The TA of week 24 takes a deep dive into recent market action, including Terra contagion, liquidations, and huge opportunities. Additionally we explore why multiple Bitcoin indicators are in the buy zone.

The Terra Contagion Seems to Spread Further

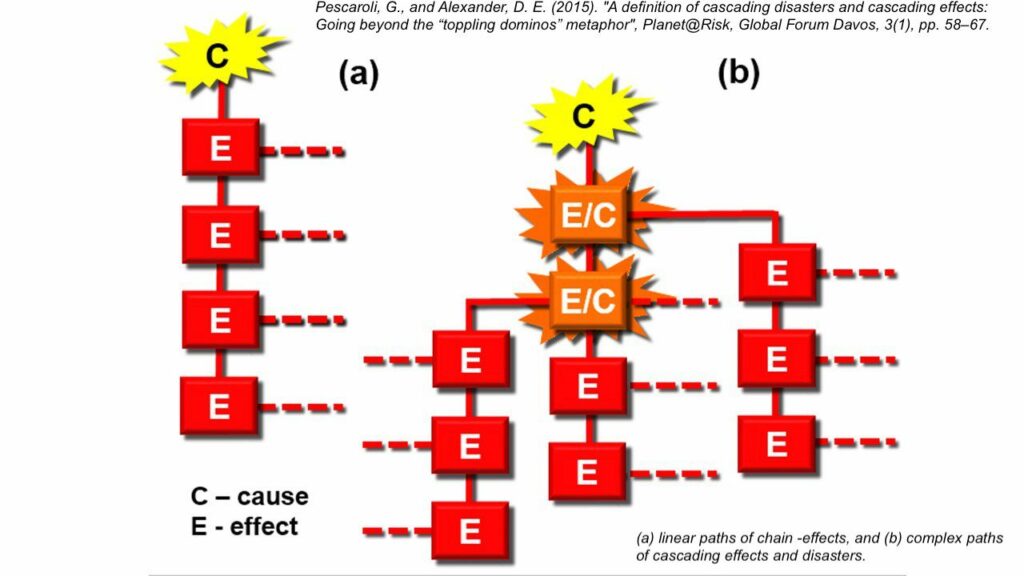

Digital assets experienced yet another rough week, as most cryptos were further pulled down by macro-level uncertainty. Investors are being scared by the cascading effect (chart below) of Terra’s ecosystem meltdown, that seems to spread to other platforms and funds. The Celsius lending platform was previously identified as one of the wallets associated with the TerraUSD (UST) depegging in May. Apparently the Anchor protocol has been a significant source of yield for Celsius and the platform might not be able to fulfill its obligations. Celsius previously received 17,5 percent yield from Anchor alone.

Another heavily affected financial institution is the crypto venture capital fund Three Arrows Capital (3AC), with allegedly $18 billion in assets under management (AUM). 3AC has previously invested in distinguished projects like Avalanche (AVAX) and Aave (AAVE). The company grew into one of the top 5 venture capital firms in the blockchain industry, however it eventually made a huge miscalculation. During spiring of 2022 the fund invested $559,6 million to buy locked Terra LUNA tokens, while the value of their LUNA position is now around 600 dollars.

3AC has also been using extensive amount of leverage in their trades and rumors say the fund is about to get liquidated against its Ethereum (ETH) positions. Three Arrows capital has been selling Lido’s stETH alongside Celsius, generating a selling pressure that threatens to depeg stETH and ETH. The 3AC also owns part of the famous derivative exchange Deribit, which announced having a “small number of accounts that have net debt to us that we consider as potentially distressed”.

Due to market developments, Deribit has a small number of accounts that have a net debt to us that we consider as potentially distressed.

— Deribit (@DeribitExchange) June 16, 2022

Recent reports suggest that Three Arrows Capital borrowed from major lending entities including BlockFi, Genesis and Nexo. These loans were uncollateralized in some cases, making the full outcome of contagion unclear. The risk associated with 3AC has forced many protocols, like Avalanche, to clarify their status with the venture capital fund in order to calm investors.

Due to recent speculation, we’d like to clarify that 3AC has never in any way managed, used, or custodied any Avalanche Foundation treasury funds.

