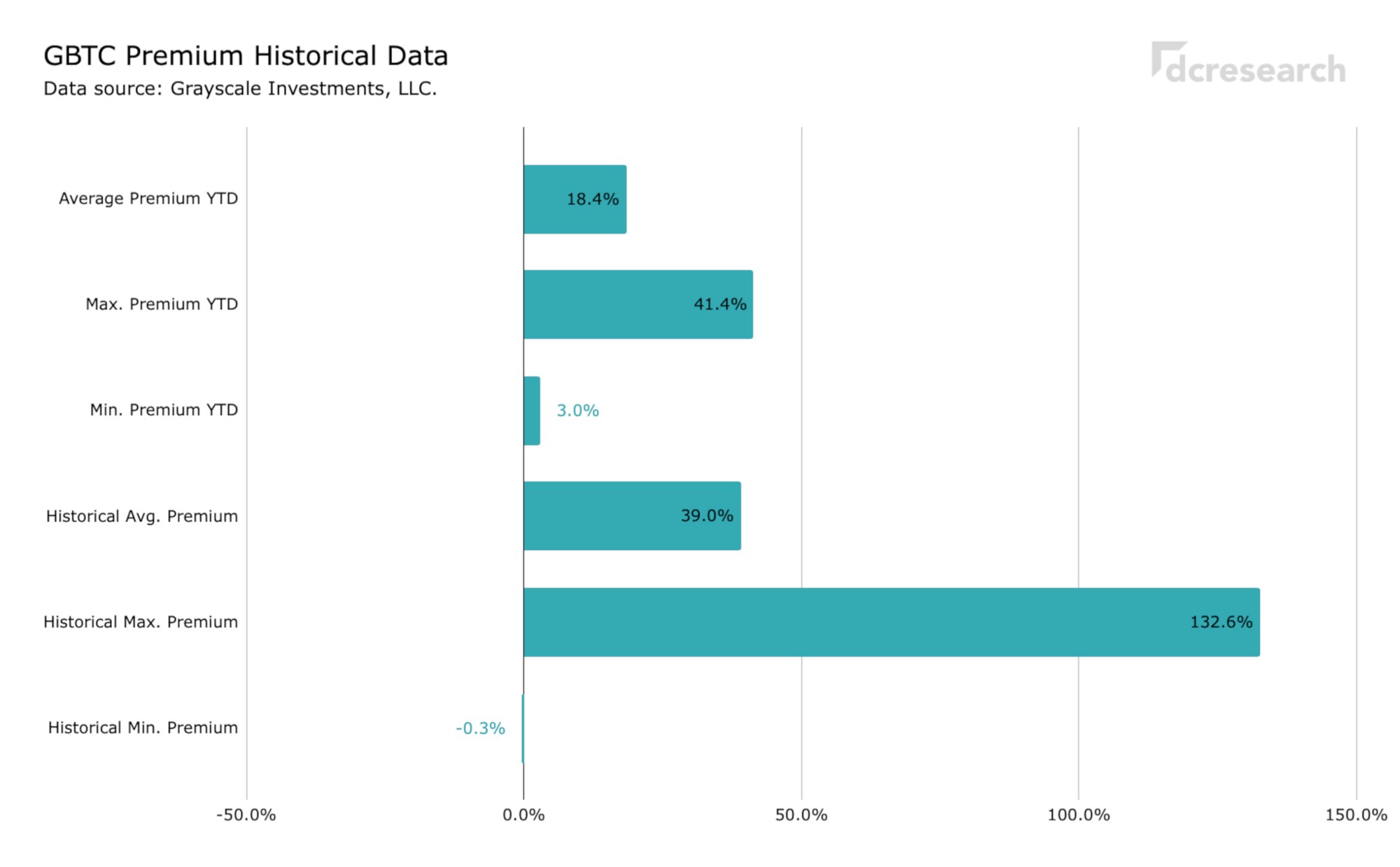

Arguably the most widely known investment product of digital asset industry, Grayscale’s Bitcoin Trust (ticker: GBTC), has evolved into the de facto indicator of bitcoin’s market sentiment. One of the most interesting aspects of GBTC has been its premium over bitcoin’s price, exceeding 132,6 percent in late May 2017.

