The technical analysis of week 41 construes the first Bitcoin ETF approval, sector rotation, and shifting market environment in general.

ProShares Bitcoin ETF is here

The ProShares Bitcoin Strategy ETF (BITO) came after issuers spent years attempting to obtain SEC clearance for an exchange-traded fund related to cryptocurrencies. BITO will not invest directly in bitcoin, but rather in bitcoin futures. The Proshares Bitcoin Strategy ETF will be launched on 19th, Oct 2021. The BITO was seen in Bloomberg terminal last week, as Bloomberg’s data team prepares for the launch. BITO will be a futures ETF and will include a fee of 0,95 percent, less than half of Grayscale’s GBTC (2%).

Bitcoin ETFs are a sign of maturing asset class, and they offer mainstream investors an easier way to get exposure to bitcoin. ETFs will likely enhance institutional adoption as well. However, the ProShares BITO might not be the only ETF launch next week; Invesco and Valkyrie will possibly accompany it.

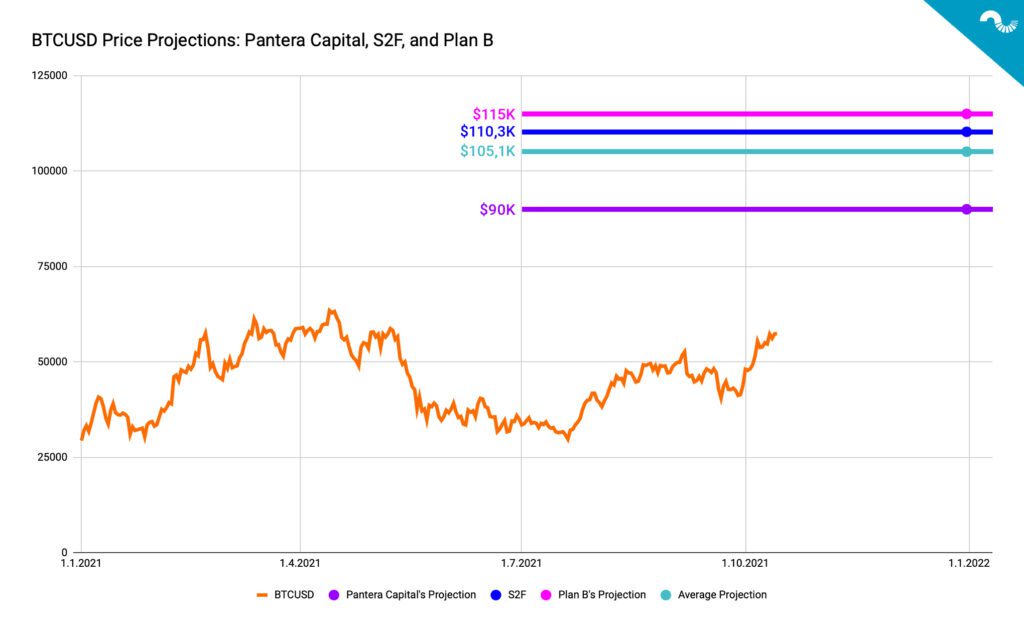

Bitcoin Price Projections for Q4

Digital asset markets positively greeted the ETF approval news, and BTCUSD has ascended 13,2 percent this week. Many analysts expect bitcoin to reach $100K levels in late quarter four (Q4), and the inflow of new financial products might be the leading factor behind the bullish sentiment. The main question among investors seems to be: How much can bitcoin still ascend in Q4?

Let’s explore some of the most popular bitcoin price projections. Pantera Capital recently updated its bitcoin outlook by announcing an $80K to $90K target for BTCUSD (purple). Pantera Capital also announced a $700K long-term price target. Bitcoin’s Stock to Flow (S2F) model would forecast a $110,3K price target for bitcoin, based on bitcoin’s scarcity attributes (blue). Plan B, the Stock to Flow model creator, said he’s expecting a $115K Q4 price level for BTCUSD (pink). The average projection calculated by these price estimates is $105,1K (turquoise), which would mirror the “consensus” price target of $100K.

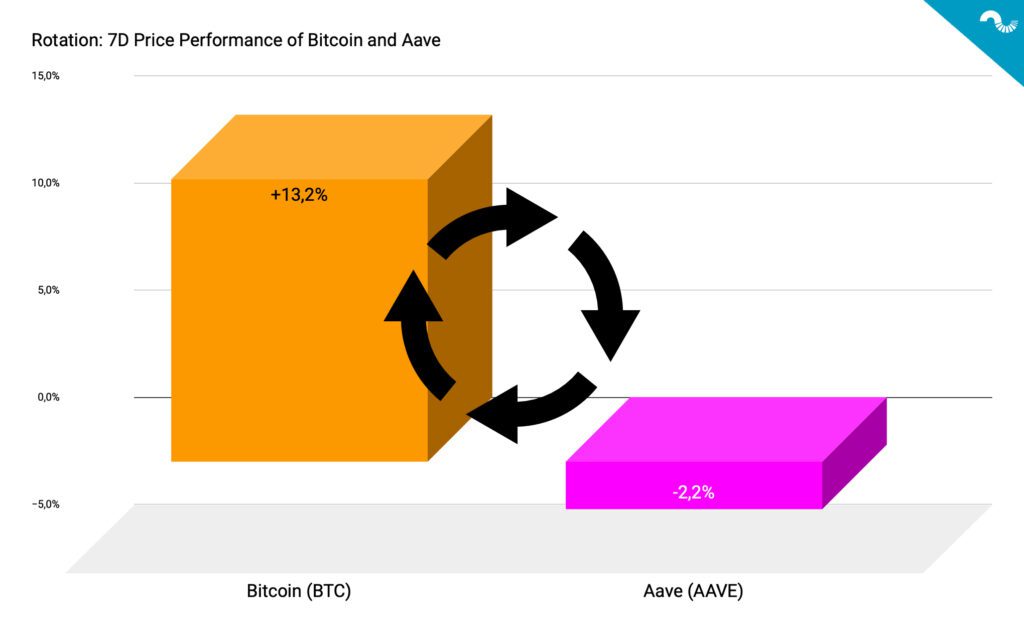

Rotation: Altcoins -> Bitcoin -> Altcoins?

