The TA of week 27 focuses on bitcoin’s price action in relation to the dollar wrecking ball. Additionally, we explore how central bank policies are shifting and what kind of market effects Mt. Gox could have.

Bitcoin and The Dollar Wrecking Ball

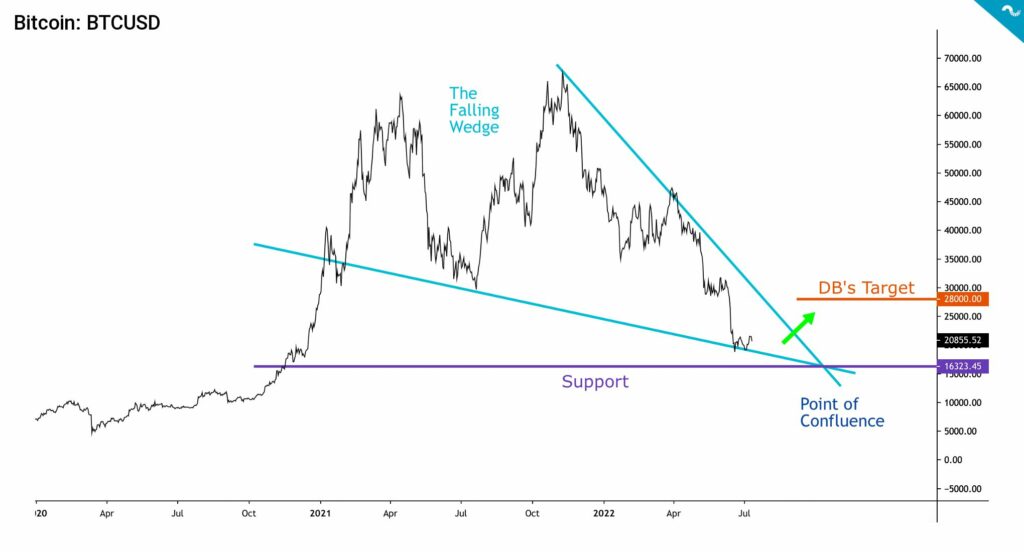

Bitcoin has been ranging between $19K and $22K levels for almost a month now since the spot price found its June bottom of $17,6K. The leading cryptocurrency is close to the tip of a multi-year falling wedge (turquoise), which points towards $16K level. Despite recent heavy selling pressure, the spot price will likely find a confluence of technical support on these levels. Many analysts are expecting bitcoin to bounce up towards Deutsche Bank’s target price of $28K. Recently the investment bank JPMorgan also considered the “crypto winter” to be over soon.

