The technical analysis of week 36 assesses the prospects of the cryptocurrency market amidst the sideways trends. In the current market setup, bitcoin can be considered an asymmetric asset, while Charles Edwards views the upcoming halving as the most significant event in 15 years. Additionally, we explore the correlations between cryptocurrencies and the outlook for the BNB token.

The cryptocurrency market sentiment has remained cautious since last week, with bitcoin gaining a modest 2.2 percent. Investors are still awaiting a clear signal regarding short-term price movements. In his recent market analysis, Charles Edwards commented on the approaching halving, referring to it as the “most important event in Bitcoin’s history.”

“This is Bitcoin’s event horizon. The April 2024 Bitcoin Halving is the most important date in Bitcoin’s 15 year history, second only to the Genesis block on 3 January 2009. On this day Bitcoin becomes the hardest asset in the world. 2X harder than gold.” – Charles Edwards

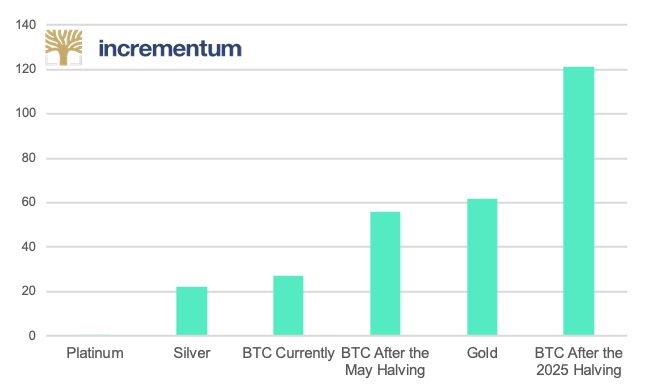

Edwards also alludes to the scarcity of Bitcoin, which will increase after the halving event, as indicated by Incrementum’s accompanying stock-to-flow model. The stock-to-flow model calculates the quantitative relationship between production and the number of units in circulation. Bitcoin is a particularly scarce asset class because its supply is precisely limited to 21 million native units. Bitcoin’s supply is determined at the protocol level, making it easily predictable.

Source: Incrementum

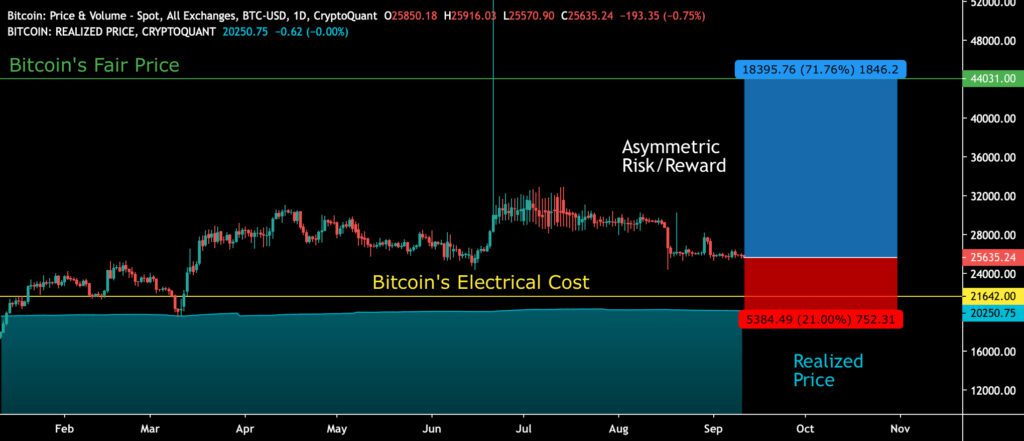

From a purely technical standpoint, bitcoin is trading at its multi-year confluence level, with decreasing volume acting as a clear risk factor of the setup. Three major indicators define the bitcoin market as shown in the chart below: Fair Price (green), Electrical Cost (yellow), and Realized Price (turquoise).

The green Fair Price, which has stabilized at $44 000, can be considered a target price for this year under favorable conditions. A spot price rise from its current level to the Fair Price would represent a 72% ascent (blue). The turquoise Realized Price can be regarded as the primary support level, and a touch of this level would imply a -21% decline in the spot price (red). The yellow Electrical Cost falls between the Realized Price and the spot price.

Sources: Timo Oinonen, CryptoQuant

At the same time, Bitcoin’s Fair Price and Realized Price mirror its asymmetric return profile. As Anthony Pompliano once said, “Bitcoin has an asymmetric return profile; there is much more upside than downside in owning the asset.” Pompliano’s thesis can be applied to long-term accumulation thinking, with the spot price still being favorable.

