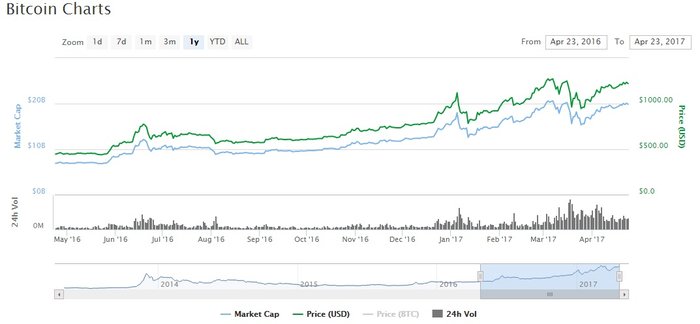

Bitcoin price approaches its all-time highs

Bitcoin price has had a rollercoaster ride since the beginning of this year. After a month of weakening following the rejection of Winklevoss ETF proposal, it is heading back towards its all-time highs. The price is now crawling to the $1,250 barrier, as the CoinMarketCap data shows a sustained upward trends for Bitcoin against a recent backdrop of altcoin volatility. Poloniex, which recently decided to delist 17 altcoins, is indicating a price per Bitcoin of over $1,300. This decision, still kind of mysterious, is believed to result in an en mass moving of altcoin funds into Bitcoin, which will certainly have certain implications on the price of the latter. There have been a few predictions expressed lately that the digital currency space will continue its upward trend. Thus, Billionaire investor Mike Novogratz, who claims to be holding ten percent of his net worth in Bitcoin and Ether, predicts that the price of Bitcoin could increase to as high as $2,000. Bobby Lee, CEO and Co-Founder at BTCC predicted that the Bitcoin price could increase to between $5,000 and $11,000 by 2020. Sharing this optimistic attitude, should one go and buy Bitcoin before it’s too late? No wonder, early investors are celebrating – seeing Bitcoin price increasing from around $50 to $1,270 during all these years is priceless.