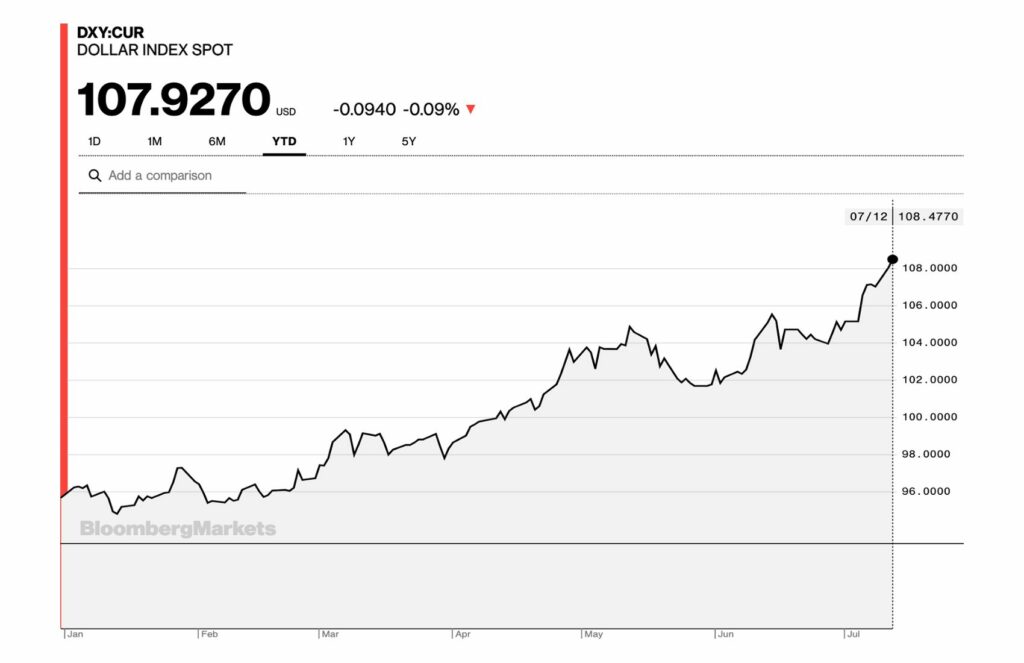

The US dollar index (DXY) has climbed to 107,93, rising over 13 percent year to date. The “wrecking ball” dollar has reached its highest level in 20 years, as investors are increasingly converting US stocks into dollars. The strong dollar is a challenge to other fiat currencies like the euro (EUR), which has weakened -11,49% against USD since January. The two western fiat currencies have now reached a historical parity, that hasn’t been seen in 20 years.

By historical data, bitcoin has a tendency to flourish during times of weak dollar and suffer during epochs of strong USD, vice versa. The recent weakness of bitcoin’s spot price supports this thesis. Bitcoin has been in a downdraft this year as investors have widely classified it as a high beta asset. While clouds of economical and geopolitical trouble fill the skies, investors have been in “risk-off” mode, selling the assets with more risk exposure. Bitcoin’s correlation with the leading stock market index S&P 500 has been weakening, however it’s still relatively high at 0,62 (Pearson, 90-day).

The spot price divergence between cryptocurrencies has been growing in recent weeks as lending platform Aave (AAVE) is up 12,3 percent, compared with negative numbers of the legacy cryptos. The AAVE/BTC correlation has dropped to 0,64 during the past seven days, while UNI/BTC correlation has been at mere 0,58. The low correlations mirror some DeFi-related tokens trying to break through the bear market.

Gold’s price performance has been under par and the asset has weakened -3,75 percent in a week. Reports are indicating a large-scale commodity-related sell-off, boosted by weakening Chinese liquidity. Gold has been in a downtrend with assets like silver, copper, and oil. The markets are waiting for inflation CPI data, which the White House described as “highly elevated”. The CPI is expected to be around 8,8%.

