Summers is on its way to Finland and the rest of the Northern Hemisphere. There can now be days featuring drifts of snow while the sun glows hot, reflecting the violent swings of cryptocurrency prices.

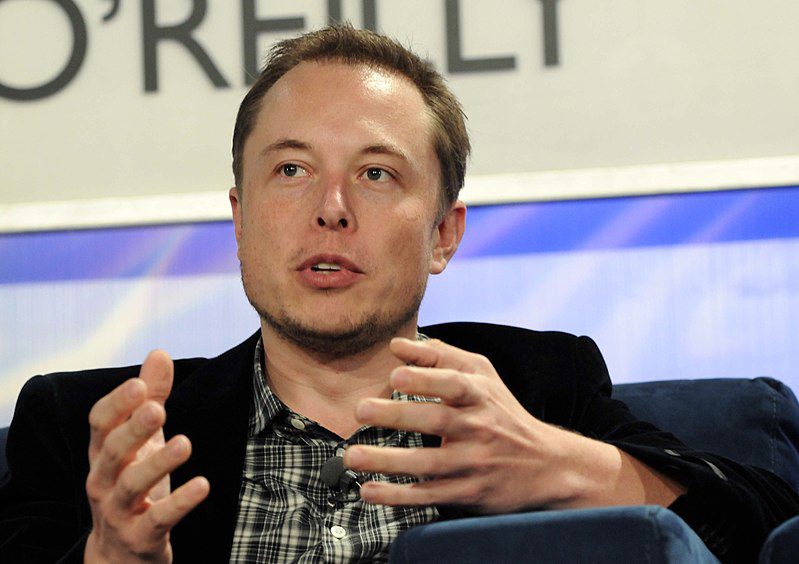

In the past week electric car giant Tesla decided to inform they will no longer sell cars for bitcoins. This startled the markets temporarily out of fear that the world’s wealthiest man no longer digs cryptocurrencies. This is, of course, not the case, but Tesla rather wants to wait for a future in which crypto mining becomes more ecological.

Another giant company, MicroStrategy, is in turn unshaken by Tesla’s decision and shining sun on the snow. The large institutional bitcoin investor has only added steam to its engines and decided to stock up more cryptocurrencies. And even that move is unlikely to remain the last.

This week we will talk more about both of these big decisions. In other news we have the central bank of England, which wants its own digital currency to combat stablecoins, as well as a Bitcoin race car driving faster than NASCAR’s Dogecoin vehicle.

The previous news archive can be found here.

Tesla no longer sells cars for bitcoins

Electric car manufacturer Tesla has stopped selling cars for bitcoins. Tesla’s founder and CEO Elon Musk reported the news on Twitter. The decision came only a month after Tesla originally started accepting bitcoins.

Musk motivated the decision by referring to Bitcoin’s carbon footprint. According to him Bitcoin mining is currently done excessively with electricity from hard coal, whereby mining can for now not be regarded sustainable.

“Cryptocurrency is a good idea on many levels and we believe it has a promising future, but this cannot come at great cost to the environment,” Musk commented on Twitter.

Musk nonetheless still expressed his belief in Bitcoin and its future. According to Musk, Tesla will not sell bitcoins already in its possession, and the company will also use it in the future once a larger share of mining moves to renewable forms of energy.

MicroStrategy buys more bitcoins

Company analysis and mobile platform company MicroStrategy is growing its crypto position. The compant recently announced buying $15 million dollars worth of BTC in addition to its earlier holdings.

During the first quarter of the year the company acquired 20 000 bitcoins. According to the company’s CEO Michael Saylor, the latest buy leaves the company with over 90 000 bitcoins.

Saylor commented that the results from the first quarter of the year clearly demonstrate that bitcoin acquisitions have brought notable additional value to shareholders.

MicroStrategy is the largest independent business analysis company on indendent stock markets in the United States.

The number of BTC whales is falling

The number of Bitcoin whales seems to be taking a downward turn, shows data by blockchain analysis firm GlassNode. The number of whale wallets has fallen roughly 16% since February.

Whale wallets refer to Bitcoin wallets containing more than 1 000 BTC. In May there were only slightly more than 2 100 such wallets, while the number was up at nearly 2 500 in February.