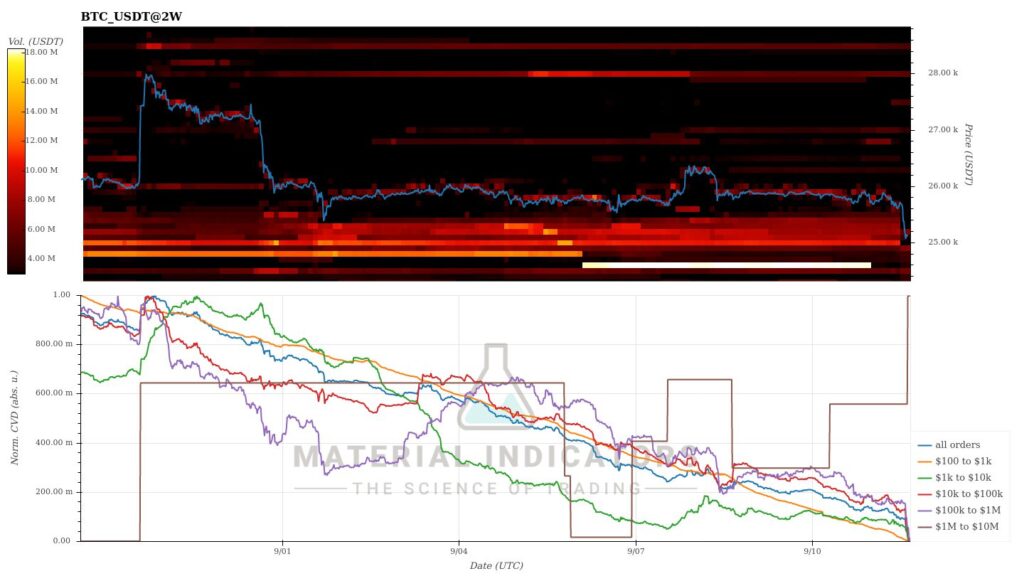

The Material Indicators’ heat map paints a relatively negative picture of the daily market. Bitcoin’s $25 000 support level is fading as the spot price actively tests it. Some relief comes from the brown cumulative volume delta indicator, which reflects the appetite of the whales.

Source: Material Indicators

7-Day Price Performance

Bitcoin (BTC): 2,2%

Ethereum (ETH): -1,4%

Litecoin (LTC): -0,7%

Aave (AAVE): -1,5%

Chainlink (LINK): -4,1%

Uniswap (UNI): -4,1%

Stellar (XLM): -0,4%

XRP: -3,3%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: -0,04%

Gold: -0,8%

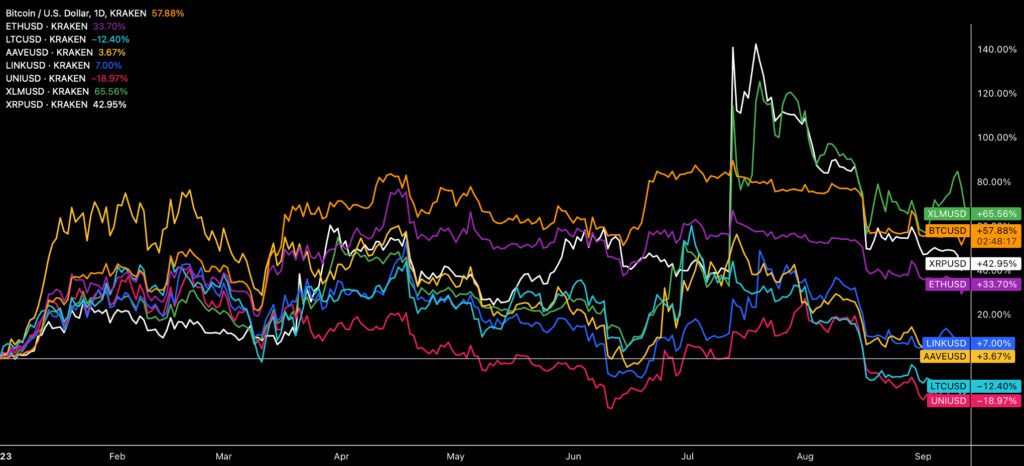

While Stellar’s price performance has cooled off from its over 120% rally in July, it still remains the best-performing cryptocurrency listed on Coinmotion when measured by year-to-date (YTD) metrics. The second-best performer since the beginning of the year is bitcoin, which has also seen a couple of percentage points of growth on a weekly basis. XRP, which climbed over 140% from January to July, has slightly lagged behind bitcoin’s pace, dropping about three percent in a week. Uniswap, the favorite token of the 2020-2021 cycle, has continued its decline, falling nearly -20% since the start of the year.

