Hello there and welcome aboard again. This time we will provide you Coinmotion’s recent quarterly report detailing the feverish frenzy on the crypto markets. Indeed the end of last year saw explosive interest in Bitcoin, and that interest only seems to be growing despite some corrective movements along the way.

Additionally we will of course check out some of the most interesting news from the past week. This time the selection includes the United States Senate, which has been strengthened by the first senator openly announcing she both supports and owns cryptocurrencies.

In other news we have Twitter’s CEO concretely supporting the Bitcoin network by running a full node, Bitcoin’s growing power consumption as well as Nigerian police corruption hampering crypto exchanges in the country.

Last week’s news can be read here.

Coinmotion published Q4 report for 2020

Coinmotion has published its latest market report for the final quarter of 2020. The report analyzes the events of the past three months and how they might affect Bitcoin and the wider crypto markets this year.

The report deals with some of the most significant phenomena last year, such as bitcoin’s immense price rise. Last year bitcoin’s prise rose over 300%, which is quite an achievement even for this exceptional asset class.

The report also presents reasons for this rise, which include last year’s block reward halving leading to the number of new bitcoins being halved from before. Additionally the report investigates the growing institutional interest for bitcoin.

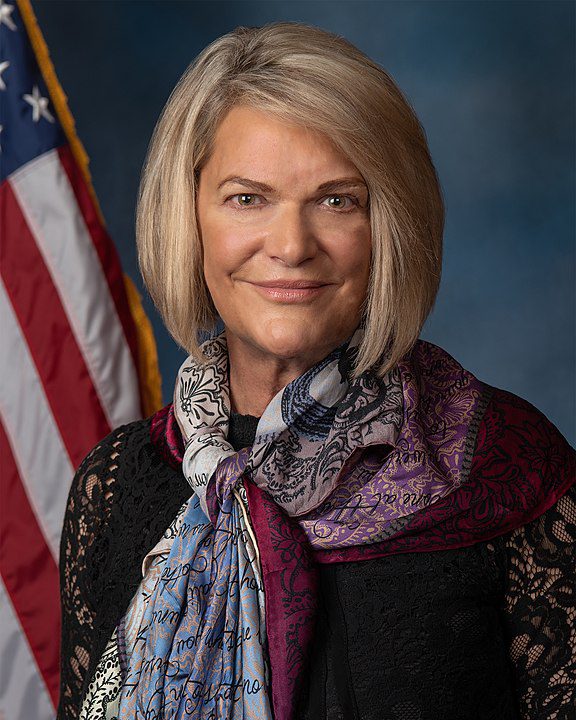

Crypto-holding senator joins US Banking Committee

Cynthia Lummis, the first senator to openly support and own bitcoins, has been assigned to the United States Senate Banking Committee. Lummis has already said she plans to educate her colleagues about the nature of cryptocurrencies and digital assets.

“Through my role on the Banking Committee, I hope to shine a light on many of these pioneering efforts and work with federal regulators to ensure that regulation of digital assets are structured to encourage innovation, instead of stifling it,” Lummis commented.

Lummis has actively spoken in favor of cryptocurrencies already before her assignment. According to her, bitcoin is an excellent safe haven against the dollar and other fiat currencies, since states and institutions cannot control it.

The addition of Lummis to the Banking Committee is naturally good news for Bitcoin users. If Lummis succeeds in her mission to guide other politicians in understanding crypto-related matters, it can also positively impact upcoming regulation of the industry.

Robinhood reopens crypto sales after market chaos

Stock and crypto trading app Robinhood has started reinstating its crypto services after being closed for a week. Robinhood removed an earlier announcement of halting crypto purchases and users have since reported successfully buying cryptocurrencies via the service.

Robinhood halted their crypto services at the end of last month in connection with the WallStreetBets market chaos. WallStreetBets is a Reddit group where so called “meme investors” discuss investing and plan their coordinated targets.

WallStreetBets gained attention after its users managed to multiply the value of GameStop and other stocks to unforeseen heights, while hedge funds short selling the stocks were struck with a severe blow.

After the GameStop incident, WallStreetBets started uplifting the price of cryptocurrency dogecoin, which Robinhood responded to by temporarily stopping crypto purchases. Dogecoin’s price has soared over 50% after Robinhood again enabled buying it through their app.

Bitcoin’s power consumption surges record high

Bitcoin’s growing price has also elevated the power consumption of the network to its highest level since the end of last year. The data is displayed by Digiconomist’s Bitcoin Energy Consumption Index.

Right now running the Bitcoin network is estimated to consume roughly 77.8 terawatt-hours (TWh) per year. For comparison, Finland consumes power approximately 86.1 TWh annually. In Germany the number is around 524 TWh per year and in China 7 225 TWh per year.

The Bitcoin network does not use energy unnecessarily, as the power consumption ensures the safety of the whole network. The network also consumes notably less power compared to larger energy guzzlers. According to Michel Rauchs, a researcher at the Cambridge Centre for Alternative Finance, the wasted energy of idle home devices such as microwaves could power the whole Bitcoin network for two years.

Nigerian central bank curbs crypto exchanges

The Central Bank of Nigeria has prohibited all financial institutions to provide services to crypto exchanges in the country. The bank has reasoned the ban with risks related to cryptocurrencies, such as money laundering, terrorism financing and other dangerous concepts.

As an extension of its ban, the bank has also demanded all business banks to close accounts belonging to crypto exchanges or other related services. The central bank has announced severe sanctions may be imposed on those violating the ban.

Cryptocurrencies have been popular in Nigeria already for years. However, they gained even wider mainstream awareness during last year’s protests. In October Nigeria saw several demonstrations against police violence and corruption. The central bank responed to this by closing all traditional bank accounts of identified protesters, which in turn made the movement turn to bitcoin and crypto donations.

Twitter CEO started running Bitcoin full node

Last Friday on the 5th of February, Twitter CEO Jack Dorsey sent a simple tweet reading “running Bitcoin”. With the tweet Dorsey revealed he had set up a Bitcoin full node.

Full nodes refers to Bitcoin nodes containing the entire Bitcoin blockchain while sharing it to other nodes and users. Full nodes are imperative for the decentralization of Bitcoin.

The tweet was also a reference to the first time Twitter ever heard of Bitcoin. In 2009 computer scientist Hal Finney had just received the first BTC transaction from Bitcoin developer Satoshi Nakamoto, whereafter he sent a tweet identical to the one Dorsey mirrored on Friday.

In essence, any willing participant can start running a Bitcoin full node. Maintaining and running a full node is easiest by downloading Bitcoin’s reference program Bitcoin Core and letting it validate the whole blockchain.