The technical analysis of week four dives into views of industry-leading analysts Lyn Alden and Luke Gromen. Additionally we explore metrics like Relative Strength Index, Exchange Whale Ratio, and interpret Grayscale’s dropping premium.

What Analysts Say About The Market?

Bitcoin and other cryptoassets rebounded this week after experiencing significant weakness between November 2021 highs and January 2022 lows. Bitcoin has climbed 8,3 percent within last seven days, while Ethereum ascended 8,7%. The performance among altcoins has been divergent: Assets like Aave only climbed 5,5% following Bitcoin, while the DeFi platform Avalanche (AVAX) strengthened almost 20%.

7D Spot Price Performance:

Bitcoin (BTC): +8,3%

Ethereum (ETH): +8.7%

Aave (AAVE): +5,5%

Lyn Alden

So what are analysts saying about the market? Lyn Alden remarks that on-chain indicators are still neutral to bullish. Like assessed in the TA of week 2, whales are currently in re-accumulation mode and increasing their holdings. Whales, or bitcoin holders with at least 1000 native units, have a tendency to front-run retail investors and buy cheap coins whenever possible.

Bitcoin’s hashrate is still close to all-time highs, mirroring the miners’ dedication towards Bitcoin network. The combined exchange reserves are in secular downtrend, reaching 2,36 million coins recently. Bitcoin’s active addresses are at 800K level, which is close to November 2021 zone.

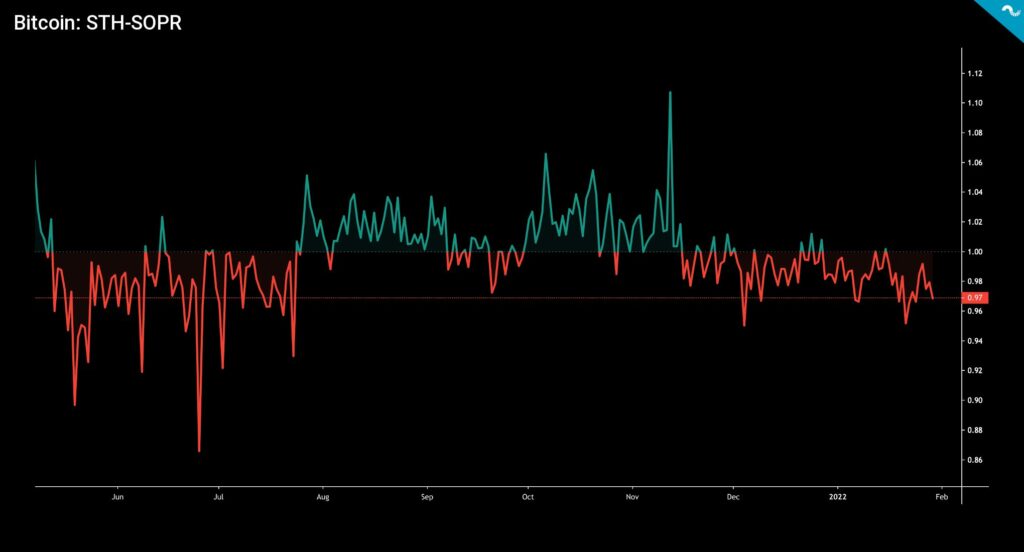

Lyn Alden additionally mentions that bitcoin’s spot price BTCUSD shows signs of capitulation after weakening almost -50 percent from November all-time highs. Bitcoin’s Spent Output Profit Ratio supports Alden’s thesis, as short term holders (STH-SOPR) have been accumulating losses since late November. As they say, the blood is on the streets. However the greater macro environment also affects Bitcoin and Fed’s tapering will likely play a role in spot price trajectory. Bitcoin has been correlated with S&P 500 Index and particularly with technology-related stocks, although a decoupling event might easily occur.

Luke Gromen

Macroeconomic researcher Luke Gromen sees bitcoin as a inflation hedge vis-à-vis gold, when governments need to inflate their way out of COVID-19 crisis. Gromen sees Bitcoin market as overleveraged, but believes in the long-term prospect of the asset. He has previously forecasted that Bitcoin’s market cap will surpass gold, and that Bitcoin might eventually disrupt the U.S. bond market.

