Hello again, esteemed readers. We are certainly living interesting times, as almost every day marks a new all-time high. This has not only concerned bitcoin’s price, as other altcoins have also rallied to new respective records.

Some could argue the markets are close to overheating due to the enormous hype. However, this time the hype appears to be backed by large institutions, banks, companies and other giants with stronger hands than the average investor. Such parties are usually not startled by minor corrections, as they are mere bumps along the ride.

Nonetheless, it is worth minding that there is a strong chance for at least come kind of upcoming corrective movement. Whether it’s counted in thousands or tens of thousands of dollars, one can still expect prices to remain rather high compared to earlier times.

This week we will check out Bitcoin’s record-breaking market value, the development of crypto infrastructure and other wealthy and renowned investors joining Elon Musk in the crypto sphere. Additionally we will look at Nigeria, which has taken the lead in global crypto adoption despite its central bank trying to curb the decentralized technology.

Last week’s news can be read here.

Bitcoin’s market value broke $1B

The combined market capitalization of all bitcoins has surpassed the level of $1 trillion dollars for the first time in history. The shift occurred on the 19th of February as bitcoin has continued its whopping rise throughout the year.

Thereafter bitcoin’s price has only continued soaring to new heights, having roughly tripled in the past three months. The entrance of institutional investors on the markets also indicates the rise may be far from over.

At the time of writing the combined market value of all bitcoins is above $1.05 trillion. To put things into perspective, this amounts to approximately half the market value of IT giant Apple.

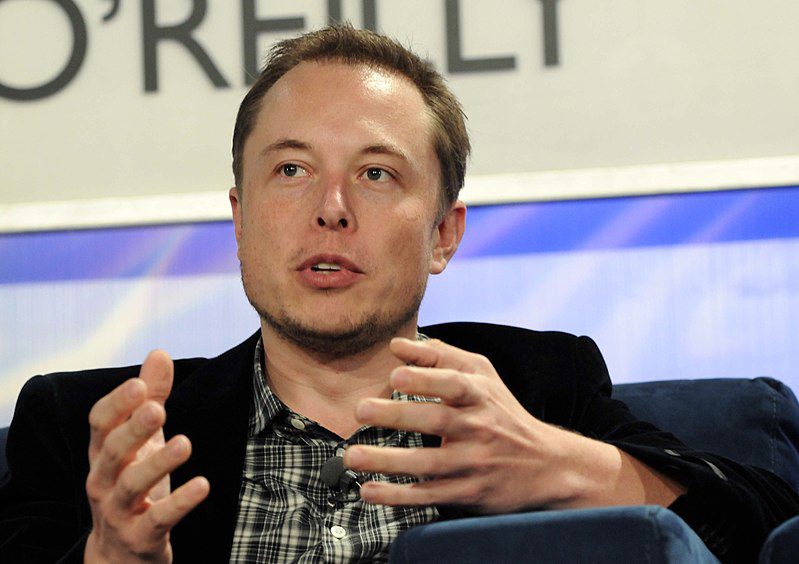

Elon Musk warned dogecoin whales

Technology innovator and the world’s wealthiest man Elon Musk has issued a warning to large dogecoin owners. In case these dogecoin whales do not sell their funds on the open markets, Musk has threatened to stop supporting the cryptocurrency.

According to Musk, dogecoin would have a chance to evolve into online cash with actual use if it was not centered into such few hands. At the moment around twenty large dogecoin owners are in control of roughly half the supply.

“If major Dogecoin holders sell most of their coins, it will get my full support. I will literally pay actual $ if they just void their accounts,” Musk commented on Twitter.

Dogecoin was originally developed as a joke currency. It is technically a near copy of Litecoin, which in turn is very close to Bitcoin in its main features. However, the supply of dogecoins is unlimited and planned for very small money transactions. Due to this it works rather like cash, whereas Bitcoin can be compared to gold.

Businessman plans the biggest BTC purchase in history

Dubai-based businessman Khurram Shroff has pledged to make the single largest investment in Bitcoin’s history. Schroff’s pledge concerns buying 100 000 BTC in order to develop the crypto infrastructure in the city of Miami. The investment amounts to roughly $5 billion counted in dollars.

Shroff is the chairman of investment firm IBC Group’s Dubai department. In the Middle East he is regarded as a kind of cryptocurrency poster boy with active following. Shroff hopes his support for Miami 2.0 Blockchain Strategy Foundation and other cryptocurrency actors will expedite local crypto adoption.

“Making the largest Bitcoin investment in history is proof of our commitment to assisting cities adopt blockchain, which we see as the key to enabling widespread adoption,” Shroff said.

Shroff is also looking forward to opportunities to work together with IBC and the city of Maimi to develop the country’s crypto strategy. He additionally believes Miami could cooperate together with Dubai to become the world’s first cities running entirely on blockchain.

Android enables crypto payments

New payment options supporting cryptocurrencies are on the way to Android smartphones. Supported by cryptocurrency payment service BitPay’s BitPay Card, the option will allow users of Google Pay and Samsung Pay to make purchases using cryptocurrencies in the US.

The BitPay Card is a payment method similar to a credit card, in which users can store different cryptocurrencies. After this they can use the card much like any other credit cards. Aside Bitcoin and Thereum, BitPay’s card supports many smaller altcoins, such as Binance’s native token as well as Bitcoin Cash.

The Google Pay and Samsung Pay integrations are meant to be implemented already within a few months. BitPay’s payment option has already been integrated to Apple Pay used by iPhone.

Crypto crime declined significantly

The revenue from cryptocurrency-related crime fell by nearly half last year, reports blockchain analysis firm Chainalysis. The report by Chainalysis shows crypto criminals profited roughly $5 billion dollars less than in 2019, marking over a 50% drop from its previous count of $10 billion.

“Cryptocurrency-related crime is falling, it remains a small part of the overall cryptocurrency economy, and it is comparatively smaller to the amount of illicit funds involved in traditional finance,” Chainalysis reports.

The 53% drop can in turn be explained by the PlusToken scam campaign in 2019, which was bigger than any other scam in 2020. Counted in dollars, the revenue from scams plunged by 71% last year.

Additionally the decline is driven by the growing knowledge of cryptocurrency users and improved systems to detect illicit activity. In essence, people are harder to scam than before and cryptocurrency companies are more vigilant in compliance matters combating crime.

The conclusions by Chainalysis correspond to similar results published by another blockchain analysis firm CipherTrace. According to CipherTrace, cryptocurrency-related crime saw a fall of 57% in 2020.

Nigeria leads global crypto adoption

Statistics firm Statista has published new data revealing Nigeria has taken the lead in global crypto adoption. The data shows every third Nigerian used or owned bitcoins or other cryptocurrencies in the past year, with international money transactions cited as one purpose.

Cryptocurrency use has grown increasingly popular in Nigeria despite the country’s central bank’s negative stance. The central bank recently prohibited local banks from providing cryptocurrency companies payment or banking services. Despite this, Nigerian cryptocurrency trading is on the rise much like Google searches on the topic.

The second and third place in crypto adoption per capita were taken by Vietnam and the Philippines. According to Statista, 21% of Vietnamese used or owned cryptocurrencies at some point last year. In the Philippines the same number in turn was 20%.