“The premium is the amount you’re willing to pay to not custody your own private key, and still get exposure to the underlying asset.” – Ryan Alfred

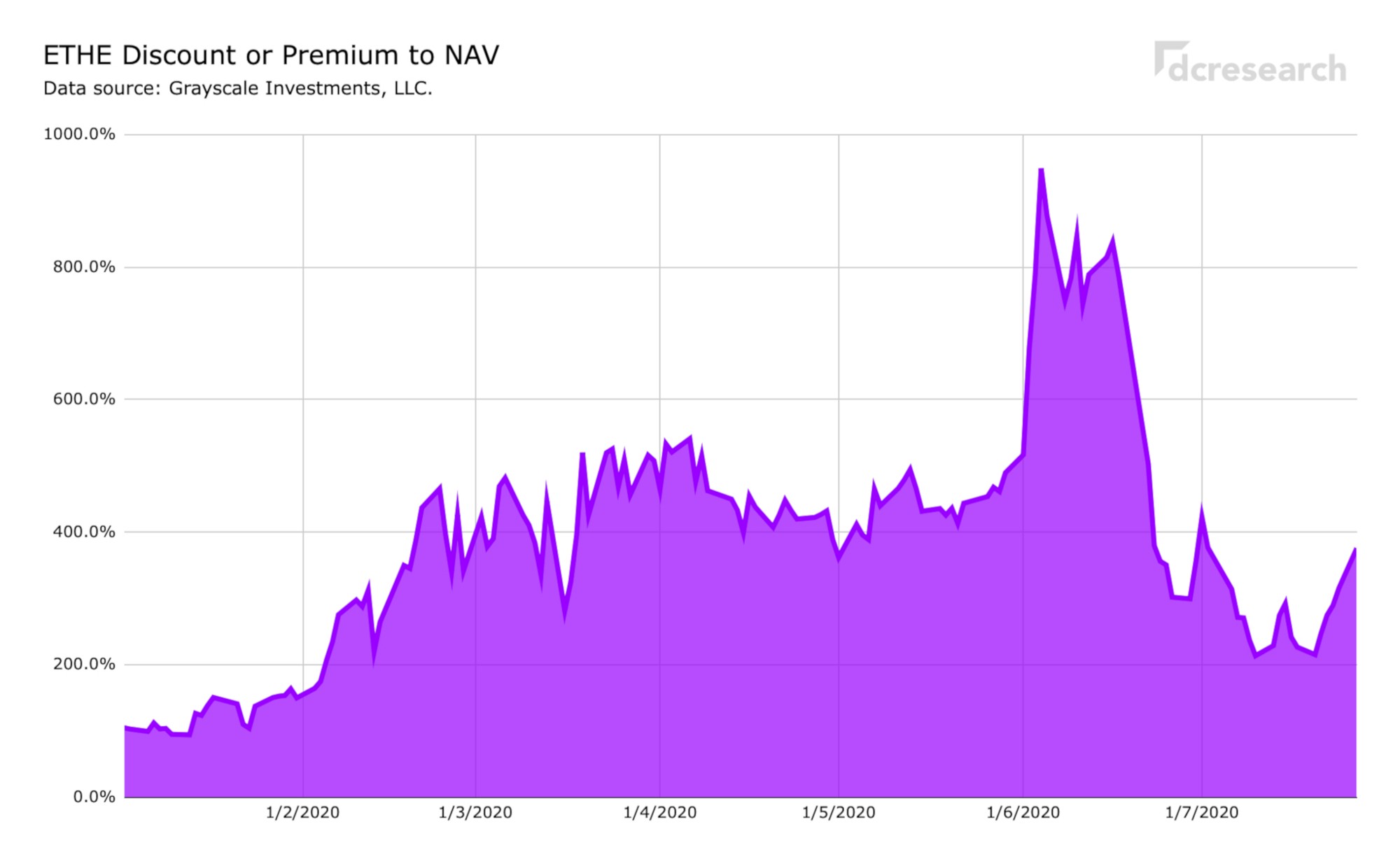

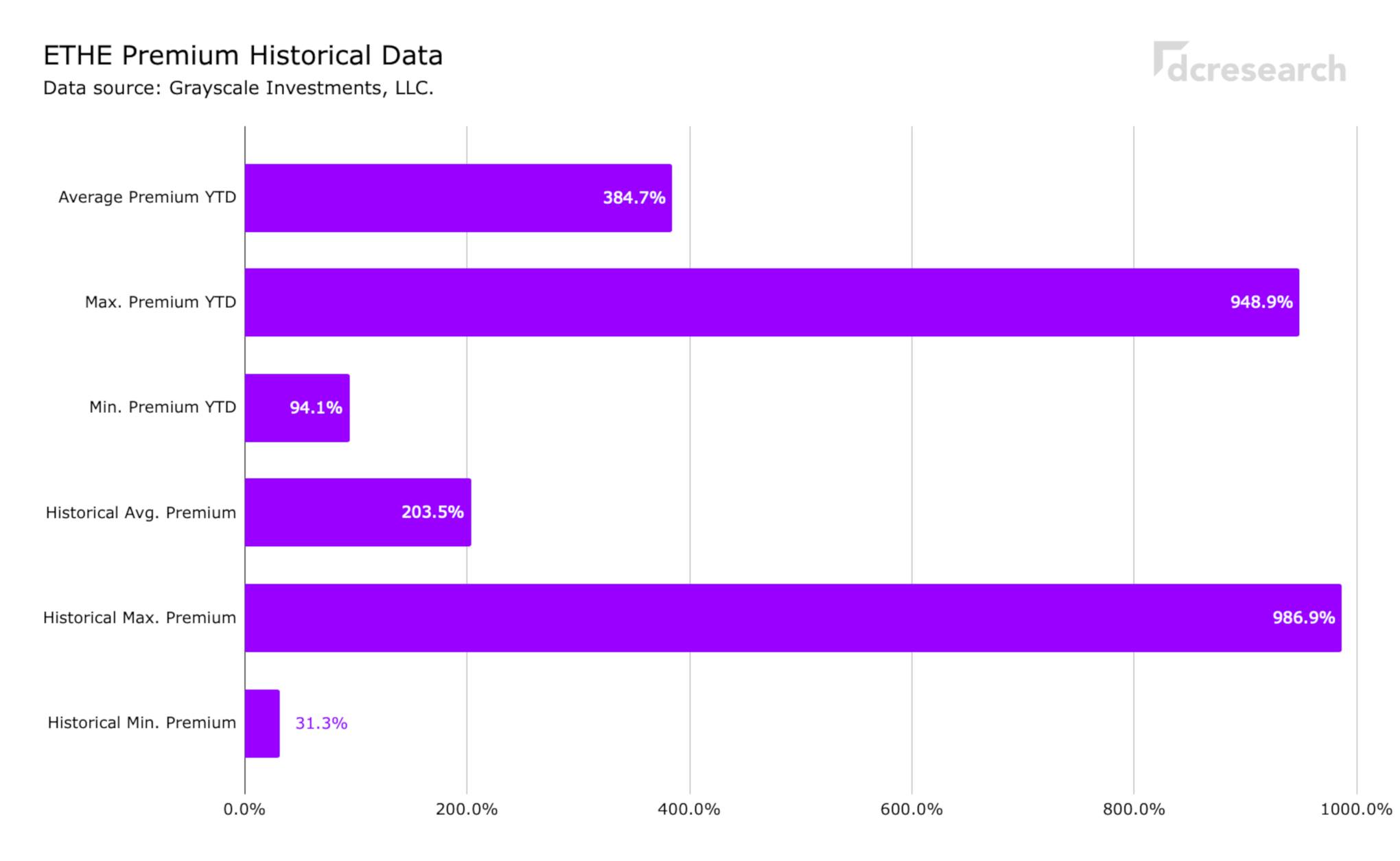

In addition to Bitcoin Trust, Grayscale also manages Ethereum Trust (ticker: ETHE), launched in 2017. ETHE has experienced even larger premiums, 986,9 percent in late August 2018. While ETHE’s inception dates back to 2017, it only became available on OTC markets last summer, on June 20th 2019.

For the time being, GBTC is the only stock offered on NASDAQ or any United States public stock exchange that holds bitcoin as its primary asset. It is also one of the few choices for investing in bitcoin without buying the asset directly.