Source: TradingView

Bitcoin and Ethereum Negatively Correlated with the Stock Market

Despite the technical headwinds of the cryptocurrency market, bitcoin and its closely correlated Ethereum have strengthened by 58% and 34% since the beginning of the year. The post-summer low-volume market has witnessed weakness in high-beta tokens and increased bitcoin dominance.

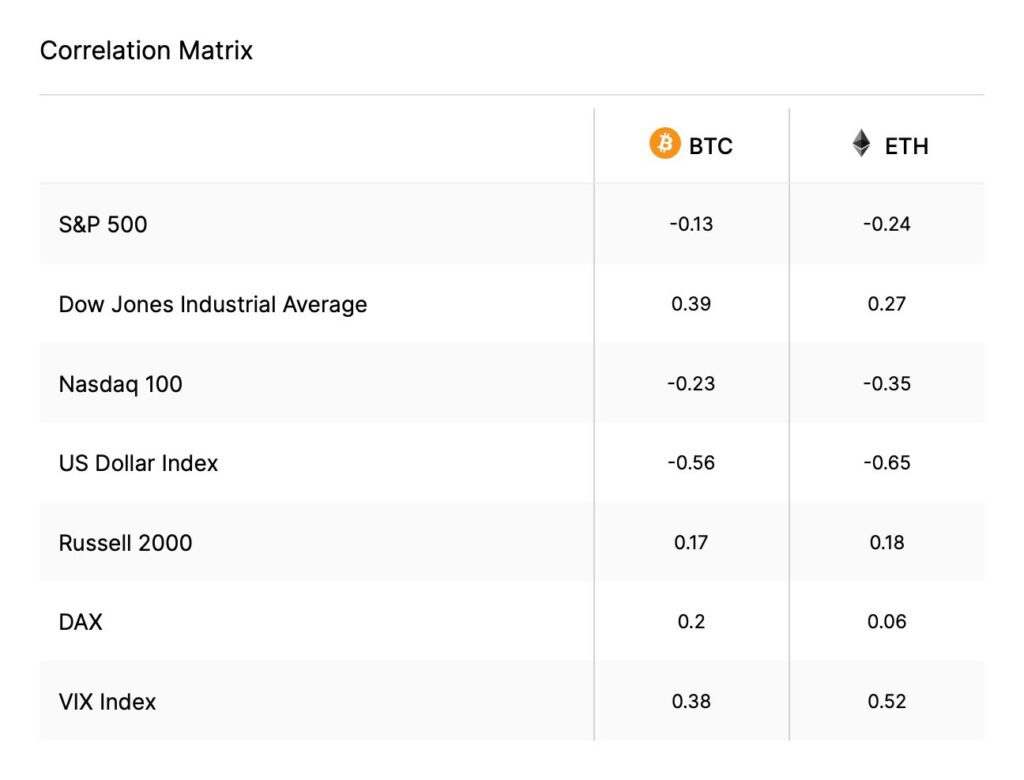

30-day data indicates that bitcoin is in a negative (-0,13) correlation with the S&P 500 stock index. Ethereum’s negative correlation with the stock market is even deeper at -0,24. Additionally, both cryptocurrencies are negatively correlated with the technology index Nasdaq.

Source: IntoTheBlock

Bitcoin was long considered a so-called “zero-correlation” asset class, with its price movements occurring independently of traditional asset classes. This narrative held true, especially during the early years of cryptocurrency, when its correlation with the S&P 500 index was close to zero.

However, the situation changed in 2020 when Michael Saylor launched his famous Bitcoin thesis, simultaneously making significant allocations through his company, MicroStrategy (MSTR). With institutional interest, bitcoin’s correlation with the stock market began to increase. Despite the current negative correlation, it is likely that bitcoin will return to a light positive correlation with the stock market.

Source: Coin Metrics

An overview of the correlations among cryptocurrencies listed on Coinmotion reveals that the coefficient between bitcoin and Ethereum stands at 0,9, reflecting an exceptionally high level of dependency. The correlation between bitcoin and its sibling cryptocurrency, Litecoin, has recently risen to a high level as well (0,8), even though there is a significant divergence in their price movements: Bitcoin has strengthened by 58% since the beginning of the year, while Litecoin’s YTD figure remains at -12%.

