The TA of week 31 focuses on cautiously optimistic markets and the indexed price performance of cryptoassets. The markets are heavily anticipating Ethereum’s merge, but could it lead to a civil war?

Cautious Optimism

Markets have mirrored cautious optimism this week, as investors are trying to price in the quickly approaching Ethereum merge. While the leading cryptocurrency Bitcoin has remained almost flat at 0,4 percent, Ethereum is up 5,5% from the last week. Ethereum’s competitors are also on the move and Avalanche (AVAX), as a reference, is up 16,8% in the past seven days. The probability of a successful merge seems high, but investors might be willing to invest in Ethereum’s alternatives in case the merge would fail. However, the correlation between digital assets still remains high, making “diversification” a challenge.

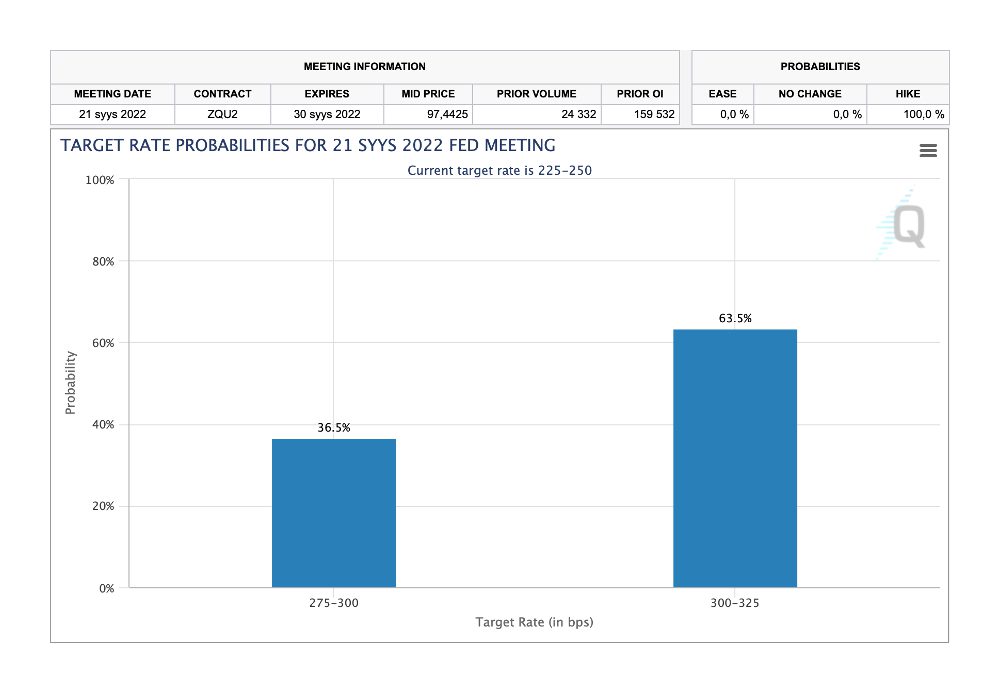

Cryptocurrencies and technology-related assets saw a rally couple of weeks ago when Fed’s 75 basis point increase was seen as relatively dovish. Back then many analysts waited for a 100 basis point hike. The next FOMC meeting will be in 43 days (21.9) and CME indicates a 63,5 percent probability for another 75 basis point increase. According to CME, the probability for a more dovish 50 basis point increase is 36,5%. The inflation is expected to peak, at least in relative terms, and a more dovish Fed would support high beta assets like Bitcoin.

