This new 11-part series is designed for beginners who want to invest in cryptocurrencies but need more information before taking the plunge. Our goal is to provide clear and concise explanations of the fundamental concepts in the world of cryptocurrencies.

Over the following weeks, we’ll publish a weekly lesson covering one topic regarding investing in cryptocurrencies. Each lesson will take less than 5 minutes to read. At the end of the course, you will better understand how to invest in cryptocurrencies, what to invest in, and when is the right time to do it.

Have you ever wondered what drives the crypto prices and bubbles and how they can be so volatile? You’re not alone. In this week’s lesson, we will share key insights into the factors that impact the value of cryptocurrencies and their market cycles. So, grab a cup of coffee and dive right in.

First, let’s talk about the core driving force behind the value of any financial asset, including cryptocurrencies: supply and demand. The basic principle of economics governs the price of every tradable asset. However, there’s more to this story than just supply and demand. Factors such as the state of the economy, market capitalization, market sentiment, and recent news can influence cryptocurrencies’ value.

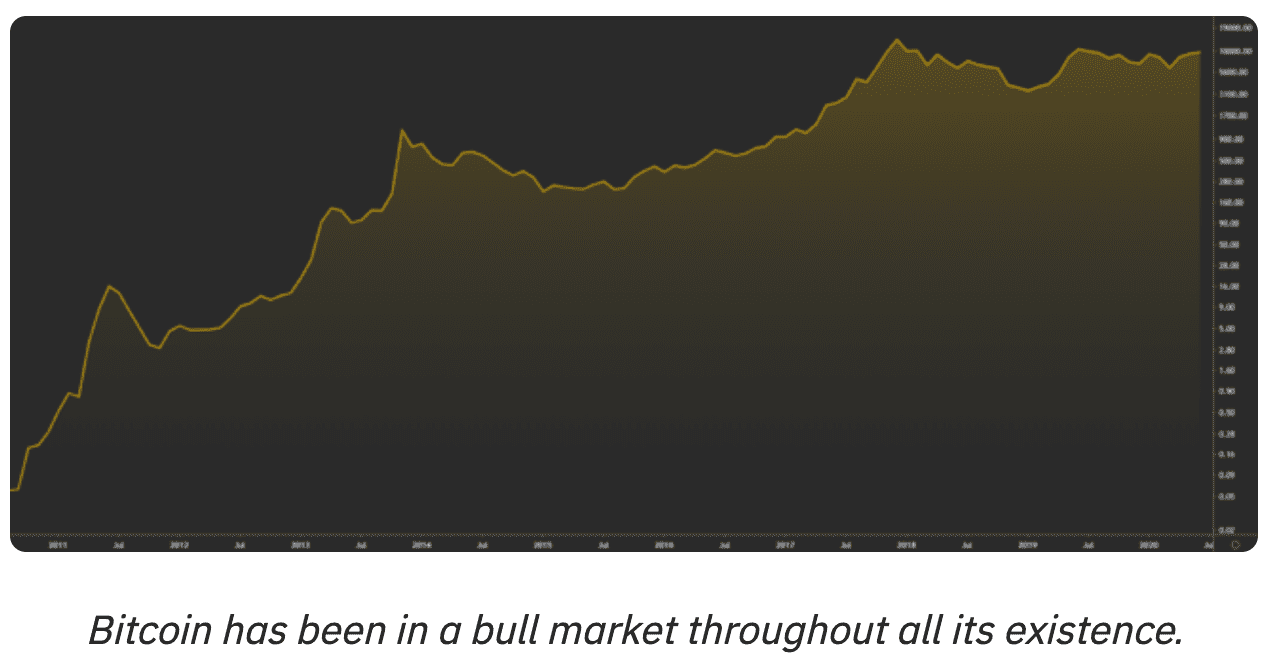

Now, let’s shift gears and talk about market cycles. A market cycle is a period of expansion and contraction that all markets, including crypto, go through. During an expansion phase (a bull market), the market is driven by optimism, belief, and greed. These emotions fuel vigorous buying activity, leading to higher prices.

Interestingly, there’s a cyclical effect in play during market cycles. As prices increase, the sentiment becomes more positive, driving the market even higher. Sometimes, this cycle of greed and belief can lead to a financial bubble. Investors can become irrational, buying assets solely because they believe the market will continue to rise, ultimately creating a local top – the point of maximum financial risk.

After reaching the local top, the market may enter the distribution stage, where assets are gradually sold, and the market moves sideways. Sometimes, the downtrend starts soon after reaching the top without a precise distribution stage.

When the market starts to decline, euphoria quickly turns to complacency, and as prices continue to fall, market sentiment turns negative. Feelings of anxiety, denial, and panic often accompany this negativity.

Anxiety is the initial reaction when investors question why prices drop, which soon leads to denial. During the denial stage, many investors hold onto their losing positions, insisting that “it’s too late to sell” or “the market will come back soon.”

However, as prices continue to fall, fear and panic take over, causing a market capitulation (when holders give up and sell their assets near the local bottom). The downtrend eventually stops, volatility decreases, and the market stabilizes. This stabilization is followed by a period of sideways movement, known as the accumulation stage before hope and optimism rise again.

So, there you have it. A deep dive into the factors that drive the crypto markets and the market cycles they experience. Understanding these concepts can help you navigate the world of cryptocurrencies more confidently and make better-informed decisions regarding your investments.

Remember to stay patient and keep a long-term perspective during market cycles. Emotions can run high, but being aware of these cycles and staying grounded can help you avoid making impulsive decisions that might not align with your investment strategy.

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.