The two least correlated currencies with bitcoin, Stellar and Chainlink, differ significantly from each other. This is because Stellar’s YTD price development is at the forefront of Coinmotion-listed cryptocurrencies with a 66% increase. In contrast, Chainlink’s price performance has been modest, rising only about seven percent since the start of the year.

Is Binance’s BNB a New Black Swan?

The world’s leading cryptocurrency trading platform, Binance, and its native exchange token, BNB, have been criticized again by experts. In particular, Travis Kling, the CIO of the asset management firm Ikigai, has emerged as a critic of Binance. He recently appeared on the prestigious Delphi Podcast to share his views.

New Podcast 🎙️🚨

— Tommy (@Shaughnessy119) September 7, 2023

Travis Kling: Binance Deep Dive From FTX Survivor

I took the role of devils advocate on @Travis_Kling's investigation into Binance

The conversation was interesting 👇

Spotify: https://t.co/oQELrdTIzY

Apple: https://t.co/BDyPeQZfnk pic.twitter.com/KpedJBe0Nt

Contrary to bitcoin’s 58% upward trajectory since the beginning of the year, Binance Coin, or BNB, has declined significantly by -13,19% and is resting on top of its multi-year technical support level (orange). Furthermore, after a brief springtime recovery phase, BNB appears to be approaching the bottom of its descending wedge pattern (white), indicating a likely further weakening.

If the long-standing $185 support level fails to hold up BNB, it will likely face escalating selling pressure. In the worst-case scenario, BNB’s decline may trigger a reflexive phenomenon where short-term investors rush to cut their losses by “dumping” the token at an accelerated pace.

George Soros’ reflexivity theory addresses the impact of positive feedback loops on investor expectations and realities. The disparity between these factors can lead to price trends that diverge significantly from equilibrium prices.

Sources: Timo Oinonen, CryptoQuant

Our technical analysis has previously raised concerns about Binance’s situation. Earlier this year, the exchange briefly held over 90% dominance in cryptocurrency spot trading, becoming the industry’s potential single point of failure. The centralized and dominant position of a single trading platform contradicts the principles of decentralization and the general philosophy of cryptocurrencies.

What Are We Following Right Now?

Bitcoin has gained increasing prominence in the political arena this year. We previously reported that Argentinian presidential candidate Javier Milei aimed to mainstream Bitcoin’s role in South America. Last week, long-standing Texan Republican Senator Ted Cruz commented on Bitcoin’s position in his state, describing Texas as the “natural home” for digital assets. Cruz sees Bitcoin and the Texan spirit of freedom intertwined, benefiting the region’s industry and innovation.

I'm bullish on Bitcoin.

— Ted Cruz (@tedcruz) September 8, 2023

Texas is the natural home for the digital asset industry since Texans love freedom and so do digital asset bulls.

This innovation is already benefiting Texas' economy and grid. https://t.co/ccZVUiau3R

The popular Telegram app, especially favored among cryptocurrency traders, has announced its integration of the TON Space wallet onto its platform. The wallet, set to launch in November, will enable cryptocurrency-based trading directly within the Telegram app.

ICYMI: Telegram integrates TON-based crypto wallet for its 800 million usershttps://t.co/u68pBQ2YbA

— The Block (@TheBlock__) September 13, 2023

Charles Edwards’ comprehensive market overview related to the macro economy, Bitcoin, and the anticipated spot ETF.

One of Europe’s largest Bitcoin-themed events, the Lugano PlanB Forum, is set to take place in the Ticino canton of Switzerland at the end of October. The event will feature a comprehensive lineup of speakers, ranging from Adam Back to Jimmy Song. The city of Lugano has long established itself as a cryptocurrency pioneer, enabling bitcoin and Tether payments within its jurisdiction.

This year's #lugano PlanB forum will be epic.

— Paolo Ardoino 🍐 (@paoloardoino) September 8, 2023

Lots of friends, voices, big announcements, art, music, amazing food (that's crucial), high quality content, fun…https://t.co/sWOkSY1PgX#bitcoin

Stay in the loop of the latest crypto events

- Dive into Cardano (ADA): A newcomer’s comprehensive guide

- Pick your strategy: Trading vs. investing: Lesson #4

- Aave: The DeFi Powerhouse Changing the Crypto Landscape

- Understanding market dynamics, cycles, and bubbles: Lesson #3

- Technical Uncertainty Weighs on Bitcoin

- Crypto Investing Made Simple: Lesson #1

- Price Projections for 2023 and 2024

- Ripple (XRP): Empowering the future of digital currency

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.