Last week’s biggest news was undoubtedly Tesla’s decision to invest $1.5 billion dollars in bitcoin. The electric car manufacturer and futuristic innovation company set a significant precedent, as such outstanding investments are rarely seen. On the other hand it was not completely unexpected, as Tesla and Bitcoin largely address the same crowd – namely young technology idealists.

However, Tesla’s move may only have opened the floodgates for a much bigger wave of institutional investors. At the same time other large-scale companies, banks, funds and other actors are competitively hoarding bitcoins. Bitcoin is quickly becoming mainstream for institutions.

For normal users this development is naturally nothing but welcome. First of all it means bitcoin’s price will rise and enrich both big and small investors. Secondly – and perhaps more importantly – it means politicians and decision-makers must update their stance on Bitcoin. When half of all banks and institutions start to hold bitcoins, prohibiting the asset is no longer a realistic chance for those disliking it. They must simply adapt.

This week we will also address other news related to institutiional investors – and there’s quite a bunch. Nearly every day some mega company. investment bank or hedge fund reports buying crypto for millions. We are certainly witnessing interesting times and a historical shift in the world of finance.

Last week’s news can be read here.

Tesla bought BTC for $1.5B

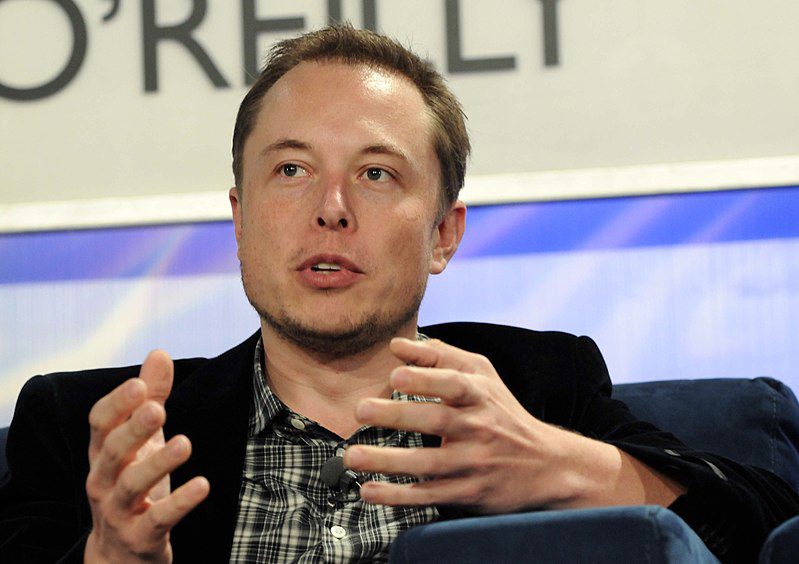

Electric car company Tesla, owned by the world’s richest man Elon Musk, has reported acquiring bitcoins for $1.5 billion dollars. Tesla made its historic purchase at the end of last month.

Tesla’s bitcoin acquisition did not come as a surprise to those having followed Elon Musk’s recent activity on Twitter. Musk had made several tweets about crypto-related matters in a positive light.

”Tesla’s recent move is significant, since Elon Musk now put his money where his mouth is. From this perspective the opening is very positive for the whole cryptocurrency sector,” Coinmotion’s CEO Heidi Hurskainen commented.

It is rather unlikely that Musk’s intention would be to only reap quick gains from cryptocurrencies. As the world’s richest man he has no need for such, and furthermore Musk’s own ideology favors Bitcoin’s long-term growth and use.

Institutional BTC hoarding may cause supply problem

Institutional investors are now holding around three percent of all circulating bitcoins, reveals blockchain data. 24 institutions have together amassed approximately 460 500 bitcoins, which at current prices amounts to roughly $22 billion dollars.

According to blockchain analyst Michael Novogratz, a continuation of this institutional hoarding may in the future lead to a scarcity problem on the markets. For investors such a scarcity would of course be beneficial, as the laws of supply and demand dictate bitcoin’s price would rise further in such a case.

Purchasing bitcoins has long been regarded a risky investment for institutions, but it now seems to have taken a turn toward mainstream. For institutions bitcoin functions as an excellent protection against fiat currency inflation and national financial politics.

Morgan Stanley considers crypto investing

US-based business bank Morgan Stanley considers investing in bitcoin, as reported by Bloomberg. The investment would be conducted by Counterpoint Global, an investing unit of Morgan Stanley.

However, before Morgan Stanley can execute its plans, it will require permission from both US policymakers and bank owners.

Morgan Stanley is not a completely new player on the crypto markets. The business bank owns approximately 11% of MicroStrategy, a company known for its heavy BTC investing.

PayPal expands crypto services internationally

Online paymen giant PayPal is expanding its crypto services outside the United States. The first outside the US to enjoy PayPal’s crypto payments will be the citizens of the United Kingdom.

At first PayPal will expand its crypto payments to UK-based Venmo users. Venmo is a smartphone app developed by PayPal, which has earlier enabled payments with traditional fiat currencies.

PayPal has earlier told that its long-term goal is to launch crypto payments globally. The UK is the first step toward realizing this goal.

Mastercard enables BTC payments

Payment card mammoth Mastercard has revealed plans to give merchants the option to receive direct payments in cryptocurrencies. Mastercard has not yet revealed what cryptocurrencies will be included in the system, but Bitcoin seems like a sure bet.

Mastercard has also earlier conducted crypto business through its collaboration with companies Wirex and Uphold. Customers of these companies have been able to acquire a Mastercard payment card, through which they could then pay with crypto. However, these differ from the company’s current plan in the sense that crypto has first been converted to fiat.

While implementing Bitcoin as part of Mastercard’s payment system seems logical, Coindesk’s sources still cast doubt on it. According to sources Mastercard is still weighing whether bitcoin is used enough for direct payments or whether it works better as a gold-like safe haven and investment instrument.

Deutsche Bank wants to provide crypto custody

Deutsche Bank, one of the world’s largest investment banks, intends to enter the crypto world. The bank now wants to provide its hedge fund customers different high-quality crypto services.

According to a report by the World Economic Forum, Deutsche Bank plans to develop “a fully integrated custody platform for institutional clients and their digital assets providing seamless connectivity to the broader cryptocurrency ecosystem”.

The report says the platform provided by the bank would not only enable trading cryptocurrencies and other digital ssets, but also an easy way for institutions to create their own crypto tokens and other utilities. Aside from crypto assets the platform could apparently be used to also administer fiat.

Deutsche Bank has already reported success in their initial tests. The service itself will be launched in stages, with the first ones set to be published during the upcoming year.