TA for the second week of 2022 focuses on Ethereum’s post-upgrade scarcity, whale re-accumulation, Death Cross pattern, and the possibility of an emerging altseason.

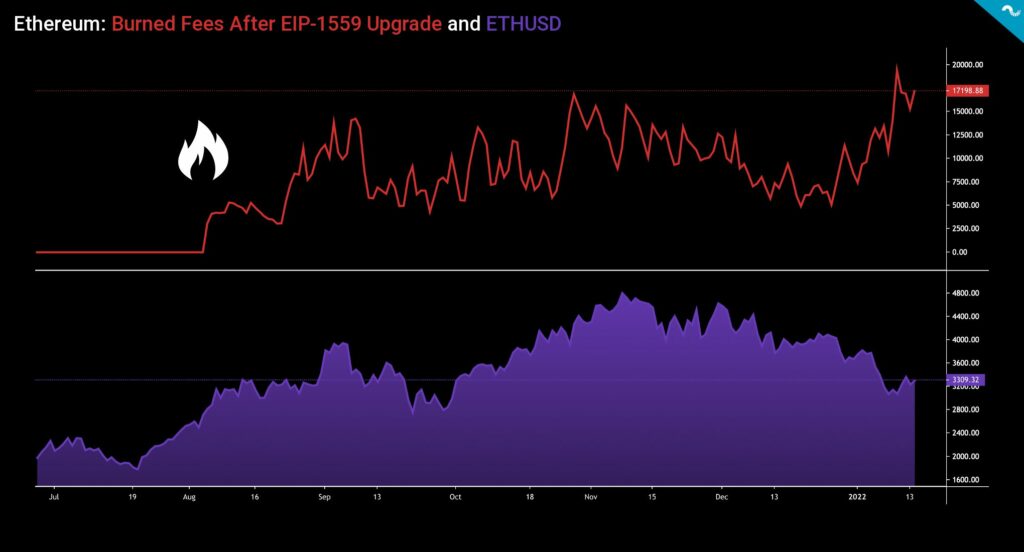

Burned Ethereum Fees Reach The Highest Point After EIP-1559 Upgrade

As Vitalik Buterin and his companions were launching Ethereum in 2015, the main thesis was to build a “world computer”. Vitalik’s platform has evolved radically since early days and first “Frontier” protocol version, rising to current market capitalization of almost $400 billion. Ethereum has also changed its development course over time, the latest narrative points towards scarcity and “ultra-sound money“. The limited supply seems to follow Bitcoin’s footsteps in digital scarcity, which is a smart choice in long-term horizon.

The said increasing digital scarcity was successfully implemented with the EIP-1559 upgrade that fundamentally changed Ethereum’s structure. The protocol-level EIP-1559 hard fork focused on making the network more scarce and lowering transaction costs. The Ethereum network is being rendered more scarce by digitally burning transaction base fees, significantly reducing the supply. Consequently Ethereum’s supply is expected to peak during late March or early April of 2022 at 118,4 million Ether units. As the embedded chart shows, the total amount of burned Ethereum fees reached 19 424,89 ETH in early weeks of 2022, marking an all-time high.

