The technical analysis of week 50 examines latest market action including Miner’s Position Index (MPI), exchanges, whales, and information asymmetry.

MPI Indicates No Significant Selling Pressure from Miners

Although bitcoin’s spot price has decreased -21,9 percent within the last 30 days, bitcoin’s underlying fundamentals are still looking robust. First of all the hashrate is close to all-time highs after recovering from China’s intervention on crypto mining during the last summer. Bitcoin’s hashrate has now completely exited China’s mainland after miners implemented their exodus to locations like North America, Kazakhstan, and Russia. The more diversified allocation of mining infrastructure is healthy for the Bitcoin ecosystem holistically.

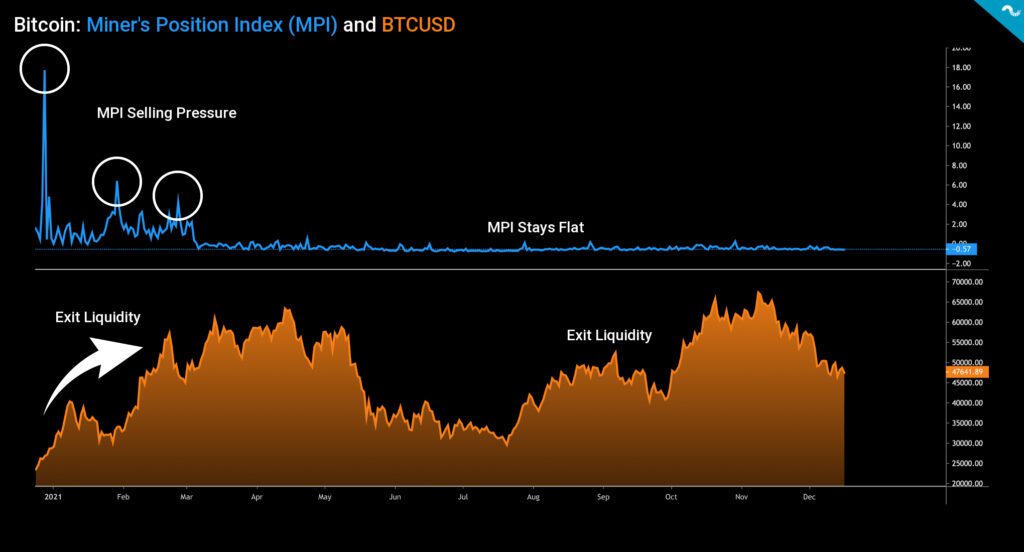

Another positive mining-related indicator for Bitcoin is MPI, or Miner’s Position Index. The MPI has been staying flat after an inflow of selling pressure in late 2020 and early 2021. As we know miners contribute heavily to ecosystem-related transactions and they mined over 400 000 native bitcoin units in 2020, equal to 16,7 billion euros. Miner’s Position Index uses 365 day moving average to address the average behavior of miners and the MPI is interpreted wit the following logic:

↑ High MPI: More Selling Pressure by Miners. Bearish.

↓ Low MPI: Less Selling Pressure by Miners. Bullish.

Mining operations generate significant costs and miners have a need to partially cover these costs by selling the bitcoin supply they mined. However miners also need a liquid market that can absorb the inflow of selling pressure, this is why we saw significant selling pressure in the bull cycle of early 2021 (exit liquidity). Miners also had another opportunity for exit liquidity as bitcoin spot price ascended from August to November. As a summary miners prefer to sell during bull trends in order to maximize liquidity. Huge amount of miner selling during a bear cycle would likely collapse bitcoin’s spot price and that would disrupt the miners themselves.