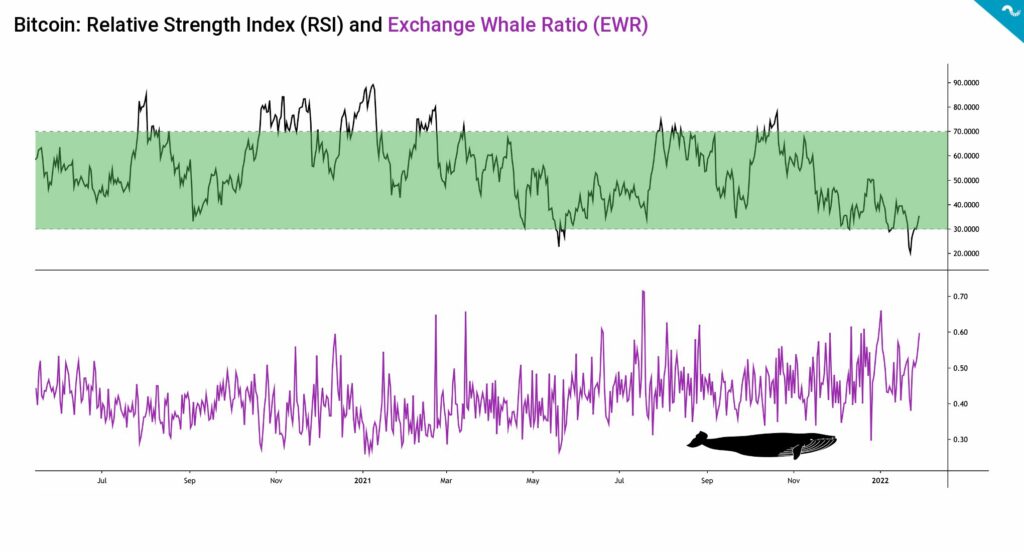

Bitcoin’s Relative Strength Index Rebounds on Level 20, Exchange Whale Ratio Rising

Relative Strength Index (RSI), one of the most popular technical indicators for bitcoin, showed the asset being oversold amid sell-offs of early 2022. Bitcoin’s RSI even briefly touched level 20, which has not been breached since March 2020. RSI would indicate a major buying opportunity for bitcoin, as the asset seems to be more oversold than in May 2021.

Relative Strength Index > 70: Overbought Bitcoin

Relative Strength Index < 30: Oversold Bitcoin

While bitcoin’s retail cohort remains cautious the Exchange Whale Ratio (EWR) is increasing, indicating that the big players are buying the dip.

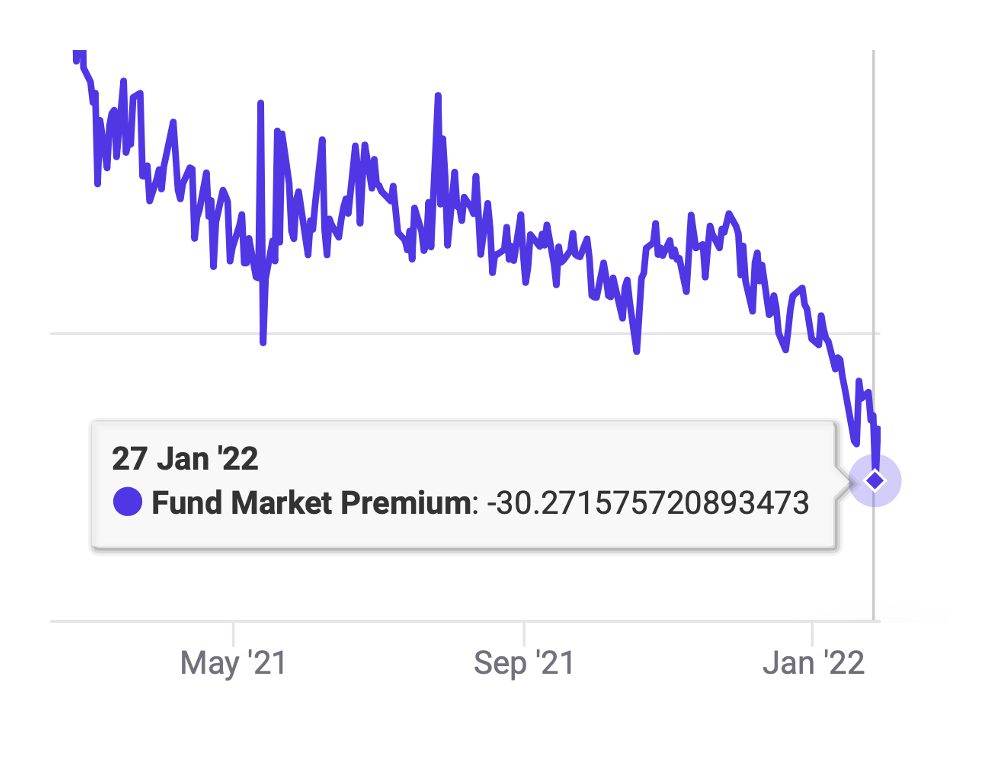

Grayscale GBTC Premium at a Record Low. Threat or Opportunity?

The premium, or should we say discount, of Grayscale’s Bitcoin Trust (GBTC) dropped to a record low of -30,27 percent on January 27th. The premium used to be exceptionally high, peaking at 132,6% during May 2017, however it plunged into negative territory in February 2021. The GBTC premium used to be a favourite instrument for Grayscale’s hedge fund clients, as they used it for arbitrage trades.

While the negative premium certainly looks bad, could it also include a speculative opportunity? Grayscale is planning to convert GBTC into a spot ETF and in that form the fund would lose its premium or discount. This all means that a cunning investor could buy GBTC shares now with -30% price cut and profit later by the ETF listing. Obviously in this blue sky scenario we assume that the spot ETF will be approved in foreseeable future, ceteris paribus.