already donated 20 000 tests, 366 000 pairs of protective globes, 5 280 hand sanitizers and many other utilities.

Stellar Development Foundation responsible for developing the Stellar Lumens cryptocurrency in turn has told they will donate as much stellar to different parties as they give. Among other plans the SDF intends to give the same amount of money in stellar for every dollar donated to Unicef in France.

BitMEX in turn has reported they will donate $2.5 million dollars for the work against corona. These funds will be directed to four major associations fighting in the frontline against the pandemic.

There are numerous individual examples of similar activity. Overall the crypto community’s charity during the corona pandemic can be measured in tens of millions.

Bitcoin-backed crypto published in Venezuela

Valiu, a Colombian payment startup company, has published a new cryptocurrency in Venezuela with the intention of combating the hyperinflation plaguing the country. Valiu’s cryptocurrency, or crypto dollar, is bound to bitcoin which has proven itself more stable than many other currencies during the corona crisis.

Valiu’s crypto dollar can be sent like normal cryptocurrencies to for instance wallets in smartphones and other users beyond borders. Transferring the currency is free of charge for Venezuelan users, and users do not need to have any deeper knowledge of Bitcoin’s technology.

Valiu’s project is still in its alpha phase, but practically soon ready for wider use. Valiu has started collaborating with Latin American food delivery app Rapp, which already has a notable user base. The crypto dollar is set to be finally published later this year.