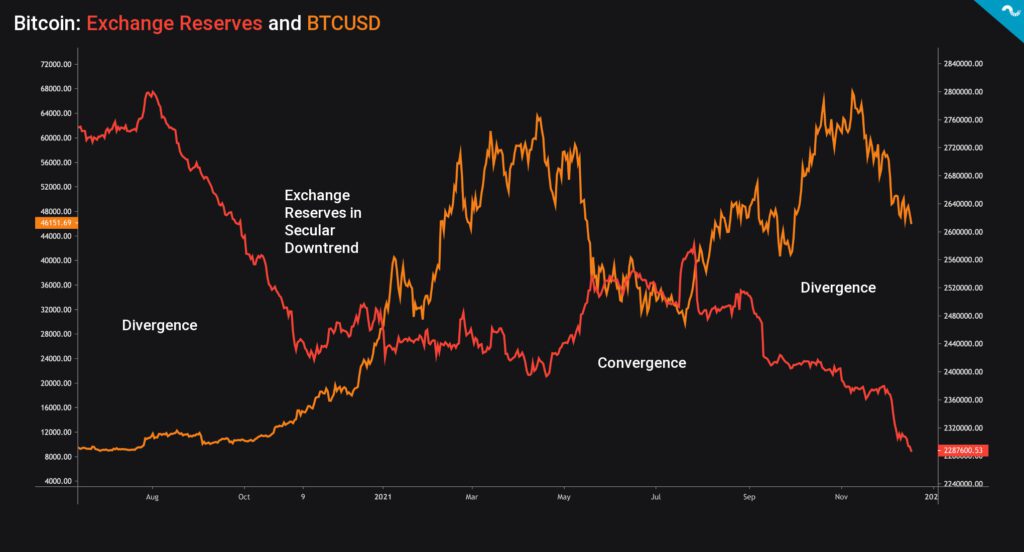

Exchange Reserves Following a Secular Downtrend

Bitcoin’s exchange reserves are still in decline, recording a new low of 2,29 million bitcoin units this week. Bitcoin’s reserves seem to be in a secular downtrend which originates from 2019’s market setting. The decreasing exchange reserves are a bullish sign to the market as they mirror the fund outflow towards cold storages. Significant reserve growth would be bearish and implicate more selling pressure.

↑ Growing Exchange Reserves: More Selling Pressure by Market Participants. Bearish.

↓ Declining Exchange Reserves: Less Selling Pressure by Market Participants. Bullish.

Bitcoin and Ethereum are both becoming increasingly scarce assets, particularly after Ethereum’s EIP-1559 update. The secular downtrend of exchange reserves is closely related to the increasing scarcity, as smart money prefers to hold their precious BTC and ETH units off-exchange.

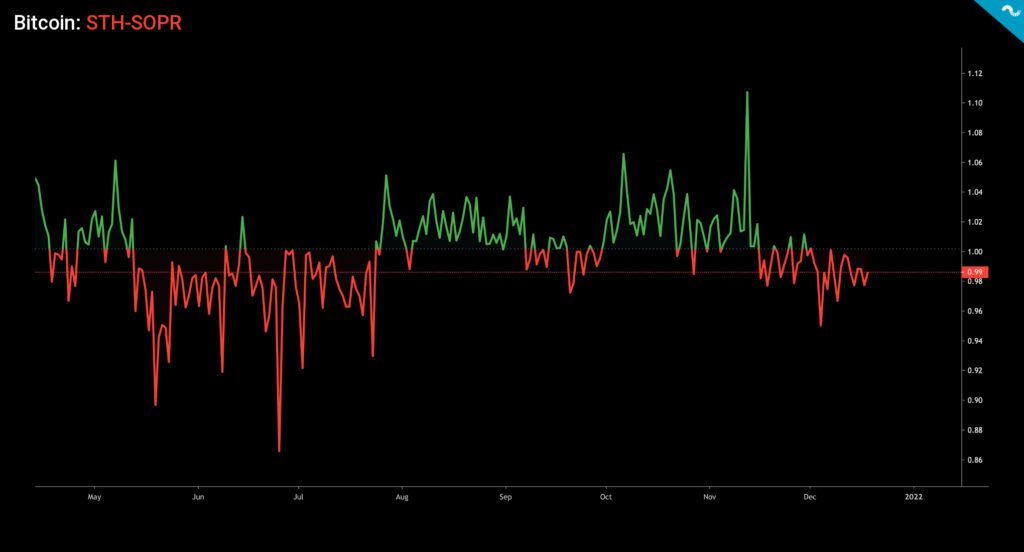

Short-Term Holders Selling at Loss

As explored in the TA of week 47, long-term holders (or HODLers) are showing much better performance than short-term investors. The following chart shows short-term holders taking deep losses during summer 2021 (June-July) and again in early December. The December’s STH-SOPR of 0,95 mirrors the biggest amount of losses taken by short-term holders since late July’s SOPR of 0,93.

