The third TA of 2022 will assess the recent market correction, Fed’s upcoming tapering-related decisions, market scenarios, and a selection of other indicators.

Markets in Panic Mode, Investors Trying to Price In The Tapering

The markets entered a full panic mode during the third week of 2022, sending cryptoassets to significant spot price declines. The leading cryptocurrency Bitcoin (BTC) has weakened -19,4 percent during last seven days, while the DeFi platform Ethereum (ETH) is down -28,2%. As usual, the small-cap tokens suffered even more, with assets like Aave descending almost -40%. Many analysts argue that the sell-off stems from Fed’s incoming “inverse QE”, or tapering decision, effectively decreasing the flow of cheap dollars in the upcoming spring. The market clearly tries to price-in the Fed-related risk.

7 Day Price Performance

Bitcoin (BTC): -19,4%

Ethereum (ETH): -28,2%

Aave (AAVE): -38,1%

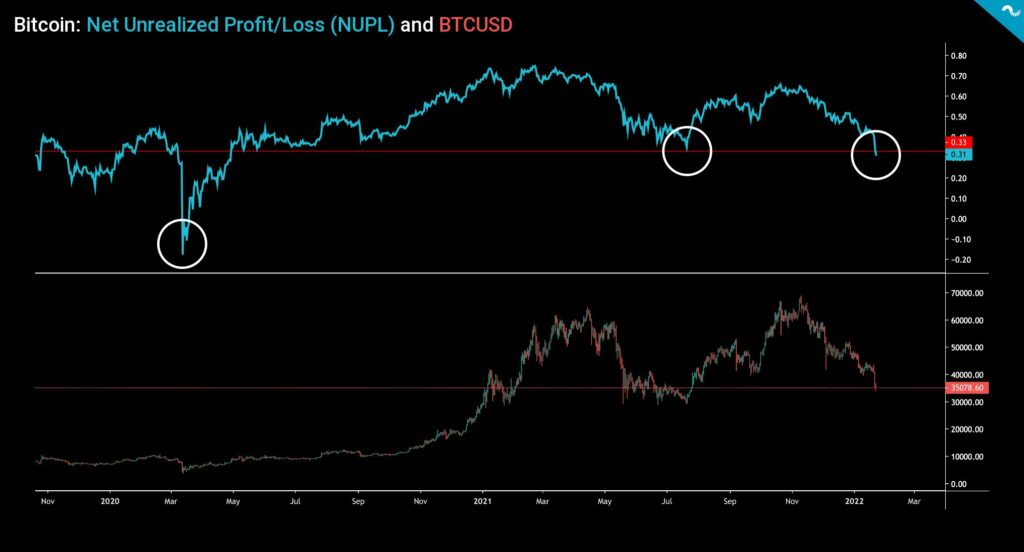

Bitcoin’s Net Unrealized Profit/Loss indicator (NUPL) shows an increasing amount of investors being at loss. NUPL dropped below 0,31 during the weekend and hasn’t been this low since 2020 COVID-induced market crash. However the market seemed to bounce on Sunday and smaller altcoins momentarily climbed in 20-30% range. A relief rally is usually expected after sell-offs of this magnitude.