The digital asset market is scaling fast, and we see an ever-increasing amount of new assets and tokens. In this quickly evolving market, one of the core concepts to understand is sector rotation. While bitcoin is the leading and dominating cryptocurrency, acting as the reserve asset, significantly younger DeFi tokens are not correlated with bitcoin. Depending on the market composition, money is constantly flowing between bitcoin and other digital assets.

This week’s price action was a prime example of sector rotation: As bitcoin ascended 13,2 percent, driven by ETF-related speculation, many small-cap DeFi tokens weakened substantially. Aave dropped -2,2% this week, showing an exceptionally low (or negative) correlation with bitcoin. As long as the market is driven by ETF speculation, bitcoin is a safe bet in a bigger time horizon. When bitcoin’s upside seems to be reached, smart investors will likely rotate to alternative digital assets.

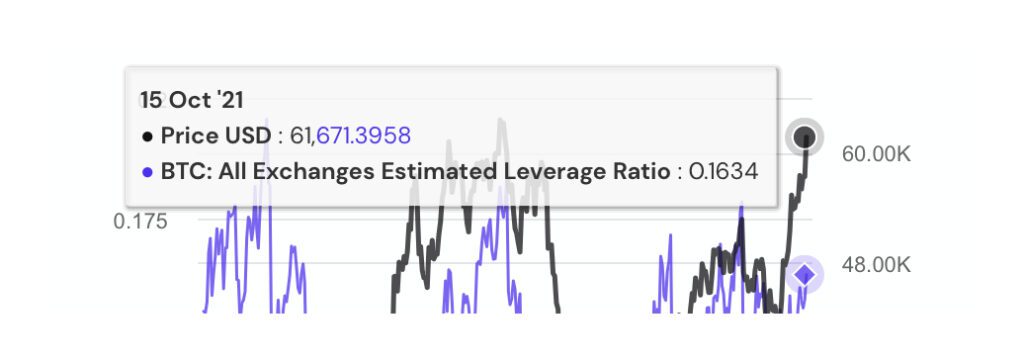

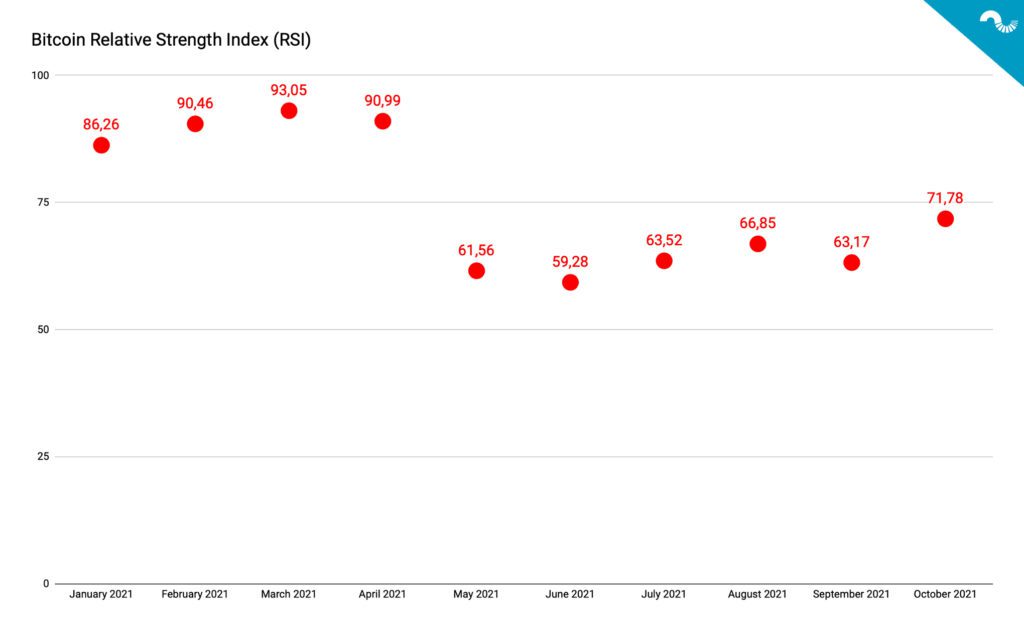

Bitcoin RSI and Estimated Leverage Ratio Growing

Bitcoin’s momentum indicator, relative strength index (RSI), is rising towards spring 2021 values again. IN MARCH, the RSI peaked, reaching 93,05 RSI and later dropped to 59,28, following May’s correction. The Relative Strength Index measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A low RSI (< 50) means the price action is negative in relation to the past 12 months, and a high RSI (> 50) mirrors positive PA in relation to 12 months. Vice versa. Spiking RSI in Q4 would indicate increasing upside for bitcoin.

Another relevant indicator, Exchanges Estimated Leverage Ratio (EELR), is climbing towards 2021 highs in correlation with BTCUSD. Bitcoin’s EELR is currently beyond 0,16, while the recent peak of 0,18 occurred in April. The last EELR highs happened right before May’s correction, although BTCUSD will possibly ascend to new ATHs. In summary, leveraged traders should be particularly cautious in the quickly shifting market environment.