7-Day Price Performance

Bitcoin (BTC): -1,8%

Ethereum (ETH): -6,6%

Litecoin (LTC): -6,8%

Aave (AAVE): +12,3%

Chainlink (LINK): -3,9%

Uniswap (UNI): +8,5%

Stellar (XLM): -7,8%

XRP: -4,5%

– – – – – – – – – –

S&P 500 Index: +1,94%

Gold: -3,75%

– – – – – – – – – –

Bitcoin’s 90-Day Pearson Correlation with S&P 500 Index: 0,62

Bitcoin RSI: 40

– – – – – – – – – –

Important Dates

13.7: CPI Report

The Shrinking Central Bank Balance Sheets

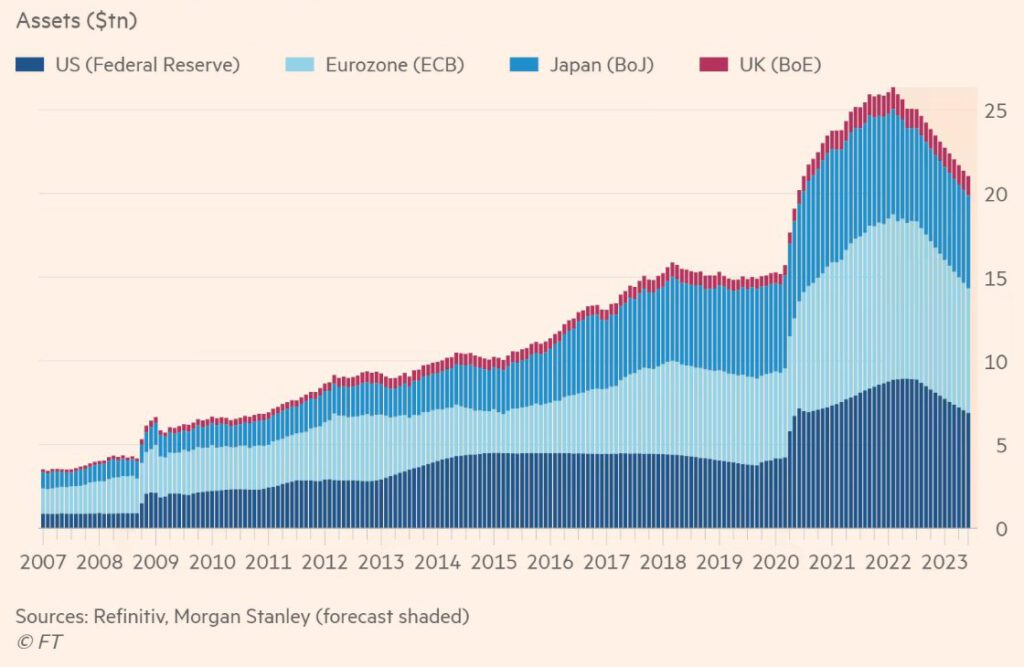

While the central banks have expanded their balance sheets for decades, the year 2020 was groundbreaking in quantitative easing. Analyst Andreas Steno Larsen has estimated that at least 20 percent of all US dollars in circulation were created during the year 2020 alone. The balance sheets expanded further in 2021, however 2022 has seen drastic measures taken by central banks in order to control the escalating inflation.

In the big picture, the shift is about moving from quantitative easing (QE) to quantitative tightening (QT). While the pivot seems essential in order to calm down inflation, it has also removed the biggest buyer from the markets. Particularly the newer DeFi tokens have benefited from zero interest rates and QE, thus making the tightening hard for them.

Mt. Gox Expected to Release 137K Bitcoin Units Next Month

Creditors of the former cryptocurrency exchange Mt. Gox are finally about to get their funds back, as the company’s bankruptcy trustee Nobauaki Kobayashi is asking creditors to register online and indicate how they want to receive their repayments. The release marks an apparent end to the long Mt. Gox saga, that spans back to the infamous hack in 2011.

In late 2021 Mt. Gox officially published a formal rehabilitation plan in order to return lost funds back to investors. This month the rehabilitation trustee has sent an email to creditors, giving the option to receive US dollars (USD), bitcoins (BTC), or bitcoin cash (BCH). Institutions, like Fortress Investment Group, have been buying the Mt. Gox claims of those individuals who wanted to cash out early. The claims have also formed a liquid market for speculators along the years, as each creditor is expected to receive around 20 percent of the original balance.

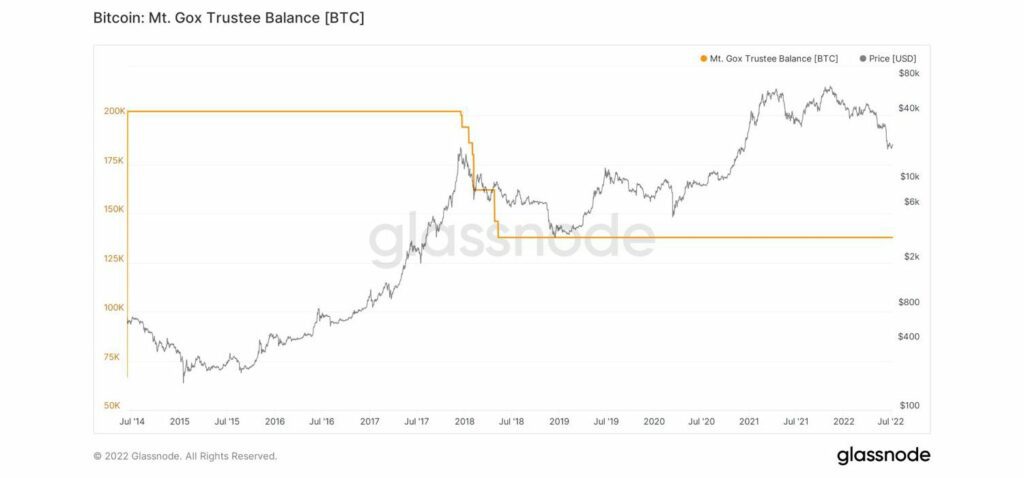

Some analysts, like Miles Deutscher, have estimated that Mt. Gox coins could have a profound sell-off effect on the market. 137 000 bitcoins, worth ~$3B, are a significant amount and perhaps enough to cause a “black swan” event. However, the bigger picture is more complicated as we don’t know if the coins are delivered to “diamond hands” or sellers.

