The first technical analysis of 2022 interprets the volatile markets and quickly shifting sentiment. We’ll also focus on spot market correction, Fed’s tapering, ELR, Exchange Reserves, and other relevant topics.

Market Corrects Heavily, FED to Start Tapering in March

Markets were disrupted again this week, as a follow-up to Fed announcing tightening monetary policy. In essence Fed plans to cease asset purchases by March 2022 and Fed has been the biggest buyer in financial markets via quantitative easing, or QE. Quantitative easing has been extensively used as part of Fed’s recovery tools and the central bank has been injecting a record-breaking amount of U.S. dollars (USD) to the system.

Tapering was implemented last time in 2013 when it generated a market-wide panic. The small-cap speculative altcoins and tokens are expected to hit hardest as the program starts in March, late quarter one. The stimulation phase can’t continue forever and we’re already seeing worryingly growing inflation figures. Obviously Fed wants to reduce the growing inflation.

While the tapering seems “healthy” for the larger economy, the results might be unpredictable. Fed’s “cheap dollars” have been flowing to all tranches of the economy, including cryptocurrencies. The lack of the biggest buyer in the economy will likely have an impact on all asset prices. However Bitcoin has been antifragile in almost all market environments and we expect it to perform well over long time horizons.

Is The Tapering Already Priced in?

Leading cryptocurrencies Bitcoin (BTC) and Ethereum (ETH) have dropped -12,8 and -17,6 percent within past seven days, while DeFi-related assets like Aave suffered even more. AAVE is currently down almost -20% in 7 days and assets like Axie Infinity (AXS) are down -25,3%. As usual, the small-cap assets contain more volatility than Bitcoin and Ethereum, they have a tendency to offer greater profit combined with higher risk ratio.

7 Day Cryptocurrency Performance

Bitcoin (BTC): -12,8%

Ethereal (ETH): -17,6%

Aave (AAVE): -19,9%

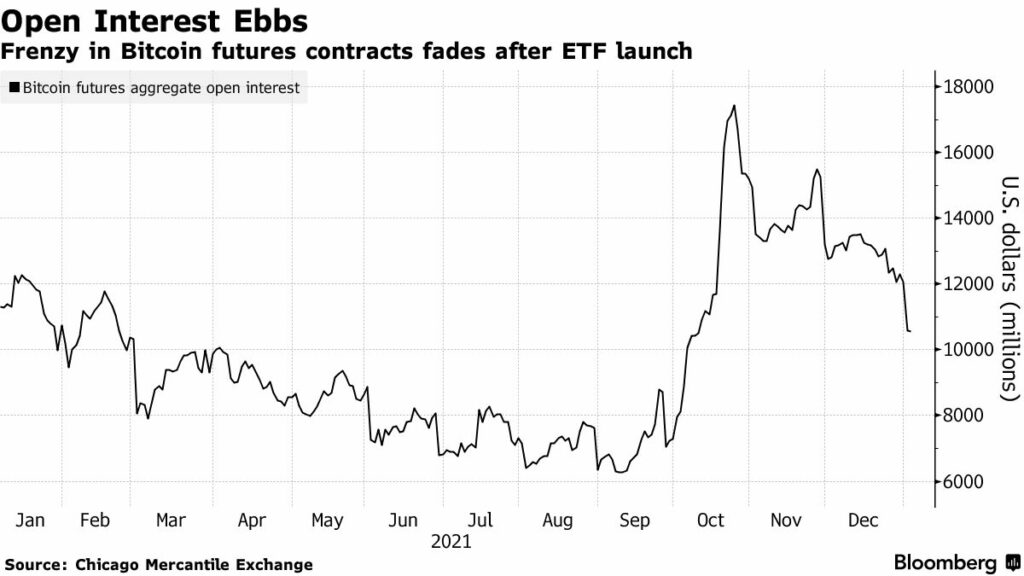

Multiple institutions and thought leaders have expressed their bearish views on market, Bloomberg sees decreasing open interest and degrowth of active addresses as bearish indicators. Michael “Mike” Novogratz sees bitcoin bottoming at 38 000 USD, an attractive level for institutional buying pressure.

Highest Percentage of UTXOs at Loss Since 2020

The percentage of UTXOs at loss has climbed to all-time highs since 2020, rising to 17,07 percent of all UTXOs. The rising amount of UTXOs mirror the amount of investors being at loss and this is obviously a bearish sign. However we should remember that 82,93% of UTXOs are still in profit, which is a significant number. Our previous TAs have showed how long-term investors have an inherent edge ovet short-term investors in crypto markets.