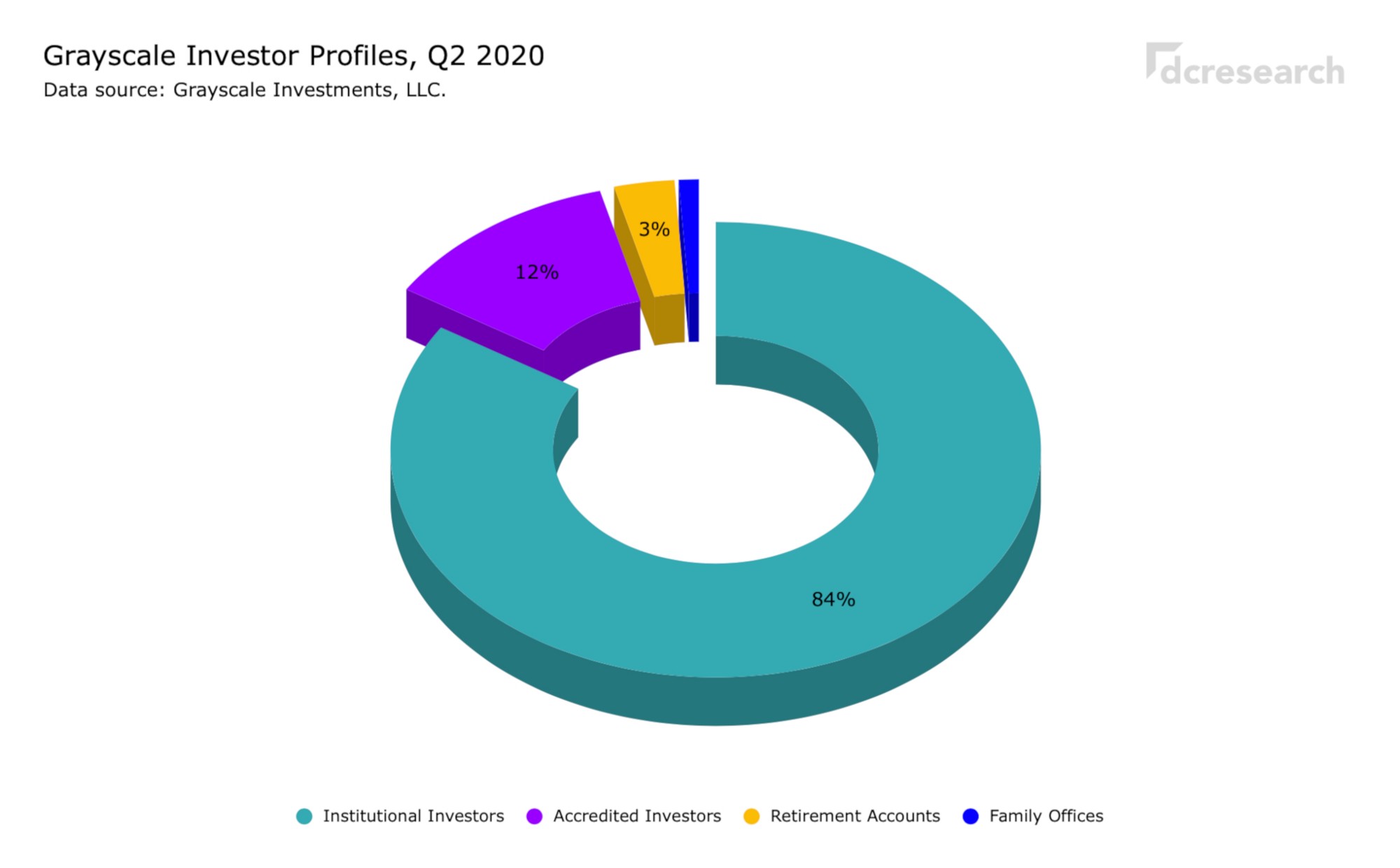

Grayscale’s product portfolio has been exceptionally popular among institutional investors as the attached graph shows. During the second quarter of 2020, 84 percent of Grayscale’s investors were institutional, this segment was largely composed of hedge funds.

Grayscale Bitcoin Trust (GBTC)

