We have published the first Cryptocurrency Market Report for 2020. The first quarter of the year was exceptional for the whole economy as the Covid-19 crisis changed the fundaments of the world economy.

You can download the full Cryptocurrency Market Report here

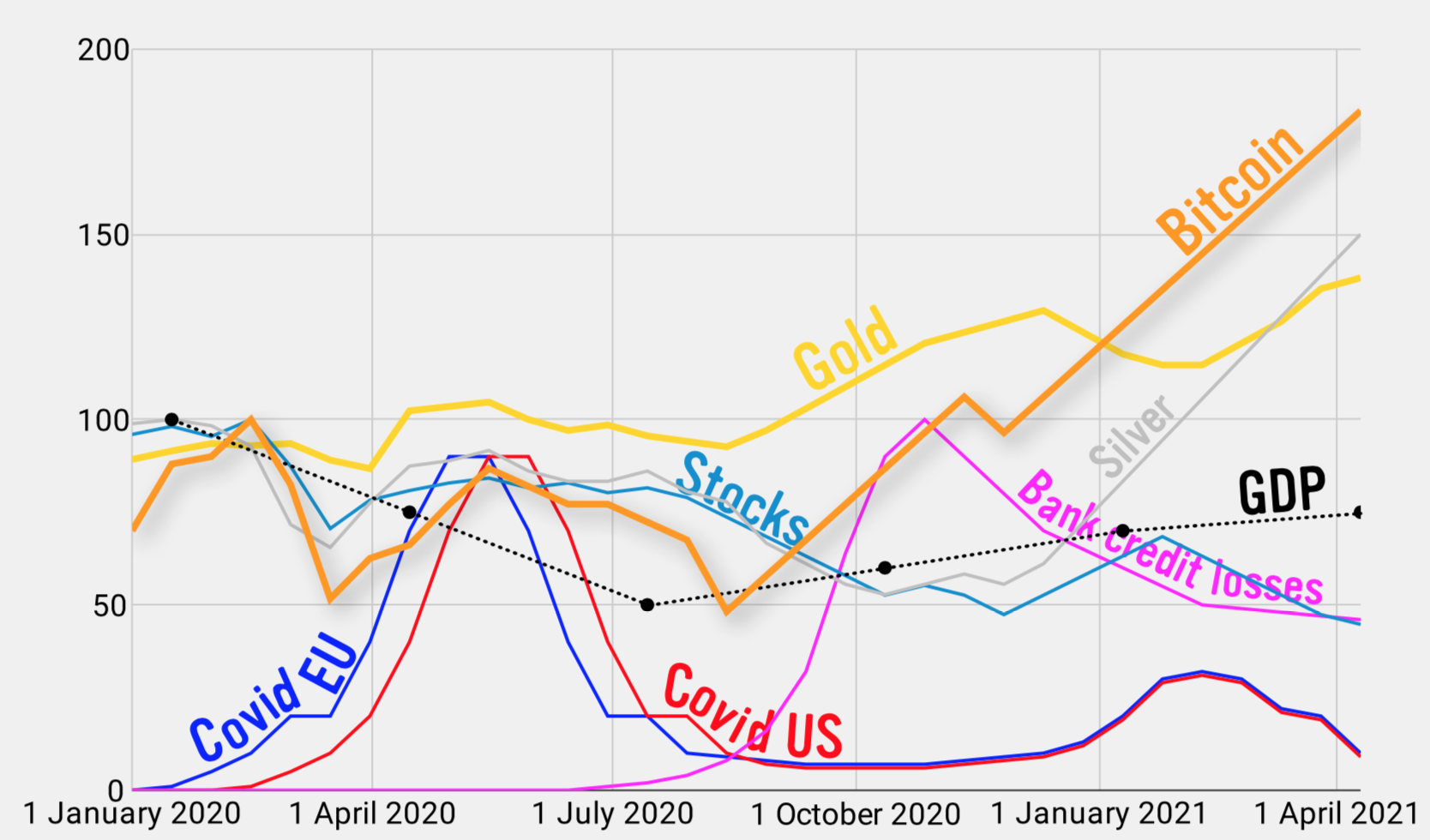

As we look back at historical data, we see that high-intensity sell-offs usually affect all asset classes, with liquidity escaping eventually into cash. Bitcoin experienced a sell-off like most asset classes, dropping up to 50% in early March. However bitcoin has recovered since, rising around 100% from March lows.

The futures market and heavy deleveraging also contributed to bitcoin’s price crash. The sudden fall was led by Seychelles-based bitcoin and cryptocurrency exchange BitMEX, which offers risky leverage trading with huge leverages. Huge wave of margin calls dropped bitcoin price temporarily to a low of $3600 on the exchange before it was abruptly closed for maintenance.

Analysis of the effects of Covid-19 crisis on bitcoin, gold and the stock market

During the crisis bitcoin seems to maintain its position as an uncorrelated asset. The 90-day correlation between bitcoin and S&P 500 Index peaked at around 0.5 and is showing early signs of reversing to its historical norm. In the contemporary sentiment, an investor should focus on long-term view. The correlation between gold and S&P500 Index has varied significantly in short time windows and we should not overweigh short- term data.

In the report we look at Swedish head fund manager Karl-Mikael Syding’s analysis about how different asset classes recover from the seen liquidation. His model is very bullish for bitcoin, gold and silver. He expects gold to keep performing well throughout the year and bitcoin to perform extremely well in the third and fourth quarter of the year.