Investors Trying to Price in The Upcoming Merge

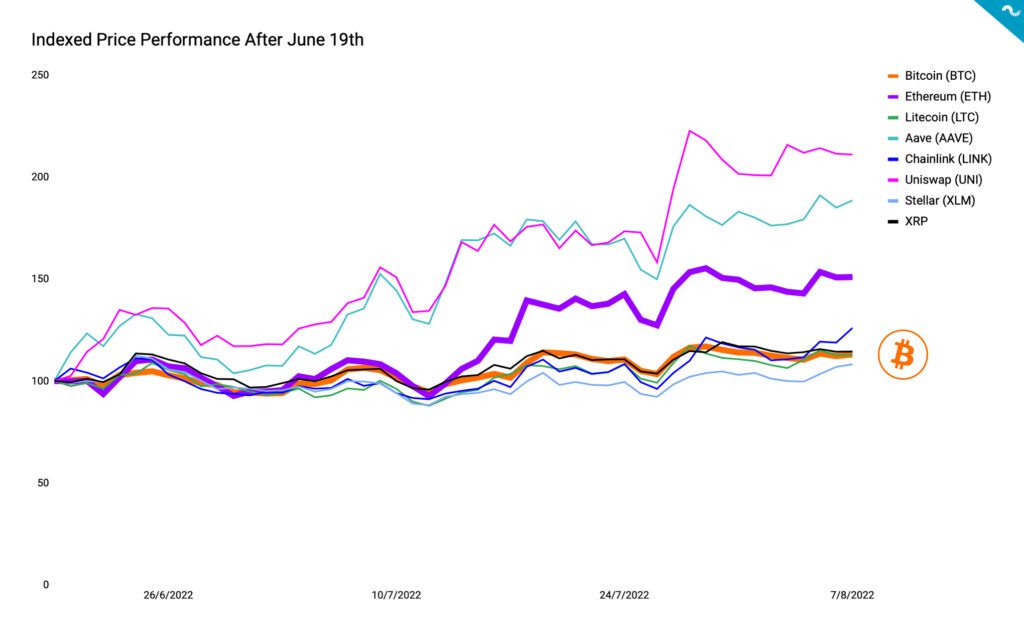

Despite the brutal spot price crash of H1 2022, cryptocurrencies have bounced well from the mid-June bottom. The leading cryptocurrency Bitcoin (orange) is up 13 percent from June lows, correlating heavily with assets like Stellar (light blue), Litecoin (green), and XRP (black). Ethereum’s growth has been in its own league compared with the former assets, as the leading decentralized finance platform is up 50,97 percent from mid-June. This divergence mirrors the heightened expectations towards the merge. Above Ethereum are Aave (cyan), rising 89 percent, and Uniswap (pink), up 111% since mid-June. Both AAVE and UNI have been favorable for brave dip-buyers.

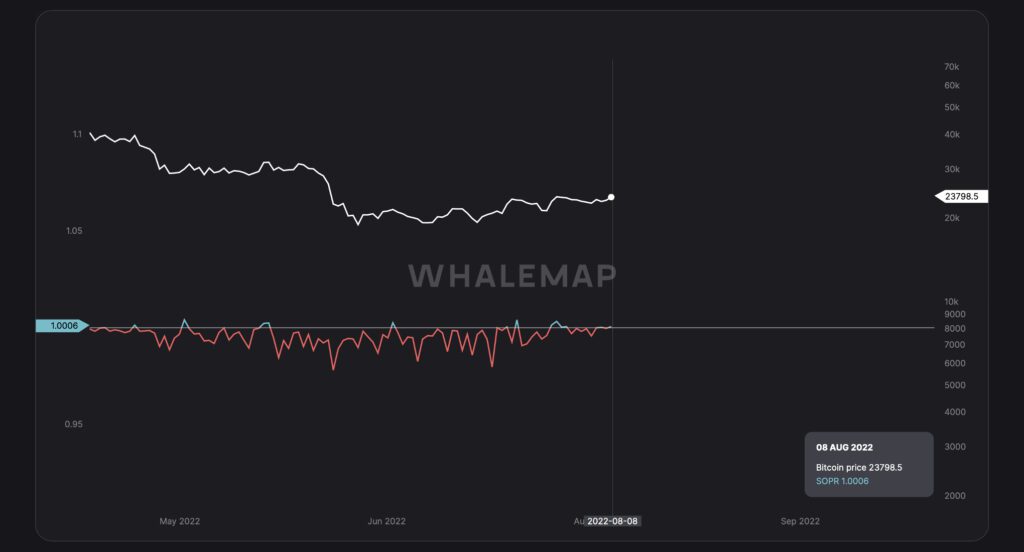

Bitcoin’s correlation with the S&P 500 Index has weakened from last week’s 0,51 to the current 0,45, signaling a possible decoupling scenario. Bitcoin’s SOPR indicator (Spent Output Profit Ratio) has managed to rise above 1 after a long epoch of loss accumulation. The currently green SOPR mirrors a possible trend reversal.

7-Day Price Performance

Bitcoin (BTC): +0,2%

Ethereum (ETH): +4,3%

Litecoin (LTC): +1,6%

Aave (AAVE): +2,3%

Chainlink (LINK): +11,8%

Uniswap (UNI): +0,9%

Stellar (XLM): +2,4%

XRP: -2,1%

– – – – – – – – – –

S&P 500 Index: +0,52%

Gold: +0,51%

– – – – – – – – – –

Bitcoin’s 90-Day Pearson Correlation with S&P 500 Index: 0,45

Bitcoin RSI: 61

The Revenge of The Miners: Ethereum’s Potential Civil War

Ethereum’s merge has definitively been the dominant topic of the industry this year and it’s currently scheduled for the 19th of September. The market is generally expecting the merge to act as a catalyst for Ethereum’s price appreciation and as Raoul Pal said, hedge funds can’t afford to miss the potential merge rally. Ethereum’s lead developer Tim Beiko published the merge schedule on July 14th and the release consequently triggered a significant ETH/USD rally, in which the ether token zoomed up 60 percent between July 13th and 22nd.