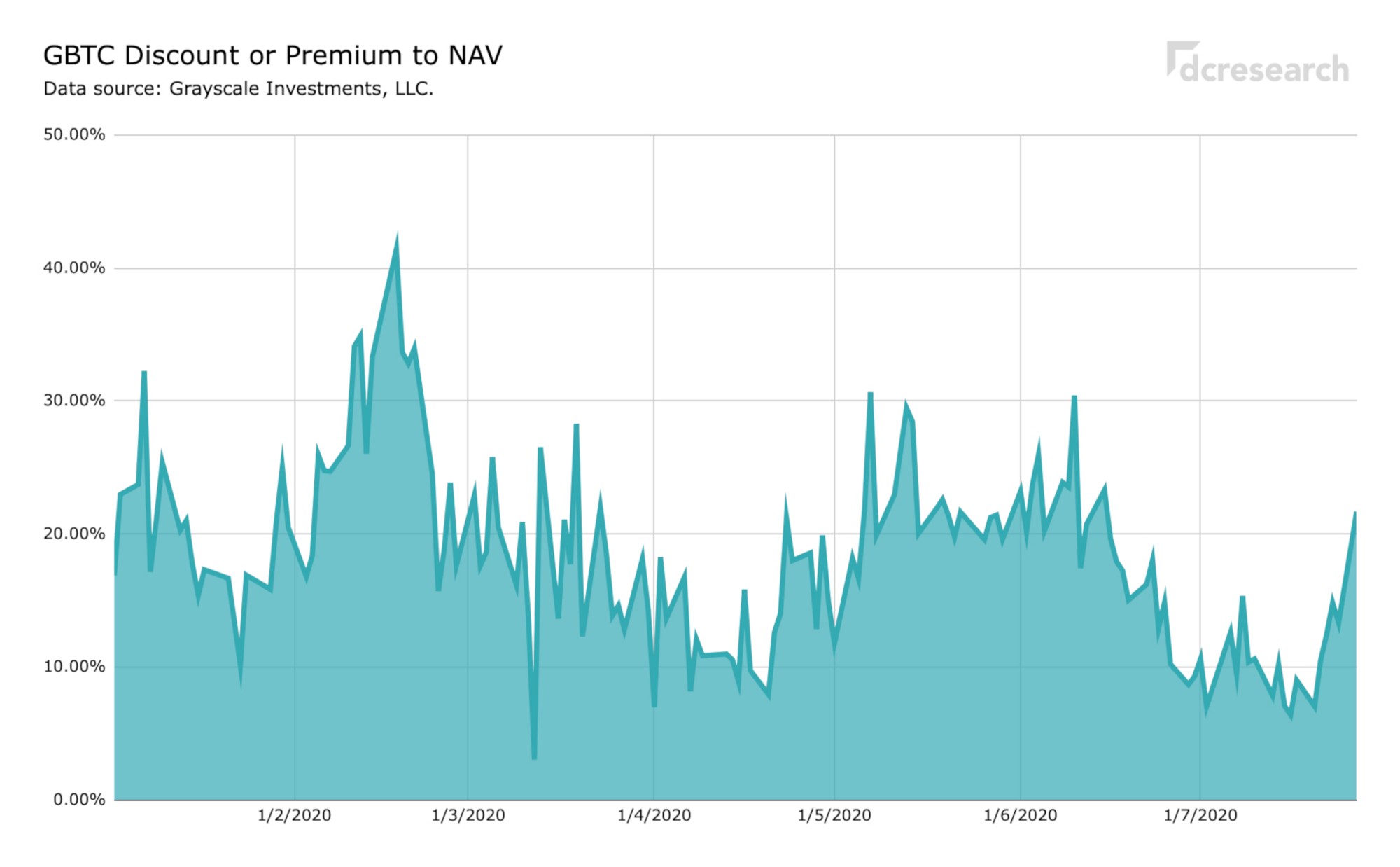

Grayscale Bitcoin Trust’s premium to net asset value (NAV) has seen two sharp declines in first half (H1) of 2020, declining from 40 percent into low 20s close to tail end of first quarter. GBTC’s premium declined again in late second quarter, from 20% level into 10% and below.

The recent GBTC premium amounts look even more reduced when compared with year-to-date (YTD) average of 18,4 percent. Highest YTD premium has been 41,4% and lowest just 3%. The historical average premium has been 39%, while GBTC’s highest premium recorded was 132.6% and lowest (negative) -0,3%.

Grayscale Ethereum Trust (ETHE)

The Grayscale Ethereum Trust (ETHE) has had an promising year so far, rising > 300 percent year-to-date. The ETHE’s performance is additionally mirrored by the fund premium, ascending to 948,9% in June 4th. ETHE premium stayed high througout most of H1, oscillating in 400+ % range from March to June.

Looking back at historical data, the early June’s 948,9 percent premium was completely in its own class. As a benchmark, historical average premium for ETHE has been 203,5%.

Conclusions

-> Asymmetric Information

Information asymmetry causes information to be unevenly distributed and the theory applies exceptionally well to digital asset markets. There might be an information discrepancy among ETHE retail investors, who could falsely assume that each ETHE share is backed by Ethereum 1:1.

-> Convenience