— Avalanche 🔺 (@avalancheavax) June 16, 2022

Some analysts say there’s a bigger chain of events underneath, as Celsius’ competitors have an incentive to try to clean the market. Some institutional players might dump bitcoin low enough to cause maximum damage to Celsius and then let crypto assets freely bounce afterwards. Terra (LUNA) was apparently targeted by speculative attacks before its eventual meltdown.

#Bitcoin is not done liquidating large players. They will take it down to a level that will cause the maximum damage to the most overexposed players like Celsius and then suddenly it will bounce and go higher once those firms are completely obliterated. A story as old as time.

— Mike Alfred (@mikealfred) June 18, 2022

Ceteris Paribus

Despite the bearish outlook in decentralized finance space, we should never be overly sceptical towards the market. The opportunity lies in an environment where everyone is fearful or already capitulated. As Michael Saylor said in his Bloomberg interview, Bitcoin’s fundamentals haven’t changed. In near term Bitcoin has been trading like a high beta speculative asset, however we’re seeing its nature to change over time. In long time horizon Bitcoin has been, and will be, a preferred alternative asset.

The huge deleverage during last weeks was partly caused by an immensely over-leveraged market, that needs to be reseted on a timely basis. Michael Saylor mentioned there are over 520 unregistered crypto exchanges, which offer at least 20x leverage. Other big theme is the exceptionally uncertain macro environment, as central banks are shuffling between quantitative easing (QE) and tightening (QT). This unpredictability makes price forecasting increasingly difficult as other factors cannot assumed be constant, ceteris paribus.

“Bottom will be when big guys fill their bags. Simple as that. So it will go as low as needed to create the liquidity needed for that transfer of positions. Not any less, not any more.” – Murad Mahmudov

Bitcoin’s spot price has weakened -27 percent during past seven days, while the leading decentralized finance platform Ethereum has weakened -25,5%. Some DeFi tokens like AAVE are below -30%, however the overall market is showing signs of selling pressure exhaustion. Bitcoin’s RSI is at 22, indicating the lowest value since January this year. The exhaustion of selling pressure and low RSI together indicate a potential market bottom, which might lead to a relief rally. The correlation between cryptocurrencies is starting to break up as Litecoin’s (LTC) correlation to Bitcoin dropped to 0,63.