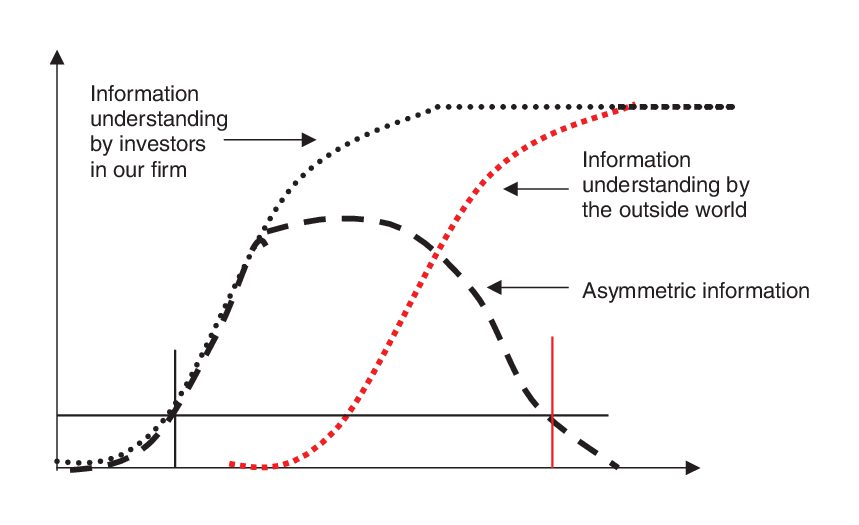

STH-SOPR, or short-term holder spent output ratio, only records the spent outputs that are younger than 155 days. Thus the STH-SOPR indicator mirrors the market behavior of investors who have recently entered the market. By a vast amount of historical data the long-term buy and hold strategy has been superior for Bitcoin investors. On a long enough time horizon Bitcoin can be seen to be in an infinite bull market. Investors or traders who implement short-term tactics are vulnerable to inherent market-related volatility. Additionally it’s hard for retail to compete with institutional investors due to asymmetric information.

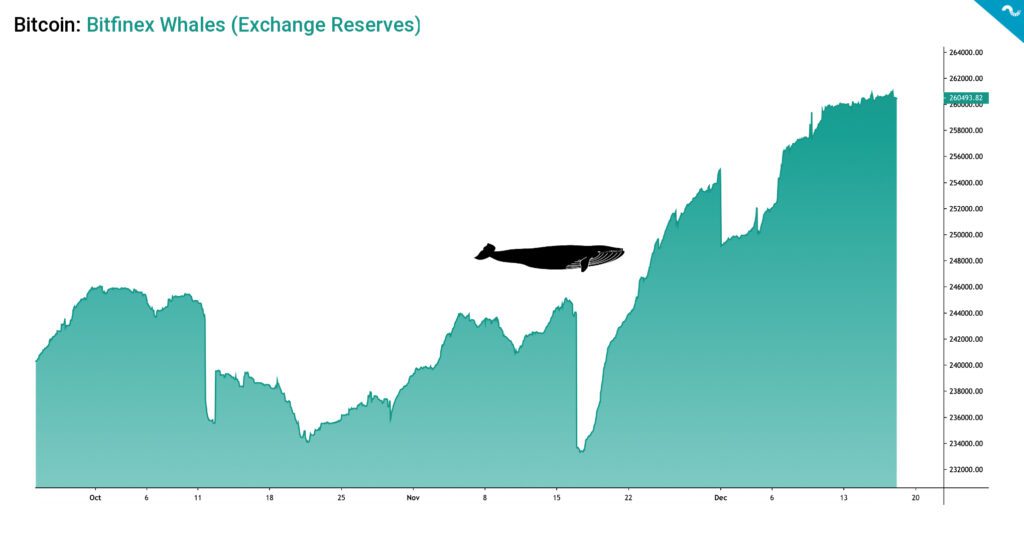

Bitfinex Whales on The Move, Selling Pressure from Asia

Bitcoin’s relatively poor price performance has been inversely correlated with an unprecedented amount of selling pressure from Asia. Bitcoins have been changing hands with Asia on the sell-side and Europe & US on the buy-side. Asian selling pressure might be stemming from the recent black swan event of Evergrande’s default. In addition to Evergrande the whole Chinese property sector seems increasingly risky and the local investors are de-risking to be on the safe side.