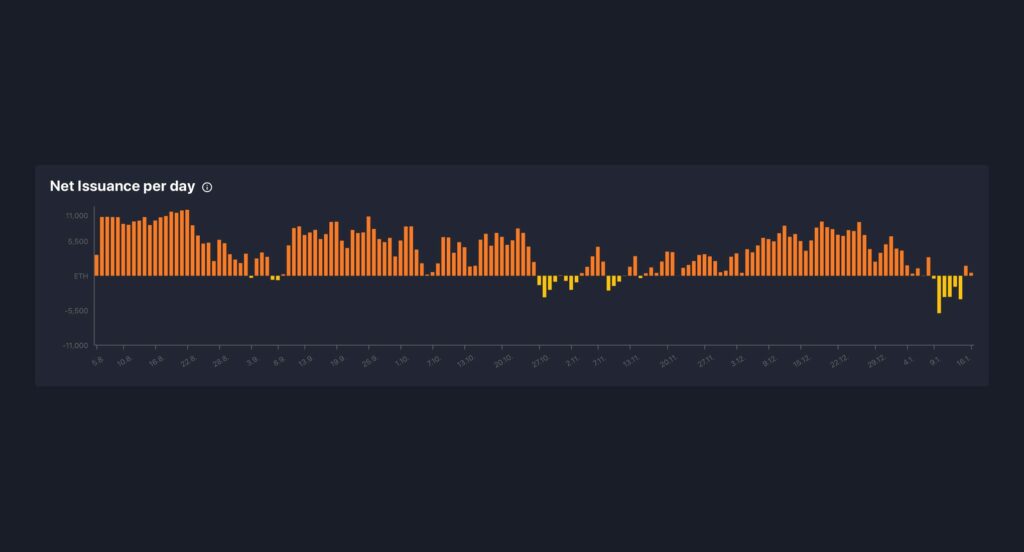

The following chart shows Ethereum’s net issuance per day dropping into negative territory, falling as low as -5941,38 ETH issued on 10th January. Ethereum was historically minted at a fixed rate of around two ETH per block, creating a yearly inflation rate of 4 percent. With the current state of affairs, Ethereum’s supply is significantly reduced and it’s becoming deflationary. The secular downtrend of Ethereum’s exchange reserves is aligned with this setting, as smart money moves their scarce Ethereum units into long-term cold storage.

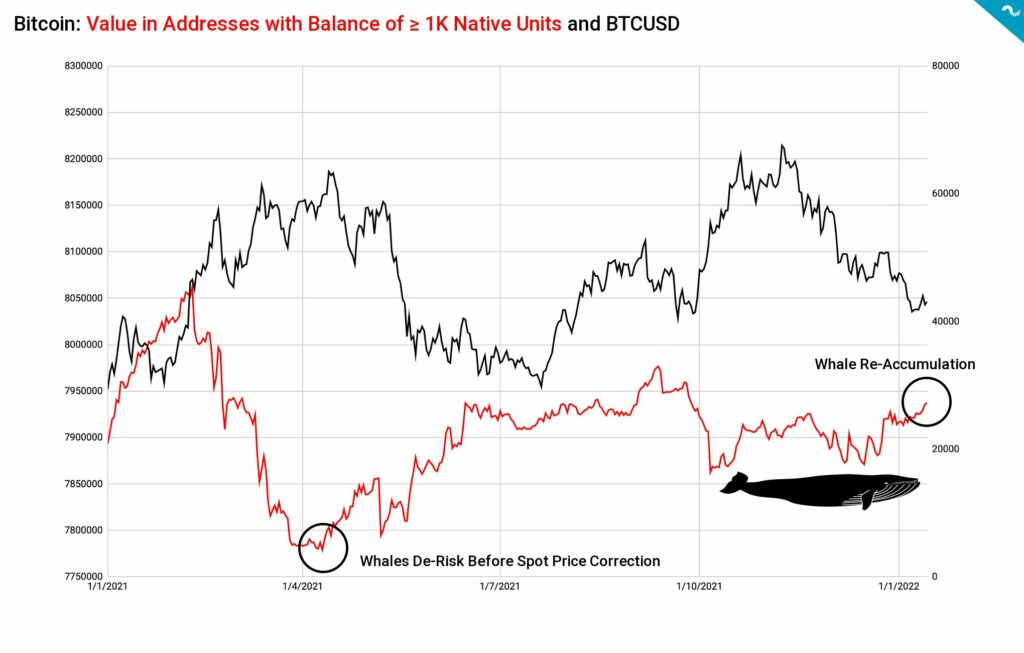

Whales in Re-Accumulation Mode

As we know the crypto asset markets are heavily influenced by whales, who by the common definition own at least 1000 native bitcoin units. Whales are known to make smart entries and exits compared with the retail investor segment and many analysts try to interpret their behavior. Especially the Bitfinex whales have been active recently.

Looking back at the year 2021, whale activity heavily increased in the parabolic spot price advance of quarter one (Q1). The amount of native bitcoin units in whale addresses peaked in early February 2021 at 8,06 million BTC. Then the whales started a sudden de-risk campaign, reducing their exposure to 7,78 million units in mid-April. This means that whales front-runned retail again and anticipated the overheated market and subsequent correction in May. The whales de-risked well before May’s huge spot correction.

The whales started to accumulate against the falling spot price during summer of 2021 and continued buys until late September. In early October whales de-risked mildly and have continued to buy again in early weeks of 2022. Whales are currently in risk-on mode, despite the weakening (or stagnant) spot price.