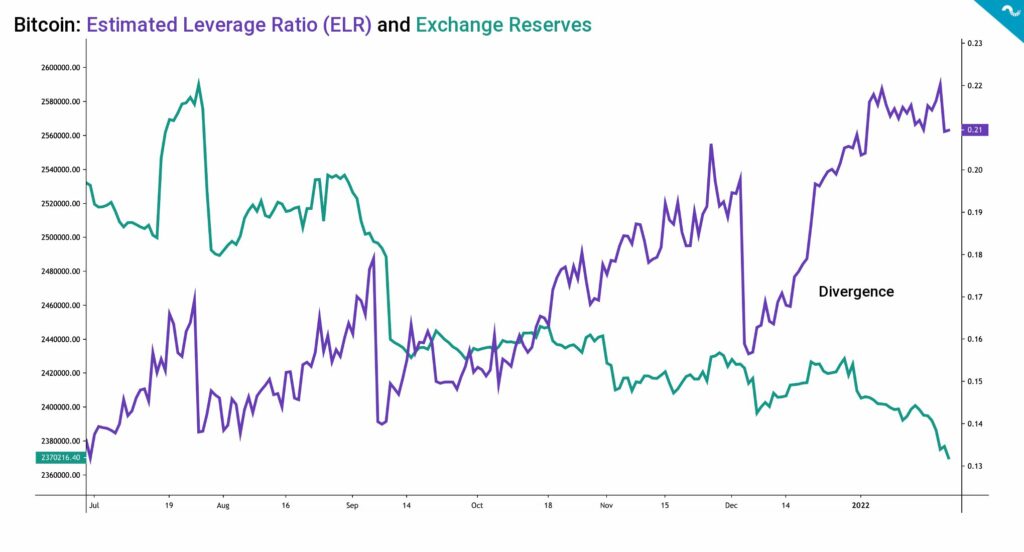

In spite of all the mayhem, Bitcoin’s core fundamentals seem antifragile. The hashrate is close to all-time high levels and mirrors the miners’ commitment to the network. Hashrate and price might diverge for a while, however they usually correlate in the long-term horizon. Somewhat surprisingly Bitcoin’s Estimated Leverage Ratio (ELR) hasn’t dropped, meaning the derivatives market hasn’t deleveraged, yet. ELR might indicate that the spot price crash was “mild”, as massive corrections have a tendency to stir up the whole derivatives market. Bitcoin’s exchange reserves continue their secular downtrend, seemingly unaffected by spot price crash.

Plausible Market Scenarios for Q1

Where would the market head after the significant crash? Let’s speculate a little.

Blue Sky Scenario

“Blue Sky Scenario” means the best case scenario for Q1. In this hypothetical setting the Fed would not announce new radical changes in FOMC meeting of January 25-26. In this scenario the stock market would stay calm and cryptoassets would gain some buying pressure.

Max Pain Scenario

In the opposite “Max Pain Scenario” Fed would begin a series of rate hikes tightening their current accommodative monetary policy to curtail the spiraling level of inflation. This scenario would bring additional selling pressure towards speculative assets, particularly to technology-related securities and small-cap digital assets.

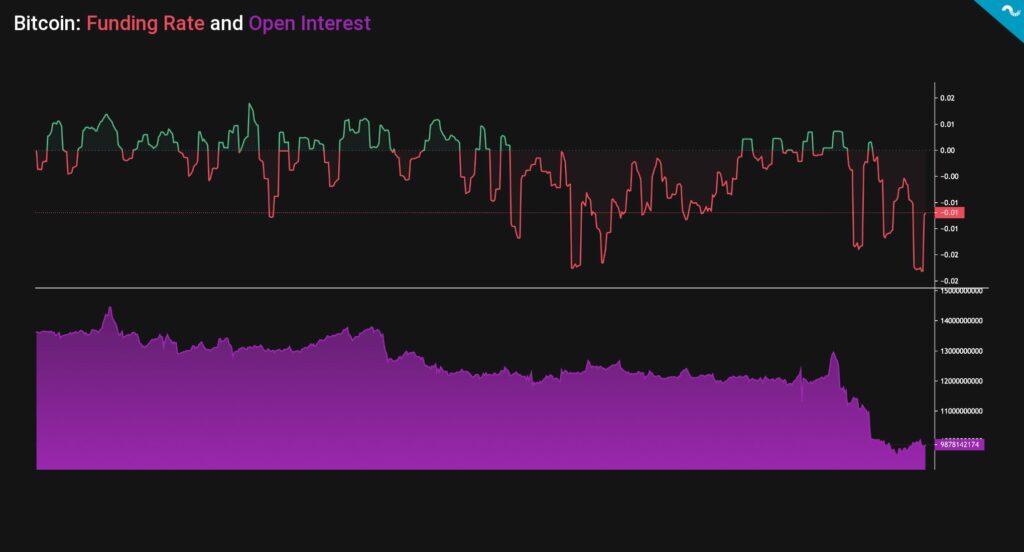

Bitcoins’s Funding Rate Turning to Negative

Bitcoin’s funding rate turned slightly to the negative sector, however derivatives traders still hold a substantial amount of long contracts. If the FOMC outcome is positive on fourth week of 2022, the derivatives market could create a setting for a short squeeze. Bitcoin saw a massive short squeeze when spot price suddenly turned upwards in July 2021.

Bitcoin Relatively Correlated with S&P 500

As we know the central banks (and particularly Federal Reserve) have been drowning the market in “cheap money”, in order to counter the negative effects of COVID-19. The massive quantitative easing has also slided in the cryptoasset market, uplifting valuations across the board. Consequently Bitcoin is more correlated with the stock market than previously. As a reference the bull market of 2017 saw close to 0 correlation between BTC and S&P, now the Pearson correlation is 0,45.

The epoch of cheap dollar has definitely affected cryptos, however the effect is more pronounced in altcoins and smaller tokens. When the January market crash occurred, technology stocks were the first to fall and ETFs like ARK Innovation ETF (ARKK) are currently down more than -50 percent from 2021 peak. The tapering actions of spring 2022 will reveal if the correlation between cryptos and stock market is permanent, or more like a temporary anomaly.