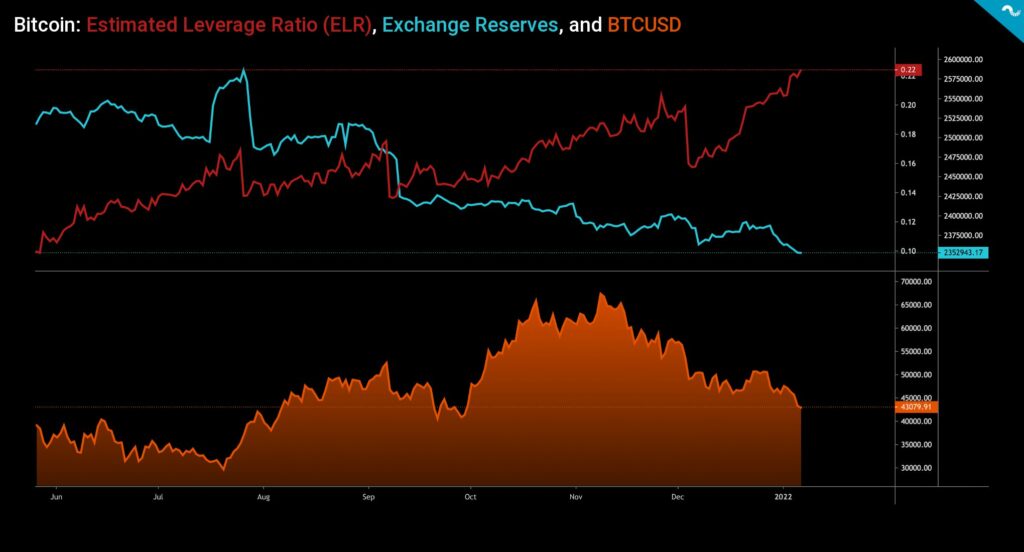

Estimated Leverage Ratio (ELR) Up, Exchange Reserves Down

While Bitcoin’s spot price (BTCUSD) continues to weaken, the Estimated Leverage Ratio (ELR) reaches new highs at 0,22. The high ELR indicates that market still hasn’t deleveraged, and somewhat surprisingly the traders are increasingly willing to take leveraged risks. A significantly ascending spot price would create a short squeeze setting on these levels.

Exchange reserves seem to continue their downtrend amid the quickly shifting market environment, reaching a new low of 2,35 million native bitcoin units. The exchange reserves seem to be uncorrelated with price action and other metrics. The decrease is likely driven by the relocation of bitcoin units into long-term cold storage. In addition to Bitcoin’s exchange reserves, Ethereum’s exchange reserves are dropping in close correlation. Ethereum is becoming a more scarce asset and smart money prefers to accumulate Ether units off-exchange. The exchange reserves have decreased from 2020 to 2022 forming a secular multi-year downtrend.

↑ Increasing Exchange Reserves: Bearish, indicating bitcoin selling pressure

↓ Decreasing Exchange Reserves: Bullish, indicating accumulation to cold storage

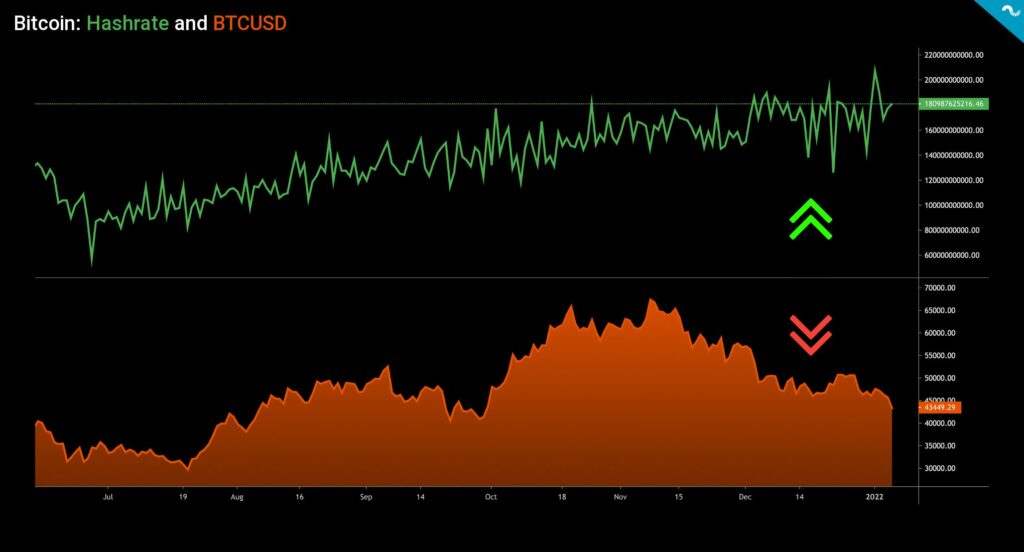

Divergence: Hashrate Seems to Be Resistant to Kazakhstan’s Crisis

Kazakhstan’s ongoing crisis, stemming from violently rising fuel prices, is showing no signs of calming and might escalate even further. Market has been fearing the possible consequence of Kazakhstan’s internet going offline, as the country represents 18,1% of global hashrate (CCAF August 2021). However Bitcoin’s hashrate seems to be highly resilient despite the crisis, staying steady through early 2022.

So why hasn’t the crisis significantly affected Bitcoin’s hashrate? First of all Kazakhstan’s miner operators might have high socioeconomic status and thus they’re well connected. The large miners with good governmental connections would have negotiation power to stay outside of internet blackout. Secondly, the miners might use higher-level technology in order to stay connected. As a reference, Blockstream Satellite offers uninterrupted connection that is immune to censorship attempts. Furthermore Bitcoin’s mining infrastructure is designed to adapt to shifting mining power and thus other locations will likely take Kazakstan’s place in hashrate.

The divergence of Bitcoin’s spot price and hashrate shows how Bitcoin’s fundamentals are exceptionally strong in midst of the selling pressure and market stress. Bitcoin’s hashrate ultimately mirrors miner’s confidence and trust towards the network, they’re willing to allocate huge resources to mining operations expecting the network to provide good risk-adjusted profit.