The EIP-1559 upgrade has been burning Ethereum’s fees since August 2021, effectively making the supply more scarce. Now Ethereum is expected to shift from inflationary to deflationary, as the supply turns down. Some analysts even expect Ethereum to enter a virtuous deflationary cycle. The main selling point of the merge will be the classification of Ethereum as a “green” and “ESG friendly” blockchain. Asset managers are increasingly aware of ESG-related topics and significantly lower energy consumption would make Ethereum easier to sell to investors. The green narrative would also allow Ethereum to differentiate itself from PoW Bitcoin.

Sounds brilliant, right? Yes, but there’s also trouble in paradise. As Ethereum has been mined with Proof of Work (PoW) consensus mechanism since 2015, there’s a huge community of retail and institutional miners still running the operations. The combined Ethereum miner revenue peaked at 2,3 billion dollars in May 2021. Because the shift to PoS effectively means the end of mining, there’s a growing revolt among miners. The miner revolution is currently being managed by Chinese Chandler Guo.

以太坊分叉微信群 进群须知 pic.twitter.com/uu1cofN629

— Chandler Guo (@ChandlerGuo) July 29, 2022

The potential revolution would mean the continuation of the PoW-based Ethereum and it has already received support from exchanges. Poloniex, and its leader Justin Sun, recently announced the listing of ETHW (PoW) and ETHS (PoS) tokens. Justin Sun later remarked having one million ether tokens and revealed his intentions to donate some of them to the ETHW community. Later the Seychelles-based exchange Huobi additionally signaled support for the ETHW. The ETHW party was joined yesterday by derivatives exchange BitMEX, which announced a new ETHPOW futures contract.

📢 The Ethereum Merge is expected to be in September 2022. Poloniex was the world's first exchange to list #ETH and now the first one to support potential forking of ETH with listing of two potential forked ETH tokens: #ETHS & #ETHW.https://t.co/QipYETT5Rq

— Poloniex Exchange (@Poloniex) August 4, 2022

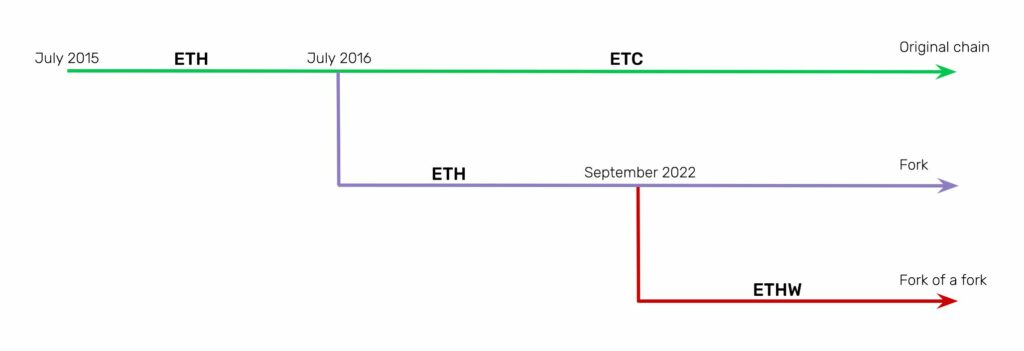

To make things even more interesting, the ETHW would be considered more as a “fork of a fork”. If we’re being precise, Ethereum Classic (ETC) is the original immutable chain of Ethereum and the longest continuous chain since 2015. The current Ethereum was forked from the original chain in July 2016, following the infamous DAO hack. The potential upcoming ETHW will be forked from the ETH chain, which itself is a fork of ETC.

While the idea of a fork is fascinating, many analysts are still expressing concerns over its eventual viability. The current Ethereum community is strong and most of the participants support the Proof of Stake protocol. While the ETHW could be a great speculative trade, its launch would probably be rocky. ETHW should expect attacks from the ETHS camp in form of shorting and dumping the ETHW tokens. When the 2016 ETH fork was considered as “peaceful”, I’d expect the ETHS / ETHW setting to be much more hostile. The stakes are now higher.

What Are We Following Right Now?

Crypto lender Hodlnaut has frozen all client withdrawals.

Dear users, we regret to inform you that we will be halting withdrawals, token swaps and deposits immediately due to recent market conditions. We have also withdrawn our MAS licence application. Here is our full statement https://t.co/5KfHUBzWsn Our next update will be on 19 Aug.

— Hodlnaut (@hodlnautdotcom) August 8, 2022

The Bankless team discusses Solana’s wallet hack and Ethereum’s PoW chain, among other topics.

The so called “meme stocks” bounced heavily yesterday. US-based crypto exchange Coinbase (COIN) climbed 9,83 percent in 24 hours.

MEME stocks are back pic.twitter.com/idDmKUAqQ6

— Danny Kirsch, CFA (@danny_kirsch) August 8, 2022

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.