7-Day Price Performance

Bitcoin (BTC): -27,3%

Ethereum (ETH): -25,5%

Litecoin (LTC): +4,5%

Aave (AAVE): -30,1%

Chainlink (LINK): -5,3%

Uniswap (UNI): -4,8%

Stellar (XLM): -8,6%

XRP: -9,2%

– – – – – – – – – –

S&P 500 Index: -5,79%

Gold: -1,76%

– – – – – – – – – –

Bitcoin’s 90-Day Pearson Correlation with S&P 500 Index: 0,54

Bitcoin RSI: 22

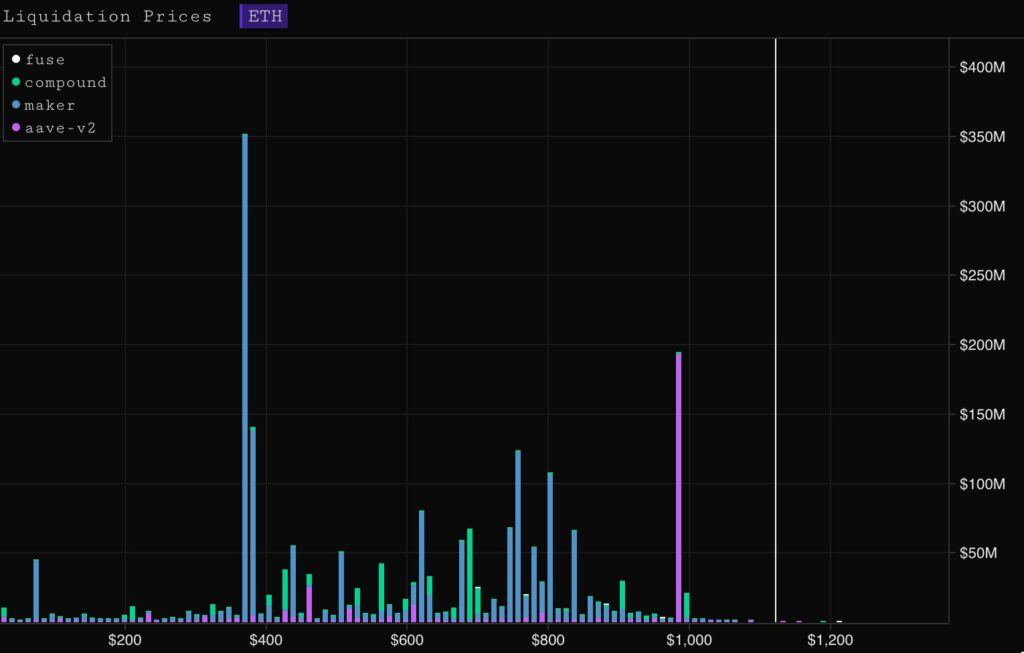

The selling pressure during past weeks has been particularly harsh towards Ethereum, which momentarily plunged into three figures. The Ethereum sell-off has been further amplified by derivative liquidations, that escalated just below $1000 (chart). It has been speculated that whales want to bring the prices down as much as possible in order to fill their longs at the bottom. Heavy selling pressure might also be another way to front-run other investors.

Smart money is clearly seeing the market situation as a buying opportunity and former hedge fund manager Murad Mahmudov said he’s deploying 20 percent of his cash capital at $17K Bitcoin.

front-running other sellers

time sensitive need

liquidations

margin calls

hunting stops

desire to bring price down as much as possible

When $BTC was trading in the 60s, I was salivating at the idea of buying the 17-19k levels.

— Murad (@MustStopMurad) June 18, 2022

The $BTC and crypto ecosystem is 100x more powerful than when BTC was first trading here in 2017.

As scary as it is, I am deploying 20% of my cash into spot $BTC here, no leverage. pic.twitter.com/gOEwkRxVlx

Mining Data Shows a Possible Market Bottom

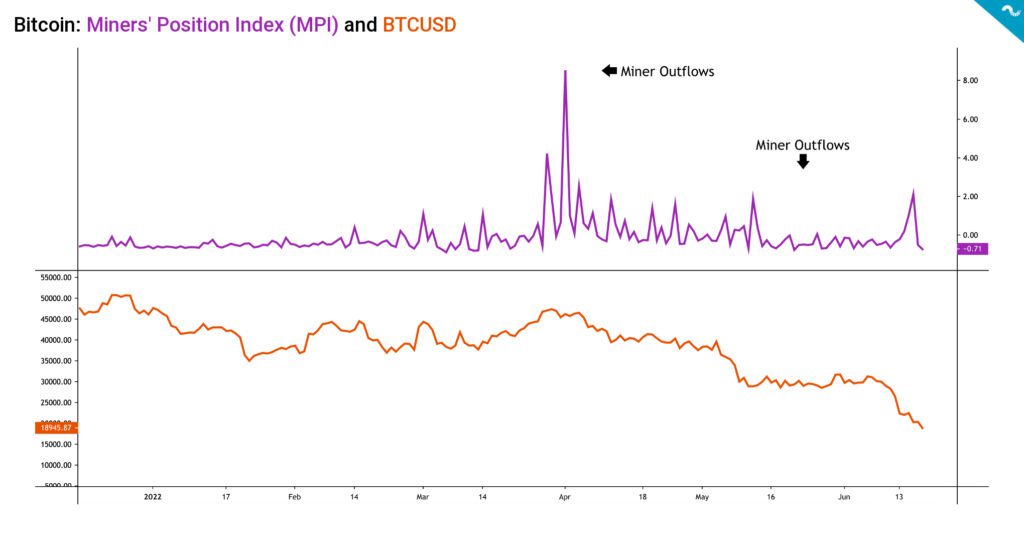

Despite the market meltdown, or should we say because of it, multiple Bitcoin fundamentals are looking strong. The Miners’ Position Index (MPI) has seen significant outflows since March, indicating miner capitulation. As Bitcoin’s spot price decreases, some miners are unable to continue operations and consequently “market dump” their coins. The miner capitulation is usually the last sign of approaching market bottom.

↑ High MPI: More Selling Pressure by Miners. Bearish

↓ Low MPI: Less Selling Pressure by Miners. Bullish

While I’ve been arguing that miners are maximizing their liquidity by selling during bull trends counter-cyclically, the miners are also conducting forced selling pro-cyclically during significant declines. Miners are currently holding around 40 000 – 50 000 bitcoins, almost one Terra’s worth. The last part of bear cycle in in late 2018 and early 2019 was reportedly driven by miners.