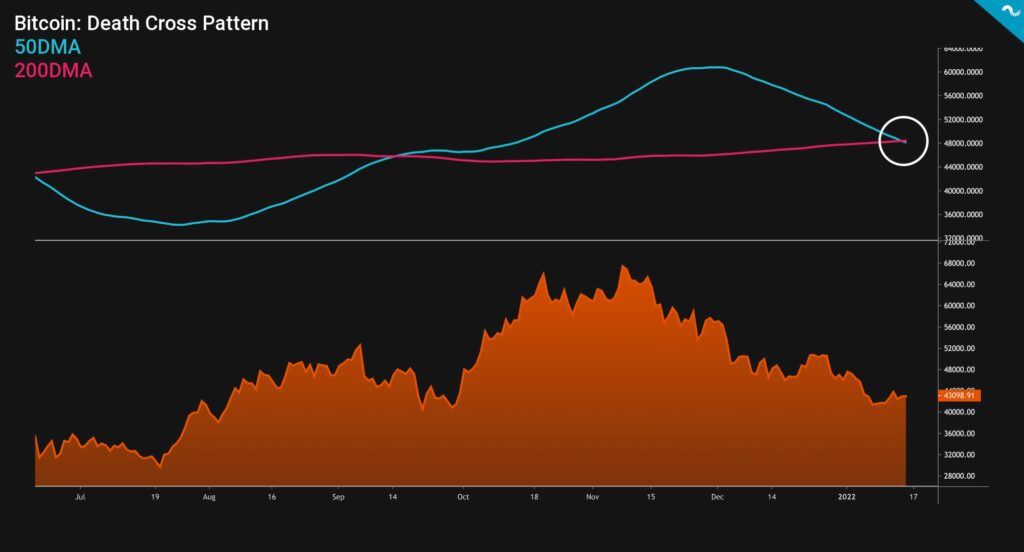

Death Cross

Like forecasted in the technical analysis of 52/2021, bitcoin reached a technical “Death Cross” pattern on 13th of January. The Death Cross setting didn’t generate immediate selling pressure, however bitcoin’s declining spot price has been correlated with 50DMA’s downward curve since late November. Some analysts say that Death Cross is a lagging indicator and this might be true, however the 50DMA approaching 200DMA from above warns traders about incoming correction.

As the name suggests, Golden Cross indicates bullish market sentiment and Death Cross bearish sentiment, vice versa. The both indicators use 50 day moving average (50DMA) and 200 day moving average (200DMA). Death Cross occurs when 50DMA crosses 200DMA to the downside = bearish. Golden Cross occurs when 50DMA crosses 200DMA to the upside = bullish.

↑ Golden Cross: 50DMA Crosses 200DMA to The Upside

↓ Death Cross: 50DMA Crossed 200DMA to The Downside

A Possible Altseason?

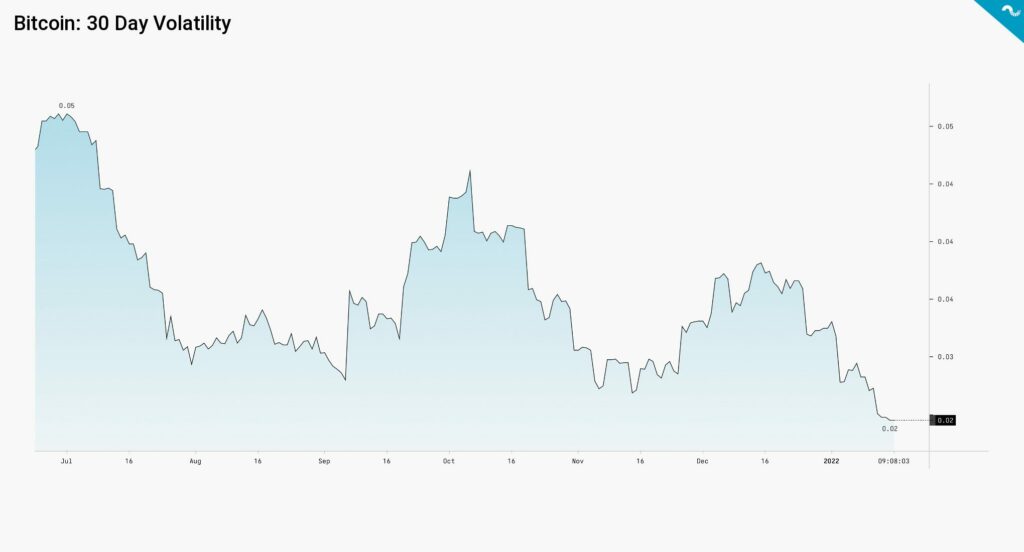

Looking at bitcoin’s volatility data, the volatility has been decreasing from July’s 30 day volatility peak of 0,05 to current 0,02. This -60 percent decrease in volatility indicates a calmer price action for bitcoin and might create a fertile ground for altcoins. The altcoins have a tendency to perform well in an environment of bitcoin’s sideways price action. The decreasing volatility of bitcoin can act as a catalyst to a new altseason in 2022 quarters one and two.