The falling number of whale wallets and simultaneous growth of users indicates owning bitcoins is stabilizing. Earlier there were few owners, but every owner had a relatively larger number of bitcoins. Nowadays there is a much larger number of owners, but their average BTC holdings are smaller.

This appears to be a sign that Bitcoin is turning into an increasingly everyday thing instead of being only a tool for few large owners.

Ethereum’s market cap is growing

The market capitalization of Ethereum’s native crypto ether has grown significantly in the past year. At the same time Bitcoin’s dominance on the markets has decreased.

At the moment ether already forms 19.2% of the market cap of all cryptocurrencies. Bitcoin’s market cap in turn has already decreased to 40,7%. In other words ether has doubled its percentual share of the market cap of all cryptocurrencies within the past year.

Ethereum’s growing market cap can be explained among other things by the use of Ethereum’s blockchain for different DeFi projects and alternative crypto. Many DeFi projects and alternative cryptocurrencies are built on Ethereum’s blockchain, whereby Ethereum tokens have increasing demand.

If Ethereum’s use in future DeFi projects remains strong, ether’s market cap can continue growing even further.

UK digital pound seems likely

The central bank of England will probably publish its own digital currency. Sir Jon Cunliffe, the central bank’s deputy governor for financial stability, says the state must publish some kind of digital currency in order to maintain the trust of citizens in public money.

According to Cunliffe, developing such a digital currency is important in order for consumers not to get “locked into private money”. Cunliffe asserts that current fiat-bound digital currencies give consumers more use features and lower costs than traditional banks. The state must answer to this challenge by creating its own digital currency, with features capable of competing with private digital currencies.

The central bank has earlier published a report paper weighing different options for the central bank’s own digital currency. Additionally the central bank has founded a task force to study the possibilities of digital currencies.

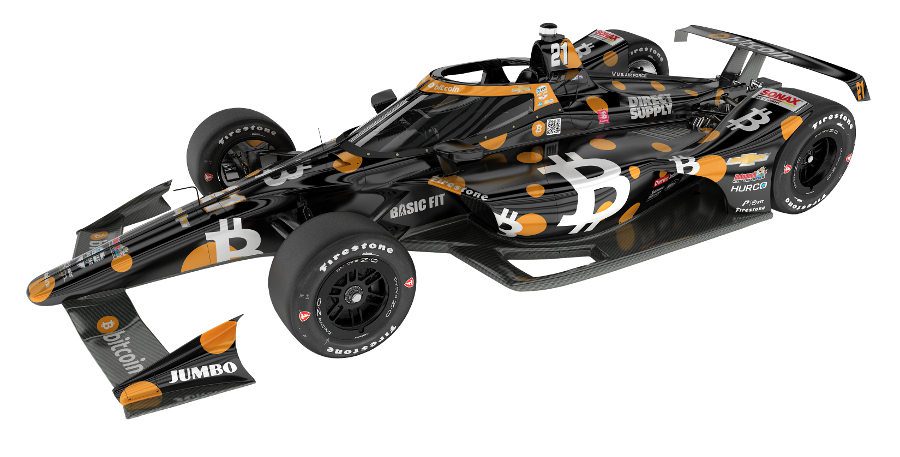

Bitcoin is getting its own race car

Bitcoin is getting its own race car for the legendary Indianapolis 500 race. Bitcoin hobbyist Ed Carpenter decided to abandon all traditional sponsors and instead decorate his car only with Bitcoin graphics.

“I don’t want to race for chips or beer this year. I’ve worked my entire life to race at the Indy 500 and have earned the platform that I have, and this year, I want to find a way to incorporate Bitcoin,” Carpenter said.

Carpenter and crypto company Zap’s CEO Jack Mallers are using the visibility of the car to collect donations from crypto users. They have informed that 70% of all donations will be used to develop open code Bitcoin development. The rest of the profits will be given to different Indianapolis charities and to cover the costs of the car.

The Bitcoin car is not the first crypto racer. The Dogecoin community has earlier funded its own Doge car for the NASCAR race, which was decorated with pictures of the famous shiba inu dog.

“In a world of potato chip and energy drinks sponsors, Ed chose to race for human freedom, financial literacy, financial inclusivity, savings technology, and Bitcoin open-source development,” commented Peter McCormack from the What Bitcoin Did podcast.