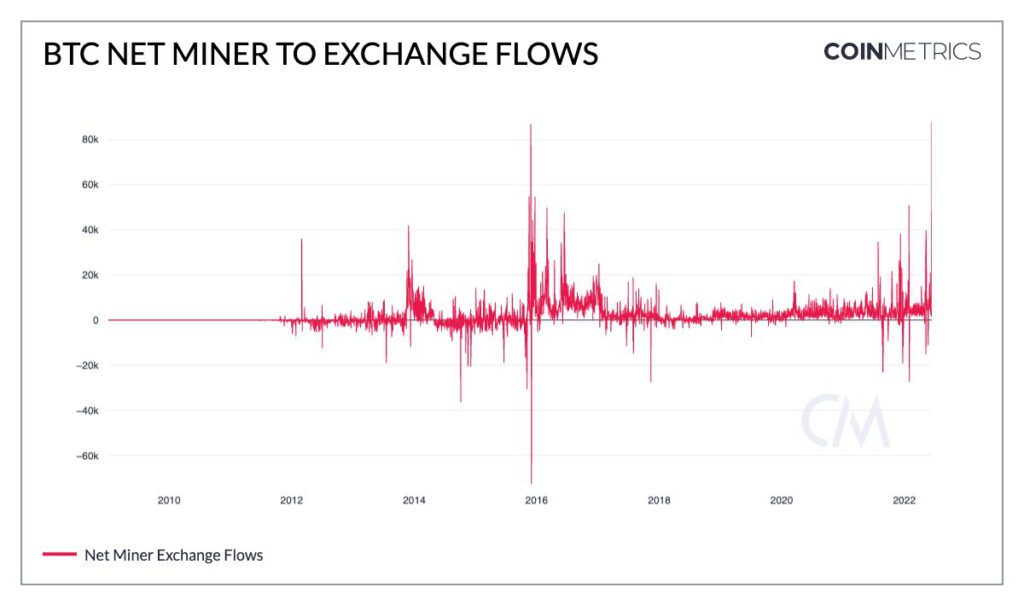

Last week 88 000 bitcoin units were sent to exchanges by miners, marking an all-time high. Multiple publicly traded miners, like Texasian Core Scientific, have recently disclosed significant sales.

Bitcoin MVRV Dips Deep into The Accumulation Zone

Bitcoin’s rapidly falling spot price has driven Market Value to Realized Value (MVRV) indicator well below one and into a definitive buy zone (blue). The MVRV dropped into 0,84, which is slightly lower than the last market bottom MVRV of 0,85 during March 2020 COVID crash. Like the March 2020 market bottom, the current market offers particularly cheap bitcoin for deployed capital.

MVRV, or Market Value to Realized Value, was firstly developed by David Puell and Murad Mahmudov in early October 2018. The Puell Multiple indicator used in technical analyses is also named after David Puell. MVRV is calculated by dividing the market cap by realized cap and it’s a good instrument for estimating if market participants are in profit or not. Bitcoin is generally considered as overvalued when MVRV exceeds 3,7 and undervalued when it’s below 1.

MVRV Sell Zone: > 3,7

MVRV Buy Zone: < 1

What Are We Following Right Now?

MicroStrategy Chairman and CEO Michael Saylor joins Emily Chang to talk about his position on a potential Bitcoin loan, his view on Bitcoin and cryptocurrency volatility, and whether he expects Bitcoin to drop even further.

Venture capitalist Kevin O’Leary discusses the crypto crash, how it can help build a stronger industry and why crypto needs more regulation.

Is the Federal Reserve weakening the economy by starting quantitative tightening (QT) too early? Cathie Wood thinks so.

The Fed seems to be worried more about its legacy than the economy: it is ignoring deflationary and dangerous signals. Relying on lagging inflation indicators like the CPI, Fed Governor Waller is calling for another hike of 0.75% in July.

— Cathie Wood (@CathieDWood) June 19, 2022

Western countries might have forgotten the importance of energy. From bitcoin mining to electrical vehicles, reasonably priced energy acts as a catalyst for growth.

1/ Since disorder is spontaneous, the human endeavor is a constant, unrelenting struggle against the forces of entropy. We are a highly ordered species – a true miracle of the universe. Beating back entropy requires energy. Ergo, energy is life.

— Doomberg (@DoombergT) June 18, 2022