The wide premiums of GBTC and ETHE might arguably mirror retail and institutional appetite to own the digital asset, however they prefer to hold trust-related shares instead of the organic asset itself. Owning Grayscale shares helps investors to bypass uncertainty related to regulation, compliance, and taxation. Additionally investors can outsource the handling of digital wallets and custody of private keys to a third party with excellent track record.

-> Hedge Funds and Arbitrage

While GBTC and ETHE are available to (accredited) retail investors, Grayscale’s data shows 84 percent of inflows coming from institutional sources, particularly hedge funds. Institutional investors have an excellent opportunity to short GBTC and ETHE at a premium, buying it back at a discount for the NAV price.

-> Premium as Leading Indicator

GBTC and ETHE premiums can be considered as leading indicators with following interpretation:

Bullish (overbought) sentiment = Divergence between NAV and premium. Increasing premium.

Bearish (oversold) sentiment = Convergence between NAV and premium. Decreasing premium.

-> Tax Advantage

GBTC and ETHE are the only investment vehicles (for said digital assets) available through tax-advantage accounts. This gives Grayscale a monopoly positions in its niche and accredited investors might prefer Grayscale regardless of the significant premium.

— — —

Data sources: dcresearch. Grayscale Investments, LLC.

Author: Timo Oinonen. Twitter. LinkedIn.

Feedback / questions? Ping me -> [email protected].

Follow dcresearch on Twitter -> twitter.com/dcresearch_io.

Previous posts from the author:

Metcalfe’s law and bitcoin’s value

UTXO Age Distribution and Bitcoin Re-Accumulation

7 Paradigm Shifts and Why We’re Long on Digital Assets