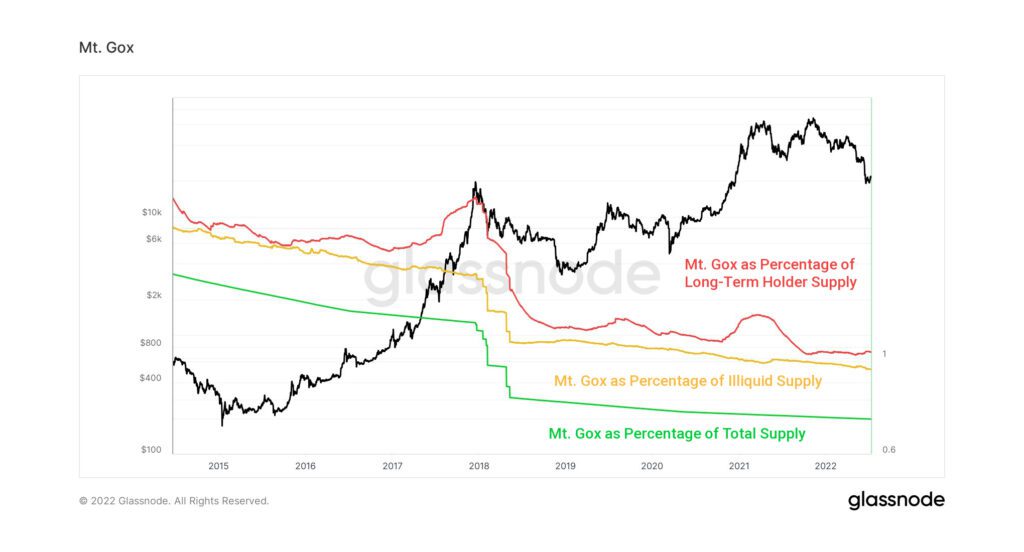

Glassnode has a vast amount of Mt. Gox-related data and it clearly shows how the significance of “Gox coins” has dropped as time goes by. The Gox coins currently account for 0,72 percent of the total bitcoin supply, which is a very small number. The Gox coins are currently 0,94% of Bitcoin’s illiquid supply and 1,03% of the long-term holder supply.

0,72 percent is hardly enough to move the markets by itself, so the Mt. Gox sell-off could be considered as a non-event. It’s pretty obvious that all the creditors are not selling as many of them are “old bitcoiners” and thus “holders of last resort”. However, depending on August’s market environment and investor sentiment, Mt. Gox could still cause turmoil and panic among investors and some speculators are likely trading the event in their favor.

“Some Mt. Gox creditors will get bitcoin. Some will sell them. It won’t be a significant fraction of total Bitcoin’s trading volume, but it might push prices down. The decline might spook some other people and we might see a further drop.”

Aaron Brown

What Are We Following Right Now?

Lyn Alden discusses crypto and macro with the Bankless team. Why the Fed is playing chicken with disaster? Why CeFi contagion is the canary in the coal mine?

Mark Yusko and Michael Ippolito discuss the recent volatility in crypto markets, bailouts by Sam Bankman-Fried, and the comparisons between CeFi versus DeFi.

Bitcoin’s net unrealized profit/loss indicator has crossed into capitulation zone.

NUPL is in the capitulation zone.

— Murad (@MustStopMurad) July 12, 2022

Went lower than the COVID bottom.

Bearish case is it can go lower towards the 2018 levels because of macro.

Bullish case is its already bottoming as both the global peaks and the global lows are getting more shallow. pic.twitter.com/UaVVonbGn3

Stay in the loop with our newsletter:

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.